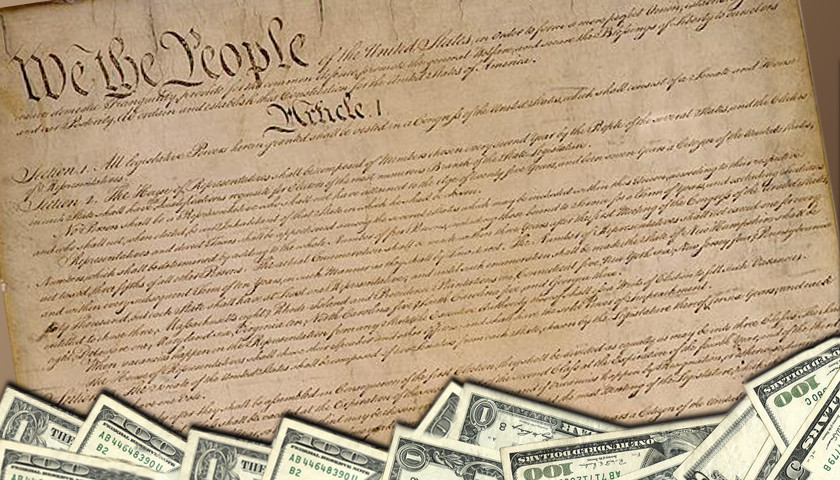

In its Article I, Section 8, Clause 5, the United States Constitution provides: “The Congress shall have Power…To coin Money, [and] regulate the Value thereof….” And since the Constitution’s drafting in the year 1787, cash has played a vital role in the nation’s economy as the generally-accepted medium of exchange. Barter still exists, but on a relatively limited basis and, although there has been chatter for decades about America one day becoming a completely “cashless” society, that day has yet to arrive. In modern times, there are, of course, multiple methods of payment for goods and services as well as to pay down debt in installments — or to completely extinguish it in one fell swoop. In addition to cash, there are checks, credit cards, electronic money transfers and other means of payment. Pursuant to the above-quoted provision from the U.S. Constitution, Congress enacted the Coinage Act of 1965 (last amended by two bills approved by the 97th Congress in Public Laws Nos. 97-258 and 97-452; the 1965 Act is the successor to the Coinage Act of 1792 as well as the Coinage Act of 1873). The 1965 version includes Title 31 United States Code Subchapter 5103 which, from 1983…

Read the full story