by Andrew Trunsky

Democrats are pushing to permanently expand monthly child tax credits in their spending package, but a new poll shows that just 35% of Americans support extending the payments beyond July 2022.

The expanded payments began in July as a part of President Joe Biden’s coronavirus relief package signed in March. While the Politico/Morning Consult poll released Wednesday found that 50% of Americans supported the increase in payments, 12 points higher than those who opposed them, 52% of Americans said the payments should not be extended beyond their set expiration.

Under the expanded credits plan, families receive $300 monthly for each child under six, and $250 monthly for each kid aged six to 17.

Although the package passed along party lines, just 47% credited Democrats in Congress for the expansion, and just 38% credited Biden.

Several moderate Democrats have objected to permanently expanding the payments in their current form. West Virginia Sen. Joe Manchin called for them to be tailored toward low-income families, and he has insisted on attaching them to a work requirement, though some recent studies have shown that the payments did mostly enable people to work even more.

The wide-ranging survey also found that 55% of Americans approve of the bipartisan infrastructure bill, while just 31% disapprove. More, the survey showed that 71% of Americans are “somewhat” or “very” concerned about the U.S. defaulting on its debts if Congress fails to raise the debt ceiling.

The poll was conducted from Oct. 2-4 among 1,998 registered voters and has a margin of error of 2 points.

– – –

Andrew Trunsky is a reporter at Daily Caller News Foundation.

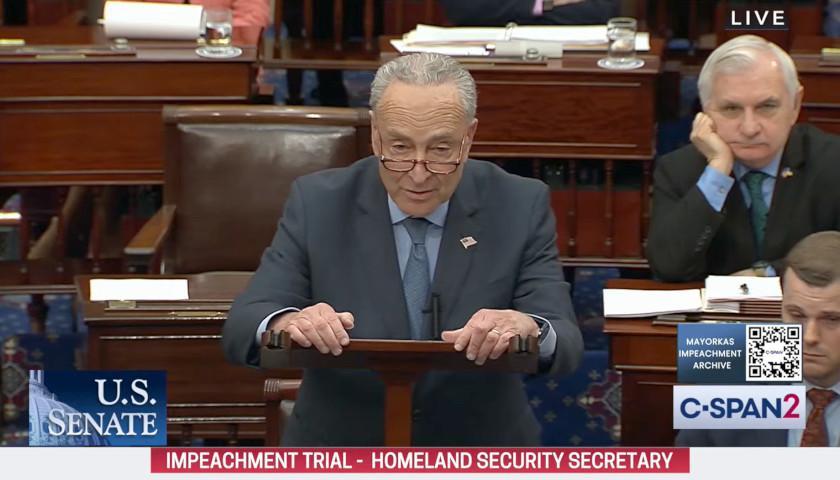

Photo “Nancy Pelosi and Chuck Schumer” by Senate Democrats CC BY 2.0.