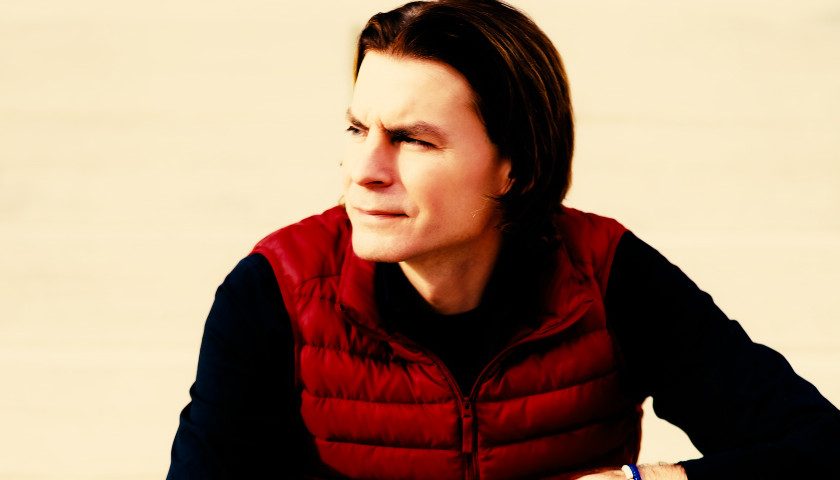

State Senator Paul Bailey, Chairman of the State Senate Transportation Committee, has not responded to an inquiry from The Tennessee Star to explain the Tennessee Department of Revenue’s correction of his assertion that Pilot Flying J, the truck stop company owned and operated by Gov. Haslam’s family, will not benefit from holding on to the extra cash generated by the proposed gas tax increase for 20 to 51 days.

The Tennessee Department of Revenue has corrected Sen. Paul Bailey’s statement regarding the timing of when fuel taxes must be remitted to the state. According to the Department of Revenue’s Communications Director, Kelly Cortesi,

“The gasoline tax is imposed when the fuel is first imported into Tennessee. The diesel tax is imposed when the fuel is sold to the wholesaler. In either case, the taxpayer is the importer/supplier, and the return is due on the 20th day of the following month.”

Sen. Bailey is the general manager and vice-president of Charles Bailey Trucking Company. The Department of Revenue was forwarded Sen. Bailey’s statement and was asked to confirm whether it was accurate in light of the fact that the Department’s website says that fuel taxes are not due to the state until 20 days after the month in which the fuel is sold.

According to Sen. Bailey’s statement, the Department of Revenue is incorrect:

“The payer of these taxes remit payment to the state upon delivery to their terminals; therefore, the only ‘float’ comes to the benefit of the state which is paid before fuel products are actually sold to end users.”

Shortly after Ms. Cortesi’s statement was received, The Star forwarded it to Sen. Bailey, offering him an opportunity to respond. To date, no response has been received by the Tennessee Star leaving open an important question overshadowing the Governor’s proposed gas tax increase.

Former State Rep. Joe Carr has raised the question of whether a possible conflict of interest exists for the governor’s fuel tax plan because of his equity holding in his family’s privately held Pilot Flying J, a company that is both a distributor and retailer of gas and diesel fuel.

If Sen. Bailey is correct that the taxes due to the state are paid upon delivery of the fuel, then he would also be correct in saying that the benefit of those funds immediately inures to the state. However, if the Tennessee Department of Revenue is correct and the distributor and retailer of the fuel can hold onto the cash generated from the taxes collected, then any benefit to the state is delayed while the private company has the use of unearned liquidity.

Explaining his decision to vote for the governor’s gas tax proposal, House Transportation Subcommittee member Rep. David Alexander, said:

“Where you have committees for many reasons. You have committees to get rid of bad bills. You have committees to amend bills and make them better and pass them forward so that the next committee can do the same thing if they want to or undo what you did.”

Committees should also ensure that all relevant questions are addressed before bills are passed.