by Jon Styf

The Tennessee Legislature continued to change the way its airports are funded through legislation passed in the final days of session.

A bill to lower the state’s corporate aviation fuel tax cap to $1 million per company passed along with a bill to reconstitute the Metropolitan Nashville Airport Authority and several budget appropriations to individual airports and the state’s airports as a whole.

House Bill 431 is the continuation of a Republican legislative plan to lower the aviation fuel tax. Rep. Mark White, R-Memphis, said FedEx paid $45 million in annual aviation fuel tax when the cap was first installed and will be down to $1 million for the 2024-25 fiscal year. The current $5 million annual cap per company will cost the state $2.6 million in taxes when it drops to $3 million and then $10.6 million annually when the cap drops to $1 million.

Rep. Bo Mitchell, D-Nashville, said he felt the state was lowering the gas tax, leading to further state funding to the airports, then using that as a reason to take over control of Nashville’s airport authority.

In Gov. Bill Lee’s budget amendment, he proposed the state’s five major airports receive $59.5 million, the state would give $23.7 million to the smaller airports in general aviation support and $20 million for a Knoxville pedestrian bridge grant.

The Legislature’s budget amendment then set aside $10 million for facility and infrastructure improvements at Music City Executive Airport, $5 million for the installation of a sewer line at Shelbyville airport, $2 million for airport upgrades at the Portland Municipal Airport and $1.2 million for a new hangar at the Crossville Memorial Airport.

“It would be a whole lot less than that if we would stop doing this corporate welfare and let our airport run itself,” Mitchell said. “You have a hold harmless clause in this bill. … let’s not use this as a weapon.”

White said he felt like the aviation fuel tax was created unfairly nearly 20 years ago and FedEx paid $9 billion in federal, state and local taxes over the past five years with $57 million last year going to the state in franchise, sales and motor fuel taxes. He said FedEx employs 372,000 in the United States and 41,000 in Tennessee.

The Institute on Taxation and Economic Policy, however, reported FedEx paid no federal income tax on $1.2 billion of income in 2020 and received a $230 million rebate. It also paid zero in 2018 and 2019 on $6.9 billion of income over the three years, the report said.

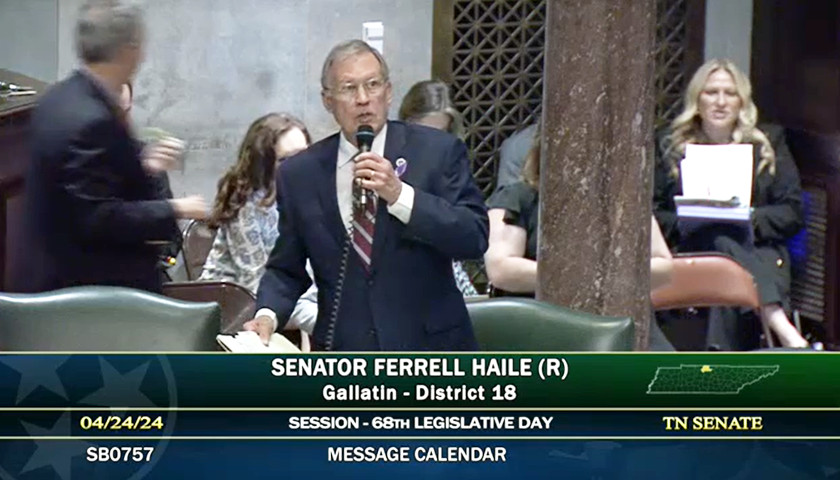

The Nashville airport board bill, meanwhile, reconstitutes the board’s appointments from the current seven-member board appointed by Nashville’s mayor.

The new structure will make it an eight-member board with two appointees each for the mayor, governor, House speaker and Senate speaker.

Mitchell also objected to those changes, saying that the Republican supermajority has power and “Absolute power corrupts absolutely.”

The aviation fuel tax cap and Nashville airport board bills will next head to the desk of Gov. Bill Lee for approval.

– – –

Jon Styf is an award-winning editor and reporter of The Center Square who has worked in Illinois, Texas, Wisconsin, Florida and Michigan in local newsrooms over the past 20 years, working for Shaw Media, Hearst and several other companies.

Photo “Nashville International Airport” by Nashville International Airport.

Sounds a lot like corporate cronyism to me. How about reducing the tax I pay for gasoline? You know the tax that the state used lies about the Hall tax in part in order to justify raising our gasoline tax by 12 cents a gallon.