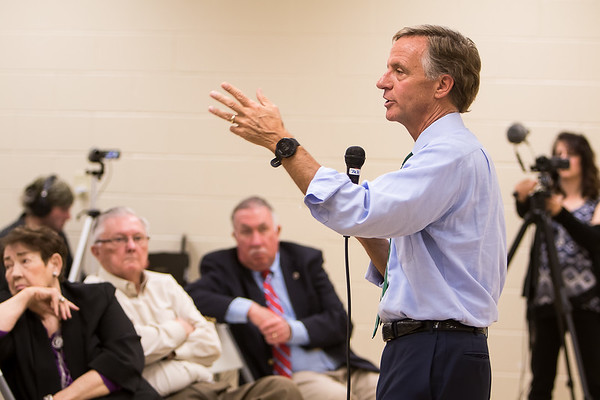

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt.

The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings.

These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on.

According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively.

The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate.

How, she asked, did the governor explain that his proposed budget this year includes $189 million from gas tax, motor vehicle registrations, and motor vehicle titles going to the general fund, education and debt service.

“What we’ve always done is say road fuel pays for roads, other things car related go to general fund,” the governor answered.

A quick check on this claim shows that $97.4 million of gas and motor fuel (diesel) tax is allocated to the general fund and debt service in Gov. Haslam’s 2017-18 budget, in addition to another $90 million of motor vehicle related fees.

To the question of whether Tennesseans are being taxed too much with a $950 million surplus, the governor says, “we’re the lowest taxed state as a percent of income.” But, with an estimated 2.6 million households (average household size of 2.5 people and a population of 6,651,195), Tennessee households have been overtaxed by $360 this year.

The gas tax increase, according to the governor, will add $48 per year per average driver or another $96 per year in addition to the $360, for a total of $456 annual over taxation per household.

The governor says he cut $550 million in ongoing expenses, nine times more than any other governor, but the budget has grown from $30 billion in 2011-12, his first budget year, to $37 billion this year. That $7 billion increase represents 19 percent total and 3 percent average annual growth in government. Compare that to Tennessee’s population growth, which, according to the U.S. Census grew from 6,346,275 to 6,651,195, for a total of 4.8 percent, or 0.8 percent per year, between 2010 and 2016. Tennessee’s government has been growing at 3 to 4 times the rate of the population under Haslam’s administration.

In the governor’s first budget year of 2011-12, the state portion of the transportation budget was $867 million, and in the latest budget year of 2016-17, the state’s portion of transportation was $133 million less than 2011-12 at $756 million. But the lowest year, 2013-14, was $684 million. Gov. Haslam actually budgeted less for transportation every year since 2011-12. Without the proposed gas and diesel tax increases, the transportation budget would have remained flat for the current budget year of 2017-18.

Other questions were asked on a variety of topics including mass transit, water lines for rural areas, how trucks handle diesel tax and the future of road funding when all cars are electric.

The governor closed the event by going back to the surplus. He said that his proposal for the $950 million surplus is for both discretionary items like teacher pay increases and the tax cuts as well as non-discretionary items like the BEP formula, employee health insurance and TennCare.

I really don’t care who you blame or whose fault it is. Just get the damned roads fixed.

Politicians only job is to get re-elected as we all know. But if the do nothings in this state can’t fix problems, then get rid of them. I’m talking about your representative as well as mine.

[…] Tennessee Star’s research shows […]

I support increasing fuel taxes. It would mean more money to REPAIR our current roads and build new ones and the TDOT and others will be assured more $$$. If we have to depend on funding from the general fund….would mean getting into the budget….approval of the Governor and legislator…..and subject to budget cuts. I would prefer to pay $100 more in tax per year to fix and keeps our roads in good condition….so as not to rattle my car parts and my teeth loose. My one concern what does “transportation” mean.

I was at this meeting, and no I didn’t get a “personal invitation”. I thought the meeting was very good everyone who had a question was allowed to ask it. Several people in the audience spoke in favor of the proposal, why did you not quote any of them? They did a good job to explain the plan and the need. While no one wants any new taxes, or any taxes for that matter, reasonable people who look at the figures must conclude something must be done. This plan is well thought out, needed, and fair, IF you take time to study the situation. Kudos to Gov Haslam for having the courage to do what’s best for the safety of the people of Tennessee. Instead of playing to hysteria just to get reelected like so many in the legislature.