An October surprise is usually defined as the well-known (and more often left-wing) tactic of manufacturing or unloading a news story right before voting to surprise a rival without allowing them time sufficiently to respond or recover.

Think of the last-minute bombshell disclosure, five days before the 2000 election, that candidate George W. Bush had been cited for drunk driving over a quarter-century earlier. That surprise may have cost Bush the popular vote that year.

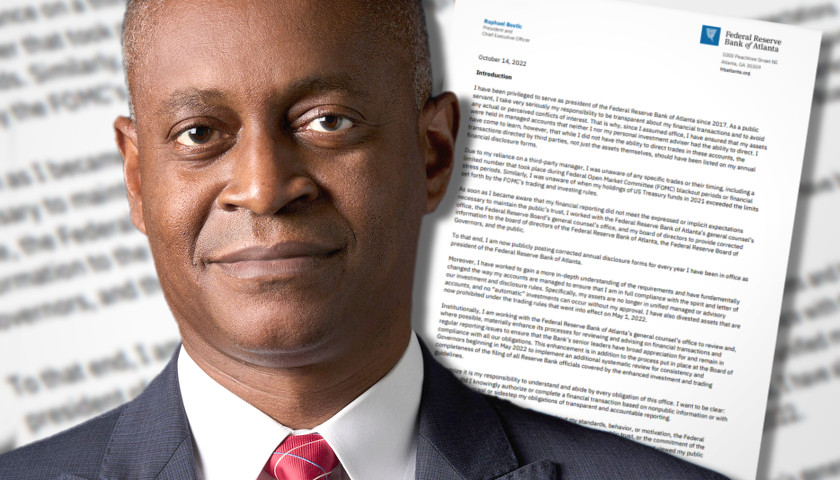

Read the full story