The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storyAuthor: Laura Baigert

Senate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyState Rep. Susan Lynn Confirms User Fees are ‘Diverted From the Highway Fund’ in Email Sent to Entire Tennessee General Assembly

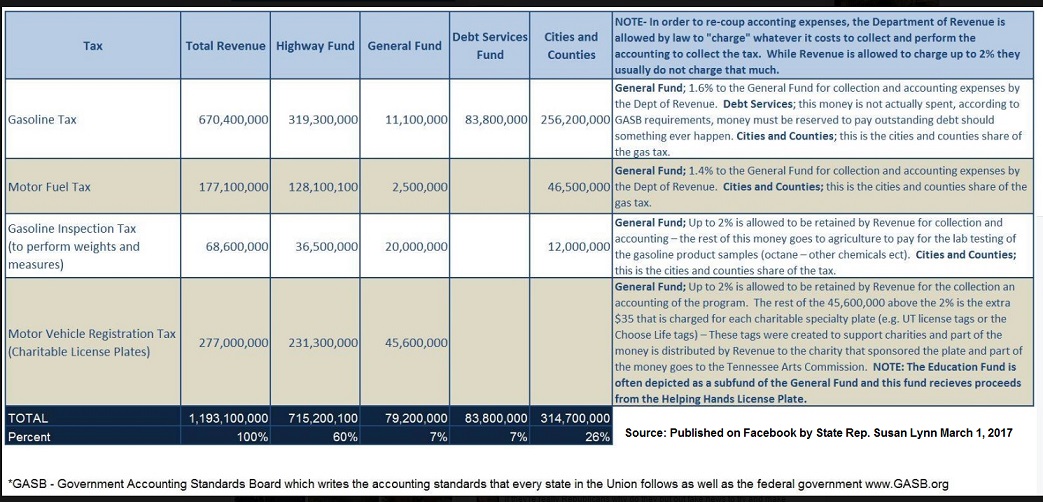

“I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes,” State Rep. Susan Lynn (R-Mt. Juliet) told a constituent in an email, confirming The Tennessee Star’s report that Highway Fund user fees are being allocated to the General Fund, Education and Debt Service. The constituent had forwarded a link to The Star’s report on Wednesday that “The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service.” In the email reply to her constituent, Rep. Lynn copied every member of the Tennessee General Assembly in both the House and Senate, ensuring that they have knowledge of the “diversion” of user fees from the Highway Fund. You can read the first part of Lynn’s reply to her constituent here: I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes. Each amount makes perfect sense. Please see my slide below with…

Read the full storyHaslam’s IMPROVE Act Forced Through House Subcommittee in Rare Political Power Play as Speaker Pro Tem Brought in To Break Tie

Through a series of political maneuvers, Gov. Haslam’s IMPROVE Act has advanced from the House Transportation Subcommittee to the full House Transportation Committee, thanks to the rare tie-breaking vote cast by Speaker Pro Tem State Rep. Curtis Johnson (R-Clarksville). Johnson was brought in at the last minute to the House Transportation Subcommittee Wednesday afternoon to break a 4 to 4 tie. With Johnson’s yes vote, the IMPROVE Act passed on a 5 to 4 vote. Subcommittee members voting yes on the amended IMPROVE Act bill were State Rep. Barry Doss (R-Leoma), who also serves as chairman of the full House Transportation Committee, State Rep. David Alexander (R-Winchester), State Rep. Sam Whitson (R-Franklin), and State Rep. Barbara Cooper (D-Memphis). Subcommittee members voting no on the amended IMPROVE Act bill were State Rep. Terri Lynn Weaver (R-Lancaster), chairman of the Transportation Subcommittee, State Rep. Courtney Rogers (R-Goodlettsville), State Rep. Jerry Sexton (R-Bean Station), and State Rep. John Mark Windle (D-Livingston). The next stop for the IMPROVE ACT is the full House Transportation Committee, chaired by Haslam ally and gas tax advocate Doss. The version of the IMPROVE ACT that passed was amended to remove the gas tax increase originally proposed by the governor.…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyGov. Haslam Has Cut State’s Portion of Highway Fund Budget by $56 Million Annually, Compared to Predecessor

During the six years he has served as the head of Tennessee’s state government, Gov. Haslam has cut the state’s portion of the Highway Fund budget by an annual average of $56 million when compared to his predecessor, Gov. Phil Bredesen. In the last six years of Gov. Phil Bredesen’s eight-year term, between FY 2005-06 and FY 2010-11, the annual average state allocation to the Highway Fund was $833 million. While the actual dollars fluctuated from year to year, overall the Highway Fund budget grew about 12 percent in those six years. Under Gov. Haslam, the state’s portion of the Highway Fund budget shrank to an annual average of $777 million during the six years between FY 2011-12 and FY 2016-17. That is an average annual reduction of $56 million, an overall reduction of 7 percent. The total Highway Fund grew 2 percent per year under Gov. Bredesen, and has been reduced 1.1 percent per year by Gov. Haslam. In that same six-year period, Gov. Haslam’s total state budget grew 18 percent. “The detailed breakdown of reduction in road spending under Governor Haslam is shocking but, unfortunately, not surprising,” State Sen. Mae Beavers (R-Mt. Juliet) tells The Tennessee Star. “I…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyPure Foods Goes Bankrupt After Benefiting From $1.2 Million in Tennessee State Economic Development Funds

Less than two weeks before Governor Haslam introduced his IMPROVE Act centered on a gas tax increase for road funding, Pure Foods, Inc., a recipient of $1.2 million in state economic development funds, filed for bankruptcy. The $1. 2 million from the state’s FastTrack Economic Development (ED) Fund did not go directly to Pure Foods. Instead, it was allocated for use by KEDB for construction of a speculative building that Pure Foods leased for 10 years. According to the Kingsport Tennessee Times News, in March 2015, the Canadian based gluten-free snack food company, Pure Foods, Inc., was set to establish its U.S. headquarters at the Gateway Commerce Park in Kingsport, Sullivan County. The deal included an investment of $22 million, an 80,000-plus square foot facility, and the creation of 273 new jobs generating an annual a payroll of $8 million. The Kingsport Economic Development Board (KEDB) and the Kingsport Chamber of Commerce also supported the project by providing financial assistance and various incentives, including the purchase of 33 acres of land in the Gateway Commerce Park for $6.5 million borrowed from First Tennessee Bank. According to the Transparent Tennessee website’s FastTrack Project Database, ED grants provide additional support for…

Read the full storyGov. Haslam Gets Tough Questions From Informed Crowd at Franklin County Gas Tax Town Hall

Governor Haslam appeared nervous and off his game Monday night, as he was peppered with questions he could not answer at a “gas tax town hall” tour stop at the Franklin County Annex Building in Winchester. After giving 30 minutes of opening comments to the standing-room-only crowd of about 150 people, the governor opened the meeting up to questions and was challenged for the next 45 minutes with more than two dozen questions critical of his proposal to raise fuel taxes. The first questioner contrasted the 7 cents per gallon gas tax and 12 cents per gallon diesel tax increase with the half-percent reduction in the grocery sales tax contained in the governor’s plan. The questioner pointed out that the two things that have strapped everyone are groceries and fuel. The fuel tax increases will offset any grocery tax savings, the questioner stated. The governor then went through his math to assert that his proposal represents a 4 cent increase per $100 purchased in diesel fuel, but the man who posed the question found that arithmetic unsatisfying. He sat down, shaking his head. County Commissioner Dave Van Buskirk asked if the money will only go to roads. Gov. Haslam said…

Read the full storyEXCLUSIVE: Rep. Sheila Butt: Bill Focuses On The Success of Our Students

Rep. Sheila Butt (R-Columbia) told The Tennessee Star in an exclusive interview on Capitol Hill that HB 617, a bill she has sponsored in the current session of the Tennessee General Assembly, will improve options for high school testing in math and English language arts. “HB 617 is a bill which would allow local school districts to have the option of using the ACT or the SAT suite of testing in lieu of the end of course test, the TNReady test and the TCAP test, in the State of Tennessee,” Butt told The Star’s Laura Baigert. “This is a bill that focuses on the success of our students and this is a tried and true measurement of college readiness and college success. And all of our districts should have the option of being able to use these tests for their students,” she added. “Local Education Agencies – As introduced, authorizes LEAs to use the ACT, ACT Aspire, or SAT suites of standardized assessments instead of the TCAP, TNReady, and end-of-course exams to test the subjects of math and English language arts for grades nine through 12,” the Tennessee General Assembly website says of HB 617 (introduced in the Senate as SB…

Read the full storyState Rep. Courtney Rogers Proposes Bill to Let Citizens Request Public Records Via Email

State Rep. Courtney Rogers (R-Goodlettsville) has introduced a bill, HB 58, which allows requests for public information to be submitted by all official modes of communication, including in person, via telephone, fax, email or other electronic means. “Public Records – As introduced, requires a records custodian, if that records custodian requires a request for copies of public records to be in writing, to accept a handwritten request submitted in person or by mail, an email request, or a request on an electronic form submitted online; requires a request for a records request form to be provided by the most expeditious means possible,” the Tennessee General Assembly website says of the bill. Rep. Rogers told the House State Government Subcommittee during hearings last week that her revisions seek to make it easier for the general public to make their information requests. In addition, she said, her bill will eliminate current ambiguities in the law to help prevent lawsuits in the future. The bill passed in that subcommittee on Tuesday, but not without some controversy that could impact its passage at the full State Government Committee meeting next week. The Tennessee Public Records Act (TPRA) is a compilation of Tennessee Code Annotated…

Read the full storyReagan Economist Art Laffer to Subcommittee Hearing on Gas Tax: ‘We Don’t Need More Taxes In Tennessee’

“We don’t need more taxes in Tennessee,” well-known economist Arthur Laffer told the House Transportation Subcommittee on Wednesday at a hearing about Gov. Haslam’s proposed gas tax increase. Laffer, who gained international prominence during the Reagan Era as the author of “the Laffer Curve” –which showed government revenues increase as high taxes are cut– testified before the subcommittee at the invitation of House Transportation Subcommittee Chair State Rep. Terri Lynn Weaver (R-Lancaster). He is probably most well-known for his role on the Economic Advisory Board under President Reagan. He has a B.A. in Economics from Yale University and his Ph.D. from Stanford University. The renowned economist “made a calculation” and came to Tennessee 10 years ago, leaving the heavily taxed state of California. He hasn’t looked back. “Economics is all about incentives. People like doing things they find attractive and dislike doing things they find unattractive. Taxes change the attractiveness of activities,” Laffer told the subcommittee: If you look at taxes, all taxes are bad, but some are worse than others. What you want to do is you want to collect your tax revenues in the least damaging fashion possible and you want to spend the proceeds in the most beneficial fashion…

Read the full storyGrassroots Pundit: The Governor’s Over-Engineered Plan for a Gas Tax Increase

After two consecutive losses on the Insure Tennessee front, Governor Haslam designed a better plan for his gas tax increase, packaging it as his IMPROVE (Improving Manufacturing Public Roads and Opportunities for a Vibrant Economy) Act. But, the good planning goes well beyond a name and includes a little help from his friends. COMPTROLLER’S OFFICES OF RESEARCH AND EDUCATION ACCOUNTABILITY REPORT The 76-page report, “Tennessee Transportation Funding: Challenges and Options,” was issued in January 2015. As the title implies, the report reviews the current situation and various ways to address transportation funding needs. One thing it doesn’t do is make any recommendations on how to proceed. With even cursory reading, it will be obvious that not all revenue that should go to roads actually does. nMOTION The Nashville Metropolitan Transit Authority (MTA) and the Regional Transportation Authority of Middle Tennessee (RTA) set out to develop the nMotion report of a transit implementation plan. The report development process started with “public engagement” from April 2015 through October 2016. Since the pre-determined goal was to develop a comprehensive ten-county mass transit plan, the presentations made by MTA/RTA and TDoT and the surveys obtained from the public were designed to create that end…

Read the full storyGrassroots Pundit: What Does Governor Haslam’s Revenue Neutral Gas Tax Increase Mean to Tennessee Families?

Governor Haslam introduced his “revenue neutral” IMPROVE Act (Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy) late last month. The proposed bill focuses primarily on increasing the fuel (gas and diesel) tax to fund transportation initiatives and offsetting the increases with other tax cuts. Under the governor’s proposal, the state tax on gasoline will increase from 21 cents per gallon to 28 cents per gallon. The state tax on diesel fuel will increase from 18 cents to 30 cents per gallon. Ominously, the tax will be indexed to increase each year based on inflation. The plan proposes tax cuts of $270 million annually, while increasing revenues through taxes and fees by $278 million this year. The taxing procedure that allows government to receive the same amount of money despite changes in tax law is the definition of “revenue neutral.” This was a strategic move by the Governor to combat the obvious and predictable opposition to any tax increase given the state’s budget surplus in excess of $1 billion. But how neutral is the IMPROVE Act for Tennesseans? At least one group is trying to explain what the gas tax increase would cost the average driver. The Transportation Coalition…

Read the full storyGrassroots Pundit: Sumner County’s Role in the Governor’s Gas Tax Increase Story

The story of the Governor’s proposed gas tax increase introduced on Wednesday was being written for nearly two years in Sumner County. The most recent chapter was added with the attendance of County Executive Holt and Jimmy Johnston of Forward Sumner, the county’s hired provider of economic and community development services, at the Governor’s press conference Wednesday. In preparation for the budget year that runs July 1 to June 30, the Sumner County Budget Committee holds several workshop-like sessions in April and May to review all of the required and requested budget line items. This was the case in 2015, the first budget to be set after the 24% property tax increase. As an outcome of a Highway Commission meeting, an additional $100,000 was proposed for the Highway Department. The proposal came out of the Highway Commission to address the poorly received stoppage of brush pick up, especially in light of the considerable property tax increase. Initially, the $100,000 was added to the proposed 2015-16 budget. But, then at the Budget Committee meeting of June 8, 2015, after County Executive Holt made the argument that funding to the Highway Department would have to be maintained in the future, it was…

Read the full story