by Madeline Armstrong

Arizonans have passed a law that would allow both commercial and residential property owners to be eligible for a tax refund if they can provide proof that the city failed to enforce public nuisance laws affecting their property.

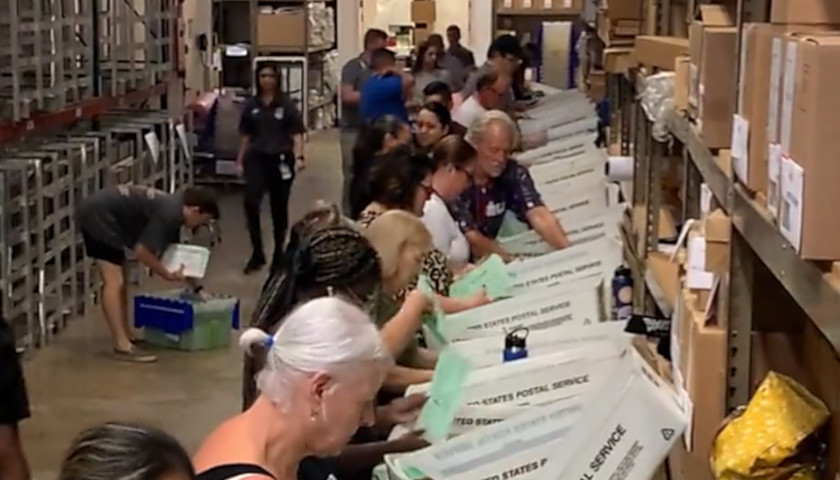

At 90% of precincts participating, 58.6% of voters approved Prop. 312. This proposition has received a national audience as one of the laws encouraging law enforcement to criminalize homelessness put forth following the 2023 ruling by SCOTUS striking down protections for homeless individuals.

Prior to this, a ruling by a federal appellate court stated that, “as long as there is no option of sleeping indoors, the government cannot criminalize indigent, homeless people for sleeping outdoors, on public property, on the false premise they had a choice in the matter.”

Prop. 312 put forward by Senate President Warren Petersen allows property owners to receive a property tax refund to cover “reasonable” costs accrued by unmitigated public nuisances related to homelessness, vandalism, property crime and drug use.

“The special-interest proponents of this policy have described Prop 312 as the ‘first-in-the nation,’ leaving us to be a testing ground for the mass policing and incarceration of unhoused Arizonans,” reads a statement filed to the Secretary of State before the election by Alejandra Gomez, executive director of Living United for Change in Arizona.

The property owner would need to document the expense and be able to prove that it was a direct result of the government failing to enforce relevant public nuisance laws.

It is then the State Department of Revenue’s responsibility to approve or deny the refund of the claims. If the claim is rejected by the state or county, property owners would be able to bring a civil claim to superior court. If the court rules in favor of the property owner, the local government would be required to repay the litigation costs.

According to a report by the Arizona Common Sense Institute, the threat of having to provide a tax refund would encourage more law enforcement and initiatives to mitigate homelessness and crime, allowing properties to retain their value.

“The status quo is costly. Crime, drug overdoses, unsheltered homelessness, and other public nuisances have risen dramatically in Arizona and the greater Phoenix area since 2019,” reads the report. “This creates a negative economic impact for those parts of the city where local officials have failed to enforce existing laws – while it’s difficult to measure documented mitigation expenses directly, this impact does show up in valuations, vacancy rates, and appreciation.”

According to data aggregated by CSI, unmitigated public nuisances have resulted in a forgone commercial property appreciation of $2.1 billion in lost value since 2019.

However, multiple organizations have spoken out against Prop. 312, saying that it is not the best way to address homelessness in highly-populated areas, such as what is considered “The Zone” in Phoenix. The Zone was a large homeless encampment in Phoenix situated between the state capital complex and some county buildings.

“The Zone was not a safe place to live,” reads an investigation by the U.S. DOJ Civil Rights Division. “Paramedics would not respond to emergencies in the Zone without a police escort. People in the Zone reported thirty rapes during 2021-2022. A dead fetus, estimated to be between 20 and 24 weeks old, was found in the street in 2022. In March 2023, a man was beaten, thrown into a dumpster, and set on fire.”

Ben Scheel, executive director of Opportunity Arizona, stated that Prop. 312 does not do anything to help the homeless population and would only “hand out tax giveaways to rich and corporate property owners.”

“Evictions continue to hit record levels in our state, and Arizona currently has the fourth-highest percentage of people experiencing homelessness nationwide,” Scheel stated.

Claims that Phoenix police would treat the homeless population unfairly with increased criminalization are not completely unfounded. The U.S. DOJ Civil Rights Division investigation released earlier this year found that the Phoenix Police Department violated the rights of homeless individuals in Phoenix.

“First, PhxPD stops, detains, and arrests people who are homeless without reasonable suspicion that they are engaged in criminal activity,” reads the investigation. “Second, the City and PhxPD seize and destroy property belonging to people who are homeless without providing adequate notice or opportunity to collect their belongings. A person’s constitutional rights do not diminish when they lack shelter. These practices violate the due process requirements of the Fourteenth Amendment and the Fourth Amendment’s prohibition on unreasonable seizures.”

Those in opposition to Prop. 312 worry that the proposition would increase police activity against homeless individuals that violate their civil rights because of the threat of having to pay a property tax refund.

– – –

Madeline Armstrong is a reporter for The Center Square.