By Printus LeBlanc

The Consumer Financial Protection Bureau (CFPB) has been in the news a lot lately, mostly because the former head of the agency Richard Cordray stepped down. However, before stepping down, Cordray believed he had the right to pick his own successor and chose Leandra English. The President disagreed and has appointed Mick Mulvaney to rein in the out of control agency. There is currently a legal battle brewing over who is in charge with a federal judge ruling Mulvaney is acting director.

The CFPB was authorized in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. It was created as a result of the 2007-2008 financial crisis. The unconstitutional agency has jurisdiction over banks, credit unions, securities firms, payday lenders, and other financial companies in the U.S. The agency is considered “off-budget” and therefore does not answer to Congress. The agency gets its funding directly from the Federal Reserve System. The only requirement of the CFPB is to appear and report twice annually before the House Financial Services and Senate Banking committees.

Why is this agency so important to liberal progressives? English went judge shopping across the country to stop Mulvaney from being appointed to head the agency. Seems like a stretch to keep power over a small government agency. Why is this the end of the world according to many progressives?

It looks like we found the answer earlier this week.

Cassandra Jackson was a former examiner in the southeast division for the CFPB. Jackson sent a letter to Attorney General Jeff Sessions detailing criminal actions by managers in the CFPB.

Jackson was assigned to audit Ace Cash Express, an Irving Texas-based business that offers installment loans, title loans, prepaid cards, and check cashing. She was asked to “change, remove, and otherwise falsify documents,” connected with the examination by people in management positions above her.

Jackson also stated management asked her to remove document evidence proving the subject of the investigation, Ace Cash Express, was complying with the rules and to write a report including findings she knew to be “false and fabricated.”

“I was specifically told to cite Ace Cash Express for a violation for which I had verified the company was in compliance and to state that Ace Cash Express did not provide, and that the CFPB did not receive, documents that would have satisfied the CFPB’s guidelines, despite having received that information from Ace Cash Express.”

After Jackson refused to commit multiple felonies at the behest of CFPB management, she was disciplined for failure to perform at her grade level. Apparently, once you rise to a position of power within the CFPB, you are expected to commit certain felonies to keep your job.

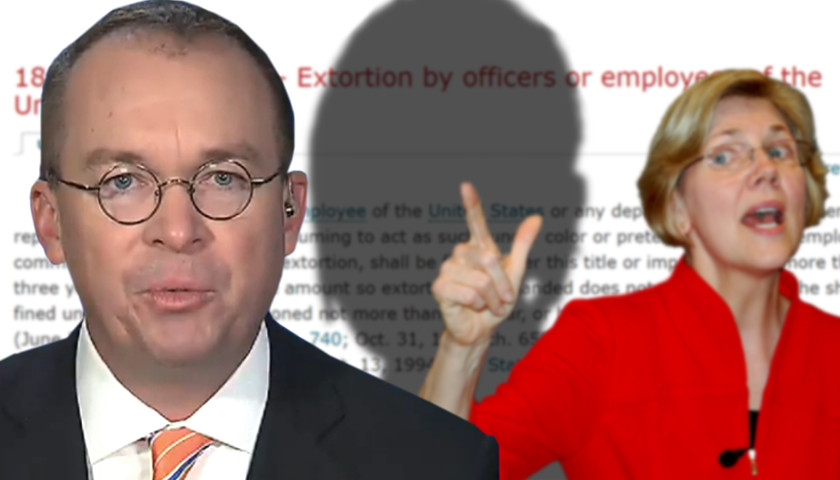

And now we find out why Sen. Elizabeth Warren (D-Mass.) is so dead set against Mulvaney taking over at the agency.

The conclusion of the investigation into Ace Cash Express led to a total of $10 million in penalties and customer restitution being extorted.

The fines and penalties do not go into the general treasury; they go into the Civil Penalty Fund. This fund is intended to help the victims of fraud and predatory lending, but tens of millions of dollars are sent to organizations that have “consumer education and financial literacy” programs. The groups allowed to receive the free money were approved by Cordray and then Labor Secretary Thomas Perez. Investors Business Daily lists just a few of the organizations benefiting from the CFPB extortion racket:

- The Legal Aid Society of the District of Columbia, whose directors include senior Democratic National Committee officials.

- The Mississippi Center for Justice, President Obama tapped MCJ Chair Debra M. Brown to serve as U.S. District Court Judge for the Northern District of Mississippi.

- People’s Community Action Corp. of St. Louis, which has seated Obama appointees and Democrat lawmakers on its board.

This follows an all to familiar pattern, as the DOJ and Labor Department had similar funds worth billions of dollars dolling out tens of millions to politically aligned groups.

Two things need to happen. First, AG Sessions needs to immediately launch an investigation into what can only be described as a government-run extortion racket the mafia would be jealous of. Multiple felonies being committed by numerous management figures screams for a RICO investigation. Two people that should immediately be questioned are former Director Cordray and Sen. Warren, both intimately involved with the functioning of the agency.

The second thing that needs to happen is Mick Mulvaney needs to settle the lawsuits against the constitutionality of the agency. No, the agency is not constitutional and therefore should be shut down.

It seems like every single day we learn of another agency poisoned by the previous administration, and the CFPB is no different. Americans are losing faith in government institutions, for a good reason, and we cannot afford any more unaccountable government overlords to run rough shot over the people. The CFPB must be investigated and shut down.

– – –

Printus LeBlanc is a contributing editor for Americans for Limited Government.

[…] “CFPB Whistleblower Exposes Agency’s Extortion Practices,” By Printus LeBlanc, Dec. 20, 2017 at https://tennesseestar.com/2017/12/20/commentary-cfpb-whistleblower-exposes-agencys-extortion-practic… […]

I filed a complaint with the CFPB recently on an unauthorized credit card purchase. 30 days later the CFPB notified me that there was nothing they could do since the company wouldn’t answer the phones. (the complaint was that the company wouldn’t…wait for it…wait for it…ANSWER THE PHONES) . If the CFPB’s job is to do nothing then they excelled .

Jail is too good for these crooks. The CPFB was nothing but a shakedown racket to steal from businesses to give to leftwing advocacy groups.

Legalized highwaymen. Organizations that are offshoots of ACORN received settlement money although they were not a party to the lawsuits nor were they victims. They then donated money back to Democrats.

They all deserve to hang and the CPFB should be abolished. A study earlier this year found that employees of this group donated greater than 400:1 in favor of Democrats.

The entire organization is a criminal conspiracy masquerading as consumer protection.