by Sarah Roderick-Fitch

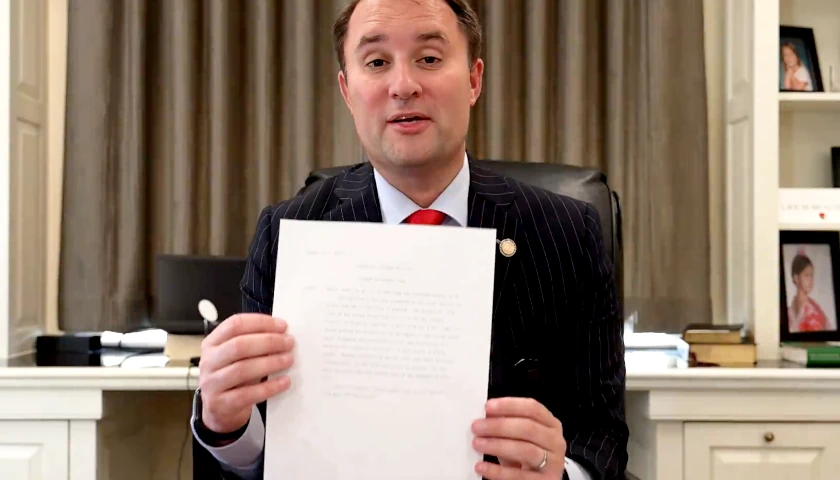

Virginia Attorney General Jason Miyares has announced Virginians affected by the alleged “tricks” from TurboTax owner Intuit will receive more than $3.6 million as part of a nationwide settlement.

Miyares says more than 119,000 Virginia consumers were “tricked into paying to file their federal tax return.” The commonwealth’s restitution is part of a nationwide settlement of $141 million to be distributed to millions of lower-income Americans.

Most people are expected to receive between $29 and $30, a release says.

The multistate settlement, which affected approximately 4.4 million Americans, was announced in May 2022. Eligible consumers will be contacted by email regarding the settlement and will not be required to file a claim. Miyares expects checks to be mailed to affected consumers throughout the month.

Miyares condemned TurboTax for misleading consumers but applauded the efforts of his office pursuing restitution for the Virginians “tricked” by the company.

“TurboTax misled Virginians, and now they are officially paying the price,” Miyares said. “Over $3.6 million dollars has been secured for the 119,899 Virginians that were tricked into paying unnecessary fees. I’m proud that my office was able to put that money back into the affected consumers’ pockets, where it belonged all along.”

The settlement came about after a report from ProPublica claims Intuit “systematically tricked millions of people into paying for tax prep.” The report from the group also claimed the company “steered low-income taxpayers toward its fee-based products after promising them access to no-cost tax filing services.” The report cited marketing that promised “free, free, free” filings.

“Many who started in TurboTax Free Edition found that if their return required certain commonplace tax forms, they would have to upgrade to a paid edition in order to file,” according to a ProPublica report.

In response to the settlement, Intuit released a statement admitting no wrongdoing but agreed to the payout in an effort to put the case behind them.

“Today, Intuit entered into an agreement with the 50 state attorneys general and the District of Columbia that resolved these agencies’ inquiry related to our advertising practices for free tax preparation. As part of the agreement, Intuit admitted no wrongdoing, agreed to pay $141 million to put this matter behind it, and made certain commitments,” a statement from Intuit read.

According to Miyares office, consumers eligible for the settlement include those who filed federal income tax returns via Turbo Tax for 2016, 2017 and 2018 and were eligible to file free with the IRS Free File Program.

– – –

Sarah Roderick-Fitch is The Center Square’s Mid-Atlantic Regional Editor. She has previously worked as an editor, and has been a contributing writer for several publications. In addition to writing and editing, Sarah spent nearly a decade working for non-profit, public policy organizations in the Washington, DC area.

Photo “Jason Miyares” by Jason Miyares. Background Photo “Intuit Software Headquarters” by Tony Webster. CC BY 2.0.