by Jon Styf

Tennessee has $144 million for education freedom scholarships that won’t be spent and will deposit an additional $100 million in the budget set to go into place for July 1.

Sycamore Institute, a non-partisan public policy research institute, recently published an analysis of what changed from Gov. Bill Lee’s initial proposed budget to the $52.8 billion budget that passed the Tennessee Legislature.

The budget year is set to begin as Tennessee’s tax and fee collections – initially budgeted for $19.8 billion in the current budget year – are projected to fall well below expectations.

The state adjusted those estimates down $719 million mid-year but the state is on pace to fall $686 million short of the initial estimates, bringing in $19.1 billion for the year.

April collections alone were $74.2 million less than estimates.

The budget included $50 million toward the relocation of the Tennessee Performing Arts Center to Nashville’s East Bank after the project received $200 million in the current year’s budget.

The educational savings account funds will go to the 2026 budget for the same purpose.

“Since lawmakers did not pass a bill to create the program, the enacted budget’s $144 million recurring for Education Freedom Scholarships will go unspent but remain in the base budget,” Sycamore Institute wrote.

The addition to the state’s rainy-day fund will put the fund’s balance at $2.2 billion by the end of the fiscal year, a new high that would cover 38 days of general fund operations, Sycamore Institute wrote.

“This is about 11 days more cushion than just before the Great Recession,” the report said.

The budget also includes 10 million for a nuclear development fund and $5 million for a film incentive fund along with $6 million non-recurring to offset the costs of deploying the Tennessee National Guard to the U.S. Southern border in Texas.

– – –

Jon Styf is a staff reporter for The Center Square.

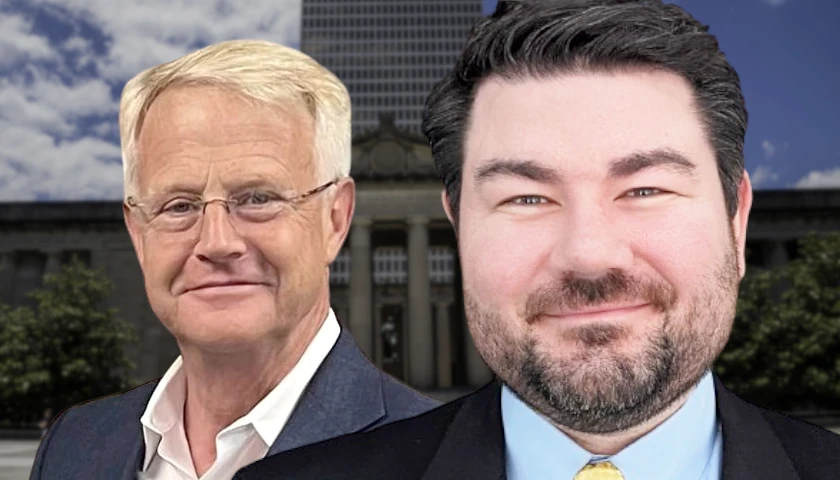

Photo “Bill Lee” by Gov. Bill Lee.

Cannoneertwo – I frequently disagree with your position but I can sure agree with you on this.

As long as the money for business handouts isn’t affected…