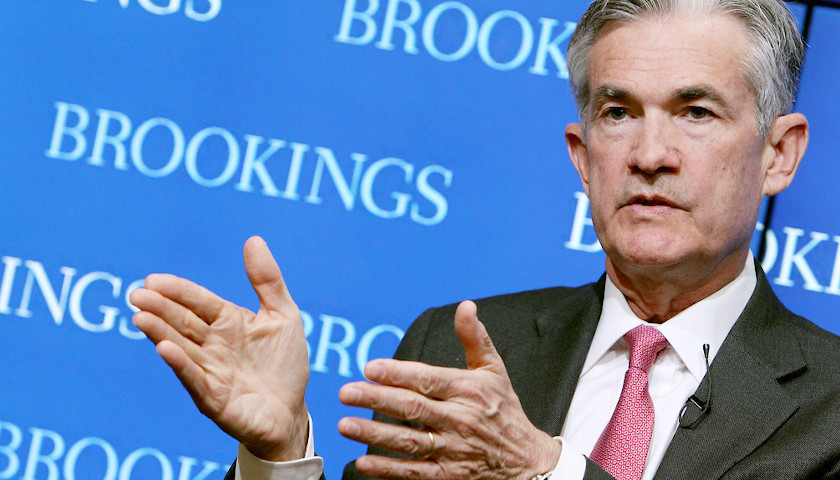

On Monday, the Federal Reserve published research suggesting that the preferred starting wage for the average American worker is at an all-time high.

According to Fox Business, the Federal Reserve Bank of New York determined that the average “reservation wage” – that is, the lowest salary at which a prospective employee will accept a job – reached $78,645 in the second quarter of 2023. This is an 8% increase from the second quarter of 2022, when the average reservation wage was approximately $72,873.

Read the full story