by Ashley Herzog

Ohio residents are tired of corporate welfare. They’re tired of politicians bailing out major corporations with their tax dollars. Unfortunately, however, the 2023 Piglet Book released by the Buckeye Institute this week prove that this sad reality is happening more often than ever.

Over $3 million on marketing for the state’s wine grape growers. Nearly $4 million on grants for sporting events. Over $160 million on “earmarks” — spending provisions that secretly award companies that don’t have to go through the government’s competitive and thorough vetting process large rewards. Ohio is doing all of this on the taxpayers’ dime. Frankly, that’s unacceptable.

While these corporate handouts coming at the state’s working families’ expense are bad enough, others aren’t just wasteful; they are also anti-competitive, affecting smaller companies’ ability to compete in the marketplace. Over the long term, this creates monopolies, increasing Ohio’s retail prices while reducing buying choices for consumers across the state.

No better example of this blatant corruption exists today than the National Association of Insurance Commissioners’ (NAIC) attempt to squash the cheap and affordable life insurance options that Ohioans have come to know and love.

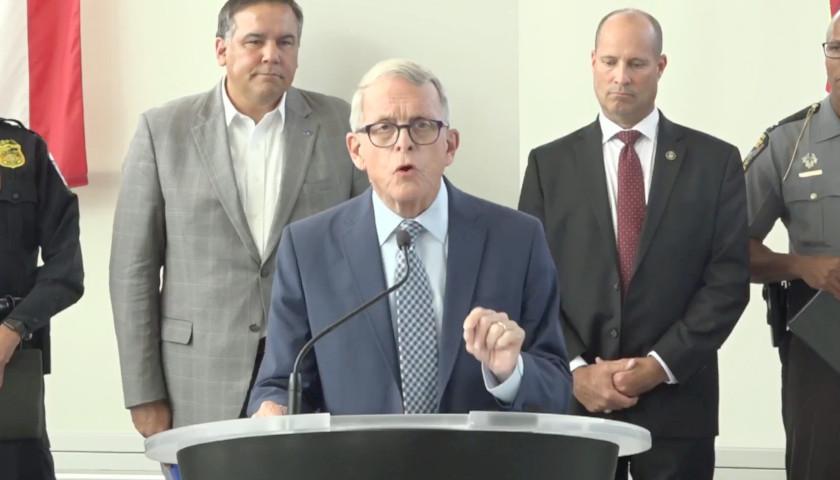

In April, big insurance companies like MetLife, Prudential, and New York Life requested that the NAIC raise cash-on-hand requirements for smaller, privately-backed insurance companies by 50 percent. They claim this proposal came from a desire to protect consumers from increased risk, but the facts don’t support this position. What they do support, however, is that this new penalty could push the big guys’ smaller competitors out of the market — reducing options, increasing costs, and even taking away insurance plans from the families in this state who pay into them with the expectation they will have financial security when they need it. It only took eight days for an NAIC committee to approve the penalties and fast-track them for approval by the organization’s full membership. Now, these fat cat insurance companies are just waiting on Ohio Insurance Commissioner Judith French and Governor Mike DeWine to approve and implement their plans.

The $150 million that Ohio offered to auto giant Honda is also emblematic of this problem.

On its face, the company may have appeared to earn this award after pledging to spend over $4 billion instate on its electric manufacturing capacity — a move that the company said would create over 2,500 jobs. But Honda is a $45 billion company, not a charity. It’s not investing in Ohio out of charity; it’s doing it because it’s good for its bottom line. Bailing it out won’t secure more jobs and economic growth in this state; it will distort the marketplace to favor one of the many auto giants that operate in this state at the expense of all the others. It won’t be long before political analysts begin reporting that the move hurt, not helped, competition and the overall economic health of this state.

Redistributing wealth from the poor to the rich is never a good thing. Picking winners and losers in the marketplace with Ohioans’ tax dollars isn’t either. So why does this state’s political class continue to do both?

The time is now for a political reset. The time is now to put people instead of corporations at the forefront of public policy. Only then will the system begin to work for Ohio’s families and small businesses rather than against them.

– – –

Ashley Herzog (Avon Lake, Ohio) is a political commentator and freelance healthcare writer for the Heartland Institute.

Photo “Honda Factory” by Wiki Historian N OH. CC BY-SA 3.0.