State Senator Paul Bailey, Chairman of the State Senate Transportation Committee, has not responded to an inquiry from The Tennessee Star to explain the Tennessee Department of Revenue’s correction of his assertion that Pilot Flying J, the truck stop company owned and operated by Gov. Haslam’s family, will not benefit from holding on to the extra cash generated by the proposed gas tax increase for 20 to 51 days. The Tennessee Department of Revenue has corrected Sen. Paul Bailey’s statement regarding the timing of when fuel taxes must be remitted to the state. According to the Department of Revenue’s Communications Director, Kelly Cortesi, “The gasoline tax is imposed when the fuel is first imported into Tennessee. The diesel tax is imposed when the fuel is sold to the wholesaler. In either case, the taxpayer is the importer/supplier, and the return is due on the 20th day of the following month.” Sen. Bailey is the general manager and vice-president of Charles Bailey Trucking Company. The Department of Revenue was forwarded Sen. Bailey’s statement and was asked to confirm whether it was accurate in light of the fact that the Department’s website says that fuel taxes are not due to the state until…

Read the full storyDay: February 28, 2017

Nashville Talk Radio Led Opposition to Sundquist Income Tax But Is Split on Haslam Gas Tax

When former Gov. Don Sundquist proposed imposing a state income tax on residents of Tennessee in 1999, Nashville talk radio hosts Steve Gill and Phil Valentine led the horn-honking opposition that ultimately killed the unpopular proposal three years later in 2002. It is a different media landscape in 2017, as political controversy surrounds Gov. Haslam’s proposal to increase the gas tax to fund road construction. Like Sundquist, Haslam is a Republican. WLAC, 1510 am, is no longer in the local political talk business. 99.7 FM WWTN owns the local conservative talk market, with all local hosts, beginning at 5 a.m. with Ralph Bristol, 9 a.m. with Michael Del Giorno, noon with Dan Mandis, and 3 to 7 p.m. with Phil Valentine. The day’s talk agenda is set by Nashville’s Morning News host Ralph Bristol, and he testified before the State Senate Transportation Committee in favor of Gov. Haslam’s plan, provided it is truly revenue neutral, which he says it currently is not. Former Nashville talk radio host Steve Gill, in contrast, came out guns a-blazing in opposition to the gas tax increase in a commentary posted today at The Tennessee Star. “17 years ago, talk radio lead the fight to stop…

Read the full storyCommentary by Steve Gill: It’s Not About the Roads!

As Governor Bill Haslam continues to tout the need for a massive tax increase in order to fund road and bridge construction and maintenance in Tennessee it is increasingly clear that the well-funded and heavily lobbied campaign for higher taxes actually has nothing to do with roads. It is actually about spending billions in surplus and increased recurring revenue on everything EXCEPT roads! A good magician is a master of misdirection. While you are captivated by what they are doing with their right hand the real trick is happening in the left hand. Governor Haslam is using the same sort of misdirect move to hide the truth about his tax increase scheme. While Tennessee currently has a surplus of a billion dollars AND an extra billion dollars in recurring revenue the Governor is fighting against any an all efforts to spend ANY of that money on roads. He prefers to impose higher taxes on Tennessee drivers with a seven cent increase in the gasoline tax and a twelve cent increase in the diesel tax (plus additional fees and taxes) that will generate about $300 million a year more for state and local road projects. State Representative David Hawk has proposed…

Read the full storyCommentary: Oppose Wednesday’s Vote to Raise Tennessee’s Gas Tax

There’s no denying that Tennessee’s infrastructure is in need of repair. But Gov. Bill Haslam’s proposed gas tax increases to fund the projects—which the state House of Representatives will vote on this Wednesday – isn’t the right solution. Instead, lawmakers should use money already in the state budget, which is more than enough to meet our transportation needs. The key component of Gov. Haslam’s plan is to increase the state’s tax by 7 cents a gallon on gasoline and 12 cents a gallon on diesel – respective increases of 33 percent and 65 percent over what we currently pay today. Not only that, but it will also be indexed to inflation every other year. That means each time you go to the pump, you’ll pay more to the state and have less money to spend on your personal needs—and it will get worse every two years. On top of the gas tax increase, Gov. Haslam wants to nickel-and-dime us with an increase in vehicle registration fees, too. All combined, the governor’s proposal includes nearly $300 million in higher taxes every year. And that’s not all. The proposal would also give municipalities a bite at the tax apple, allowing them to hold referendums on raising local sales taxes to…

Read the full storyCommentary by Richard Viguerie: Radical Democrats Rebranding Themselves into Permanent Minority

By Richard A. Viguerie, CHQ Chairman February 28, 2017 In my book TAKEOVER I discussed how I apply to politics the marketing knowledge and experience I’ve gained over my 55-years in direct marketing. Over those many years, I developed what I call “Viguerie’s Four Horsemen of Marketing,” which are: Position (a hole in the marketplace) Differentiation Benefit Brand (what makes you singular or unique) Brand is really defined by a combination of the other three elements; in politics it is what makes Republicans Tom Perezunique and stand apart from Democrats. While I prefer to use that hard-earned experience to help conservatives raise money and win elections, the same concepts apply to Democrats as well. So, it was with great interest and pleasure that I observed how this past weekend – by electing former Obama Labor Secretary Tom Perez as Chairman and runner-up Congressman Keith Ellison as Deputy Chairman – the Democratic Party officially and publicly abandoned its 85-year-old brand as the party of Franklin Delano Roosevelt’s New Deal to become the party of George Soros, pink kitty hats, Muslim extremism and the hardcore Far Left. This radical (pun intended) rebranding has been coming for a long time, but the election…

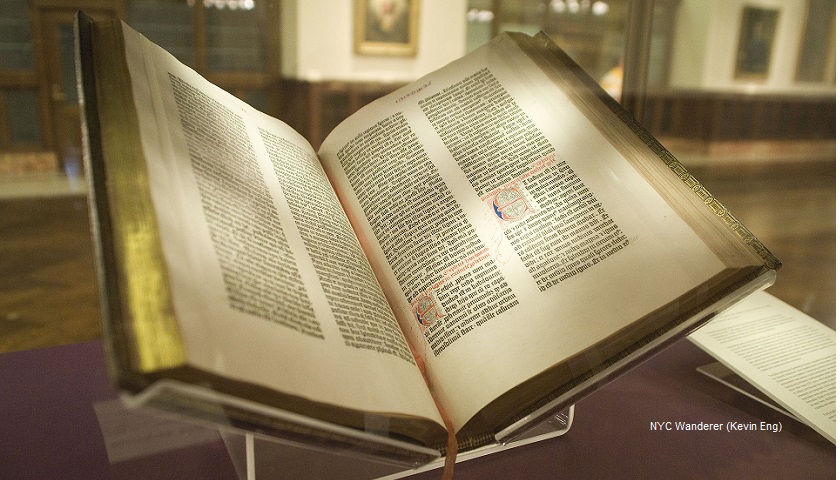

Read the full storyFaith: Verse of the Day for Tuesday, February 28

VERSE OF THE DAY Be blessed and be a blessing Tuesday, February 28 Psalm 34:4 I sought the Lord, and he answered me, and delivered me from all my fears. Philippians 4:6-7 Do not worry about anything, but in everything by prayer and supplication with thanksgiving let your requests be made known to God. And the peace of God, which surpasses all understanding, will guard your hearts and your minds in Christ Jesus.

Read the full storyJeremy Hayes to Challenge State Rep. Susan Lynn in GOP Primary Over Her Support of Gas Tax

In an exclusive interview with The Tennessee Star, Jeremy Hayes says he will challenge State Rep. Susan Lynn (R-Mt. Juliet) in the 2018 Republican primary because of her support for Gov. Haslam’s gas tax increase proposal. “I think it’s absolutely ridiculous. It’s the dumbest bill,” Hayes, the former co-chairman of the Trump campaign in Wilson County, told The Star’s Laura Baigert when asked his position on the governor’s IMPROVE Act, which raises the price of gas by 7 cents per gallon and the price of diesel fuel by 12 cents per gallon. “You do not need a math degree to understand that this thing does not make sense,” Hayes said: One, they’re telling us that they’re going to save half a cent in the grocery store, on your food tax. Well then, proposing raising the fuel tax 7 cents the first year, the diesel tax 12 cents the first year. What’s that going to do? . . . They’re going to pass that tax on to the consumer. “In addition they want to put it an index,” Hayes added, citing another feature of the governor’s gas tax proposal he opposes. Hayes also noted that the gas tax increase is unnecessary,…

Read the full storyDemocrat State Rep. Windle Files Five Obstructionist Amendments to Hawk Plan, Part of Effort to Force Gas Tax Through House

State Rep. John Mark Windle (D-Livingston), who pulled the surprise move to adjourn last week at the House Transportation Subcommittee before a fair chance was given to vote on the Hawk Plan, the alternative to the governor’s gas tax increase plan that reallocates sales tax revenue, is at it again. “Windle filed five amendments to Hawk’s legislation Monday after being rebuffed last week by Weaver. Windle, of Livingston, is introducing measures to remove sales taxes on baby formula, milk, bread and baby diapers. Yet another amendment would provide a 10-year franchise tax exemption on manufacturing plants that open or expand in economically distressed counties,” the Memphis Daily News reported. Windle’s latest exercise in legislative skullduggery came two days before the House Transportation Subcommittee is scheduled to reconsider both the Hawk Plan and Gov. Haslam’s IMPROVE Act on Wednesday. Subcommittee chairman State Rep. Terri Lynn Weaver (R-Lancaster) is a strong opponent of the governor’s proposal. “My district knows it. I’m opposed because my district is opposed to it,” Weaver told the Daily News. But Windle has aligned himself with three Republican allies of Gov. Haslam on the Transportation Subcommittee who are determined to prevent the Hawk Plan from surviving the committee:…

Read the full story