President Donald Trump apparently does not believes the Church of Scientology is a real religion, which could lead the church to lose its tax-exempt status just as Trump moves to appoint a new head of the Internal Revenue Service. Trump told Lynne Patton — a regional head at the Department of Housing and Urban Development —…

Read the full storyTag: Tax reform

A Tale of Two Tax Bills: Comparing the House, Senate Reform Plans

Last week, the House GOP released the first concrete details on how Republicans plan to update the federal tax code. The Tax Cuts and Jobs Act provides tax relief to many Americans and has the potential to facilitate real economic growth through important business-tax reforms. While the House proposal as a whole is certainly a step…

Read the full storySenate and House Face Off Over Tax Reform

After an embarrassing off-year election in New Jersey and Virginia last Tuesday, the Republican Party now faces the very real possibility that it could stumble on tax reform, perhaps sinking its majorities in the 2018 midterm elections. The Senate Republicans announced on Thursday the latest iteration of the White House tax plan, hoping to delay the…

Read the full storyJudson Phillips Commentary: Tax Reform, Corporate Loopholes, Affiliate Reinsurance

ANALYSIS/OPINION: Donald Trump’s signature promise as he ran for President was he would drain the swamp. There is no greater symbol of the swamp that needs to be drained than the tax code of the United States. Actually, calling it the tax code of the United States is a misnomer. It is a tax code inflicted…

Read the full storyGOP Moves to Crack Down on Corporate Tax Dodgers

Under the introduced last week in the House of Representatives, giant multinational corporations get a fat tax cut — but also the threat of a stinging new levy if they continue commonly used tax-avoidance schemes. The hope of tax writers was that the threat of a 20 percent excise tax on the sale of products from…

Read the full storyTaxes To Be Filed on a Postcard?

The dream of tax reformers for decades has been to transform the maddeningly complex federal tax code into a system simple enough for Americans to file their tax returns on a postcard. Republican leaders who the Tax Cuts and Jobs Act on Thursday said that dream would become reality for 90 percent of taxpayers. Meeting with…

Read the full storyTrump Predicts Corporate Tax Cut Will Bring Back Jobs

The centerpiece of the proposed House Republican corporate tax reform is a bet that slashing the top rate from 35 percent to 20 percent will trigger an economic boom that will raise workers’ wages and goose long-term growth. President Donald Trump on Thursday cited a study by the White House Council of Economic Advisers that the…

Read the full storyGOP’s Tax Bill Cancels $23 Billion in Credits Claimed by Illegal Immigrants

The new GOP tax overhaul would strip illegal immigrants of the ability to claim several major tax credits, saving the government $23.1 billion over the next decade, according to the bill’s authors. For years Republicans have complained that despite a general ban on taxpayer benefits flowing to illegal immigrants, the IRS has allowed them to collect…

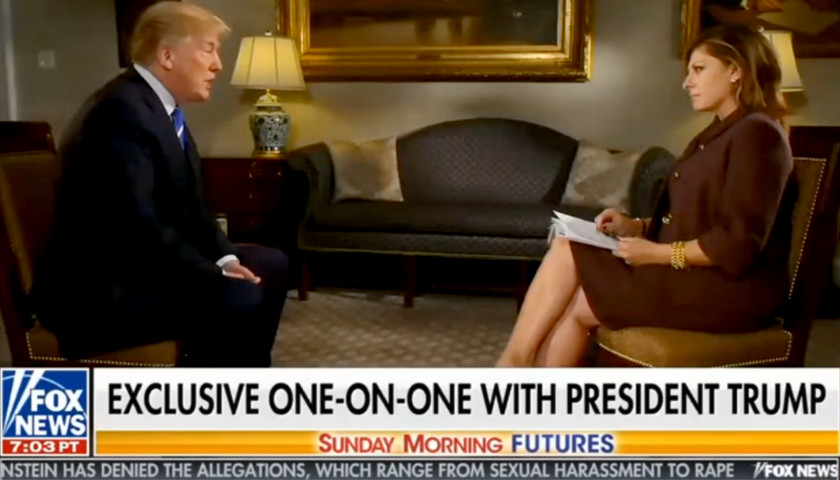

Read the full storyPresident Trump Tells Laura Ingraham: My Policies Are Creating Jobs

President Donald Trump said jobs that were never going to happen are being created thanks to his new policies. Trump made the boast on Fox News’ “The Ingraham Angle” on Thursday night, in his first interview as president with Laura Ingraham, also the founding editor of LifeZette. “I have been in here 10 months, and we…

Read the full storyRepresentative Mark Meadows, Freedom Caucus Chair: Tax Cuts Should Pay for Themselves Over 15 Years

The head of the House Freedom Caucus said Friday he is confident the GOP’s plan to overhaul the federal tax code will pay for itself over 15 years, downplaying warnings from fiscal hawks who warn the proposal will push the nation deeper into debt. Republican lawmakers on Thursday rolled out their long-awaited rewrite of the tax…

Read the full storyGOP Tax Plan Eliminates BILLIONS In Green Energy Subsidies

The GOP’s plan to overhaul the U.S. tax code includes changes to green energy tax subsidies that lawmakers say will save taxpayers billions of dollars every year. Republicans want to modify production and investment tax credits for green energy projects, including wind turbines and solar panels, and push for eliminating subsidies for purchasing electric cars. However,…

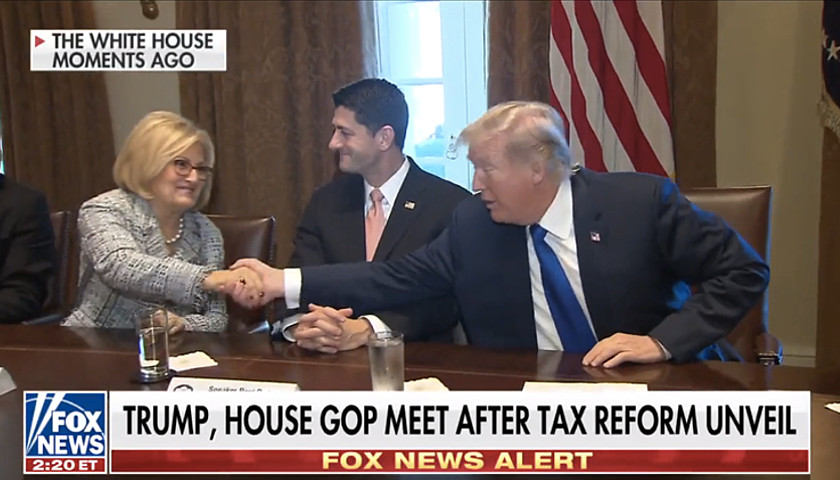

Read the full storyPresident Trump to Rep Diane Black: ‘You Came Through’ on Tax Reform

It’s been a busy day for Republicans on The Hill, as the tax reform package promised by then-candidate Trump and touted by now-President Trump, is finally introduced to Americans. While the details of the proposal are yet to be fully understood, the Republican House leadership team that produced the work took a bit of a victory lap Thursday with the President. Among them is the House Budget Committee Chair, Representative Diane Black (R-TN-06), who is also running to replace outgoing governor Bill Haslam. During a press availability at the White House Thursday, President Trump made sure to single out Rep. Black individually for her role to both pass the budget and the create the tax reform bill. “I called Diane Black and you came through, Diane,” he said, shaking her hand as Speaker Paul Ryan looked on. In a separate statement from the White House, President Trump said, “I applaud the House Ways and Means Committee for introducing the Tax Cuts and Jobs Act, which is another important step toward providing massive tax relief for the American people. My tax reform priorities have been the same since day one: bringing tax cuts for hardworking, middle-income Americans; eliminating unfair loopholes and deductions; and…

Read the full storyCommentary: Why an Advertising Tax Is the Worst Idea

President Donald Trump and the Republican majority in Congress are moving full throttle on tax reform, hoping to save American families thousands of dollars by lifting nonsensical burdens on businesses and the middle class. While all of the details aren’t yet public, the Republican tax bill is expected to deliver President Trump’s promise of a shrunken…

Read the full storyPresident Trump Thanks Rep. Diane Black for Her Role in Passing the Budget

For the first time in nearly a decade, the House and the Senate has passed a budget – albeit without much help from Democrats. The move sets the stage for a massive tax reform package, the largest since President Ronald Reagan’s overhaul in 1986. President Trump took the opportunity to offer his thanks for a job well done this morning to Tennessee’s own Representative Diane Black (R-TN-06), who serves as the powerful House Budget Committee Chair. Diane Black of Tennessee, the highly respected House Budget Committee Chairwoman, did a GREAT job in passing Budget, setting up big Tax Cuts — Donald J. Trump (@realDonaldTrump) October 27, 2017 To which, Ms. Black replied: Thank you for your support @realDonaldTrump! Great working with you — big tax cuts next! #MAGA https://t.co/AV7RX4CgS1 — Diane Black (@DianeBlackTN) October 27, 2017 Representative Black – who is running to replace the termed-out Governor Bill Haslam – released a short statement reiterating her strong support of President Trump’s agenda, and her commitment to bringing the same kind of ‘America First’ principles to Tennessee, should she be elected. It reads: This morning, President Trump praised Diane Black for her work on the budget and paving the way for tax cuts…

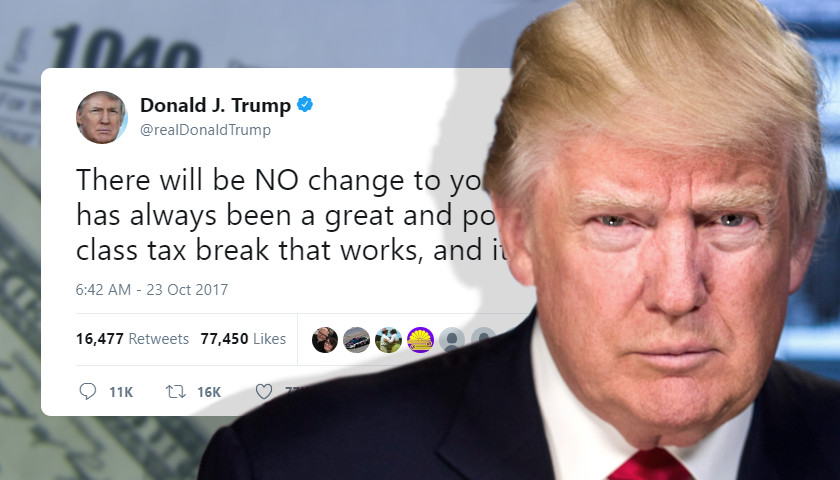

Read the full storyPresident Trump: ‘No Change’ to 401(k) Retirement Plans

President Trump said Monday he won’t allow Congress to reduce tax-exempt contributions to popular 401(k) savings plans, amid reports that lawmakers are considering such a move. “There will be NO change to your 401(k),” Mr. Trump tweeted. “This has always been a great and popular middle class tax break that works, and it stays!” As Congress…

Read the full storyDonald Trump Says Feuding with Lawmakers Can Be Helpful in Getting Things Done

After several feuds with both Democratic and Republican lawmakers, President Trump said the fighting can be helpful in getting things done. “Sometimes it helps, to be honest with you,” Mr. Trump said in an interview on Fox Business that aired Monday. “Sometimes it gets people to do what they’re supposed to be doing, and that’s the…

Read the full storyDavid Williams Commentary: Senate Must Pass Budget – Tennessee Small Businesses Need Tax Reform Now

by David Williams This week, the U.S. Senate is holding a budget vote that is a vital component in passing tax reform – if they can’t get the budget passed, it will make the path to overhauling our outdated, growth-killing tax code extremely difficult. It is essential that all U.S. Senators – including Senator Bob Corker – support passage of the budget so Congress can quickly move onto and pass the kind of pro-growth tax reform package Tennessee small businesses need to drive meaningful, long-term growth and job creation. The federal tax code is a bloated, cumbersome disaster. The business rate of 35 percent (39 percent with local and state taxes) is far higher than that of most of our competitors, which makes U.S. companies less competitive in the global marketplace and stifles growth and job creation. The tax code itself is an additional burden. At tens of thousands of pages and millions of words, regular small-business owners have little hope of navigating it. So, their choice is between hiring expensive tax compliance help or dealing with sleepless nights worrying about the IRS knocking on their door. Worse, the tax code strongly favors big businesses, making it even harder for smaller firms…

Read the full storyBill Kristol Urges GOP To Snub Trump: ‘Have A Little More Self Respect’

Editor at large of The Weekly Standard Bill Kristol took a shot at Senate Majority Leader Mitch McConnell on MSNBC Tuesday, when he called him and other Republicans “pathetic” for publicly supporting President Donald Trump. “You stand there and basically, you have to say nice things about Donald Trump. ‘We’ve been friends for a long time.…

Read the full storyMick Mulvaney, OMB Director, Says His Concern for the Deficit Drives Tax Reform

Office of Management and Budget Director Mick Mulvaney said Tuesday that his concern for the deficit is what drives him to pass tax reform. “You will never balance the budget in this country again at 1.8 percent or less growth. It’s just not going to happen. We have an appetite in this country for a certain…

Read the full storyThe Tax Break for the Rich That the Democrats Are Fighting to Keep

For a progressive, few tax breaks should offer a juicer target than the write-off taxpayers can take on the state and local income, sales and property taxes that they pay. The tax break costs the federal government a massive amount of money — a projected $1.3 trillion over the next 10 years, according to the non-partisan…

Read the full storySean Duffy: GOP ‘Will Get Absolutely Destroyed’ If Tax Reform Fails

Rep. Sean Duffy (R-Wis.) said Thursday that the Republican Party “will get absolutely destroyed” if Congress does not pass President Donald Trump’s tax reform plan. Duffy said on “The Laura Ingraham Show” on Thursday that it’s time for the GOP to pull itself together, get on board with Trump’s agenda and pull off a significant and…

Read the full storyPresident Trump Wows Pennsylvania Truckers With Tax Pitch

President Trump delivered a stem-winder of a campaign-style speech to an enthusiastic, capacity crowd of American Trucking Association members at Harrisburg, Pennsylvania Wednesday. In the forty-minute appearance, President Trump discussed the policy framework of his pro-growth tax overhaul proposal, and the urgency to pass it. President Trump began by acknowledging the victims of the many natural disasters and tragedies that have befallen our fellow Americans over that last several weeks. “Before we begin,” he said, “I want to take a moment to address some of the recent tragedies that have struck our incredible nation. In the darkest moments, the light of our people has shown through like seldom before — their goodness, their courage, and their love. No destructive force on Earth is more powerful than the strength and resilience of the American people.” “We are praying for all of the families affected by the horrific mass shooting that took place in Las Vegas. We grieve with you, and we will never leave your side,” President Trump said, to thunderous applause. Watch the speech: TRANSCRIPT via the White House: THE PRESIDENT: Thank you very much, ladies and gentlemen. It’s great to be back in Pennsylvania with the proud men and…

Read the full storyKevin Brady: Senate Republicans Need to Back Tax Plan

House Ways and Means Chairman Kevin Brady said Wednesday that Republican senators need to support the tax reform legislation to prevent another legislative disaster. “At the end of the day, look, given what happened in the Senate in health care reform, I think it’s important for every Republican senator to make the commitment now that they’re…

Read the full storyCommentary: Support President Trump’s Tax Reform Or Else

By CHQ Staff Vice President Mike Pence and his team have, sometimes to the annoyance of conservatives, generally kept a pretty low profile in the controversies generated by President Trump’s attacks on the DC Swamp. Indeed, conservatives have wondered, “Where’s Pence” when Capitol Hill establishment Republicans went after the President on his terrorist travel ban, limits on importing dangerous refugees, and other elements of the Make America Great Again agenda and the Vice President was trying to play the peacemaker instead of standing on the frontlines slugging on his behalf. But much of that annoyance was forgiven yesterday when POLITICO broke a story alleging that Nick Ayers, the Vice President’s recently appointed Chief of Staff suggested to a group of major donors that they needed to “form a coalition” to take on GOP leaders and members who don’t back the president. To that we say Hallelujah, someone in the White House finally gets it. POLITICO claims Ayers dropped the bombshell in remarks at a Republican National Committee event at the St. Regis Hotel in Washington on Tuesday morning, where he also warned that Republicans are “on track to get shellacked” in next year’s midterm elections if GOP lawmakers don’t…

Read the full storyDonald Trump to Pressure Senate Democrats on Tax Reform

President Trump will be putting intense pressure on Senate Democrats in states that he won in November, demanding that they get on board for tax reform, according to sources involved in the White House plan to tap into widespread support for tax relief in Trump country. It’s part of a more aggressive White House offensive to…

Read the full storyPresident Trump Launches Tax Overhaul Initiative, Calls on Congress to Support ‘The American Model’

President Donald Trump traveled to Springfield, Missouri Wednesday to begin, in earnest, his bid to overhaul the leviathan that is the US Tax Code. “We’re here today to launch our plans to bring back Main Street by reducing the crushing tax burden on our companies and on our workers, ” President Trump began. “Our self-destructive tax code costs Americans millions and millions of jobs, trillions of dollars, and billions of hours spent on compliance and paperwork.” Dubbed ‘The American Model,’ President Trump said his Administration will enact policies to encourage companies to hire and grow in America, to raise wages for American workers, and to help rebuild our American cities and communities. “That is how we will all succeed and grow together, as one team, with one shared sense of purpose, and one glorious American destiny,” he said. Tax reform was a major part of candidate Donald Trump’s bid for the presidency, as a part of an America-first, pro-growth platform to unleash the country’s idle economic engine. “In the last 10 years, our economy has grown at only around two percent a year,” Trump said, “If you look at other countries and you look at what their GDP is,…

Read the full storyAmerican for Prosperity Launches Major Campaign to ‘Un-Rig’ the U.S. Economy Through Pro-Growth Tax Reforms

Americans for Prosperity (AFP) announced Friday it has launched the first in a series of ads calling on members of Congress to “un-rig” the U.S. economy by passing pro-growth tax reform. The ad campaign will run in the six-figure range, and appear on digital platforms targeting abut a dozen members of Congress as a part of a summer-long push to shape the House of Representative’s tax-reform efforts around five pro-growth principles. Rep. Black chairs the Budget Committee and is a member of the House Ways and Means Committee, which will write the tax reform bill the House will consider later this year. AFP – Tennessee’s State Director Andy Ogles said in a statement, “Americans want a tax system that is honest and fair, which will grow the economy and create jobs.” Ogles added: We hope Rep. Black will fight back against the current rigged tax system by leading the effort to pass pro-growth tax reform based on AFP’s 5 Principles of simplicity, efficiency, equitability, predictability, and no new burden on taxpayers. That means opposing a border adjustment tax – a trillion-dollar tax on consumers masquerading as a tax on imports. Included in the first round of ads is one…

Read the full storyCommentary: Tax Reduction and Reform: President Trump Goes After The Swamp

by ConservativeHQ.com Staff Nothing embodies the Washington DC swamp better than the U.S. tax code: The Congressman and Senators who write it, the lobbyists who work to manipulate its arcane rules to benefit the inside few and the Internal Revenue Service that enforces it – or not – form one of Washington’s most fearsome iron triangles. And yesterday, President Donald Trump took them all on. The one-page outline for changes to the tax code the White House issued pinpointed numerous changes proposed by the President that would affect almost every American, and American business. The last major effort to successfully reform the U.S. tax code was over 30 years ago under President Reagan. The Reagan tax cuts and tax reform kicked-off two decades of economic growth, however, since then the supply-side economics underpinning the Reagan tax plan have been substantially eroded. Today, according to the IRS’ National Taxpayer Advocate, the federal tax code is nearly four million words long. Congress has made more than 5,900 changes to the federal tax code since 2001 alone, averaging more than one change a day. What’s more, with a corporate tax rate of 35%, US businesses face the highest statutory tax rate in the…

Read the full story