After much drama, heated exchanges on the floor, a tense caucus meeting on Thursday, it seemed that Friday’s floor session to address the fiscal year 2017-18 budget was not starting off much better when there were not enough members present for a quorum at 9:07 a.m. But, by 11:23 a.m. the four bills that made the state $37 billion 2017-18 budget had been passed by the House.

When a quorum was not detected by 9:07 a.m., Republican Caucus Leader Ryan Williams (R-Cookeville) requested a recess until 10 a.m. for the purpose of a caucus meeting, which took place in the library.

The caucus meeting was quickly turned over by Williams to House Majority Leader Glen Casada (R-Franklin), who reviewed the process for the day.

Casada explained that there would be two amendments to the budget appropriations bill, the first being a “stripper” amendment, which would take off all of the additional appropriations to HB 511 approved Thursday. The second was the addition of a $55 million non-recurring appropriation to counties taken from the Highway Fund for the purpose of “kick starting” road work.

Casada also mentioned the possibility of a third amendment, but was reluctant to share details until he was pressed by several members for the specifics. Rep. Gerald McCormick (R-Chattanooga) then offered that it was a $55 million education appropriation for Minority Leader Craig Fitzhugh (D-Ripley).

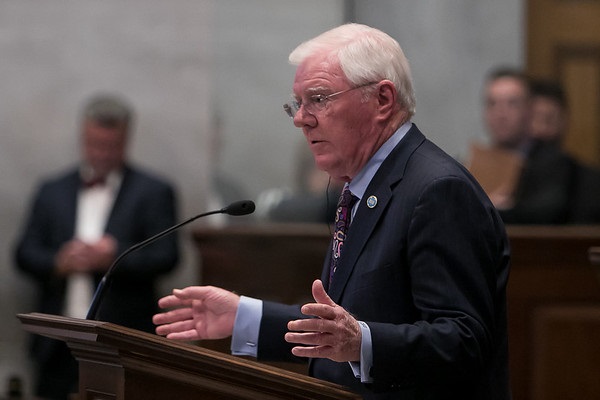

Once back in the floor session a little after 10 a.m., the “stripper” amendment 22 to HB 511 was presented and moved for adoption by House Finance, Ways & Means Chairman Rep. Charles Sargent (R-Franklin).

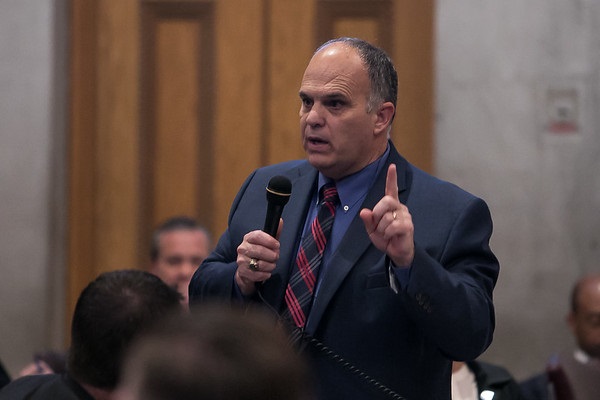

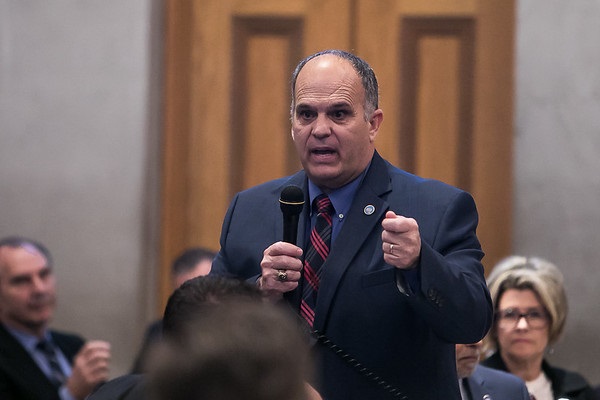

Rep. Judd Matheny (R-Tullahoma), sponsor of amendment 1 to amendment 22 explained the $55 million road funding would use the existing formula as to the percentage each county would receive for use on state-aid road projects, referencing a handout provided to all members via email.

Apparently off-script, Sargent unexpectedly spoke against Matheny’s amendment, saying he would personally be voting against it. Sargent tried to make the case, ineffectively, that this money would be going to counties and not cities. Democrats, including Representatives Fitzhugh, G. A. Hardaway (D-Memphis) and Joe Towns (D-Memphis) all made variations on the question and argument that all cities lie within the boundaries of a county and there was nothing to stop the funding from being used within cities.

Rep. Barry Doss (R-Leoma) was visibly agitated during the discussion, and finally had to add his input by stating that “100 percent of our cities lie within the county and 100 percent of the citizens of those cities pay county property tax,” to which there was mild applause.

The amendment passed by a vote of 77 ayes, 9 nays and 1 present not voting, which received applause from the body.

Sargent then delivered some highlights of the 2017-18 budget, including that it is a 4.7 percent increase over the 2016-17 budget. He concluded by thanking everyone by name who assisted with the budget.

Amendment 22 to HB 511, which reverted to the original bill with the addition of the one-time $55 million to counties for state-aid roads, was adopted by voice vote.

McCormick was then recognized on amendment 23, which was the $55 million allocation for the education fund. After commenting that it was a “joyous day as opposed to yesterday,” McCormick withdrew the amendment, which also drew applause.

The amended budget appropriations bill, HB 511, was approved by a vote of 83 ayes and 2 nays.

Next on the agenda was HB 514, as Sargent described it as the “indexing bill” or Copeland Cap bill. The Copeland Cap, a 1978 constitutional amendment that requires a simple majority vote if state appropriations exceed economic growth measured by per capita income, was exceeded by 2.85 percent or $384 million for fiscal 2016-17. The revenue has been received by the state, but must be “recognized” through the passage of this bill in order to be spent.

Sargent reported that for the upcoming fiscal year of 2017-18, the revenue growth is expected to be 3.17, and with personal income growth projected at 4.51, they would not be looking at breaking the cap next year.

Concerns were expressed by a couple of representatives, but without enough votes to prevent the Copeland Cap from being exceeded which would send the budget back to the Finance, Ways & Means Committee, in the end HB 514 that authorized breaking the Copeland Cap passed by a vote of 74 to 10.

Budget implementation bill, HB 512, clarifies that Department of Human Services, at the request of the federal government, supervises the administration of the food stamp or food assistance program and reinstates salary step increases for certain employees that were suspended in 2003-04. The bill passed unanimously at 85 to 0.

HB 513 is the bond bill, although, as Sargent reported, “this is the second year in a row that we did not issue debt for capital projects,” which was met with applause. The bill authorizes $80 million in bonds serving as a credit line for transportation, which are not sold but cancelled every year in the event that the need arises for a federal funding match. Passage of the bill would allow the Tennessee Department of Transportation to issue the bonds without further authorization by the legislature. The bill passed by a vote of 82 to 3.

All four bills have been placed on the Senate Regular Calendar for May 8.

There are 99 bills coming “behind the budget” that are placed on the calendar for the House Finance Ways & Means Subcommittee May 8 along with 30 other bills.

Matheny voted against the tax bill but he voted in favor of the Governors budget. So in essence anyone that voted against the tax bill but then voted for the Governors budget in the end supported the gas bill. That is how I see it. Senator Mae Beavers was the only R Senator that voted against the gas tax and the Governor’s budget for that very same reason. Standing on your principles to the bitter end is lacking in Nashville as well as DC especially when it comes to an issue that most Tennesseans did not want.

[…] last week’s two-day House floor showdown over Governor Haslam’s 2017-18 budget never did take up an amendment for a $55 […]

Can anyone explain to me how it is possibly legal to VOTE to ignore a CONSTITUTIONAL AMENDMENT. That cap was put in place to prevent overspending. A simple vote by the perpetrators to ignore it seems compketely ridiculous… and should be illegal.