State representative Dallas Kephart (R-PA-Clearfield) wants to reduce Pennsylvania’s corporate net income tax (CNIT) to four percent by 2025.

Last year, lawmakers budgeted a gradual decrease in the CNIT from 9.99 percent to 4.99 percent over the coming decade. Before the change, the Keystone State charged corporations the highest state business tax in the U.S., behind New Jersey’s 11.5 percent rate. Now at 8.99 percent, Pennsylvania’s levy is 8.99 percent — the fifth highest. Assuming other states’ rates stay constant, Pennsylvania’s CNIT will end up roughly in the middle in terms of corporate taxes in 2031.

Yet inaction by other states is a bad bet: Arkansas, Iowa, New Hampshire and Idaho all made cuts to their corporate levies last year. This has spurred lawmakers in the commonwealth to expedite the current reduction’s phasing. In a bipartisan vote last month, the state Senate Finance Committee passed a bill to immediately drop the percentage to 7.99 and thence lower it by one point yearly until it hits 4.99 percent in 2026, moving up the final reduction by five years.

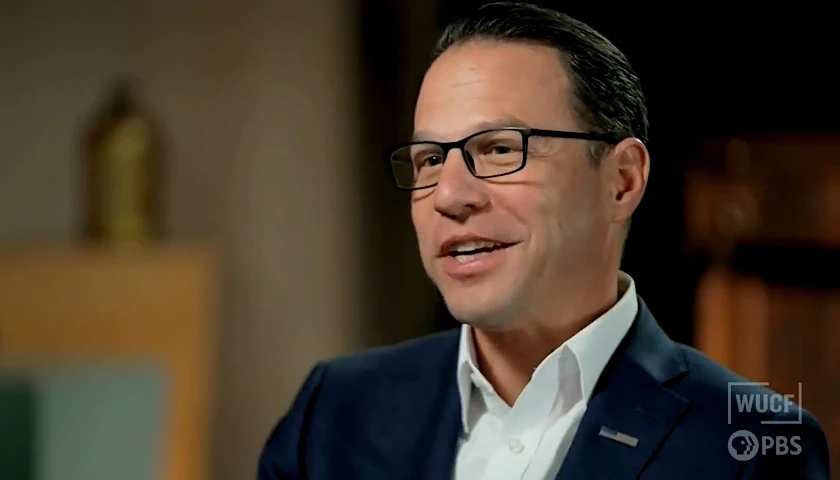

Not only should the decrease occur quicker, Kephart suggested in a memorandum asking other lawmakers to cosponsor his measure, the rate should fall nearly a percentage point lower. The representative recalled that Democratic Governor Josh Shapiro mentioned during his 2022 campaign that he hoped to bring the CNIT down to four percent by next year.

“This legislation is another step in the right direction in changing Pennsylvania’s trajectory for the better,” Kephart wrote. “It is critical for Pennsylvania to encourage business investment and development. This legislation will lead to more economic growth, capital investments, and wage growth.”

His legislation would bring the rate down to 5.99 percent next year with the final reduction to four percent transpiring the following year.

Kephart’s cut faces rough odds in the Democrat-controlled state House; despite some moderate Democrats wanting bolder CNIT cuts, progressives dominate the chamber’s leadership. Writing a deeper or accelerated cut into the Fiscal Year 2023-24 budget, on the other hand, could happen; Republicans control the state Senate and the two chambers will eventually need to reconcile their budget legislation to get a spending plan onto Shapiro’s desk.

Republicans and center-left Democrats have been emboldened in their vision for lower state corporate taxes in light of new revenue collections exceeding the CNIT yields that came in one year before when the levy was higher.

Advocates for a reduced CNIT often observe Pennsylvania’s economic competitiveness has lately suffered to a visible extent, demonstrated by the state’s demographic slump. Figures from the state’s nonpartisan Independent Fiscal Office indicate Pennsylvania will lose 0.5 percent of its working-age population between 2020 and 2025 even as the rest of the nation grows in that category by 7.5 percent.

Survey data from the Harrisburg-based Commonwealth Foundation has similarly alarmed policymakers who especially worry at the revelation that 44 percent of Pennsylvanians either considered leaving the commonwealth or know someone else who has.

– – –

Bradley Vasoli is managing editor of The Pennsylvania Daily Star. Follow Brad on Twitter at @BVasoli. Email tips to [email protected].

Photo “Dallas Kephart” by Dallas Kephart. Background Photo “Pennsylvania Capitol” by Ad Meskens. CC BY-SA 3.0.