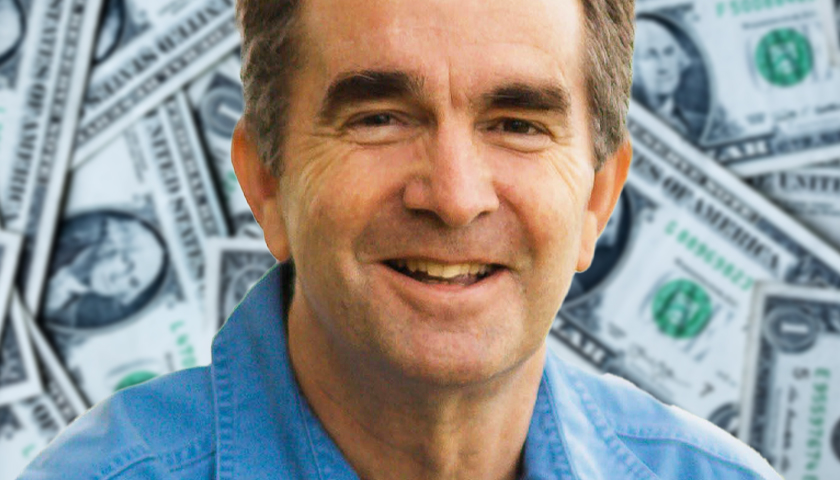

Governor Ralph Northam touted Virginia’s 2021 $2.6 billion surplus and economic recovery in his annual revenue speech to a joint meeting of the Senate Finance and Appropriations, House Appropriations, and House Finance Committees.

“I am here today to update you on the Commonwealth’s revenues for the fiscal year that ended on June 30. And it’s good news. Really good news,” he said, according to prepared remarks of the Wednesday speech.

Read the full story