Governor Mike DeWine aggressively condemned his fellow Republicans Monday for not supporting his gas tax increase in a candid interview with the Cleveland Plain Dealer Editorial Board. During the interview, he accused them of outright endangering the safety of Ohioans statewide by not supporting his plan. DeWine, in one of his first major bills proposed to Ohio legislature, chose to introduce House Bill 62 (HB 62), to the 2020-2021 transportation budget. Starting off his tenure as a Republican Governor with a tax increase was inevitably going to give many Republicans pause. However, this initial hesitation was greatly compounded by the fact that there are no tax offsets to the hike. In addition, the tax increase will not be gradually phased in over several years, as similar tax increases often are, but will into effect immediately. Lastly, the tax will be indefinitely pegged to the Consumer Price Index which could potentially see the tax increase every year. This is a tough pill to swallow for many Ohio Republican legislators. Conversely, DeWine is accurate when he notes the dire state of roads and bridges in Ohio. As previously reported: A 2018 study gave the state’s infrastructure an “A-” while the national state average came in at a “D+.”…

Read the full storyTag: Becker

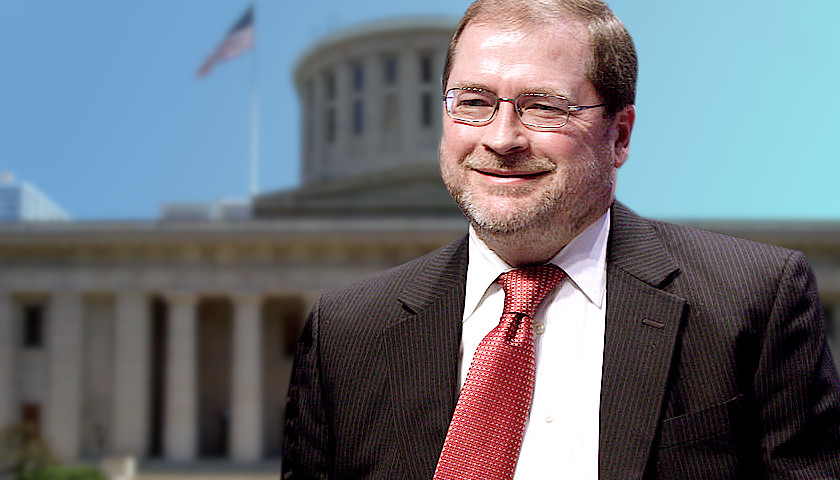

Americans for Tax Reform Urges Ohio to Reject ‘Straight-Up’ Gas Tax Increase

Grover Norquist, President and Founder of the nationally recognized Conservative taxpayer advocacy group Americans for Tax Reform (ATR), implored Ohioans Friday to reject the “straight up” gas tax currently being considered by the Ohio Legislature. In an open letter, Norquist warned; A gas tax hike does the greatest harm to households who can least afford it. Coupled with gas tax prices that have been creeping up in Ohio, a gas tax hike would have especially adverse effects on the state’s lower income earners. Additionally, the 2003 gas tax increase failed to meet revenue projections. Also consider that a state gas tax increase would counteract the benefits of federal tax reform and eat into Ohio taxpayers’ federal tax cut savings. This is one of the reasons why Congress has declined to raise the federal gas tax, despite pressure for them to do so. The bill has been a source of significant controversy, forcing a schism between many Ohio Republican legislators and the Ohio Republican Governor, Mike DeWine. While there is an overwhelming consensus that something must be done to address the rapidly decaying roads and bridges in Ohio, how best to fund these repairs is still up for debate. When DeWine first introduced House Bill 62 (HB…

Read the full storyFederalism Committee Chair John Becker Gauges Gas Tax as Ohio Statehouse Battle Ignites

COLUMBUS, Ohio — The battle over a gas tax increase has officially kicked off in the Ohio Statehouse. Since taking office, Ohio Republican Gov. Mike DeWine has insisted that a gas tax was critically necessary to preserving and repairing the state’s decaying roads and bridges. Though many in the state on both sides of the political aisle agreed that some form of revenue increase would be necessary, the real question was exactly how much would the increase would be. In his State of the State Address on Tuesday, as previously reported, DeWine explicitly stated that his proposed gas tax increase of 18 cents was lowest it could go: “Members of the General Assembly, by requesting $1.2 billion dollars to fill the budget hole and meet existing needs, let me assure you that I am taking a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy. He intended for it to go into effect immediately with no tax break offsets, and would peg it to the Consumer Price Index (CPI), thereby ensuring it would increase over time as the economy grew. However, prior to that speech, Ohio Republican State Speaker of the House Larry Householder…

Read the full storyOhio Federalism Committee Convenes to Discuss Government Overreach

COLUMBUS, Ohio— The Federalism Committee of the Ohio House of Representatives convened its Wednesday session with an unusual goal: debate and discuss the 10th amendment, the limits of state sovereignty, and the greater philosophies that underpin the constitutional system. The spirited session began with guest Michael Maharrey of the Tenth Amendment Center briefing the committee members, along with a crowd of roughly forty attendees, on his analysis that the federal government has grossly overstepped its constitutional limits, specifically the tenth amendment. Per the center’s site: The Tenth Amendment makes explicit two fundamental constitutional principles that are implicit in the document itself. The federal government is only authorized to exercise those powers delegated to it. The people of the several states retain the authority to exercise any power that is not delegated to the federal government as long as the Constitution doesn’t expressly prohibit it. He asserted that the federal government, through a myriad of abuses, including warrantless monitoring of citizen communications and unrestricted warfare, has greatly violated the sovereign rights of the states. He claimed that the states have the right to combat these abuses by several measures, the most powerful of which is nullification. The organization outlines this process as follows: Madison gave…

Read the full storyGoogle Wants 20 Years of Tax Breaks for Central Minnesota Data Center

Google wants 20 years’ worth of future tax breaks with a value of up to $15 million for a data center the tech giant plans to build in central Minnesota. Google plans to build the $600 million data center in Sherburne County on 300 acres owned by Xcel Energy. According to MPR News, filings submitted to the Minnesota Public Utilities Commission by Google estimate that the project will create 2,300 temporary construction jobs, and at least 50 permanent jobs. Becker Mayor Tracy Bertram noted that the tech jobs at the data center would have an annual payroll of $4 million, and said the data center will produce $7 million in economic activity per year. As such, Google asked Sherburne County and Becker city officials for property tax breaks for 20 years, which would save the company roughly $15 million. “This will generate a lot of economic activity that will benefit not only the city and the county, but also the state and the region,” Sherburne County Administrator Steve Taylor said. Taylor expects that county commissioners will be open to the request, but will be holding hearings in March to convince the public. The tax abatement would save Google between $7…

Read the full story