An amendment by State Rep. Charles Sargent (R-Franklin), a motion to adopt the IMPROVE Act “Tax Cut Act of 2017,” HB 534, passed the Tennessee House of Representatives Wednesday afternoon in a 61-35 vote.

This was a preliminary vote prior to the anticipated final vote on IMPROVE Act “Tax Cut Act of 2017,” which is expected to come late Wednesday.

Thirty-four Republicans, joined by a solitary Democrat, State Rep. John Mark Windle, voted against the motion to adopt.

A full list of the 34 Republicans and one Democrat who voted no was compiled by reporters for The Tennessee Star on the scene (click at the bottom to see the second page):

[pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2017/04/IMPROVE-Act-Amendment-House-Vote-4-19-17.pdf” title=”IMPROVE Act Amendment House Vote 4-19-17″]

Notable among those Republicans who voted no were State Rep. Matthew Hill, State Rep. Timothy Hill, State Rep. David Hawk, State Rep. Sheila Butt, State Rep. William Lamberth, State Rep. Judd Matheny, State Rep. Jerry Sexton, and Speaker Beth Harwell.

Twenty-three Democrats voted for the motion to adopt, along with 38 Republicans.

Notable among those Republicans who voted yes were Majority Leader State Rep. Glen Casada, State Rep. Susan Lynn, State Rep. David Alexander, State Rep. John Ragan, and State Rep. Bill Dunn.

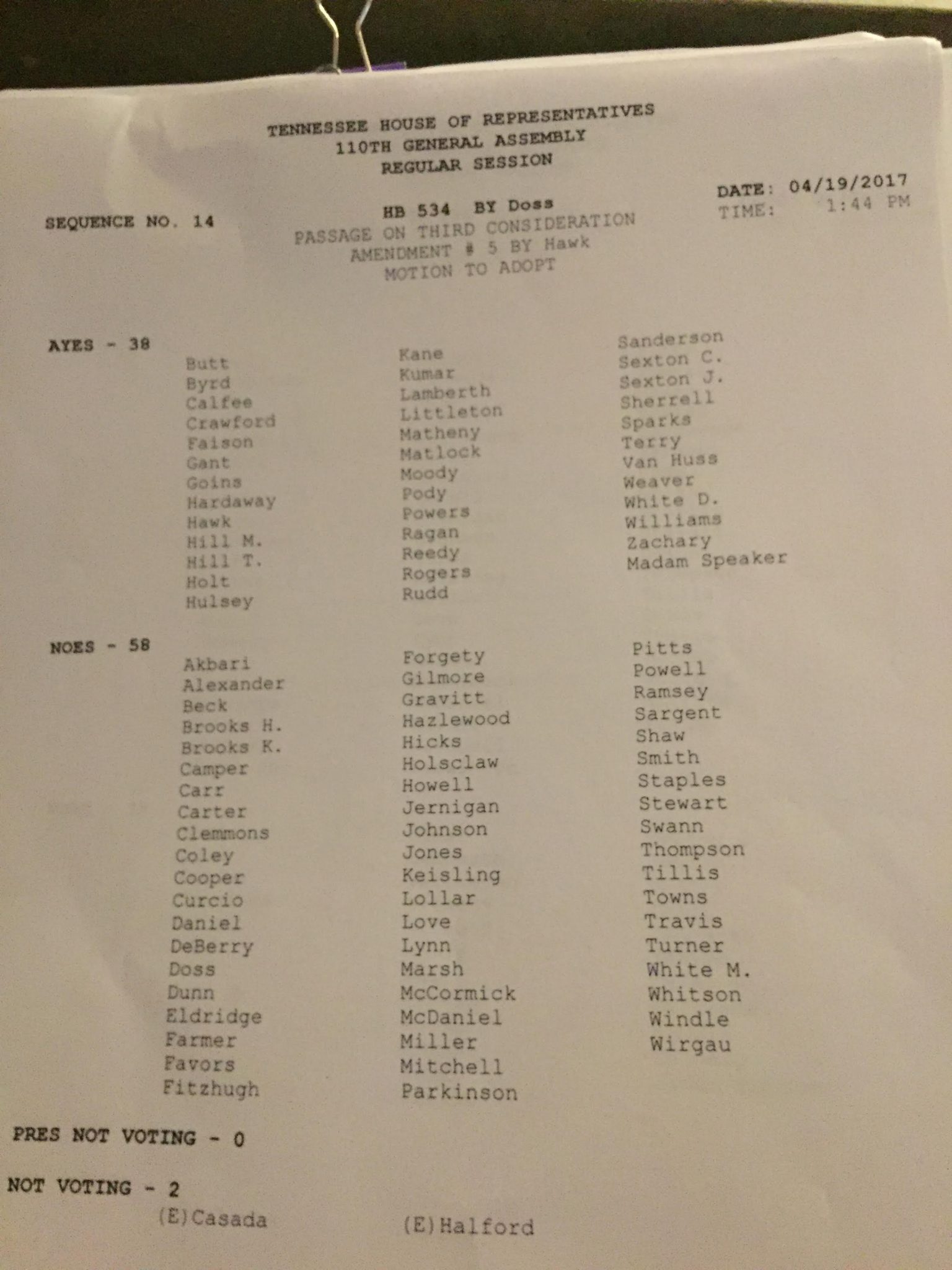

The House subsequently voted on an amendment proposed by State Rep. David Hawk (R-Greenville) that would substitute a reallocation of sales tax for the gas tax increase, which failed by a vote of 38 in favor to 58 opposed.

You can see the vote tally on the Hawk amendment here: