by David Williams

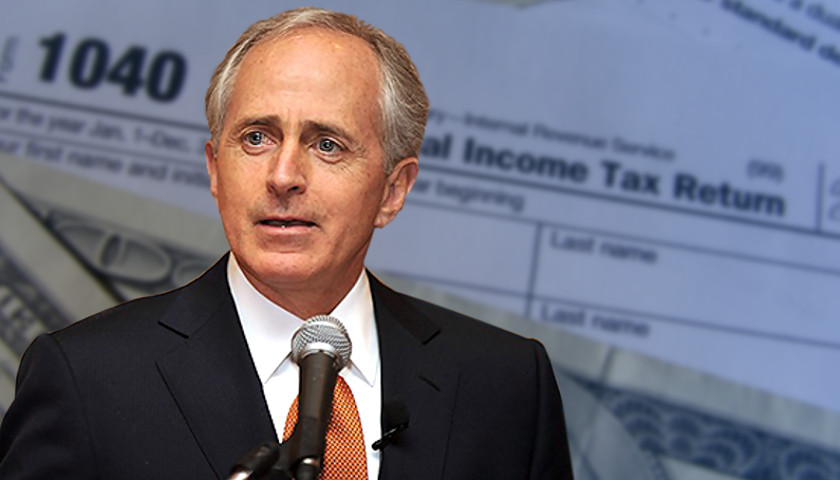

This week, the U.S. Senate is holding a budget vote that is a vital component in passing tax reform – if they can’t get the budget passed, it will make the path to overhauling our outdated, growth-killing tax code extremely difficult. It is essential that all U.S. Senators – including Senator Bob Corker – support passage of the budget so Congress can quickly move onto and pass the kind of pro-growth tax reform package Tennessee small businesses need to drive meaningful, long-term growth and job creation.

The federal tax code is a bloated, cumbersome disaster. The business rate of 35 percent (39 percent with local and state taxes) is far higher than that of most of our competitors, which makes U.S. companies less competitive in the global marketplace and stifles growth and job creation. The tax code itself is an additional burden. At tens of thousands of pages and millions of words, regular small-business owners have little hope of navigating it. So, their choice is between hiring expensive tax compliance help or dealing with sleepless nights worrying about the IRS knocking on their door. Worse, the tax code strongly favors big businesses, making it even harder for smaller firms to compete.

Something has to change – and thankfully, a comprehensive tax overhaul is in the works. The tax reform package developed by the White House and Congressional Republicans will, if enacted, drive significant economic growth, job creation, and wage increases, both nationally and in Tennessee. According to a recent study by the White House Council of Economic Advisers, cutting the statutory federal corporate tax rate from 35 to 20 percent would increase household income by an average of $4,000 annually, with potentially much larger impacts – such as an even bigger bump in household income and a return to sustained, robust economic growth rates – in the years ahead.

In Tennessee, the impact would be just as positive, especially for small businesses, which according to the Small Business Administration make up a staggering 99.5 percent of all state businesses and employ more than one million people in Tennessee. The nonpartisan Tax Foundation finds that tax reform along the lines proposed by Congress and the White House would create 34,517 jobs and increase after-tax income for medial households by $4,118 in Tennessee. Roughly $4,000 back in the pockets of regular Tennesseans each year is a big deal – that’s real money for real families with real bills to pay and real mouths to feed.

There is no time to waste. Republicans control the White House and both chambers of Congress. An opportunity like this to pass comprehensive, pro-growth tax reform may not come again for many years—probably another generation. Tennessee small businesses, and their counterparts across this nation, have been struggling under the burdens of an inefficient, outdated, and anti-competitive tax system for too long. It’s time for tax reform—and that means it’s time for all senators, including Sen. Corker, to get on board and pass the budget this week.

– – –

David Williams is president of the Taxpayers Protection Alliance.

According to the Constitution, only Capital gains can be taxed, labor is considered an equal trade of labor for money, no capital gain, therefore income is not taxable,

and four Supreme Court decisions have upheld.

The IRS code is not part of the CFR, (Code of Federal Regulations, (Federal laws) for a “legal reason”, taxing labor income is illegal under the Constitution, the code only become applicable to citizens when they sign the agreement that says, “Under penalty of perjury”.

They’ve collected your taxes, you file the 1040 form but didn’t sign it, they’ll remind you of your oversight, send it back to them unsigned,

There’s no law in the land that can force you to sign your name on any agreement,

Send it back unsigned and see what happens, and I’m not writing this from a prison cell.

In stepping outside the rights enumerated to Government, spending money for things the Constitution never authorized, welfare, healthcare, foreign aid, education

The government has created a state of government control and dependency on Government which is the exact opposite of how the Constitution was intended to function.

Instead of focusing on the things that create a strong economy in this country, they have created a welfare state here at home and around the world that cost so much businesses are taxed to the point those that could leave the country, did leave.

Thomas Jefferson and Davy Crockett both asked where did the Constitution authorize the spending of money outside the enumeration listed to Government, neither received an answer.

P.S. The Sixteenth Amendment was never ratified by 3/4 of the states as required by the Constitution,

But “John Knox” put it up for ratification it anyway.

I agree that the tax code needs a LOT of revision toward providing an opportunity for citizens to retain more of their earnings. I do not see the that happening under terms of the current proposal. Mr. Williams, you make the claim that “…the tax code strongly favors big businesses, making it even harder for smaller firms to compete.” without providing any support for your declaration. Having been a small business owner for years I am familiar with the virtually unlimited demands of the federal and state governments that are placed upon all businesses. But specially how are small businesses disadvantaged other then in the fact that their resources are miniscule compared to large corporations?