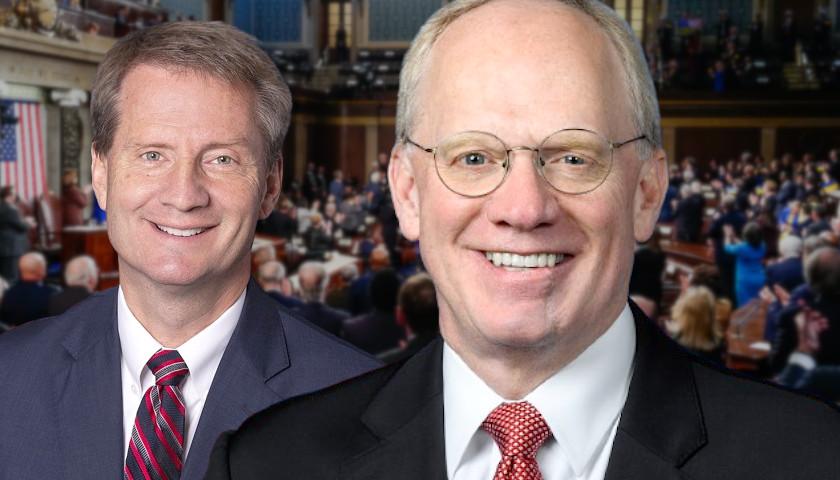

Tennessee U.S. Representative John Rose (R-TN-06) introduced a bill on Friday that would ban trigger leads, with some exceptions, when consumers apply for financing through lending companies.

Trigger leads occur when credit bureaus sell the information of consumers who have applied for financing – such as a personal loan or mortgage – to other lenders without the consumers being notified.

“Consumers are then often bombarded with hundreds of calls that confuse consumers and seek to lure them away from their chosen lenders,” Rose’s office explained.

Rose’s bill, the Protecting Consumers from Abusive Mortgage Leads Act, would “prohibit a consumer reporting agency from furnishing a trigger lead unless the third party certifies to the consumer reporting agency that the third party has a current relationship with the consumer,” according to its summary.

In addition, Rose’s bill, according to his office, is “tailored to give consumers more control over the information they receive as part of the homebuying process and eliminates trigger lead abuses while preserving their use in appropriately limited circumstances.”

“Buying a home is stressful enough for many consumers. The last thing most folks want is to be annoyed incessantly by the constant barrage of emails, text messages, and phone calls after they apply for a mortgage,” Rose, who serves on the House Financial Services Committee, said in a statement. “My bill would put an end to this shady and confusing practice and restore data privacy for homebuyers.”

Rose’s bill has the support from the Mortgage Bankers Association and the Tennessee Bankers Association.

“Representative Rose’s legislation would ensure Tennessean’s right to privacy by preventing credit bureaus from selling their information when a credit report is pulled. It is not unusual for bank customers to receive 50+ misleading texts, phone calls and emails within the first 24 hours of applying for a mortgage,” Colin Barrett, President and CEO of the Tennessee Bankers Association said in a statement in support of Rose’s bill.

Bill Killmer, executive vice president of Legislative and Political Affairs for the Mortgage Bankers Association, added, “The Mortgage Bankers Association commends Representative John Rose for introducing this legislation…We urge Congress to quickly consider this legislation that will stop the unwanted harassment of consumers and maintain an efficiently functioning mortgage market.”

– – –

Kaitlin Housler is a reporter at The Tennessee Star and The Star News Network.

Photo “John Rose” by United States Congress. Background Photo “Houses” by Dillon Kydd.