Nokian Tyres officials recently announced that the company will invest $174.1 million to expand operations at its Dayton facility to “double its tire production capabilities.”

Read the full storyTag: economy

State Senate Majority Leader Pitches Flat Tax for Wisconsin

by Benjamin Yount Wisconsin’s Senate majority leader says there is plenty of money available to reconfigure the state’s personal income tax rates. State Sen. Devin LeMahieu, R-Oostburg, on Friday said Wisconsin’s record $6.6 billion surplus will help get the state over the hump. “So, for sure in the first two years of the budget we’ll have plenty of revenue,” LeMahieu said. His proposal would move Wisconsin from a top personal income tax rate of 7.65% to a flat rate of 3.25% for everyone by 2026. LeMahieu estimates that his plan will save taxpayers $5 billion. “It maybe looks a little daunting in years three and four,” Lemahieu said of the impact on state coffers. “When other states have done this, sales tax revenue goes up, and other revenue goes up because there’s more money in the system. It changes people’s spending habits.” LeMahieu said Wisconsin’s economy has grown over the past several years, and he expects that to continue. He also said lowering the tax rate to 3.25% would make Wisconsin the lowest among its neighbors. Minnesota’s income tax rates start at 5.35%, while Illinois, Iowa and Michigan all have flat taxes that are or would be higher than…

Read the full storyCrom’s Crommentary: The Irony of Two Articles, China’s Economy and U.S. Lockdowns

Monday morning on The Tennessee Star Report, host Leahy welcomed the original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyHouse Speaker Fight Foreshadows Larger Debt Ceiling Battle on the Horizon for Republicans

The gridlock that paralyzed House Republicans over the past week in their quest to elect a new Speaker could be a foretaste of more to come, with party moderates and conservatives set to tangle in the months to come over raising the debt ceiling and reining in reckless government spending.

Although newly elected Speaker of the House Kevin McCarthy ultimately prevailed in his bid for the office over a small but determined band of House Freedom Caucus members, his slim GOP majority in the House will be vulnerable if and when conservatives rebel again down the road, as some are predicting, in an effort to reassert debt reduction as a top priority for the party.

Read the full storyFinance Professor Murray Sabrin Talks 2023 Economic Outlook, ‘We Have a Mess on Our Hands, Courtesy of the Federal Reserve’

Friday morning on The Tennessee Star Report, host Leahy welcomed Finance Professor Murray Sabrin to the newsmaker line to give his take on the 2023 economic forecast.

Read the full storyPoll: Americans Pessimistic About the Economy in 2023

Americans are not optimistic about the economy this year.

A new poll from Gallup found that about 80% of those surveyed expect higher taxes, a higher deficit, and a worse economy in 2023.

Read the full storyBig Banks Predict Significant Economic Downturn in 2023: POLL

Of the 23 major financial institutions that work directly with the Federal Reserve, 16 anticipate a recession within the next 12 months, with two anticipating one the year after, according to a survey published by The Wall Street Journal Monday.

These institutions, which range from Bank of America to UBS, note that Americans are spending their savings, banks are heightening lending standards and the housing market is in a decline, all classic warning signs that a recession is impending, the WSJ reported. All of this is being exacerbated, the banks say, by the Fed’s historically aggressive pace of interest rate hikes, designed to blunt stubbornly persistent inflation.

Read the full storyTennessee Touts 2022 Economic Developments: 16,000 Job Commitments, $8.6 Billion in Private Investments

Governor Bill Lee and the Tennessee Department of Economic and Community Development (TNECD) posted their picks for the top five new business investments in the state during 2022.

In all, about 100 projects were supported by TNECD statewide in 2022, resulting in more than 16,000 jobs and $8.6 billion in private investment, according to the department.

Read the full storyCommentary: The $1.7 Trillion Omnibus Prioritizes Diversity, Equity, and Inclusion in Higher Education and STEM Spending

The national debt is growing, but Congress’ recent spending bill is a telltale sign that it has no intention of shrinking the deficit.

After receiving bipartisan support in the Senate, the House passed a 1.7 trillion spending bill on Dec 16, avoiding a government shutdown.

The bill allocates funding mostly to defense, including $45 billion to Ukraine, which will assist the country in its war effort against Russia.

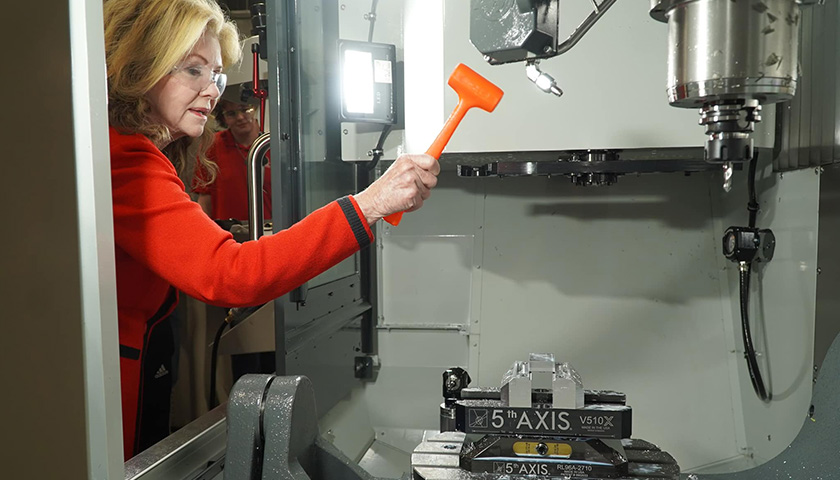

Read the full storyBlackburn Releases New Video on the Economy, Discusses What Has Kept Tennessee Growing as Nation Struggles

Tennessee Republican Senator Marsha Blackburn is preparing to release a video via social media discussing the state’s economy and spoke with The Tennessee Star this week to discuss both the pressures it endures as well as its bright spots compared with other regions.

In the one-minute spot, which shows the senator touring a Clarksville-area manufacturing plant, she discusses the challenge ongoing inflation poses to producers as they attempt to provide affordable goods to Tennesseans.

Read the full storyCrom’s Crommentary: Identifying ‘America’s Cancer’ as Economic Restructuring Looms

Monday morning on The Tennessee Star Report, host Leahy welcomed the original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyPennsylvania Is Missing 113,000 Workers

Pennsylvania is missing young workers and the problem is one that won’t simply go away.

While the commonwealth isn’t the only state struggling with a shrinking youth population, state-to-state comparisons are difficult to make due to data issues. What’s clear is that Pennsylvania has had a significant drop in its labor force participation rate. Rather than a story of older workers retiring, the majority of missing workers are under 45 rather than over.

Read the full storyCommentary: It’s the Most Wonderful Time of the Year (for the Washington, D.C. Establishment)

It is Christmas season. The decorations are hung or need to be. Gifts are being purchased. The Advent Week of peace is being celebrated. Parties are being thrown. And Americans wind down from a long, stressful year.

Unfortunately, while most Americans refocus, the rest of the world doesn’t stop, but in many cases looks at this time as an opportunity to exploit.

Read the full storyVirginia Will Enter Next Session with Money Surplus

Virginia lawmakers will enter their next regular session in January as the state continues to record budget surpluses.

The commonwealth finished the last fiscal year with a surplus of nearly $2 billion and the state revenue collections continue to exceed expectations. Some economists are warning against using the excess money to increase spending during the legislative session.

Read the full storyAuthor Samuel Gregg Discusses His New Book, ‘The New American Economy’

Monday morning on The Tennessee Star Report, host Leahy welcomed Action Insitute Fellow and author of the new book, The New American Economy, Samuel Gregg to the newsmaker line to talk about how to improve the American economy.

Read the full storyCommentary: Don’t Give an Inch on the Debt Ceiling

The dust has barely settled from the contentious midterms, and the battle lines are already being drawn for the next legislative fight in Washington: the debt ceiling. With the nation at unprecedented levels of indebtedness, the choice in this fight is a stark one: a path toward stability or fiscal Armageddon.

If that sounds hyperbolic, consider the following facts about America’s finances.

Read the full storyEconomists: Buying a Home May Not Get Any Cheaper Even If the Economy Tanks

Despite expecting a recession and reduced inflation that would ordinarily put downward pressure on prices in 2023, a critical shortage of housing means prices are unlikely to change much, two economists told the Daily Caller News Foundation.

The median sales price for existing homes increased 6.6% in October compared to the same month in 2021, jumping to $379,100, according to the National Association of Realtors (NAR), primarily due to demand outstripping supply, according to both Nadia Evangelou, senior economist and director of real estate research at the NAR, and E.J. Antoni, economist at the Heritage Foundation. The inventory of unsold existing homes fell to 1.22 million in October, down 10,000 from September 2022, and less than the 1.39 million unsold existing homes in December 2019, according to the National Association of Realtors.

Read the full storyInvestors Flee the Housing Market in Troubling Sign for the Economy

Investors bought 30% fewer homes in the third quarter of 2022 compared to the same time period last year, as high borrowing costs pressured investors out of the housing market, according to real estate brokerage Redfin Tuesday.

Besides a brief plunge in the second quarter of 2020 in response to the beginning of the coronavirus pandemic, the decline was the steepest since 2008, and surpassed the 27.4% overall decline in home purchases nationwide, Redfin reported. The pandemic ultimately boosted demand for homes in suburban areas, sending investors on buying spree as they raised rents in those areas, in some cases by double digits, The Wall Street Journal reported Tuesday.

Read the full storySen. Blackburn Hammers Biden on Economy Days Ahead of Election

A U.S. senator from Tennessee is hammering President Joe Biden and the Democrat Party on the economy – particularly skyrocketing inflation – ahead of Tuesday’s midterm elections.

Sen. Marsha Blackburn has been focused on the topic all week.

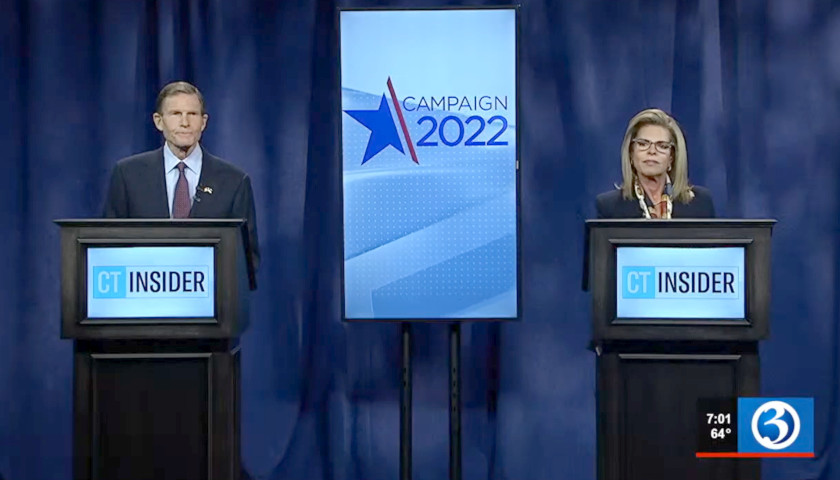

Read the full storyRichard Blumenthal Runs from Grading the Economy in Debate with Leora Levy, Says It’s ‘Ongoing,’ Can’t Give It a Grade ‘Midstream’

Senator Richard Blumenthal (D-CT) sidestepped giving the economy a letter grade during his only debate with Connecticut Republican Senate candidate Leora Levy Tuesday night, but when pressed to do so by the panelist, he responded the grade is “ongoing,” and “I don’t think that we can give it a grade midstream.”

Levy, however, plainly answered, “I would grade the economy ‘F.’”

Read the full storyNashville Home Prices Fall as Mortgage Rates Continue to Rise

The average median list price for single-family homes and townhouses in Nashville for October was $510,000, according to data compiled by Movoto Real Estate – down from the previous month’s average list prices of $549,000 in September and $569,553 in August.

Read the full storyReports Indicate Connecticut GDP Fell in Second Quarter

The economy in Connecticut has some catching up to do.

Initial figures from the U.S. Bureau of Economic Analysis show the state’s economy fell behind the rest of the nation in the second quarter of 2022.

Read the full storyPoll: Joe Biden Faces Strong Disapproval Among Majorities of Catholic Voters in Six Battleground States

A new EWTN News/RealClear Opinion Research survey published Tuesday found Joe Biden is facing strong disapproval from Catholic voters in six battleground states, with large majorities stating the economy is the most pressing issue in the 2022 midterm elections.

Read the full storyPublic Affairs Specialist Clint Brewer on Fetterman’s Debate Performance and How Midterms Are a Vote on ‘Economic Discomfort’

Thursday morning on The Tennessee Star Report, host Leahy welcomed all-star panelist Clint Brewer in the studio to comment upon GOP momentum heading into the midterm elections and Pennsylvania US Senate candidate John Fetterman’s cognitive performance Tuesday evening.

Read the full storyHome Sales Plummet in Ominous Sign for Economy

Sales of existing homes fell in September for the eighth month in a row, as historically high mortgage rates pummel demand for homes, the National Association of Realtors (NAR) announced Thursday.

The 1.5% decline from August contributed to a 23.8% slide compared to September 2021, as the median existing-home sales price rose 8.4% from last September, from $355,100 to $384,800, the NAR reported. NAR Chief Economist Lawrence Yun said that high mortgage rates were contributing to reduced demand, particularly in “expensive regions of the country.”

Read the full storyCalifornia’s Economy Hurting as Companies Flee in Droves

California officials are sounding the alarm after recent statistics showed that fewer corporate and start-up activity in the state was leading to a decline in tax revenue, according to a report by Bloomberg News.

This year, just nine companies based in the state had held initial public offerings (IPOs), which is when a company first lists shares for sale on the stock market – considered a milestone in its growth after strong activity and high valuation, the report revealed. In 2021, California – whose start-up ecosystem in ‘Silicon Valley’ is considered the most prodigious in the world – saw 81 companies conduct IPOs, making 2022 a year of a nine-fold decrease.

Read the full storyGeorgia Democrat Stacey Abrams on Why Abortion Is Necessary: ‘Having Children Is Why’ You’re Worried About Food and Gas Prices

Georgia Democrat gubernatorial hopeful Stacey Abrams said Tuesday access to abortion is necessary because “having children is why you’re worried about your price for gas … how much food cost.”

“You can’t divorce being forced to carry an unwanted pregnancy from the economic realities of having a child,” she told MSNBC’s Morning Joe.

Read the full storyAndy Ogles Talks Top Achievements as Mayor of Maury County and Key Concerns of Citizens

Wednesday morning on The Tennessee Star Report, host Leahy welcomed TN5 GOP Nominee, former Mayor of Maury County Andy Ogles to the studio to discuss past achievements as mayor and issues he is hearing on the ground through state townhalls.

Read the full storyNew Kari Lake Ad Promises to Cut Taxes for Arizonans

Arizona’s Republican gubernatorial nominee Kari Lake told Arizonans that economic relief might be on the horizon in a new ad released Sunday detailing her plan to fight high costs if elected as the state’s next governor.

“Thanks to Joe Biden’s and Katie Hobbs’ liberal tax-and-spend agenda, Arizona has one of the highest rates of inflation in the country. Katie Hobbs and the Democrat Party won’t do anything to provide relief for Arizonans, but Kari Lake will,” said the Kari Lake Campaign in a statement.

Read the full storyReport: Pennsylvania Population Growth Woes a Risk to the Economy

While Pennsylvania’s retired population grows in the future, its working-aged and school-aged populations that support them will shrink.

Such are the projections in a new report from the Independent Fiscal Office, noting flat state population growth in the near term and a slight decline in the long term (-0.1% annually).

Read the full storyCommentary: Neither White House nor Common Man Can Evade Recession Data

Newly released data from the Commerce Department show what some people have been saying for months: The nation is in recession.

Furthermore, the Biden administration’s cherry-picking of data has come back to bite it, with even its selected data points now being revised to indicate a recession. And while these numbers confirm the economy shrank in the first half of the year, the rest of this year holds little promise of recovery.

Read the full storyPennsylvania Senate Race Tightens; Economy and Crime Focal Points

Though polls in the race for Pennsylvania’s U.S. Senate seat have shown Democrat John Fetterman with a comfortable lead, it may be narrowing.

As the Nov. 8 election draws closer, Republican Dr. Mehmet Oz trails Fetterman 45% to 43%, according to a new poll of very likely voters released today by Emerson College and The Hill.

Read the full storyCommentary: The Fed’s Interest Rate Hikes Have only Destroyed $398 Billion of the $6 Trillion It Printed

“Our expectation has been we would begin to see inflation come down, largely because of supply side healing. We haven’t. We have seen some supply side healing but inflation has not really come down.”

That was Federal Reserve Chairman Jerome Powell on Sept. 21, speaking to reporters following the central bank’s meeting where the Federal Funds Rate was once again increased 0.75 percent to its current range of 3 percent to 3.25 percent in a bid to combat sticky 8.3 percent consumer inflation the past year.

Read the full storyShelby County Jobless Rate at 5.6, More than Double Williamson County’s Rate

The Tennessee Department of Labor and Workforce Development recently released county unemployment data for the month of August.

Read the full storyCommentary: Can’t Forget the Motor City

“In the 1950s,” writes J. Eric Wise in “The French Exit: A Detroit Love Story,” Detroit was “outwardly living well, a very healthy city, technologically advanced, with economic diversity, prosperity, peace, and civil life supporting the arts and sciences.” That is no exaggeration, as this writer can testify.

As Wise explains, Detroit prospered enormously from World War II and attracted workers from far and wide. My father, a mechanical engineer, was among them. In 1952, he moved our family from Alliance, Ohio, to Detroit, Michigan. The Big Three automakers gave him all the work he could handle.

Read the full storyBlake Masters Receives Endorsement from Leading Small Business Advocacy Organization

Trump-endorsed Arizona Senate nominee Blake Masters received another big-ticket endorsement Thursday, this time from the National Federation of Independent Business (NFIB), the national leading small business advocacy group.

“Blake Masters has experience working in the business community and will be a strong supporter of Arizona’s small businesses in the U.S. Senate,” said Chad Heinrich, NFIB Arizona State Director. “His top priority in Congress will be to get the economy back on track and to create a pro-small business environment. He has also expressed an interest in improving workforce training, which will help small businesses immensely as they continue to manage a worker shortage. We are proud to endorse Blake Masters today and look forward to working with him.”

Read the full storyCommentary: (Not) Sorry Democrats, Abortion Won’t Save You

The desperate attempts by the White House, congressional Democrats, and the corporate media to refocus voter attention on abortion rather than inflation are failing. Most reputable polls show that the electorate is far more concerned about mismanagement of the economy by President Biden and his collaborators in Congress than about threats to reproductive rights posed by “MAGA Republicans.” Contrary to Democratic hopes, November won’t be about abortion vs. inflation. The midterms will be a referendum on Biden’s performance, particularly as it affects inflation.

Read the full storyNew Poll Shows Americans Trust Republicans More than Democrats with the Economy

Voters overwhelmingly trust Republicans to manage the economy, a new poll ahead of this year’s midterm elections suggests, while also viewing the economy as the most important issue.

Roughly 52% of voters said that they trust Republicans to manage the economy, compared to 38% for Democrats, while only 1% of respondents said they agreed with the proposals of both parties to manage it, according to a poll conducted by the Times and Siena College, which measured the relative strength of both parties in advance of the election scheduled on Nov. 8. The economy has been the most important issue to voters heading into the polls; in a July edition of the same NYT/Siena poll, 20% called it the “most important problem facing the country today,” while roughly 76% said that it would be “extremely important” to them as they vote.

Read the full storySenator Marsha Blackburn Issues Statement Following President Biden’s Celebration of the Inflation Reduction Act

Senator Marsha Blackburn (R-TN) called out President Joe Biden on Tuesday for holding a formal celebration for the recent passing of the Inflation Reduction Act.

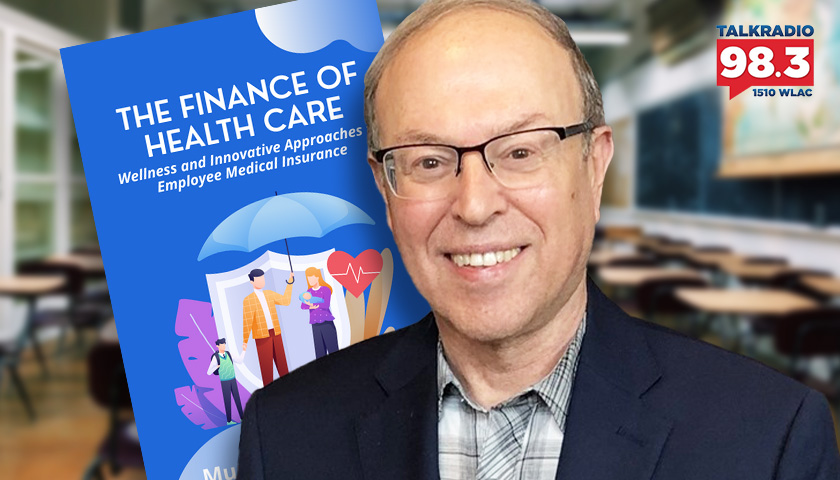

Read the full storyDr. Murray Sabrin Talks About His New Book, Background, and Solutions to America’s Current Economy

Tuesday morning on The Tennessee Star Report, host Leahy welcomed libertarian, professor, and author Dr. Murray Sabrin to the newsmaker line to discuss his new book The Finance of Health Care and his thoughts on how to fix the American economy.

Read the full storyHispanic Americans Point to Crime, Immigration and the Economy as Key Concerns

Recent reports indicate a dramatic political shift for Hispanic Americans, citing a defection from the left toward the right. While some mainstream media accounts dispute the shift, other national surveys are missing the on-the-ground factors that illustrate why a sizeable portion of Latinos are moving right politically, and the fact that many polls suggest Hispanics are drifting from the Democratic party over economic issues.

Read the full story‘Bideninflation’ Increases Price of Raising a Child by $26,000 in Georgia

Amid record-high inflation sweeping the country, the expense of raising a child has reached new heights. What is commonly called “Bideninflation” costs families $26,000 more per child.

Read the full storyFinance Guru Liz Peek Reacts to Student Loan Forgiveness Executive Order and Inflation

Friday morning on The Tennessee Star Report, host Leahy welcomed Fox Business contributor and Wall Street expert Liz Peek on the newsmaker for her reaction and interpretation of how the student loan forgiveness will impact inflation.

Read the full storyRevised GDP Numbers Show the Economy Shrinking

The Department Of Commerce revised the estimate of Gross Domestic Product (GDP) Thursday morning, finding similarly to July’s estimate that real GDP contracted in the second quarter of 2022.

The revised estimate for the second quarter finds that real GDP decreased annually at a rate of 0.6%, slightly less than the July 28 estimate of a 0.9% decrease, according to the Bureau of Economic Analysis.

Read the full storyVentcon, Inc. Announces $6.7 Million Investment in Madison County

Ventcon, Inc. officials announced on Tuesday that the company will invest $6.7 million in Madison County to establish its first manufacturing operations outside of the company’s headquarters in Allen Park, Michigan.

Read the full storyAnalysis: New Pennsylvania Budget Boosts Corporate Welfare to $1.3B

Pennsylvania’s latest budget deal increased spending, and a good chunk favored private businesses, according to critics.

A new analysis from the Commonwealth Foundation says the budget carried $1.3 billion in corporate welfare spending.

Read the full storyThousands Joined Arizona’s Workforce Last Month

Arizona’s seasonally adjusted unemployment rate remained steady, remaining at 3.3% from June 2022 to July 2022. In that stretch, the state’s seasonally adjusted labor force increased by 7,209 individuals (0.2%); plus, Arizona added 18,300 jobs in that span, according to a report from the Arizona Commerce Authority.

Read the full story$4.3M Minnesota Taxpayer Subsidies Expected to Create 321 Jobs

The Minnesota Department of Employment and Economic Development will give $4.3 million of taxpayer money to five private businesses through the Minnesota Job Creation Fund and the Minnesota Investment Fund.

The state says these projects will create 321 jobs over the next three years and will eventually boost the local tax base.

Read the full storyFlorida’s Job Growth Continues Surge as Unemployment Rate Hits Historic Low

Florida’s job growth continued to surge in July while its unemployment rate also dropped to an historic low 2.7%.

“Florida continues to outperform the nation because freedom first policies work,” Gov. Ron DeSantis said. “July’s job numbers represent one of the largest month’s job gains over the past generation and Florida continues to outpace the nation in labor force growth.”

Read the full storyU.S. Senate Passes Massive Tax and Spend Bill Targeting Carbon Emissions, Prescription Drug Costs, More

The U.S. Senate on Sunday passed a $740 billion new taxing and spending bill that seeks to combat climate change and allow the government to control the price of prescription medications, among other things.

No Republicans voted for the bill, named the Inflation Reduction Act of 2022, in the divided 50-50 Senate, forcing Vice President Kamala Harris to break the tie. The measure must return to the House for a concurrence vote after senators passed several amendments Sunday. The House is expected to take the bill up again on Friday. If the House concurs, President Joe Biden has indicated he will sign it.

Read the full story