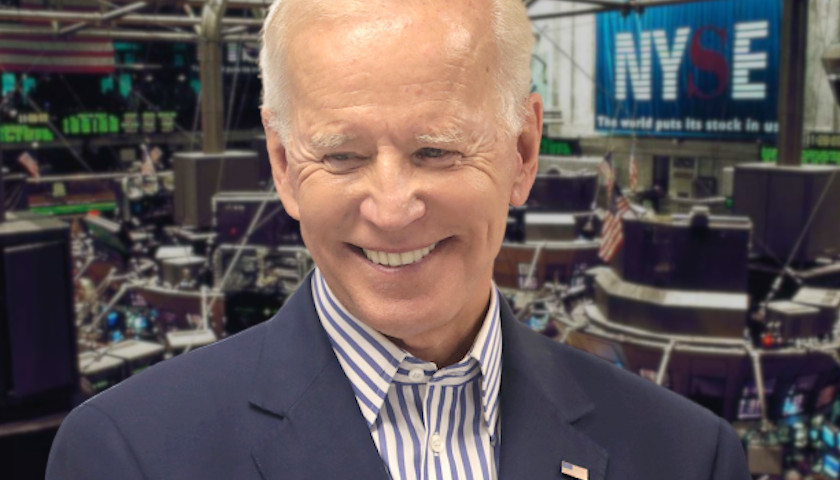

The biggest decision the Securities and Exchange Commission (SEC) is likely to make this year will be on mandated disclosure of information related to climate change and corporate environmental, social, and governance (ESG) goals. The Commission has been working on the issue since early last year, and a new proposed rule is now scheduled to be released on March 21st. The contents of that rule will likely determine the future direction of “responsible” investing in the United States.

In March of last year, then-Acting Chair Allison Herren Lee issued a request for information on the matter, consisting of 15 questions and described as a response to the “demand for climate change information and questions about whether current disclosures adequately inform investors.” The questions covered a wide range of topics, from how to measure greenhouse gas emissions to how climate disclosures “would complement a broader ESG disclosure standard.”

When the SEC first issued guidance on climate change-related disclosures for public companies in 2010, the standards were fairly general and advisory, but the questions from last year’s request-for-information suggests that the agency’s leadership is considering a more aggressive and prescriptive framework.

Read the full story