The Tennessee Department of Transportation (TDOT) boasts on its website that:

“Tennessee’s conservative process of funding its highway program is often referred to as a ‘pay as you go’ program. The agency only spends the funds that are available through its dedicated revenues, the highway user taxes and fees, and federal funding.”

For consumers, the Governor’s proposal adds a 7-cent increase per gallon for gas and a 12-cent increase per gallon for diesel with future increases tied to the Consumer Price Index. The plan also includes a $5.00 increase to vehicle registration prices.

Americans for Tax Reform and the Brookings Institute agree, that higher gas prices negatively impact economic growth and low to moderate income households:

“…higher gas prices drain purchasing power from the economy. That means that these families get hit twice: once by the direct impact on their household budgets but a second time when higher prices retard the economic recovery.”

Add to that, higher fuel taxes are likely to add to the cost of consumer goods when the increased cost paid by businesses is passed onto consumers. even with the tax cut in taxes paid by businesses included in the Governor’s plan. There is also a modest half percentage point tax cut for groceries.

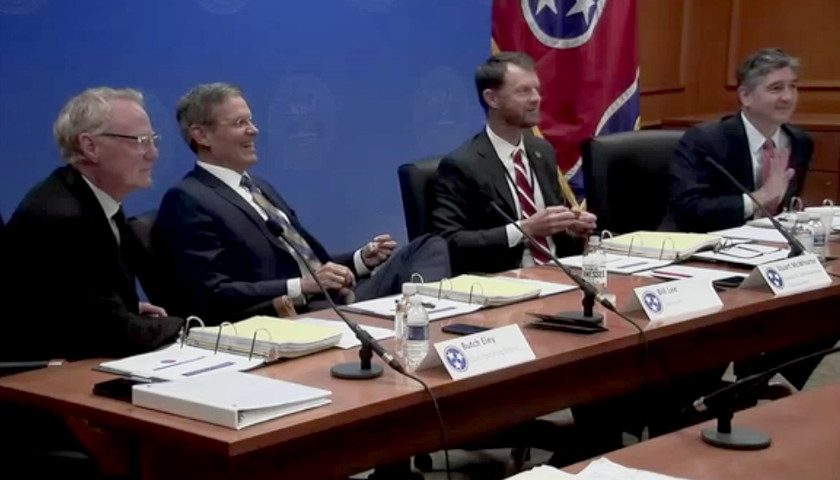

State Sen. Paul Bailey and State Rep. Barry Doss, who chair the Senate and House Transportation Committees respectively, each operate businesses using heavy diesel fueled machinery and trucks. Doss supports the Governor’s gas tax increase; Bailey has been more guarded in making his support known.

Both legislators are well positioned in their respective businesses to explain in committee whether and how, the increase in fuel tax could be passed onto the consumer.

A Nashville radio host who supports the Governor’s gas tax increase told his listeners that if you can own a car and the insurance, you can afford to pay more for the gas.

The latest available data on uninsured motorists ranked Tennessee the state with the sixth highest percentage of uninsured motorists at 201.%. As a result of this statistic, a new insurance verification system launched by the TN Department of Revenue this year can result in fines up to$300 and/or surrendering your vehicle’s registration. There is no exemption from the insurance requirement even if a motorist is unable to afford the insurance.