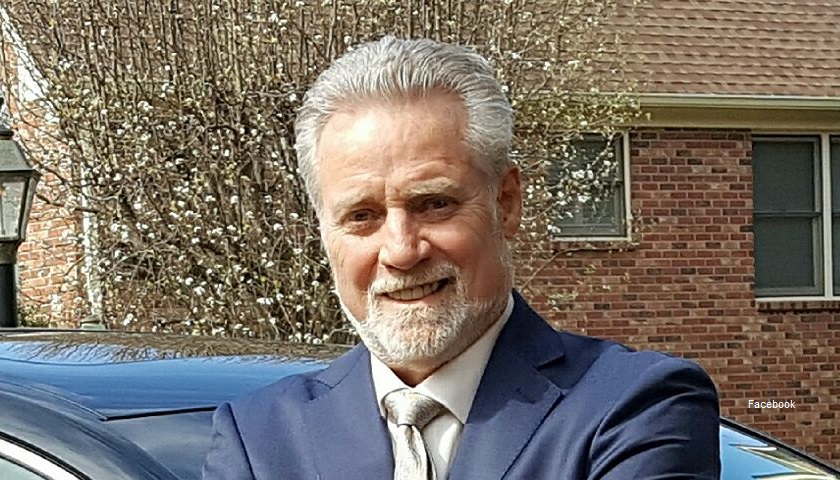

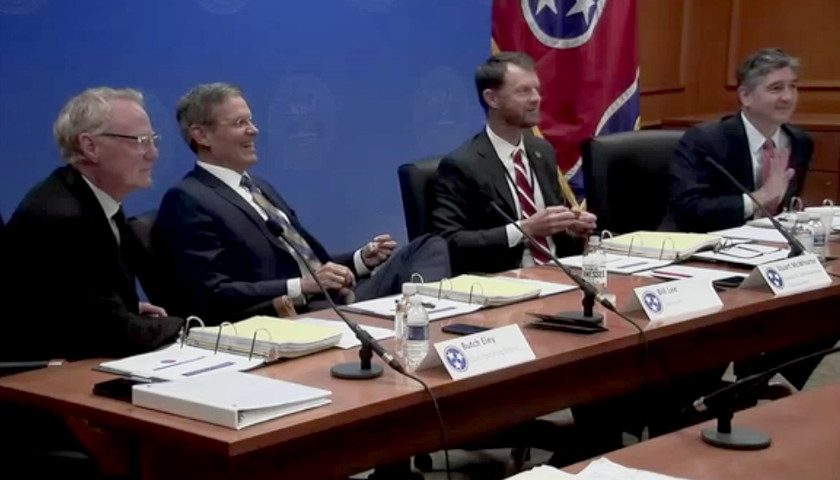

At the invitation of Chairman State Sen. Paul Bailey, 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News, testified before the State Senate Transportation Committee on Monday afternoon about Gov. Haslam’s proposal to pay for additional road construction funding by increasing the state’s gas and diesel tax.

Bristol provided The Tennessee Star with this summary of his prepared statement, which he authorized us to release after 1:30 p.m. today, when he was scheduled to deliver his testimony.

Here is the complete final draft of his prepared statement, as provided to The Star late Monday morning:

Testimony to Senate Transportation Committee (final draft)

By Ralph Bristol, host, Nashville’s Morning News, 99.7 WTN

(approx. 7:00)

I’ll try to honor Chairman Bailey’s request to share a summation of my radio audience’s response, over the past few months, to the proposals before them, including, but not limited to the governor’s, to increase transportation funding, and to offer my own insight, however limited value that might have.

First, understand that I understand my audience is not representative of all of Tennessee. Nor, might I add, are the fans of of the Tennessean or the Memphis Commercial Appeal, but I digress.

People who listen to conservative talk radio – even a program as fair-minded as mine – tend to have a default negative response to anything that sounds like a tax increase, and perhaps, as you know, especially people in Tennessee, and maybe even more especially Middle Tennessee.

So, it should come as no surprise that the majority of my Middle Tennessee conservative, tax-averse talk radio audience is, at best, skeptical of Governor Haslam’s plan. Anything else would be very surprising. You have some heavy lifting to do.

Their skepticism breaks down into three general areas:

1) They don’t believe the needs are as great as you say, either because of the available “surplus” as it has been most often described, to Gov. Haslam’s chagrin, or because they think you, and he, are simply inflating the problem to justify a tax increase. Good old fashioned healthy cynicism.

2) They don’t trust that you’re spending wisely – there are lots of anecdotal stories about what appears to different people as wasteful activity, including one from a caller who identified himself as an experienced contractor and claimed competing contractors intentionally dragged out projects for double the necessary time.

3) But, the majority of the feedback to me has been – no tax increase, no how, no way, never, and don’t give me this “tax swap” stuff about lowering other people’s taxes while raising mine. We heard that during the income tax debate.

So, what should you do with that?

If I were in charge of a state with 7 million people and I saw a need to rebalance a tax policy that is under-producing in one area and is over-producing in another, I’d have no tactical aversion to increasing the flow from the overfilled lake to alleviate the drought in the transportation valley, through which all the goods and people traverse.

I wouldn’t deny there will be sacrifices by some, for the good of the many, but repair always requires some sacrifice, and the overall sacrifice here, by most standards, is small, compared to the potential benefit of keeping a “user-fee” funding system intact.

Before I get to that, I hope you appreciate the relative ease of the task in front of you.

Rebalancing a fully-funded, some would say overflowing, revenue system is much easier than increasing taxes, so the first thing you should be doing is thanking God that you don’t have to actually take more money from the collective pockets of Tennesseans in order to fund any deficiencies, real or imagined, in road and bridge funding.

The second thing you should do is take a bow.

The fact that you are debating a rebalancing of the tax portfolio, rather than increasing the people’s overall tax burden is evidence (not proof, but evidence) this body and the governor have exercised sound fiduciary responsibility over the recent past, during a nearly disastrous national recession and an anemic national recovery.

Would that our federal government enjoy, and deserve, such an envious fiscal reputation and balance sheet as this esteemed body.

That said, the fruits of your own responsible actions now demand that you give the people of Tennessee the ultimate prize – better roads and bridges – with no tax increase on anyone – not just on the whole body – on anyone.

And the wonderful thing is – you can do this.

You can either do it the easy way, by adopting the Hawk plan, and simply move one-quarter of one cent of the seven-cent state sales tax into the transportation fund, but by doing so, create a crack in the wall of separation between transportation and all other funding — or you can leave the wall intact by lowering the sales tax more, to fully offset the increase in the gas and diesel tax on nearly every family in the state.

Do not deny the people’s claim that the governor’s proposal will leave a significant portion of the population with a personal tax increase, by their reasoned calculations. Simply put, for many individuals and families, the fuel tax increase will be more than their food tax break.

They are not inclined to factor in any perceived additional benefit for them from the governor’s proposed manufacturing tax breaks, nor the mere keeping of the promise to deliver previously approved tax breaks on passive income.

I don’t envy Governor Haslam’s responsibility. He has a solemn obligation to lead in solving a problem about which there is very little disagreement in this body.

It is hard enough for a husband and wife to agree on a significant change to their budget, let alone a governor and the 7 million people over whose collective budget he presides.

It is my humble, but considered opinion that Governor Haslam has almost presented a thoughtful, responsible plan that preserves the integrity of an admirable and enviable tax system, which has become even more admirable and enviable under his watch, albeit not always with his initial full blessing, and that his plan adequately addresses a real need that has always been considered so sacred that it deserved special protection, even from economic downturns that affect the rest of the people’s purse.

But, I do not support the Governor’s plan, as is, because I don’t believe it is the revenue neutral plan it advertises itself to be.

If this body did nothing, the people of Tennessee would see a considerable and permanent tax cut, not later than 2022, by virtue of the Hall Tax cut you passed last year, unencumbered by any awaiting tax increase.

It was a tax cut I believe the state can afford, and one that has likely already more than paid for itself by attracting more holders of large, passive income to the state, who pay and generate taxes in other ways.

Tennessee has made tax cuts and enjoyed revenue gluts in the same time period that national economic growth has been anemic, and I don’t believe the two are unrelated, but I digress – again.

Whether it’s a revenue drain or producer, using that unencumbered, permanent Hall tax cut to help balance a proposed new tax increase changes the rules of the Hall Tax cut after that tax cut decision was made – that game was over.

I have somewhat unique knowledge of this because I was on the phone with chairman of the House Ways and Means Committee, Charles Sargent, at the very moment he agreed to let the Hall tax cut pass. There were no strings attached. That was not part of the deal he agreed to.

Governor Haslam’s plan could easily be made revenue neutral, or better, with a larger sales tax cut, whether in groceries, or products in general, and I believe it’s affordable.

The governor argues that such a cut is unaffordable and he challenges those who want such a cut to offer cuts to his spending plan. That’s a fair challenge, and one I believe this Republican general assembly should take up immediately.

Republicans who think Gov. Haslam has a $2 billion dollar surplus to work with can surely find cuts to his plan to spend it all.

With that, I’ll stop, and thank you for listening. I’m both eager and anxious to take your questions.

[…] February, Bristol testified before a Senate committee on the gas tax increase bill that “Governor Haslam’s plan could […]

[…] the host of Nashville’s Morning News on 99.7 FM WWTN, said in testimony before the State Senate Transportation Committee on Februrary 27, “It is my humble, […]

[…] House Senate Transportation Chairman Paul Bailey (R-Sparta), and 99.7 FM WWTN radio’s Ralph Bristol, host of Nashville’s Morning News–have yet to answer one key question about the […]

[…] day’s talk agenda is set by Nashville’s Morning News host Ralph Bristol, and he testified before the State Senate Transportation Committee in favor of Gov. Haslam’s plan, provided it […]

[…] neutral, an argument 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News, disputed in his testimony before the State Senate Transportation Committee on […]

First of all thank God for people like Phil Valentine did led the march to oppose any tax and second of all if any tax was necessary, what would be wrong with David Hawks plan?