A bill passed by the Tennessee General Assembly last week reveals that in fiscal year 2019-2020 the Copeland Cap, at $629 million or 3.6 percent, hit its highest level in more than a decade.

The legislation, which passed as HB2819 in both chambers on March 19 with only one “no” vote by Democrat Representative G. A. Hardaway (D-Memphis), was one of the four bills addressed in an expedited fashion to enact a bare bones budget before lawmakers recessed until June 1 amid the COVID-19 health crisis, The Tennessee Star reported.

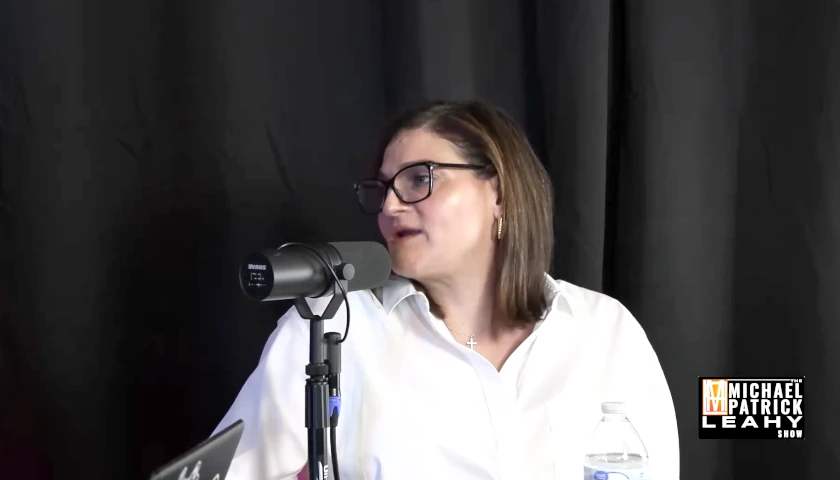

The Copeland Cap is the common reference to Article II, Section 24 of the Constitution of Tennessee, named for its House sponsor former Republican State Representative David Copeland of Ooltewah (pictured above), who passed away last year.

The 1970s-era amendment to the state constitution establishes that “in no year shall the rate of growth of appropriations from state tax revenues exceed the estimated rate of growth of the state’s economy.”

The provision further establishes that “no appropriation in excess of this limitation shall be made unless the General Assembly shall, by law containing no other subject matter, set forth the dollar amount and the rate by which the limit will be exceeded.”

The estimated rate of growth of the state’s economy is based on the projected change in the personal income of Tennesseans.

The estimate of growth in Tennessean’s personal income is sourced from the University of Tennessee Boyd Center for Business and Economic Research and is included in the governor’s budget document each year.

In the simplest terms, the Copeland Cap amendment approved by a majority of Tennessee voters in 1978, says that state government spending should not grow faster than that of Tennessee taxpayers and their ability to pay for state government growth.

The reality is that the Copeland Cap serves strictly to make lawmakers aware that the growth in state government exceeds that of the state’s economy. They need only vote – by a simple majority – to proceed with exceeding the Copeland Cap.

A comparison to the last 10 years when the Tennessee General Assembly voted to approve exceeding the Copeland Cap five times, demonstrates the high-water mark of this current fiscal year.

Fiscal year 2010-2011 appropriations exceeded estimated growth by $250 million or 2.15 percent

Fiscal year 2011-2012 appropriations exceeded estimated growth by $250 million or 2.01 percent

Fiscal year 2012-2013 appropriations exceeded estimated growth by $132.5 million or 1 percent

Fiscal year 2016-2017 appropriations exceeded estimated growth by $438 million or 2.85 percent

Fiscal year 2019-2020 appropriations exceeded estimated growth by $629 million or 3.6 percent

In 2018, legislation passed that established, for purposes of determining compliance with the Copeland Cap, that funds allocated to the state’s rainy day fund or expended from the rainy day fund will not be included in the calculation.

In recent history, legislation authorizing appropriations to exceed the estimated growth of Tennessean’s personal income has not failed to pass.

As a practical matter, by the time the legislature approves the so-called “busting” of the Copeland Cap, the revenues have already been collected. As a sales-tax driven state, accounting for 55 cents of every dollar in state revenues, refunds are all but impossible.

There are a few bills introduced this year to reduce the sales tax burden on Tennesseans that could be taken up when the lawmakers return from recess on June 1.

The most significant of these bills is HB1697 by Representative Patsy Hazlewood (R-Signal Mountain) and SB2683 by Senator Bo Watson (R-Hixson), the “Food Tax Holiday Act,” which would exempt the retail sale of food and food ingredients from sales tax for the months of June and July 2020. The resulting decrease in state revenues and corresponding sales tax savings to Tennesseans is estimated at $88 million over the two-month period which spans the 2020 and 2021 fiscal years.

Other bills seek to eliminate sales tax on diapers and wipes; gun safes and gun safety devices; and feminine hygiene products. If all three bills were enacted, the combined reduction in state revenues and corresponding sales tax savings to Tennesseans is about $14 million, according to the fiscal notes.

However, the General Assembly already passed SB2182 last week requiring marketplace facilitators with sales of at least $500,000 to remit sales tax. In turn, this will increase sales tax on Tennesseans by an estimated $151 million –$113 million to the state and $38 million to local governments – in a full year of collections.

—

Laura Baigert is a senior reporter at The Tennessee Star.

Photo “State Rep David Copeland” by The Copeland Family.

The Assembly just seems to always want to spend and spend and spend. Same for my County Commission.