The taxpayer-funded Tennessee School Boards Association (TSBA) had $5.3 million in assets at the end of 2017 and paid its top two executives $499,000 annually in 2016, according to audited financial statements and IRS Form 990 reports.

The TSBA filed those reports, which The Tennessee Star obtained copies of this week.

Tennessee taxpayers contributed more than 85 percent, slightly more than $2 million, of the TSBA’s $2.3 million revenues in 2016 through Local Education Agencies (LEA- the formal name for public school districts in Tennessee) dues and no bid contracts.

The no bid contracts were a gift to the TSBA, which was organized way back in 1939, provided by the Tennessee General Assembly in 1990.

“In 1990, the Tennessee Legislature mandated that school board members attend one full-day training session each year. The State Board of Education authorized the Tennessee Department of Education to plan and implement the program. The Department of Education contracts with TSBA to conduct all of the training. TSBA also conducts a variety of meetings, workshops and seminars throughout the year to inform board members and administrators about key issues and topics affecting public education, ” according to the TSBA website.

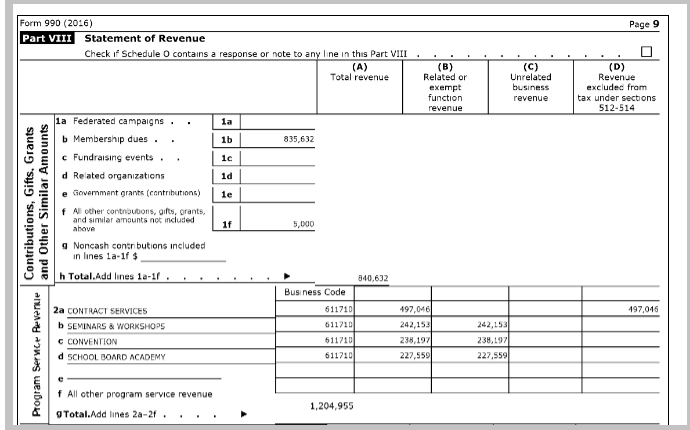

Taxpayer funding to TSBA came in at least two forms in 2016, according to the organization’s Form 990 filed with the IRS: $835,632 in membership dues from participating school boards across the state, and more than $1.2 million in these no bid contracts with the TSBA in 2016, paid for by Tennessee Department of Education, to provide “contract services” in the amount of $497,046, “seminars and workshops” in the amount of $242,153, “Conventions” in the amount of $238,197, and “School Board Academy” in the amount of $227,559, as shown on page 9 below of the TSBA’s 2016 IRS Form 990:

You can see the entire TSBA Form 990 filed with the IRS for 2016 here below:

[pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2019/03/TSBA990_2016.pdf”]

Sources tell The Tennessee Star that the TSBA has used these taxpayer-funded no bid contracts to provide training to school board members across the state to lobby for and promote policies that benefit the TSBA.

The most notable recent example of that is what appears to be an orchestrated effort by school boards across the state to oppose school vouchers. Since Bill Lee was elected governor in November 2018, school boards in Maury, Rutherford, Madison, Houston, and Wilson counties have formally opposed school vouchers. School officials in Nashville and Oak Ridge have done the same.

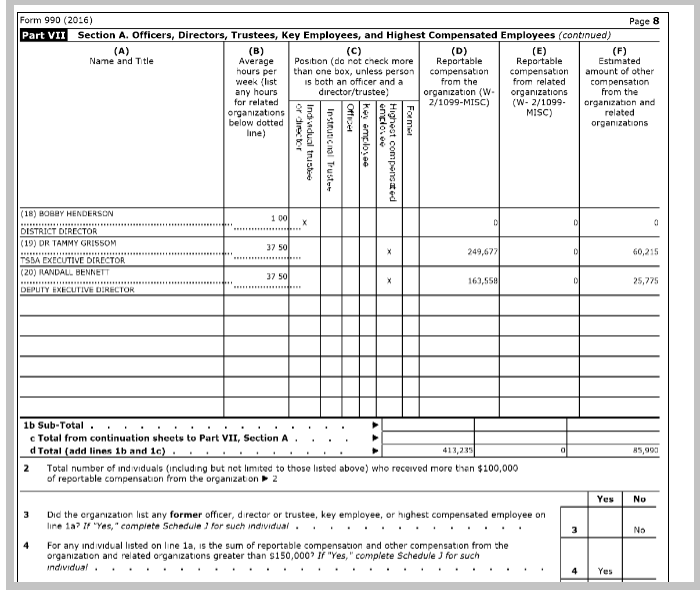

According to the TSBA IRS Form 990 for the year 2016, its top two executives, executive director Dr. Tammy Grissom and general counsel Randy Bennett, made more than $499,225 combined in 2016 in salary and benefits. These two individuals accounted for more than 50 percent of all TSBA payroll costs in 2016, and over 25 percent of all TSBA expenses that year.

Grissom was paid $249,677 in W-2 compensation and $60,215 in other compensation, for a grand total of $309,882 in compensation from the TSBA for 2016. Bennett was paid $163,558 in W-2 compensation and $25,775 in other compensation, for a grand total of $189,333 in compensation from the TSBA for 2016.

You can see the details of the 2016 compensation for Grissom and Bennett here on page 8 of the TSBA 2016 IRS Form 990:

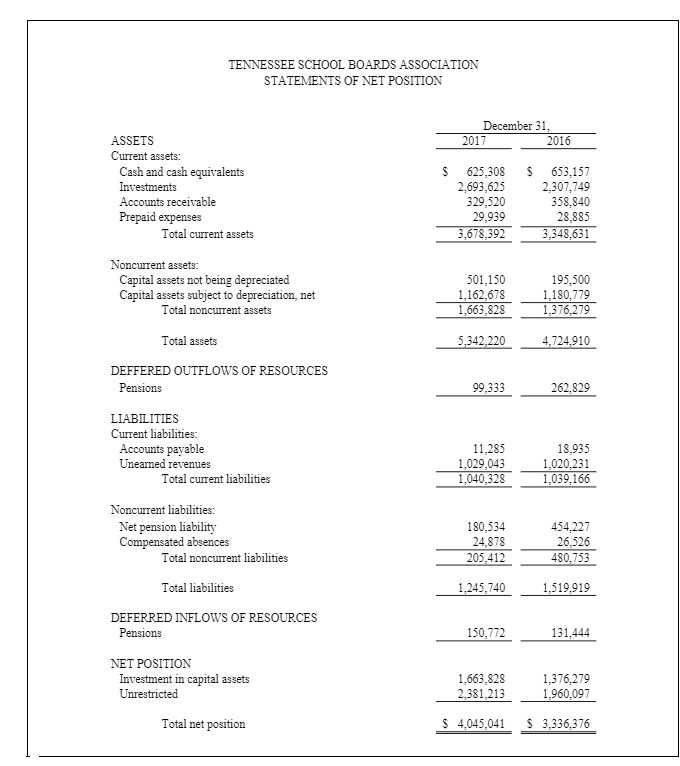

The TSBA had less than $206,000 in long term debt as of December 31, 2017. The organization had substantial current and long-term assets totaling more than $5.3 million, including $625,308 in cash, more than $2.6 million in exchange-traded mutual funds, and more than $1.6 million in real estate and other capital assets, as seen here on page 13 of the TSBA Audited Financial Statement for December 31, 2017:

With only $1.2 million in liabilities, the TSBA had a total net position of more than $4 million as of December 31, 2017.

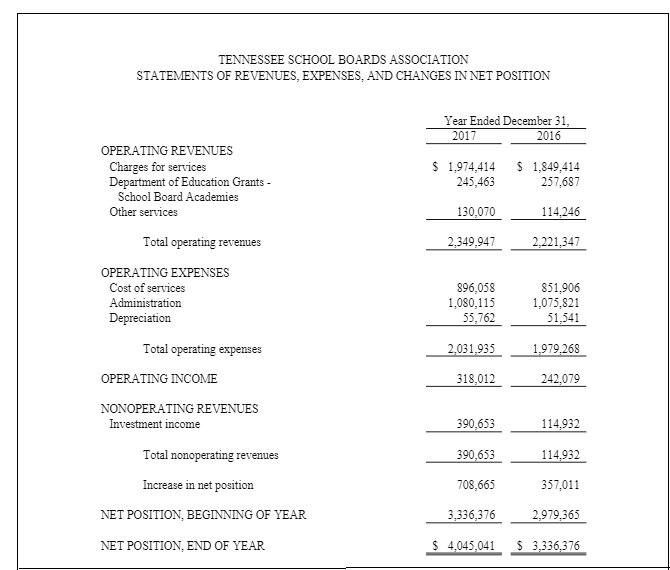

TSBA’s huge balance sheet enabled it to secure more than $390,000 in investment income in 2017 , which contributed substantially to its $708,000 profit (increase in net position) that year, as seen here on page 14 of the TSBA Audited Financial Statement for December 31, 2017:

One curious aspect of the financial documents The Tennessee Star obtained is the TSBA’s relationship with what it calls “Business Affiliates.” In 2016, according to page 9 of the TSBA 2016 IRS Form 990, it received $82,000 in revenue from business affiliates.

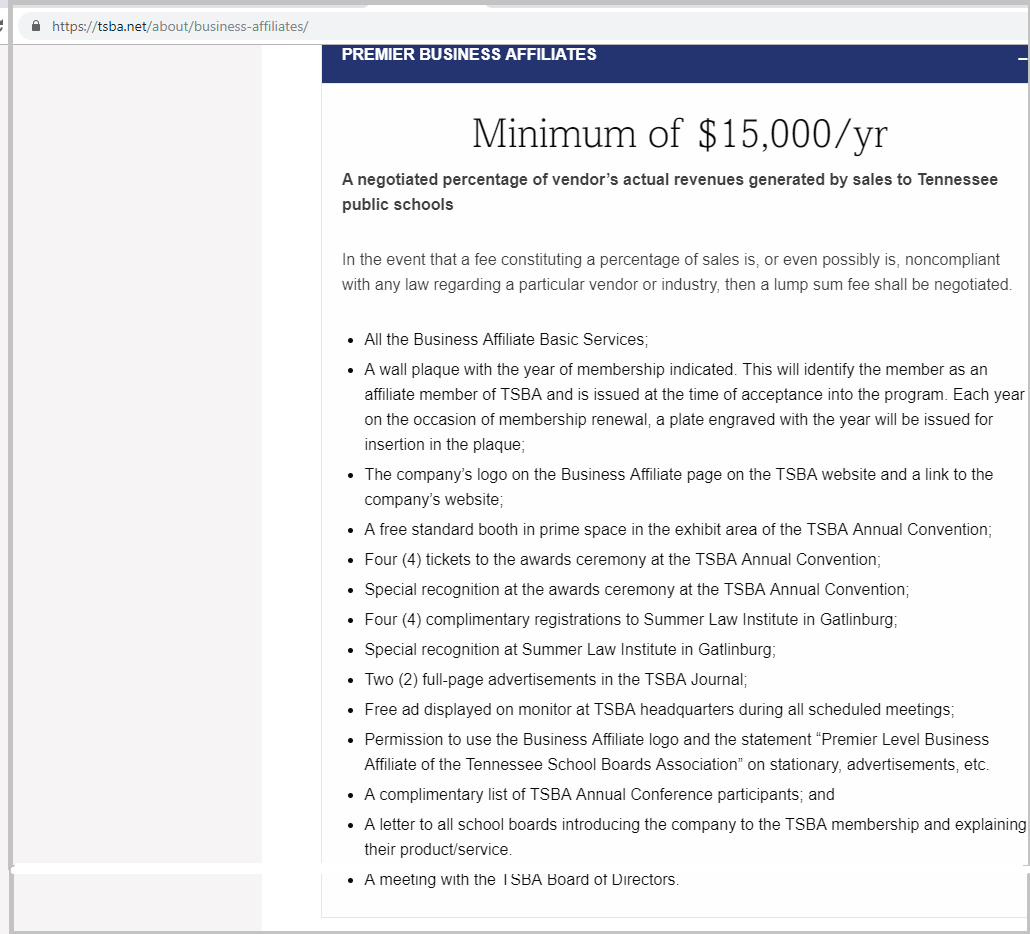

According to its website, a TSBA “Premiere Business Affiliate” vendor can get special access to LEA decision makers by giving TSBA a negotatiated percentage of the “Premiere Business Affiliate’s” actual revenue from sales to LEAs.

For a minimum payment of $15,000 per year to the TSBA, “Premier Business Affiliates” are apparently provided special access to Tennessee public schools, but agree to provide TSBA with “a negotiated percentage of vendor’s actual revenues generated by sales to Tennessee public schools,” according to the TSBA website.

The TSBA adds this qualifier on the arrangement:

In the event that a fee constituting a percentage of sales is, or even possibly is, noncompliant with any law regarding a particular vendor or industry, then a lump sum fee shall be negotiated.

Among the many benefits Premier Business Affiliates receive are:

- A complimentary list of TSBA Annual Conference participants.

- A letter to all school boards introducing the company to the TSBA membership and explaining their product/service.

- A meeting with the TSBA Board of Directors.

You can see a screen shot of the TSBA Premier Business Affiliates page taken at 8:00 pm on March 3, 2019 here:

Such an arrangement raises a number of legal and ethical questions.

Only one entity was listed as a Premier Business Affiliate on March 3, 2019: Brentwood based Public Risk Insurors.

You can see a screen shot of the TSBA Premier Business Affiliate status of Public Risk Insurors taken at 10:00 pm on March 3, 2019 here:

Lesser levels of access to school boards were provided to “Platinum,” “Silver,” “Gold,” and “Basic” Business Affiliates.

In 2016, GCA was listed on the TSBA website as a Premier Business Affiliate. Public Risk Insurors was listed only as a Gold Business Affiliate in 2016.

According to its website, “Public Risk Insurors is an independent insurance agency and broker that specializes in providing comprehensive and cost effective public entity insurance coverage for all types of public entities including cities, counties, school systems, utilities, human resource agencies, and non-profit organizations.”

Laura Jungmichel is the founder and principal of Public Risk Insurors.

(TSBA Audited Financial Statements, Dec. 31, 2017 below)

[pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2019/03/Audit-2017-tsba.pdf” title=”Audit 2017 tsba”]

(TSBA Audited Financial Statements, Dec. 31, 2016 below)

[pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2019/03/Audit-2016-tsba.pdf” title=”Audit 2016 tsba”]

[…] Strong opposition to last year’s school choice bill came from the Tennessee Organization of School Superintendents and the Tennessee School Board Association, both of which are funded by membership dues paid for by taxpayer dollars. The latter has more than $5 million in assets and paying its top executives nearly a half million dollars, as The Star reported. […]

[…] In addition, strong opposition came from the Tennessee Organization of School Superintendents (TOSS) and the Tennessee School Board Association (TSBA), both of which are funded by membership dues paid for by taxpayer dollars, the latter having more than $5 million in assets and paying its top executives nearly a half million dollars, as The Tennessee Star reported. […]

[…] Public Risk Insurors Chief Financial Officer Dave Williams to The Star in response to our story, published March 4, titled “Taxpayer-Funded TSBA Has $5.3 Million in Assets, Paid Top Two Execs $499k […]

If you think that is bad, please expose the Tennessee Organization of School Superintendents! They conduct business in a similar manner & are point locally for budgets, contracts, etc. We’ve got swamps to drain!

I have long wondered why the TSBA even existed. Now we know why. Same with SCORE. This s just another indication of what happens when business gets in bed with government. We should do the country a favor and get rid of all tax exempt organizations. Let fail or succeed on their own dime. This is what happens when you mix business with government. It is called corporate fascism and it is always corrupt.

Nice to see the press doing its real job.

No wonder our schools are such a mess with little hope of them getting better. Public money should not be available for such operations.