by Chloe Anagnos

The debate surrounding the student-debt crisis in America continues to prompt both lawmakers and political commentators to discuss the matter as they search for a way to address the issue. But as expected, whenever policy solutions are debated, the fact that the crisis was manufactured by government intervention itself seldom gets discussed.

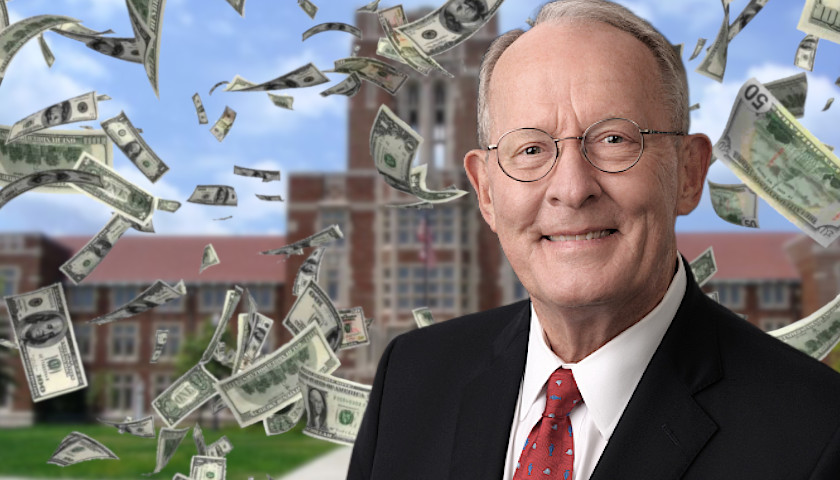

The latest solution to get some media attention comes from Senator Lamar Alexander (R-TN), who wants to fix the student-debt problem by taking loan payments straight from debtors’ paychecks.

Much like the idea behind the withholding tax, the automatic-repayment plan would work by requiring employers to deduct federal student-loan payments directly from employees’ paychecks.

To Alexander, the chairman of the Senate Health, Education, Labor, and Pensions Committee, the idea is worth exploring because it would keep borrowers from defaulting or falling behind. With 40 percent of student-loan borrowers expected to default by 2023, this proposal may appeal to many in the federal government. But when a crisis such as this is born out of artificial demand for college education, which inflates the cost of pursuing a degree, wouldn’t this purported solution add more fuel to the fire?

The Solution Is Less Government

While most critics of Alexander’s proposal will obviously focus on how the automatic-payment system will exert greater pressure on lower-income borrowers, that is far from the only problem with his idea.

Student loans are heavily subsidized. As a result, the price of education soars, thanks to the artificially high demand for college degrees that the easy access to loans creates. But what’s perhaps even more concerning is that when a student takes on loans, especially federal ones, the government doesn’t take default risk into account.

So a borrower with a bad credit history or no credit history at all has as much of a chance of getting a federal or subsidized loan as someone who might be more likely to repay their debt in the future. Furthermore, students seeking degrees that will lead to jobs that are in high demand or that lead to higher wages, such as engineering, shouldn’t be seen as a high risk to the lender whereas loans to English, history, or philosophy majors should. But because the government is in control of this process, and the goal has never been to help but to push a false narrative that government is here to defend the supposed right to education, constraints that would exist in a free market suddenly disappear.

Over time, the very denial of how economics works take its toll, as people who wouldn’t have pursued higher education in the first place are now stuck with debt they can’t afford. But as we see a greater number of people defaulting on their payments, government officials have only one answer to the problem, and that is making the government even more involved in the process.

To really fix this issue, there’s only one option, and that is to get government completely out of the student-loan business. After all, the market will only heal itself once it is allowed to restore the pricing mechanism, and that will only happen if schools are responding to real-world demand.

If Alexander is serious about protecting the federal government’s assets while helping students keep up with their loan payments, he must first understand that it is because of bad policies that we now have this mess. Only by identifying the real problem will lawmakers be able to identify an effective solution.

– – –

Chloe Anagnos is AIER’s Publications Manager. She is a writer and digital marketer and has been an AIER contributor since 2017. Her work has been the subject of articles in FOX News, USA Today, CNN Money, and WIRED. She has been a writer, commentator, and panelist for media outlets around the country on subjects like political marketing, campaigning, and social media. Follow @ChloeAnagnos.

Background Photo “University of Tennesee” by Nightryder84. CC BY-SA 3.0.

I agree the government should get out of the student loan business AND I agree the loans need to be repaid and garnish wages does work.

Do both of these things and be finished with it. Prices will come down and those who want an education will be more aware what they want and what they need.

The real crisis, in many cases, is that the four or five year education the student receives is worthless. Instead they’ve been given an indoctrination into cultural Marxism and progressive socialism and now think they now know something.

I’ve seen the results of this indoctrination and it produces young people who can’t spell, read well, write a coherent paper and have no knowledge about world history, much less the history of their own country – young people like Alexandria Ocasio Cortez who don’t need facts when because they have the high leftist moral ground. As more of these young people are elected to political office, we will find out exactly how major this crisis is.

When more money is infused into student loans, liberal colleges & universities merely raise professor salaries, which pushes up tuition costs. Never ending cycle. It provides a way for academicians, who hate capitalism and the rich, to become wealthy by abusing the system and stealing from the helpless taxpayers.

I just returned from an out of state trip to my alma mater. What I observed was a student body that appeared to be enjoying all of the luxuries of a very expensive lifestyle. I assume much of it paid for with student loan dollars. I had already observed this behavior with my own grandchildren and was appalled at their extravagant living. It is way too easy for students to get government money while enjoying life’s better things.

Also the influx of government money and the glut of scholarship and grant money has done nothing to help the cost of attending. That money has simply providing the schools with an excuse for jacking up tuition and fees to the point that hardly anyone can attend without going into debt.

“To really fix this issue, there’s only one option, and that is to get government completely out of the student-loan business.”

I disagree. I myself could not have gone to college/law school if not for government student-loans. But when I was in college/law school more than fifty years ago, the costs of higher education were reasonable. I worked between the end of the Spring semester and the beginning of the Fall semester. And when I graduated from college/law school I only owed a total of a few thousand dollars for my education. Today the costs of a higher education are completely insane. And I attribute these excessive higher education costs to TOO MUCH federal government money going into higher education which then incentivizes higher education institutions to continually expand–I think, unreasonably so. Higher educational institutions have learned how to ‘milk’ the system for federal money, and this is what should be stopped. But politicians are reluctant (i.e., afraid) to do this.

When I was a student my alma mater had an entire student body population of 8,000 something (both undergraduate and graduate schools, everything)–today this university’s student body is approximately triple that number yet the population of the state has only increased by a moderate fraction of its population then. But, new expensive multi-million dollar school buildings are now everywhere on campus. These structures have to be paid for somehow, to say nothing of the personnel required to staff them. I attribute this lavish growth to readily available, EASY federal money. Until this changes, and reverses, I think that the problem will only get worse. And if nothing changes, I think that eventually the country’s higher education system will collapse under the weight of its own excess.

Well, when I went to law school (Georgetown) the cost was under $20 per credit hour. I was able work full time and attend “late afternoon” classes. And, yes, it was in the 1957 to 1960 time period, more than fifty years ago.

John, you and I are getting old.

IMO as long as the government guarantees the loans you will never have a proper evaluation of the value of a degree vs the cost thereof. Kids are graduating with degrees that have no value-added as compared to experience in one of the trades. Computer literacy does not require a BS. Note the service jobs with Xfinity, for example. And auto mechanics learn how to troubleshoot the modern computer-dependent automobiles.