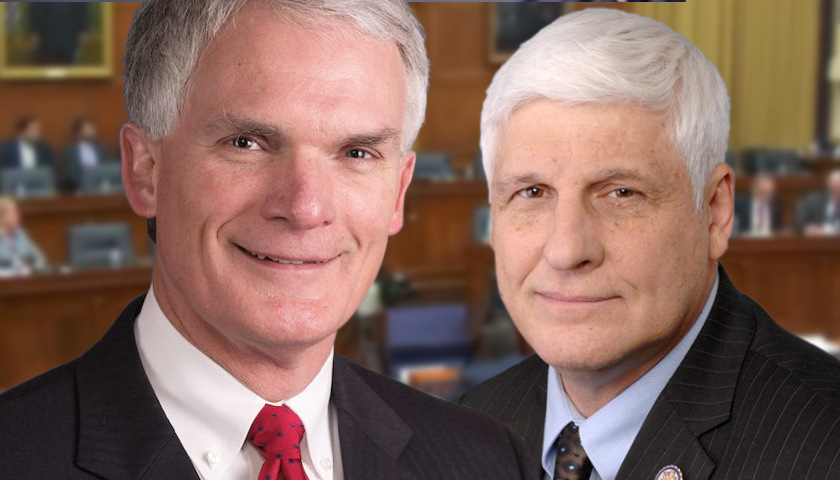

Two Republican members of Ohio’s congressional delegation have signed on as cosponsors of a bill that would end tax deductions for abortions. The IRS currently allows residents to deduct medical and dental expenses from their taxes if they exceed 7.5 percent of a person’s adjusted gross income. Legal abortions and birth control pills are both treated as tax-deductible expenses, but a bill introduced by Rep. Andy Biggs (R-AZ-05) seeks to change that. His bill, H.R. 2742, would amend the federal tax code to “provide that amounts paid for an abortion are not taken into account for purposes of the deduction for medical expenses.” The bill currently has 22 Republican cosponsors, including Reps. Bob Gibbs (R-OH-07) (pictured, right) and Bob Latta (R-OH-05) (pictured, left). “The ending of a human life should not be a part of a taxpayer’s money-saving strategy when they file their taxes each April,” Latta said in a press release. “I’m proud to support legislation to remove financial incentives for abortions, and will continue to work with the pro-life caucus to end all federal funding streams for them.” Biggs, in a statement provided to The Daily Signal, said that the “Abortion Is Not Health Care Act” is…

Read the full story