by Madison Hirneisen

Heading into the second year of his term, Virginia Gov. Glenn Youngkin says he wants to “compete to win” with other states when it comes to attracting business and people to the Commonwealth.

That was the main takeaway from a speech given by the governor Thursday, when he touted proposed budget amendments to cut $1 billion in taxes and outlined his strategy to “win” in the Commonwealth.

Youngkin says he wants to accelerate the building of business-ready sites, cut taxes for small businesses and enhance workforce development as part of a plan to “win” against other southern states.

The governor told an audience at Carter Machinery that states south of Virginia “are competing every day to win Virginians to move there, to win business decisions to locate there.” He said this year he wants to “accelerate” progress in the Commonwealth by lowering taxes for individuals and businesses, which he hopes will ultimately attract businesses to migrate and people to stay in Virginia.

“Competing to win with people and jobs starts with taxes,” Youngkin said Thursday. “It starts with both corporate and individual taxes.”

“I remind everybody in government every day that it’s your choice, not ours, where you live. It’s your choice where you domicile your business, and we have to win that choice every day,” Youngkin later added. “Texas, Florida, Georgia, South Carolina, Tennessee, North Carolina – they get it. We’re about to get it.”

Youngkin’s proposed budget amendments, which he unveiled last month, include proposals to reduce the top personal income tax rate to 5.5% and the corporate income tax rate from 6% to 5%. For small businesses, the proposed budget amendments would create a 10% deduction on business income – a measure supporters say is “first in the nation.”

The proposed tax cuts have been well received thus far by Republican lawmakers. When discussing the tax cuts Thursday, Del. Joe McNamara, R-Roanoke County, said “it’s high time, it’s past time.”

Youngkin’s proposals will have to be approved by both Democrats and Republicans in the General Assembly and could be subject to pushback.

“Fresh off campaigning for election deniers across the country, Glenn Youngkin is getting right to work pushing for huge tax giveaways for the ultra-wealthy and biggest corporations,” Democratic Party of Virginia Chairwoman Susan Swecker said in a statement Thursday. “While Virginia’s working families carry the load and pay more than their fair share into our economy, Youngkin is making sure the top 1% and his wealthy donors are off the hook by cutting their taxes yet again as he seeks to boost his own national profile.”

Virginia’s highest tax bracket starts at just $17,000 and hasn’t changed since 1990, as reported by the Virginia Mercury. Youngkin’s proposal would lower the tax rate from 5.75% to 5.5% for those in the top bracket, despite an October report to the governor and General Assembly that suggested raising taxes on higher income filers and indexing state tax brackets to inflation to make individual income tax more progressive.

In addition to proposed tax cuts in his budget amendments, Youngkin has proposed $450 million to prepare business-ready sites – an investment he hopes will help drive “transformational projects” and promote business growth in the Commonwealth.

The governor also said he is “acutely focused” on workforce development, noting that his upcoming budget will include funding to launch “dual enrollment accelerator” projects to help students earn credentials and enter the workforce right out of high school.

– – –

Madison Hirneisen is a staff reporter covering Virginia and West Virginia for The Center Square. Madison previously covered California for The Center Square out of Los Angeles, but recently relocated to the DC area. Her reporting has appeared in several community newspapers and The Washington Times.

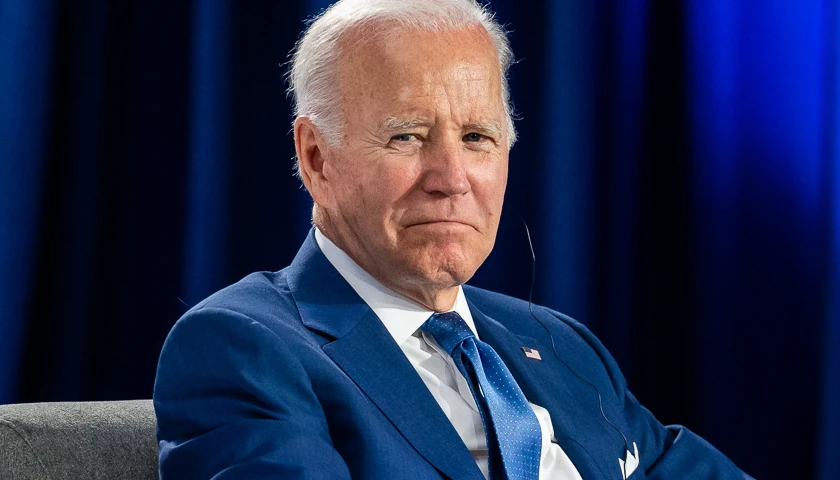

Photo “Glenn Youngkin” by Glenn Youngkin. CC BY-SA 2.0. Background Photo “Virginia State Capitol” by Skip Plitt. CC BY-SA 3.0.