Live from Music Row Monday morning on a Special Edition of The Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 a.m. to 8:00 a.m. – host Leahy welcomed Attorney David Vicevich who specializes in telecommunications law to the newsmakers line.

At the end of the third hour, Vicevich outlined the legal and insurance issues that could be directly related to a telecommunications service like the AT&T data center that was struck by a bomb early Christmas Day in Nashville. He later explained how cyber insurance is the fastest growing insurance product and although costly can support small businesses and professionals.

Leahy: We’re joined now by an expert in telecommunications law David Vicevich. Do I have that right, David?

Vicevich: You do, sir.

Leahy: Okay, David. So you have a very interesting background. You live in Butte, Montana; but you went to Gonzaga or you went to another law school? Where did you go to law school?

Vicevich: Washington University.

Leahy: Oh, yeah fantastic law school. We saw that in your bio. And from there, you’ve got an LLM in telecommunications law at the University of Nebraska. So if anybody knows about telecommunication law, I think you’d be the guy.

Vicevich: Hopefully. (Chuckles)

Leahy: Hopefully. So the news here in Nashville, we’ve talked a little bit about some of the telecommunications infrastructure things. What are some of the legal issues and the insurance issues related to this bombing and the disruption of AT&T service that hit the AT&T data center you could tell us about?

Vicevich: This would be what I would consider a perfect storm in terms of liability. You have a situation where the perpetrator isn’t going to be liable and doesn’t have the resources to recoup those that are damaged. Many insurance policies for example in businesses that were damaged by the loss of service, most of the insurance policies that they will carry will exempt acts of terrorism for one.

Acts of war which they may argue this is. Physical cause. And internet outage. So an individual cyber policy most likely will have some sort of an exemption or exception to covering an incident like this. It may be that AT&T is covered and has a sophisticated policy for something like this. But otherwise, I doubt there’s much coverage out there in terms of insurance.

Leahy: So there are a huge number of businesses in downtown Nashville. Restaurants and things of that nature were impacted. 41 buildings were hit by this. And so your take on it from a legal perspective is that there may not be much opportunity to recover any insurance money to cover the damages. Is that what you’re saying?

Vicevich: That’s what I’m saying. Yes. There are many fire policies or liability policies that will exclude the loss of data. At the same time, many policies that cover data will exclude lots of data caused by a physical cause. It sounds like from AT&T that there’s flooding and potentially fire damage and things like that. So we also got a number of potential different causes. And as we have seen after hurricanes, for example, the insurance industry will pick the cause that best suits them under their policy.

Leahy: So in your view would this be a situation David where it would be appropriate for federal or state action here from a compensation perspective?

Vicevich: Yes, it would be. I think it’s damage to basic infrastructure. No different than if the interstate was down. And that would make it appropriate.

Leahy: How would that happen? Obviously we’ve got three legal entities involved. The federal government, the state government of Tennessee, and the Metro Nashville Davidson County government. What would be the appropriate action step that perhaps legislators would consider in this particular circumstance?

Vicevich: Well, I think most likely would come either from the federal or state. In fact, it may be that there is some federal funding available. If AT&T had an insurance policy that would cover something like this it’s most likely backstopped by what’s called the terrorist risk insurance program, which was developed after 9/11 when buildings in Manhattan could not obtain insurance.

The federal government came in and said if you have a loss over a certain cap, then the federal government will come in and make up the difference. So that’s one way there could be federal resources employed. Emergency resources are the other. And it appears from what I was reading that a state of emergency was declared. And then there could be straight legislative action perhaps from Tennessee.

Leahy: So going forward, let’s say you’re a business and you’re located near a data center or I don’t know an electricity hub or power station or substation. Is there anything that can be done to anticipate this kind of possibility or are you just kind of stuck?

Vicevich: I think you’re stuck. If someone came to me and asked should I be worried about this? This is an anomaly. At least we hope it is. And usually what we’re more concerned about is the traditional risk of fire, flood, and perhaps criminal activity. And if you think through the risk management process with respect to those, the location that you have is actually better served for fire service, police service, HVAC contractors, and things like entities that protect you if you’re in one of these unsafe locations in terms of somebody that would have a car bomb.

Leahy: People who want to reach you can at www.vicevichlaw.com. You are from Butte. Your offices are in Butte, Montana is that right?

Vicevich: That’s correct.

Leahy: An interesting phenomenon. I’m originally from upstate New York and I have a couple of friends that actually are involved in intellectual property law and they’re able to have sort of a lot of foreign clients because people think because of the New York address that they are a New York City law firm and they’re not. Are you able to basically conduct sort of a national practice out of Butte and compete with the big boys? Is that your plan?

Vicevich: Yes, it is. And I love it here. That’s why I’m here. But we do have a multi-state practice and we’re able to do specialized work like this all over. I would say there is one answer, which is you got to look at your insurance policies and get some help with insurance because there is a way to cover for this. So you need to be reading the policies and getting help with that.

Leahy: When you say a way to cover for it, would it be this business continuity or business Interruption? What is the best way that businesses that have been put out of business because of this bombing and downtown Nashville or have had their business disrupted would be able to go about to recover some damages with insurance coverage?

Vicevich: Through cyber insurance. And then you just have to make sure that you would want business interruption, business continuity, loss of data protection, and then third party coverage, which is the trick. So that you’re covered if your AT&T service goes down. So that’s the rub and you’re going to pay more for these policies and then it becomes a business decision. They’re extremely expensive and something at the tune of three times what a regular fire policy would cost you.

Leahy: You said cyber insurance. I have actually never heard that term but it makes sense now that you’ve mentioned it. How long have cyber insurance policies been around?

Vicevich: Essentially since 9/11. The insurance companies split off cyber insurance policies from liability policies after 9/11 out of concern and also to make sure that they qualified for federal backup through the trip program.

Leahy: How many businesses currently have cyber insurance?

Vicevich: Not many, but it’s growing. A lot of professional practices, accountants, and lawyers do because they can get a rider on malpractice insurance that’s fairly affordable. I would guess about a third of large businesses would. Maybe a tenth of small businesses. So it’s a growing field but a difficult field.

Leahy: Well, yeah seems to me that it would be very difficult. And of course, as a small business just from a practical perspective, you said that cyber insurance would be three times what normal Insurance business insurance would be in terms of costs?

Vicevich: Yes.

Leahy: You say about ten percent of small businesses have it. Do you see over the next decade a dramatic increase in cyber insurance?

Vicevich: Yes, it’s been and is anticipated to continue to be the fastest-growing sector in the insurance business.

Leahy: David Vicevich. On the web at www.vicevichlaw.com. Thanks so much for talking with us today. I really appreciate it. It’s very early out there in Butte but I appreciate you taking the time to be on the Tennessee Star Report.

Vicevich: Thanks for having me.

Listen to the full third hour here:

– – –

Tune in weekdays from 5:00 – 8:00 a.m. to the Tennessee Star Report with Michael Patrick Leahy on Talk Radio 98.3 FM WLAC 1510. Listen online at iHeart Radio.

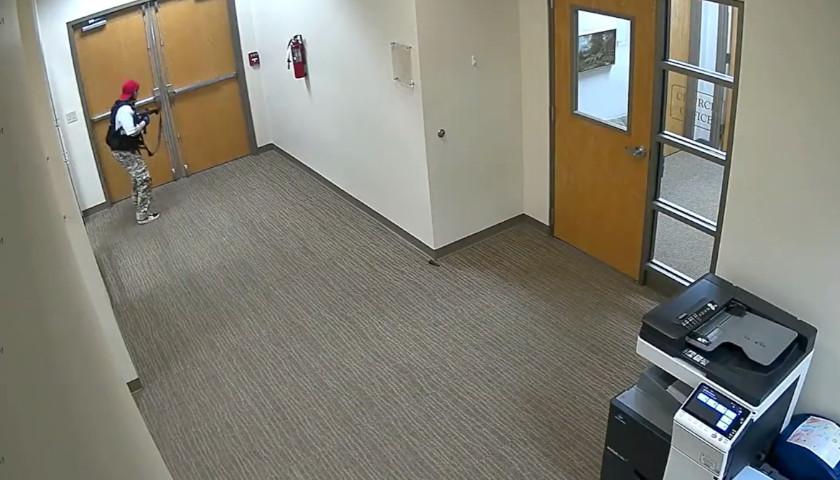

Photo “David Vicevich” by David Vicevich and “Nashville Christmas Morning Explosion Damage” by Nashville Fire Department.