James Erwin, federal affairs manager for telecommunications at Americans for Tax Reform, said Tennessee is leading the nation in awarding funding for broadband internet provided by the federal Broadband Equity, Access, and Deployment (BEAD) program by ensuring funds do not go exclusively towards government-owned networks (GONs).

Read the full storyTag: Americans for Tax Reform

Pennsylvania Clean Slate Expansion Passes House Overwhelmingly, Heads to Senate

Pennsylvania’s House of Representatives this week approved a bipartisan expansion of the commonwealth’s “clean slate” policy affecting those with low-level, drug-related felony convictions.

The measure, which passed 189-14, builds on a 2019 policy that made the Keystone State the first in the nation to enact automatic record-sealing for summary offenses as well as certain nonviolent misdemeanors and arrests that didn’t lead to convictions. That reform benefited 1.2 million commonwealth residents. The bill that now awaits consideration by the state Senate would seal records of those who were convicted of minor drug felonies but thereafter stayed crime-free for 10 years.

Read the full storyGovernor Tony Evers Can’t Be Bothered With Issuing Ronald Reagan Day Proclamation

The Ronald Reagan Legacy Project has again asked for all governors to proclaim Feb 6. Ronald Reagan Day in honor of the 40th president’s birthday. Once again, Gov. Tony Evers has refused to do so.

The liberal governor, however, has been glad to issue all manner of proclamations celebrating everything from Tamil Language and Heritage Month to Transgender Day of Remembrance.

Read the full storyCoalition Backs Universal License Recognition in Ohio

A coalition of free-market associations sent an open letter on Tuesday to Ohio’s state lawmakers encouraging them to enact universal occupational license recognition, meaning the Buckeye State would honor professional certifications issued in other states.

Message signers included leaders of Americans for Prosperity-Ohio, the Buckeye Institute, the Goldwater Institute, the National Taxpayers Union and Americans for Tax Reform. The organizations observed that the state’s population is declining and that it will continue to do so if pro-market reforms aren’t made to attract new workers, including universal license recognition. Numerous states, including Arizona and North Carolina, generally accept credentials obtained elsewhere by people moving into those states.

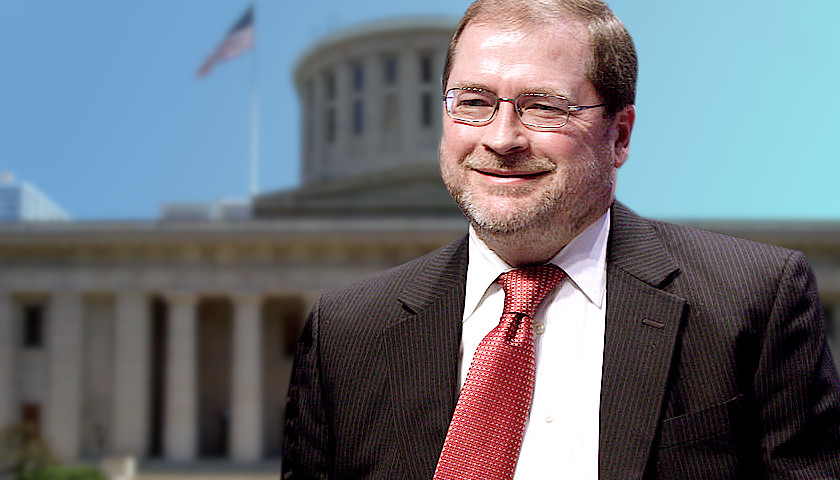

Read the full storyExclusive: Grover Norquist Previews Biden’s SOTU for The Star News Network

Washington, D.C.– The Americans for Tax Reform president told The Star News Network that President Joseph R. Biden Jr. has an uphill battle when he gives his State of the Union Address to a joint session of Congress here.

“Because his polling numbers are down, because people blame him for inflation and blame him for energy costs, he needs to redirect the entire discussion between now and the election,” said Grover Norquist, the Massachusetts resident, who founded ATR in 1985 at the personal request of President Ronald W. Reagan, so that the conservation movement would have an organization on-call to fight against tax increases and for tax cuts.

Read the full storyNorquist: Perdue’s Promise to End Georgia’s Income Tax Part of Trend in Red States

WASHINGTON, D.C.-The founder and president of Americans for Tax Reform (ATR) praised David A Perdue Jr.‘s pledge to eliminate the state’s income tax in an exclusive interview with The Georgia Star. “His coming out and saying: ‘Let’s phase down to zero,’ is helpful because we’re seeing this in other states,” said Grover Norquist, who started ATR in 1985 at the personal request of President Ronald W. Reagan. “Where either the preferred candidate or the incumbent candidate says: ‘I’m going to take this out,’ or somebody else does,” he said. “In fact, I did not know Perdue was introducing himself with that issue, but that is a huge advantage because he’s not relitigating 2020,” said the Massachusetts native. “He’s looking forward–phasing out the income tax is a forward-looking thing.” “I would project that all red states will, over the next five years, have Republican governors who will say it is our goal to get to zero,” he said. “Doesn’t mean tomorrow, but our goal is to get to zero, which means every year there’s a budget.” When Perdue announced his challenge to Gov. Brian P. Kemp this month for the GOP gubernatorial nomination in the May 24 primary, the former…

Read the full storyHistoric Income Tax Overhaul Reduces Burden by 13 Percent for Most Arizonans

Arizona Governor Doug Ducey is expected to sign a budget bill the Arizona Legislature sent to him on Friday that includes a historic tax reform package. HB 2900 implements the lowest flat tax in the country, 2.5%. The average Arizona family will see a 13% income tax reduction, about $350 per year. According to the nonpartisan Tax Foundation, Arizona previously had one of the highest marginal income tax rates in the country.

The budget bill also eliminates taxes on veterans’ retirement pay and prevents a 77% increase on small business taxes. It reduces property taxes by 10% on small businesses and job creators by 10%, capping the maximum tax rate on businesses at 4.5% and reducing commercial property taxes. According to a report by Ducey, 43% of Arizonans in the private sector work for small businesses. HB 2900 increases the homeowner’s rebate so the state covers half of homeowners’ primary property taxes.

Read the full storyGroups Come Together for ‘No Tax on My Occupation’ Lobby Day at State Legislature

NASHVILLE, Tennessee – Eight groups partnered together Tuesday for a “No Tax on my Occupation” lobby day at the Tennessee state legislature.

Read the full storyAmericans for Tax Reform Urges Ohio to Reject ‘Straight-Up’ Gas Tax Increase

Grover Norquist, President and Founder of the nationally recognized Conservative taxpayer advocacy group Americans for Tax Reform (ATR), implored Ohioans Friday to reject the “straight up” gas tax currently being considered by the Ohio Legislature. In an open letter, Norquist warned; A gas tax hike does the greatest harm to households who can least afford it. Coupled with gas tax prices that have been creeping up in Ohio, a gas tax hike would have especially adverse effects on the state’s lower income earners. Additionally, the 2003 gas tax increase failed to meet revenue projections. Also consider that a state gas tax increase would counteract the benefits of federal tax reform and eat into Ohio taxpayers’ federal tax cut savings. This is one of the reasons why Congress has declined to raise the federal gas tax, despite pressure for them to do so. The bill has been a source of significant controversy, forcing a schism between many Ohio Republican legislators and the Ohio Republican Governor, Mike DeWine. While there is an overwhelming consensus that something must be done to address the rapidly decaying roads and bridges in Ohio, how best to fund these repairs is still up for debate. When DeWine first introduced House Bill 62 (HB…

Read the full storyTennessee Reportedly Seeks Free Market Approach to Health Care

This week Forbes profiled a bill in the Tennessee House of Representatives that takes a “patient-centered, free-market approach to transform healthcare in Tennessee.” The bill, known as the CARE Plan creates price transparency through the Right to Shop Bill and more data on healthcare prices. The legislation also promotes competition among institutions, facilities, and providers through Certificate of Need Reform — one that loosens requirements — to benefit both urban and rural access needs, said Americans for Tax Reform Vice President of State Affairs Patrick Gleason. Gleason is also a senior fellow at the Nashville-based Beacon Center of Tennessee, a free market think tank. The CARE Plan also is designed to increases rural healthcare access through Telehealth and Telemedicine alternatives. The legislation also explores options to increase access to behavioral health services, including medication-assisted therapy for substance use disorder. The bill if enacted into law, would request federal block grants to empower Tennessee to create a healthcare system that addresses our unique needs, Gleason wrote in Forbes. “This plan is an important first step in addressing the health concerns of all Tennesseans through increased competition and transparency, and once again, this plan demonstrates Tennessee’s ability to lead on an important issue…

Read the full storyForbes Calls Tennessee Part of a ‘Southern Taxpayer Safe Space’

Tennessee is one of four states with a governor that has taken state tax hikes off the table, according to a new article in Forbes. Florida, Georgia, and South Carolina are the other three states, according to Patrick Gleason, vice president of state affairs at Americans for Tax Reform. Gleason is also a senior fellow at the Nashville-based Beacon Center of Tennessee, a free market think tank. Gleason said these four states “have experienced some of the nation’s most rapid population growth in recent years.” This is advantageous for people in those states, particularly now, Gleason said, in his Forbes article. “Congressional Democrats who control the U.S. House of Representatives are already pushing to ratchet up the federal corporate tax rate and hike the top personal income tax rate, which hits a large share of small business income, as high as 70%,” Gleason said. This, while a new lineup of Southern governors carry out low tax and other free market policies in their respective states, Gleason wrote. “One thing that Florida Governor Ron DeSantis, Tennessee Governor Bill Lee, South Carolina Governor Henry McMaster, and Georgia Governor Brian Kemp all have in common, aside from the fact that they’re all Republicans, is that each one of them signed a…

Read the full storyThirty Tennessee General Assembly Members Signed The ‘Taxpayer Protection Pledge,’ But Some Are Breaking It With The IMPROVE Act

“Politicians often run for office saying they won’t raise taxes, but then quickly turn their backs on the taxpayer. The idea of the Pledge is simple enough: Make them put their no-new-taxes rhetoric in writing,” says Americans for Tax Reform. The “Taxpayer Protection Pledge” commits an elected official or candidate for public office “to oppose [and vote against/veto] any efforts to increase taxes.” According to the Americans for Tax Reform searchable data base, the Pledge has been signed by 30 active Tennessee State Representatives and State Senators, who are listed below. State Representatives State Senators District First Last District First Last 24 Kevin Brooks 17 Mae Beavers 19 Harry Brooks 16 Janice Bowling 71 David Byrd 22 Mark Green 63 Glen Casada 26 Dolores Gresham 16 Bill Dunn 27 Ed Jackson 11 Jeremy Faison 23 Jack Johnson 56 Beth Harwell 13 Bill Ketron 7 Matthew Hill 5 Randy McNally 22 Dan Howell 1 Steve Southerland 68 Curtis Johnson 24 John Stevens 89 Roger Kane 14 Jim Tracy 38 Kelly Keisling 57 Susan Lynn 72 Steve McDaniel 36 Dennis Powers 45 Courtney Rogers 61 Charles Sargent 49 Mike Sparks 40 Terri Lynn Weaver The IMPROVE Act includes five tax increases: a…

Read the full story