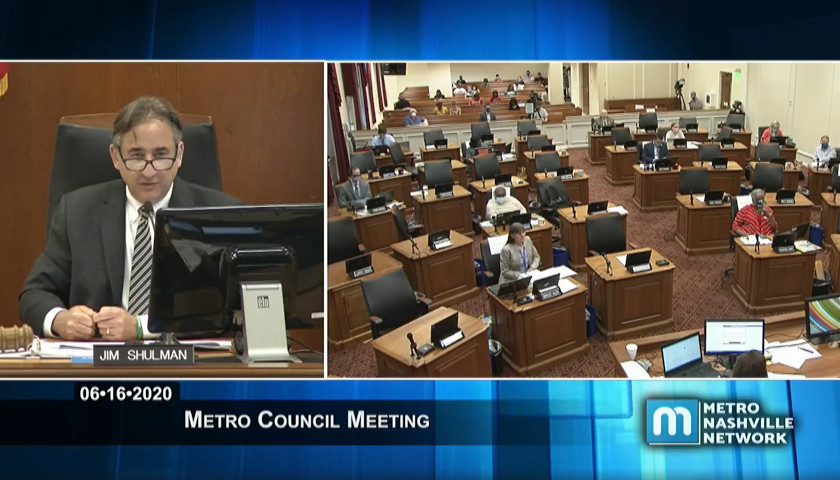

During another lengthy meeting that began Tuesday night and went into Wednesday morning, by a 32 to 8 vote the Nashville Metro Council passed a budget that includes a record 34 percent property tax increase, increased funding for police, cost-of-living raises to city employees, increases funding to the school district as well as funding for a school district minimum wage of $15 per hour.

The Council-approved property tax increase is even higher than the 32 percent increase that Mayor John Cooper called for in his budget proposal.

The budget that passed was an amended version of that proposed by Member-at-Large Bob Mendes, who chairs the Budget and Finance Committee.

With the tax increase, the Metro Council delivers a hefty load to taxpayers, despite the outcry from several citizen-led groups that called for no tax increase or a lower tax increase.

However, unpopular but loud calls for the defunding of police were also unsuccessful.

In fact, additional funding of $2.6 million was included that the department says is needed to hire 48 recruits. Another $2.1 million will go toward full deployment of body-worn cameras, according to a statement from Mayor Cooper.

The property tax rate will increase $1.066 from the current $3.155 per $100 of assessed value to $4.221 in the city’s urban district.

The increased burden on taxpayers comes on top of the devastating March 3 tornadoes and the effects of Mayor Cooper’s ongoing COVID-19 restrictions, which continue to impact the ability of citizens to earn an income and the operation of many Nashville businesses at full capacity.

While Mayor Cooper and others have attempted to promote the increased property tax rate as lower than that of other major city/county tax rates, the argument is disingenuous when the property value portion of the equation is omitted from the tax burden discussion.

Because of the high value of properties in Nashville/Davidson County, property tax revenues on a per-penny-of-tax-rate basis to the city were more than 50 percent higher than the next highest-valued properties in Memphis/Shelby County in 2018, the most recent year data was available.

As recently as Monday, Mayor Cooper dismissed the issue of tax burden on Nashville’s property owners.

“Financial matters are easy for misunderstanding,” Mayor Cooper said during the June 15 COVID-19 Press Conference, but the tax burden is “because your values have increased and we should be celebrating that not complaining about it.”

An effort by Metro Council Member-At-Large Steve Glover to lessen the burden on property owners through a combination of budget cuts, an increase to the wheel tax, and a lower property tax increase as well as budget alternatives proposed by two other Council members were unsuccessful.

Nashville property owners will see the increase in their property tax bills that are mailed by the trustee’s office the first week of October and must be paid in full by the last day of February 2021.

The NoTax4Nash grassroots group pledged to initiate a recall election for Council members and Mayor Cooper for their support or vote in favor of a property tax increase, said spokeswoman Michelle Foreman.

The volunteer effort of 4GoodGovernment.com is working on The Nashville Taxpayer Protection Act.

Among other provisions, The Tennessee Star reported, the Act seeks to limit Nashville’s Mayor and Metro Council on raising property taxes to no more than 2 percent per year without a vote from the public.

Watch the full discussion and vote:

– – –

Laura Baigert is a senior reporter at The Tennessee Star. The Associated Press contributed to this report.

Maybe y’all can use some of the new revenue to build a much needed Major League Baseball stadium on the East Bank.

Thanks for helping me decide to never move to Nashville.

What a sad day for our city. Thanks to Councilman Glover for standing up for the taxpayers. When he was booed during the council meeting it showed me a lot about this cities politics. Well folks you voted for them so you got what you wanted. Maybe we can get that all tax increases have to go before the taxpayers on a voting booth ballet.

It was very sad since there were alternatives to get the funding but it all fell on deaf ears.

You are right they were voted in. Many voters approved the spending too.

Like children, the “I want” did not think about what it would really cost.

The “It City”… is going to be in deeper trouble on this path. Crime, education, are just a couple fo factors.

The raises are needed—this is a good step toward a $15 minimum wage. Not so sure about more money for police at this point, but the cameras will protect people of color from abuse in some cases.

Just asking? How many of the council members live in Davidson County?

I am not sure why anyone is really shocked, Democrats are not known for low taxes and small government. I like that some parks and water parks are still closed yet we have not furloughed any of those “essential” park employees.

I think that’s great, Nashville is following Chicago’s lead, you’ll be insolvent in 3-5 years, no business or residents will want to come into your city, crime is going to increase and your crappie schools will become even worse, the financial death spiral will get out of control and your city will die, good luck with that, your property value will die a slow death, I advise you get out while the getting is good.

How are you allowing this to happen, good people of Nashville?

Mayor Cooper has not be forthcoming about the dire financial condition of Nashville to get the results he wants just like his Health Dept. has distorted Covid 19 numbers for Mayor Cooper to get the results he wants to play politics and keep Nashville shut down. Cooper and his cronies need to pay dearly for their manipulation and mismanagement of Nashville. They need to be removed from office!