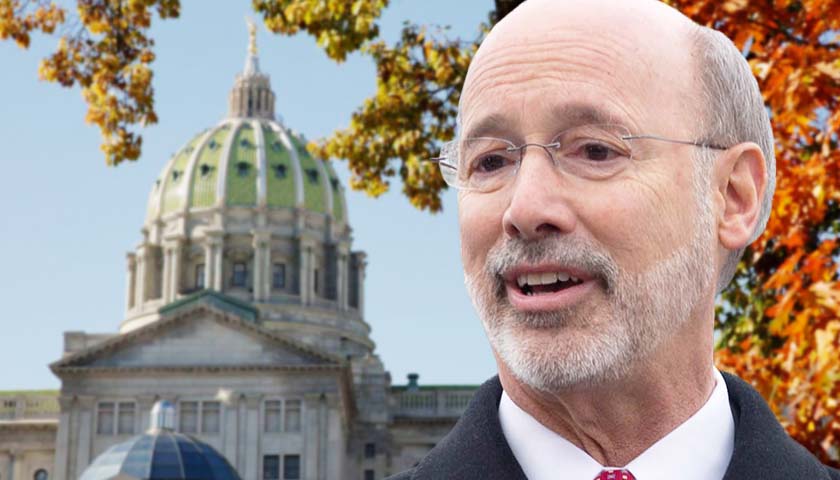

State representative Dallas Kephart (R-PA-Clearfield) wants to reduce Pennsylvania’s corporate net income tax (CNIT) to four percent by 2025.

Last year, lawmakers budgeted a gradual decrease in the CNIT from 9.99 percent to 4.99 percent over the coming decade. Before the change, the Keystone State charged corporations the highest state business tax in the U.S., behind New Jersey’s 11.5 percent rate. Now at 8.99 percent, Pennsylvania’s levy is 8.99 percent — the fifth highest. Assuming other states’ rates stay constant, Pennsylvania’s CNIT will end up roughly in the middle in terms of corporate taxes in 2031.

Read the full story