Mayor John Cooper’s budget for the 2021 Fiscal Year (FY) includes a five percent increase in spending, which will come at the expense of Nashville property owners by way of a 32 percent property tax increase.

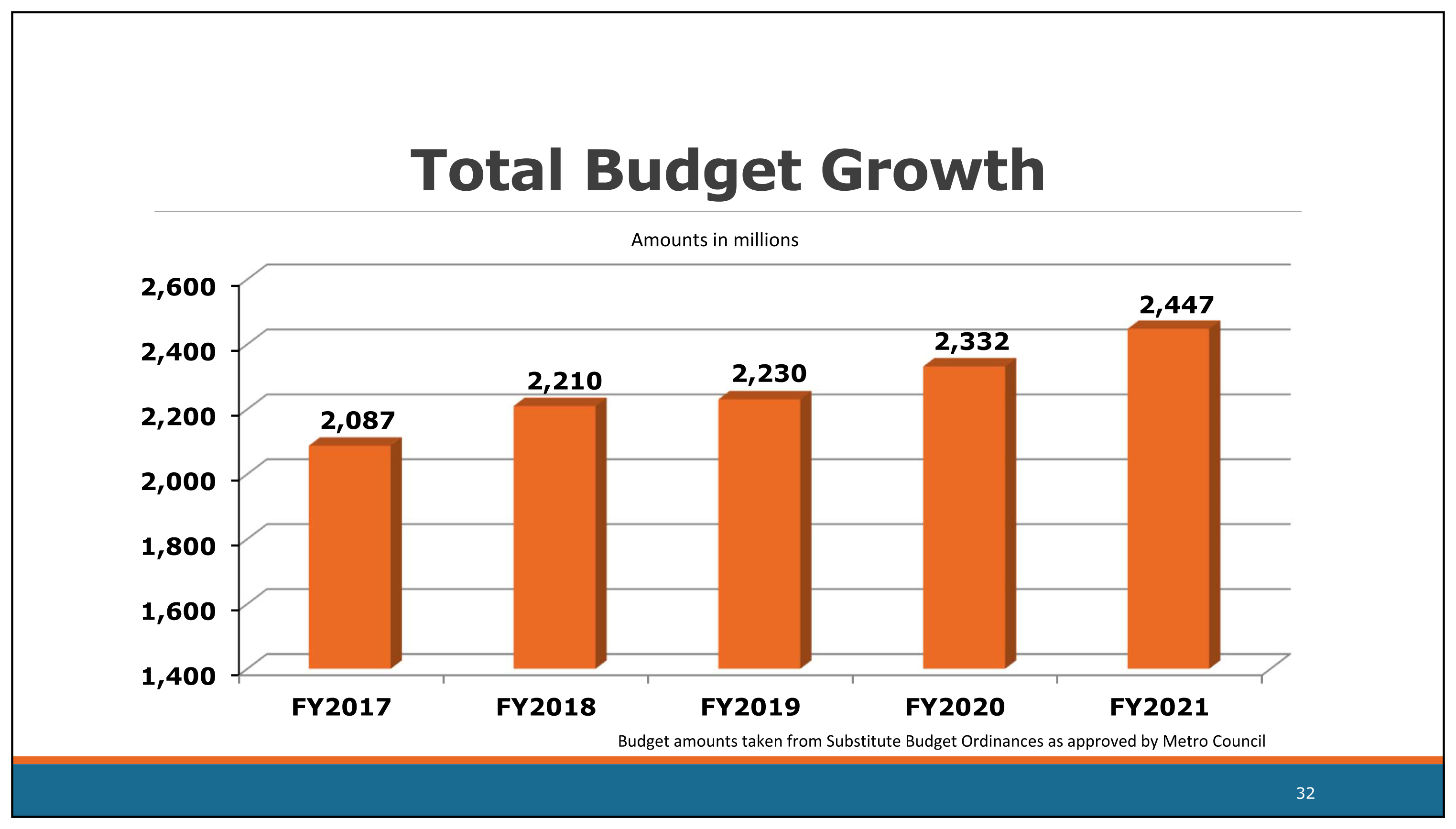

The record-high budget of $2.45 billion is Cooper’s first, and comes on the heels of a devastating tornado on March 3 and during a worldwide coronavirus pandemic which resulted in major losses of personal property and income for Nashvillians.

While Cooper has had Nashville/Davidson County under a “Safer At Home” order since March 23 due to COVID-19, which has required that all “non-essential” businesses be shut down, the local government has seen a revenue shortfall.

The revenue shortfall for the current fiscal year ending June 1, 2020, is estimated at $215.8 million. Based on revenue numbers obtained from budget documents, at $13.6 million, less than 10 percent of the current shortage is from property taxes.

Going into FY 2021, which begins July 1, revenue impact from COVID-19 and the March 3 tornado is estimated at $280.6 million.

Meanwhile, FY 2021 initial additional funding “needs/requests” in the budget presentation were identified as $404.5 million.

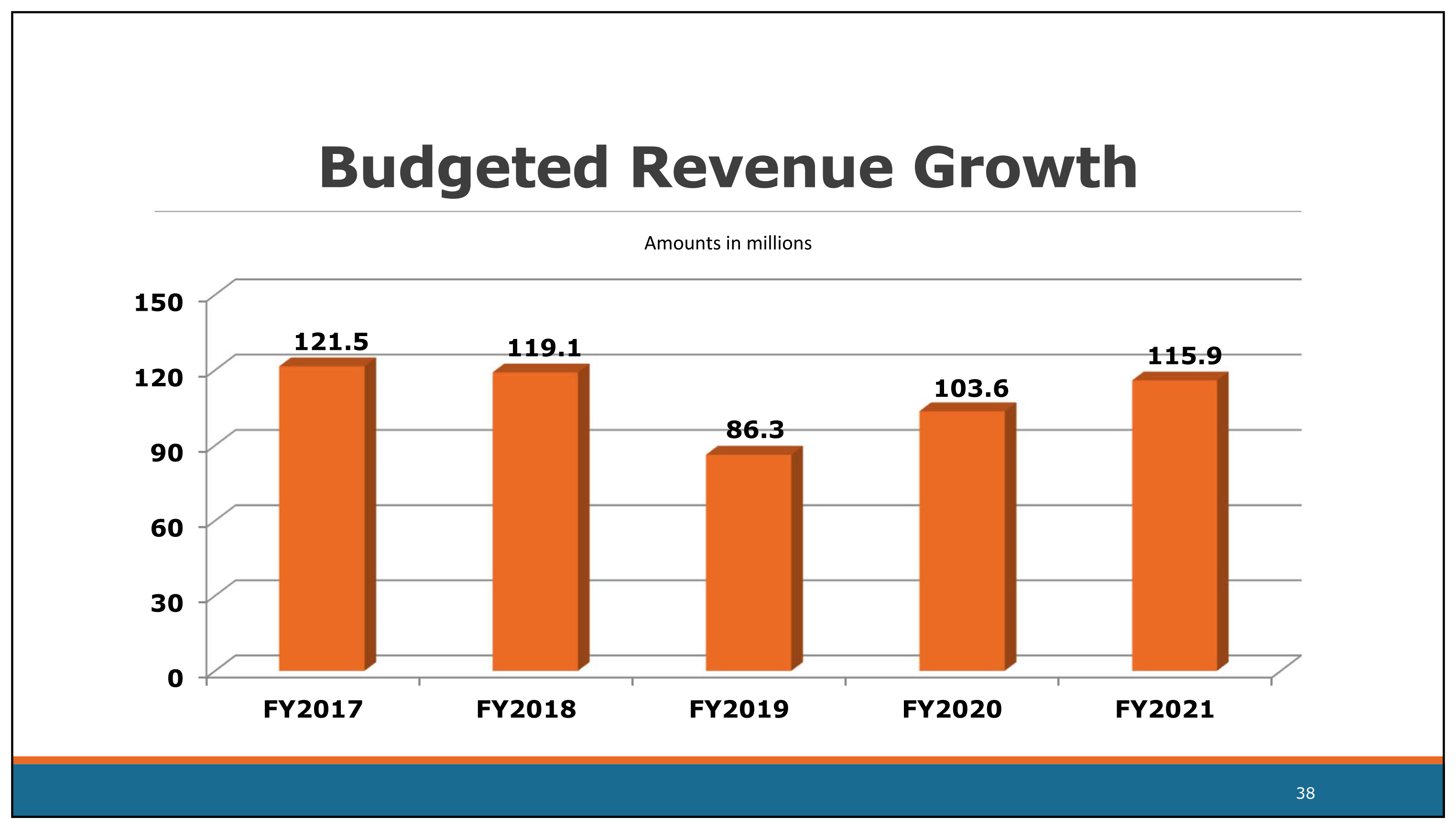

The additional “needs/requests” amount was pared down to a “minimum” $115.9 million in “funding needs,” according to the FY2021 budget presentation.

As typical for government, the starting point for the FY 2021 budget is the prior year’s budget plus projected growth in revenues.

On that basis, Nashville’s FY 2020 budget was $2.3 billion. Added to that for FY 2021 budget documents show $71.2 million in “normal revenue growth” in addition to $63.5 million in “new revenues” for a total FY 2021“pre-disaster” revenue projection of $2,396.5 million.

However, the loss in revenue for FY 2021 due to COVID-19 and the tornado is estimated to be $280.6 million over the four major revenue categories:

- Property Taxes – minus $4.5 million

- Local Option Sales Tax – minus $161.4 million

- Grants & Contributions – minus $21.4 million

- All Other Revenues – minus $93.3 million

The $280.6 million revenue shortfall for FY2021 along with the $115.9 million in additional “minimum funding needs” combines for a $332 million gap in Cooper’s budget.

Cooper’s solution is a $1.00 property tax increase.

A $1.00 addition to the current property tax rate of $3.1550 per $100 of assessed value will result in bills to Nashville property tax owners that are 32 percent higher.

Budget documents indicate that the property tax increase will shore up Cooper’s 4.97 percent budget increase over FY2020, for a total FY2021 recommended budget of $2.447 billion.

Cooper’s budgeted revenue growth for FY2021 of $115.9 million is higher than the past two years, which was just $86.3 million from FY 2018 to FY 2019 and $103.6 million from FY 2019 to FY2020 under Mayor David Briley.

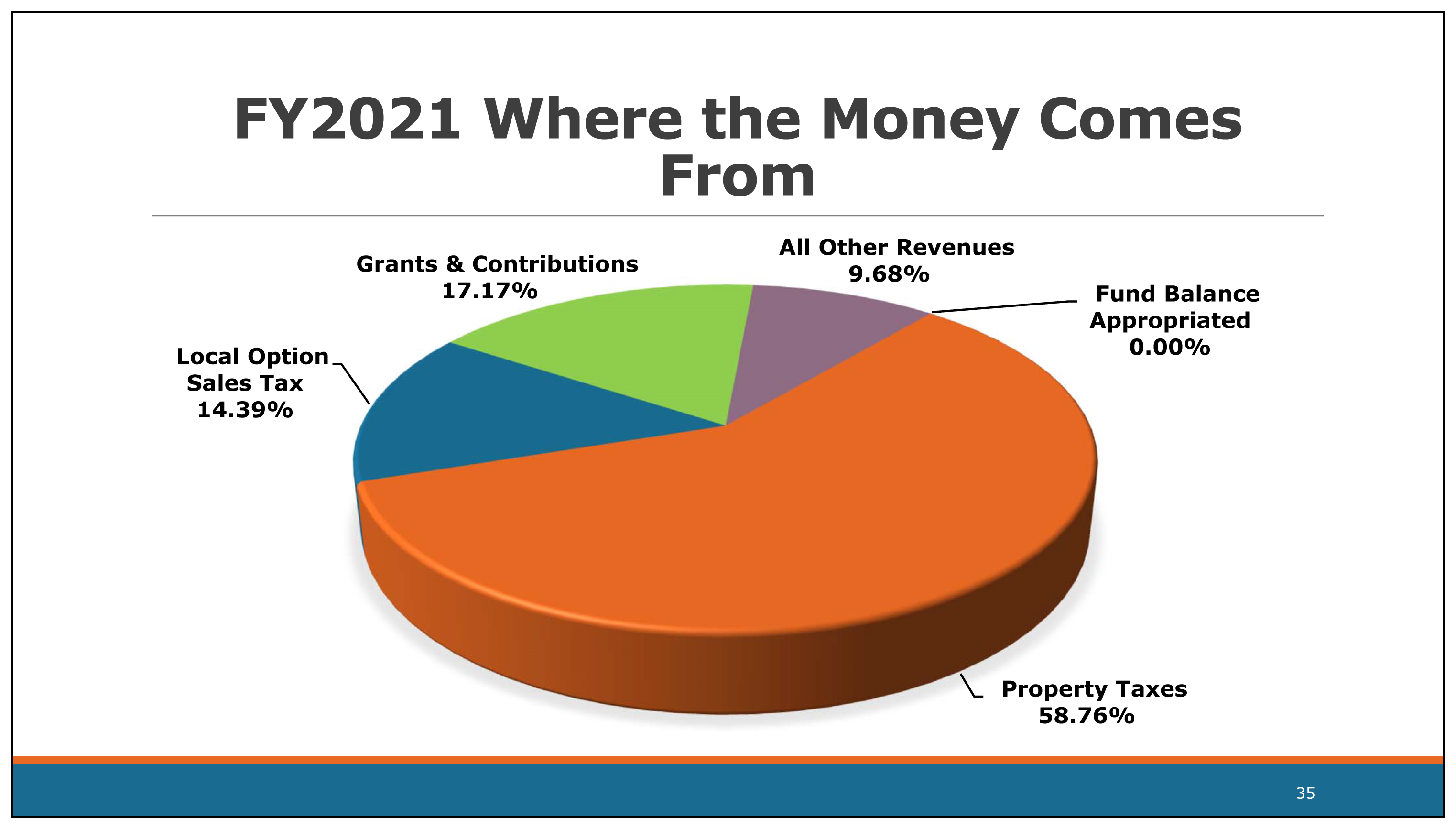

The property tax increase also represents a major shift in the balance of Nashville’s funding sources.

Currently, less than half of Nashville’s revenues – 45.7 percent – come from property owners.

After the property tax increase, Cooper will increase the share that Nashville’s property owners are burdened with to 58.8 percent of total funding.

Of course, even the 32 percent increase in property tax is presented as a lower property tax rate as compared to other major Tennessee cities or counties.

However, a property tax rate is only half of the equation when it comes to a property tax bill. The other half of the equation is the value of the property.

For an entire city or county, rather than an individual property basis, the correlation between property tax rate and total property values is described as revenue per one cent of the property tax rate.

In 2018, the most recent data available, the revenue per one cent of the property tax rate in Nashville/Davidson County at $3.2 million was the highest in the state. In fact, that rate was 50 percent higher than the next closest rate of Shelby County at just over $2 million in revenue per one cent of the property tax rate.

The property tax increase, along with the increase in property values from new and improved properties is expected to yield an additional $373 million in property tax revenues in FY 2021 over the FY 2020 property tax revenues, representing a 35 percent increase in revenues from property taxes.

According to the Treasurer’s Report to the Council, currently Nashville-Davidson County has $4.3 billion in debt and a proposed $1.16 billion in additional capital spending has been authorized but the bonds have not yet been issued.

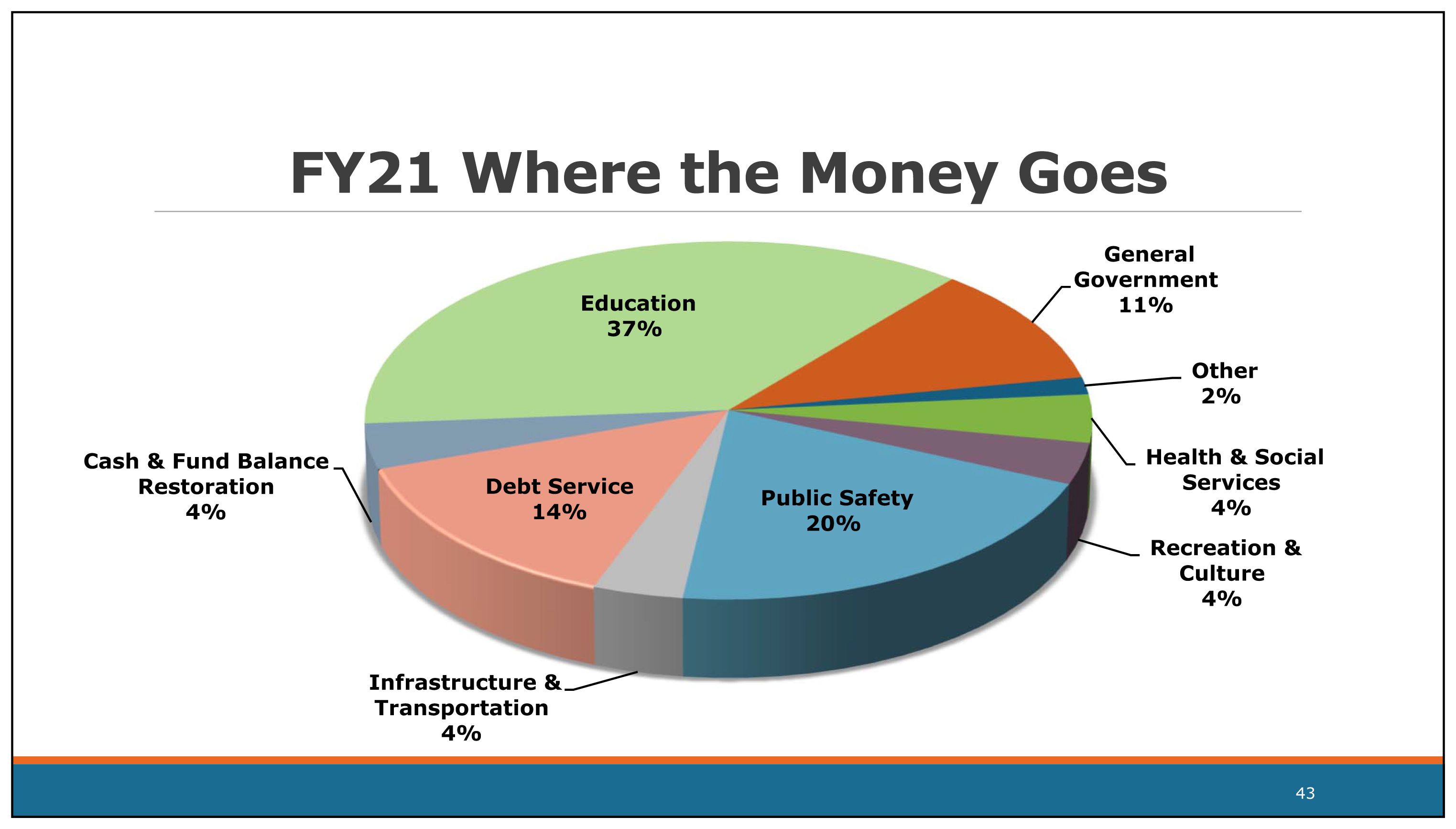

As a percent of Nashville-Davidson County’s operating budget, debt service – payments of interest and principal – at over $321 million per year is at least a 10-year high at over 14 percent.

That percentage is the third-highest, coming after only education and public safety at 37 and 20 percent, respectively.

Falling behind the percentage going to debt service is general government at 11 percent, infrastructure and transportation, health and social services, recreation and culture at four percent each, and “other” at two percent.

This year, nearly $100 million or four percent of the total budget is designated by Cooper for the restoration of the cash and fund balances, which have been essentially depleted in 2020.

The Metro Nashville Budget and Finance Committee and full Council will conduct public hearings and are required to pass Cooper’s proposed budget ordinance or a substitute budget by June 30, or Cooper’s recommended budget and property tax rate will take effect by default.

– – –

Laura Baigert is a senior reporter at The Tennessee Star.

Photo “John Cooper” by Nashville.gov.

Will there be any additional taxes on sporting events? (Titans, Predators, etc.)

Only one sporting event should have an increase, you know the one where they throw the politicians to the lion! I’ll pay good money to see that one!

Metro is a prime example of mismanagement and corruption that happens when one party runs everything for years. Look at every city that is having financial problems and every city is run by the democrats. Our Mayor and Bob Menendez want the citizens to pay for the continued mismanagement of funds by our so called leaders. Nashvile has grown in spite of itself but, we may be seeing the beginning of the end.

Thanks for this eye opening article!

5% increase in the budget? How about a 5% decrease in the budget until Nashville is in a recovery cycle. Yeah, it’s going to hurt but not as much as a 32% increase in property taxes on your tax payers, the same folks that pay YOUR salary. You were hired to sail the ship through stormy times not run it aground.

Proving once again the elite ruling class is completely out of touch with everyday constituents. Cooper rolls on with budget ‘increases’ right over the shelter at home altered budgets of the taxpayers! A good leader would recognize the hurt and harm he’s done to the personal budget of his constituents with these so called necessary steps. But, elite’s don’t see those personal budget shortfalls, because they live in ivory towers eating with silver spoons! A good leader would cut government budgets in times like these, like a real business would! But not an elite ruling class politician!

Agree!

What’s wrong with this picture? We’re told that “non-essential” businesses can’t operate, yet 37% of 2.4 BILLION goes to an education system where most of the kids can’t read. We’re told to wear masks and stay away from other people, yet 20% of 2.4 BILLION goes to “public safety” while crime keeps going up. And how about that 4% for “recreation and culture”, and 1% for “other”, when you can’t pay your “essential” bills, you don’t deserve to spend our money on “non-essentials”!

Fire all the Nash-villains in City Hall, except maybe the janitor. He’s got to throw out the rest of the trash!

I’m guessing trips to Greece are out?

Megan, why would you ever think that when the new budget has a 5% increase? There’s always more pork for the trough.