When the Tennessee House of Representatives passed Governor Haslam’s gas tax increase bill by a 60 to 37 margin on Wednesday, a bare majority of Republicans–37 for and 35 against—voted yes in favor of the unpopular tax increase. The 35 conservative Republicans who stood for the foundational principle of limited government were not sufficient to withstand the huge financial and political pressures mounted by the special interests who wanted the bill to pass. Those forces arrayed against the conservative opposition were significant, beginning with Governor Haslam’s taxpayer funded statewide tour that promoted a 962 road project list in all 95 counties, the support of lobbying groups numbering in the thirties, tax reductions for a select group of businesses, and a reported $250 million taxpayer funded deal for the Democrats. These conservatives lost the battle in 2017, but the war for the Tennessee General Assembly election in 2018 has just begun. The arguments made by these 35 stalwarts on the floor of the House on Wednesday will resonate throughout the state over the next year and a half. The process through the House subcommittees and committees was not without controversy including the make up of the Transportation Committee, procedural issues, breaking…

Read the full storyTag: gas tax increase proposal

The 962 Road Construction Projects Costing $10.5 Billion in The Gas Tax Increase Bill Can Be ‘Modified’ by TDOT

Governor Haslam and other administration officials have stated since announcing the IMPROVE Act , now the “Tax Cut Act of 2017,” on January 18 that the purpose of the gas and diesel tax increases included in the bill is to fund 962 needed road construction projects in all 95 counties for a price tag of $10.5 billion.

These projects, however are the seventh in priority in a list of seven things for which the additional funds raised in the bill can be used.

Read the full storyGas Tax Increase Passes House Finance Committee on a Voice Vote

Rep. Charles Sargent (R-Franklin), chairman of the House Finance, Ways, and Means Committee, presided over a voice vote on Tuesday that advanced the controversial IMPROVE Act “Tax Cut Act of 2017” to the Calendar and Rules Committee, where it awaits scheduling for a vote on the floor of the full House. Rep. Barry Doss (R-Leoma), as sponsor of the bill, once again presented the features of the IMPROVE Act “Tax Cut Act of 2017.” Doss unexpectedly made a point of saying that the renaming of the bill last week to include The Tax Cut Act of 2017 was something that was not important to him, but it was to its sponsor, Rep. Gerald McCormick (R-Chattanooga). Chairman Sargent allowed a leisurely-paced question and answer period from Committee members to Rep. Doss, which came primarily from Democrat members of the Committee. Rep. Mike Carter (R-Ooltewah) pointed out that while he wished it wasn’t included in the IMPROVE Act “Tax Cut Act of 2017”, he wouldn’t vote for a bill that didn’t include the change from the franchise and excise tax to the single sales factor due to the loss of Polaris from his district to the state of Alabama. Rep. David Hawk (R- Greeneville)…

Read the full storySpeaker Harwell Says She Will Have a Road Funding Plan That Does Not Raise The Gas Tax

Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storyAmericans For Prosperity To Hold ‘A Gas Tax Day Of Action’ In Speaker Harwell’s District

Americans For Prosperity-Tennessee (AFP) announced ‘A Day of Action’ in the fight against the gas tax hike in the home district of Speaker Beth Harwell (R-Nashville), in order to encourage her to oppose the unpopular measure. Volunteers will be door-knocking all day Saturday, April 8 from 9 a.m. to 5 p.m. in the Belle Meade, Forest Hills and Oak Hill areas of Nashville. Full details are available on AFP’s Facebook page. The gas tax increase is the more common term applied to Governor Haslam’s IMPROVE Act – recently renamed the “Tax Cut Act of 2017” – which, in its current form, includes a 6 cent per gallon gas tax increase and a 10 ten cent per gallon diesel tax increase. The tax hikes are slated to be phased in over a three-year period to fund the Tennessee Department of Transportation’s (TDOT) list of 962 projects that currently carry a $10.5 billion price tag. Speaker Harwell has played a key role this session in the advancement of the gas tax through the Tennessee House of Representaives. At the outset of the current 110th Tennessee General Assembly, she assigned the members and picked the chairmen of the House Committees and Subcommittees including the critical…

Read the full storyTennessee Republican Assembly Calls for Ethics Investigation of Boss Doss Over TDOT Contracts

The Tennessee Republican Assembly has asked Speaker Beth Harwell (R-Nashville) to begin an ethics investigation of the business conduct of State Rep. Barry Doss (R-Leoma), a vocal supporter of Gov. Haslam’s gas tax increase proposal, over potential Tennessee Department of Transportation (TDOT) contracts for his firm. “The Tennessee Republican Assembly (TRA) is calling upon you, Speaker Beth Harwell, to investigate a potential ethics violation by Rep. Barry Doss, who also serves as Chair of the Transportation Committee,” the organization said in a letter dated March 27 signed by its entire leadership team and hand delivered to members of the Tennessee House of Representatives on Tuesday. “Chairman Doss should have recused himself from the proceedings that could potentially have a direct financial impact on his business,” the TRA said of his oversight of the Transportation Committee as it considered the gas tax increase proposal last week. “In this role, Rep. Doss has the capability to sway the committee by means of influence or by manipulation of the rules governing the committee derived from Mason’s Manual,” the letter continued. “In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyBoss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee

In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram an amended version of Gov. Haslam’s gas tax increase through the House Transportation Committee he chairs on Tuesday. A bill containing the new and improved IMPROVE Act amendment, which restores many of the elements of Gov. Haslam’s original gas tax increase proposal, passed the House Transportation Committee in an 11 to 7 vote, but that outcome could not have taken place on Tuesday had not Chairman Doss broken Rule 34 of the Tennessee House of Representatives. Rule 34 of the Tennessee House of Representatives allows any member the privilege of “separating the question” when an amendment is added to a bill that is up for consideration. A key element of Rule 34–which is known to every member of the House–is that it is a “privilege” that can be exercised without question whenever a member invokes it in a committee hearing. It is not a “motion,” which is subject to a vote of the committee. Every chairman of every committee in the Tennessee House of Representatives, including Rep. Doss, is well aware that Rule 34 is a privilege,…

Read the full storyUnder Governor Haslam, Tennessee Department of Transportation ‘Overhead’ Costs Have Grown 63 Percent, While ‘Highway Infrastructure’ Spending Has Shrunk By 33 Percent

The Tennessee Department of Transportation (TDOT) total costs for “Administration” plus “Headquarters Operation,” what would be considered “overhead” in the business world, have grown by 63 percent, from $78.9 to $117 million, in the seven years between Gov. Haslam’s first budget in FY 2011-12 and his proposed budget for FY 2017-18. While TDOTs overhead has skyrocketed, spending on one of the main Programs for road improvements, “Highway Infrastructure,” has gone down by more than 30 percent in that same time period. Table 1 provides the details of TDOT’s “Recommended Budget By Program and Funding Source” obtained from multiple years of budget documents and includes the links to the source documents and the page references. The table demonstrates that since fiscal year 2010-11, the last year of Governor Bredesen’s administration, there are multiple Programs, including Administration, Headquarters Operation, State Industrial Access, Planning and Research, Interstate System and Highway Infrastructure and TDOT as a whole, for which the funding was reduced by Gov. Haslam’s in his first year and have never recovered. Table 1 Department of Transportation Recommended Budget by Program Source Source Source Source Source Sheet 46 of 656 Sheet 46 of 550 Sheet 46 of 558 Sheet 47 of 558…

Read the full storyMetro Transit Authority CEO Steve Bland Asks Nashville Mayor Megan Barry for $85 Million Increase in Capital Budget

“The Metro Transit Authority asked Nashville Mayor Megan Barry for a 427 percent capital budget increase on Monday,” Fox 17 WZTV reports. MTA’s request for this quadrupling of its capital budget comes as the Tennessee General Assembly is debating Gov. Haslam’s IMPROVE Act proposal, which would increase gas taxes by 7 cents per gallon and diesel taxes by 12 cents per gallon. As The Tennessee Star reported earlier this week, in FY 2015-2016, highway user fees, primarily gas and diesel taxes, generated $1.2 billion in revenue for the State of Tennessee. $309 million of these highway user fees were given by the State of Tennessee to cities and counties for “transportation” projects: The Haslam administration has not, as of yet, presented evidence that all of the $309 million in highway user fee taxes sent to city and county governments for “transportation” projects is spent on road construction. “The money in the cities and counties column is their share of the collected taxes,” State Rep. Lynn asserted in her email to a constituent. It is at present unknown how much of these $309 million in highway user fee taxes sent to city and county government is spent on projects such as parks,…

Read the full storyCarr Amendment Funds Highways Through ‘User Fees’ Without A Gas Tax Increase

The House Transportation Committee convenes on Tuesday to vote on Gov. Haslam’s IMPROVE Act. The big question is whether Committee Chairman State Rep. Barry Doss (R-Leoma) will allow a vote on an amendment proposed by State Rep. Dale Carr (R-Sevierville), a member of the committee, that would change the funding source of from a gas and diesel tax increase, as proposed by the governor, to a re-allocation of 33.5 percent of taxes collected from the sale of new or used motor vehicles for highway funding. Proponents of Gov. Haslam’s gas tax increase proposal have argued that road construction must be funded by users through “user fees.” Carr’s amendment addresses those concerns, since taxes on the sale of new or used motor vehicles are clearly paid by users of the state’s highways. Rep. Carr tells The Tennessee Star that he hand delivered the amendment to Chairman Doss on Tuesday of last week, and intends to present it for consideration when the House Transportation Committee begins deliberations on Tuesday. He notes that the amendment was “written in consultation with leadership.” “A lot of people don’t want the [gas] tax and they are having a hard time moving it through committee,” he tells The Star in an exclusive…

Read the full storyHouse Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyState Rep. Susan Lynn Confirms User Fees are ‘Diverted From the Highway Fund’ in Email Sent to Entire Tennessee General Assembly

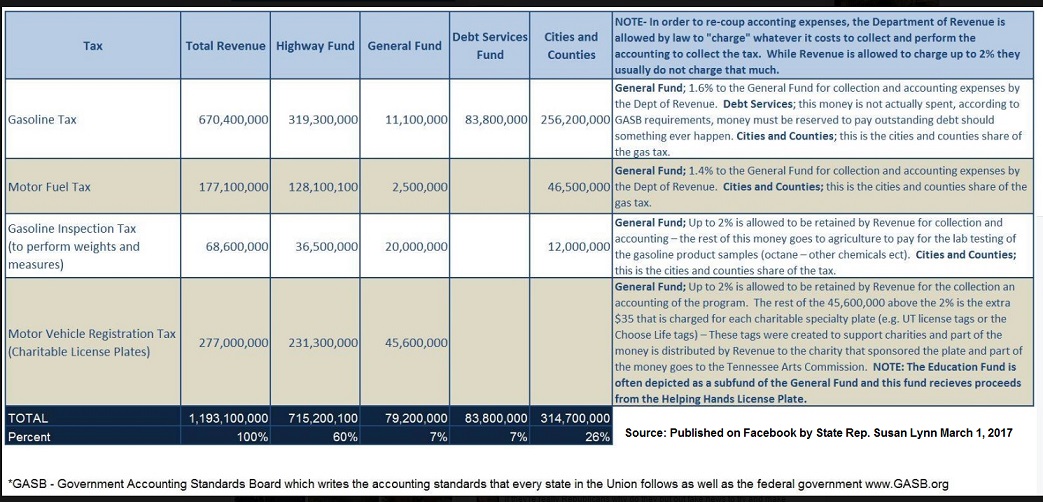

“I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes,” State Rep. Susan Lynn (R-Mt. Juliet) told a constituent in an email, confirming The Tennessee Star’s report that Highway Fund user fees are being allocated to the General Fund, Education and Debt Service. The constituent had forwarded a link to The Star’s report on Wednesday that “The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service.” In the email reply to her constituent, Rep. Lynn copied every member of the Tennessee General Assembly in both the House and Senate, ensuring that they have knowledge of the “diversion” of user fees from the Highway Fund. You can read the first part of Lynn’s reply to her constituent here: I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes. Each amount makes perfect sense. Please see my slide below with…

Read the full storyHaslam’s IMPROVE Act Forced Through House Subcommittee in Rare Political Power Play as Speaker Pro Tem Brought in To Break Tie

Through a series of political maneuvers, Gov. Haslam’s IMPROVE Act has advanced from the House Transportation Subcommittee to the full House Transportation Committee, thanks to the rare tie-breaking vote cast by Speaker Pro Tem State Rep. Curtis Johnson (R-Clarksville). Johnson was brought in at the last minute to the House Transportation Subcommittee Wednesday afternoon to break a 4 to 4 tie. With Johnson’s yes vote, the IMPROVE Act passed on a 5 to 4 vote. Subcommittee members voting yes on the amended IMPROVE Act bill were State Rep. Barry Doss (R-Leoma), who also serves as chairman of the full House Transportation Committee, State Rep. David Alexander (R-Winchester), State Rep. Sam Whitson (R-Franklin), and State Rep. Barbara Cooper (D-Memphis). Subcommittee members voting no on the amended IMPROVE Act bill were State Rep. Terri Lynn Weaver (R-Lancaster), chairman of the Transportation Subcommittee, State Rep. Courtney Rogers (R-Goodlettsville), State Rep. Jerry Sexton (R-Bean Station), and State Rep. John Mark Windle (D-Livingston). The next stop for the IMPROVE ACT is the full House Transportation Committee, chaired by Haslam ally and gas tax advocate Doss. The version of the IMPROVE ACT that passed was amended to remove the gas tax increase originally proposed by the governor.…

Read the full storyStanding-Room-Only Crowds Greet the Transportation Subcommittee As They Meet to Vote on Gas Tax Increase

Standing room only crowds gathered to greet the Transportation Subcommittee as they are set to vote on the increasingly unpopular Haslam Gas Tax increase. The Tennessee Star crew arrived early. The room was full by 10:45am for the 12pm meeting… more updates on Facebook…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyGov. Haslam Has Cut State’s Portion of Highway Fund Budget by $56 Million Annually, Compared to Predecessor

During the six years he has served as the head of Tennessee’s state government, Gov. Haslam has cut the state’s portion of the Highway Fund budget by an annual average of $56 million when compared to his predecessor, Gov. Phil Bredesen. In the last six years of Gov. Phil Bredesen’s eight-year term, between FY 2005-06 and FY 2010-11, the annual average state allocation to the Highway Fund was $833 million. While the actual dollars fluctuated from year to year, overall the Highway Fund budget grew about 12 percent in those six years. Under Gov. Haslam, the state’s portion of the Highway Fund budget shrank to an annual average of $777 million during the six years between FY 2011-12 and FY 2016-17. That is an average annual reduction of $56 million, an overall reduction of 7 percent. The total Highway Fund grew 2 percent per year under Gov. Bredesen, and has been reduced 1.1 percent per year by Gov. Haslam. In that same six-year period, Gov. Haslam’s total state budget grew 18 percent. “The detailed breakdown of reduction in road spending under Governor Haslam is shocking but, unfortunately, not surprising,” State Sen. Mae Beavers (R-Mt. Juliet) tells The Tennessee Star. “I…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyHouse Transportation Subcommittee Adjourns Before Any Action Taken on Road Funding Proposals.

The House Transportation Subcommittee adjourned suddenly on Wednesday after State Rep. David Hawk (R-Greeneville) presented his alternative road funding plan. A report late Wednesday in The Chattanooga Times Free Press makes it clear that State Rep. Barry Doss (R-Leoma) (pictured in the headline image), a member of the subcommittee, “who is chairman of the full House Transportation Committee and who is carrying the governor’s bill” is the force behind the surprise adjournment. “[W]e were about to get the governor’s bill out today. But evidently there were some people who were uncomfortable, maybe, with the Hawk plan. And they weren’t ready to vote on the Hawk plan,” Doss told The Times Free Press: Doss said he sees the adjournment vote as a response to the Hawk bill. “And I think there’s a lot of people uncomfortable with that bill,” Doss said. “We come back next week and I think more people are comfortable with the governor’s plan.” The “Hawk Plan” increases road funding in Tennessee without increasing taxes and has been embraced by conservative legislators seeking an alternative to the plan presented by Governor Haslam which dramatically increases gasoline and diesel fuel taxes for Tennessee drivers and guarantees automatic future increases through “indexing”. Immediately…

Read the full storyHouse Transportation Subcommittee Vote on Haslam Gas Tax Scheduled Today, No Representative from Pilot Flying J Has Yet Been Called to Testify

The first test of Gov. Haslam’s proposal to increase the gas tax to fund road construction is scheduled to take place when the House Subcommittee on Transportation votes today on whether to move the bill to the full Transportation Committee. The Subcommittee has heard testimony from various supporters and opponents of the bill, but to date has not yet heard testimony from representatives of one private corporation that will be impacted by the proposed gas tax increase: Pilot Flying J, the company owned and operated by Gov. Haslam’s family. Questions have been raised by opponents about the potential conflict of interest posed by Governor Haslam’s proposed fuel tax increase if it benefits the privately held, family owned business Pilot Flying J, a distributor and a retailer of gas and diesel fuel. Critics of any fuel tax increase, whether it is the governor’s plan or the alternative Hawk plan, have questioned whether cash flow increases on the distribution side from collecting and holding the increased tax and/or increased profits on the retail side, could aid Pilot’s recovery from its $162 million payout related to the company’s rebate fraud case. The Tennessee Star asked committee members whether a representative from the ranks…

Read the full storyState Rep. David Alexander Changes Mind on Gas Tax Increase After Dinner With the Governor

A key member of the House Subcommittee on Transportation who has previously stated his opposition to Gov. Haslam’s gas tax increase proposal has changed his mind. In an exclusive interview with The Tennessee Star, State Rep. David Alexander (R-Winchester), who many thought would vote to kill the governor’s gas tax increase proposal in the Subcommittee on Transportation when it comes to a vote this week, now says that after having dinner with Gov. Haslam in Winchster Monday night he wants to see the bill brought to the full House for a vote by all 99 members. The Star’s Laura Baigert first asked Alexander how he thought Monday evening’s gas tax town hall in Franklin County went. You can watch the full interview below: Alexander acknowledged that many of the questioners at the town hall opposed the gas tax increase, as The Star reported earlier on Tuesday. Alexander praised the governor’s answering of questions at the event. “For the last 15 or 18 months he’s been talking about the issue across the state of Tennessee so he’s got it well learned,” Alexander said. “It went on for about an hour,” Alexander said of the town hall meeting. “After it was…

Read the full storyGov. Haslam Gets Tough Questions From Informed Crowd at Franklin County Gas Tax Town Hall

Governor Haslam appeared nervous and off his game Monday night, as he was peppered with questions he could not answer at a “gas tax town hall” tour stop at the Franklin County Annex Building in Winchester. After giving 30 minutes of opening comments to the standing-room-only crowd of about 150 people, the governor opened the meeting up to questions and was challenged for the next 45 minutes with more than two dozen questions critical of his proposal to raise fuel taxes. The first questioner contrasted the 7 cents per gallon gas tax and 12 cents per gallon diesel tax increase with the half-percent reduction in the grocery sales tax contained in the governor’s plan. The questioner pointed out that the two things that have strapped everyone are groceries and fuel. The fuel tax increases will offset any grocery tax savings, the questioner stated. The governor then went through his math to assert that his proposal represents a 4 cent increase per $100 purchased in diesel fuel, but the man who posed the question found that arithmetic unsatisfying. He sat down, shaking his head. County Commissioner Dave Van Buskirk asked if the money will only go to roads. Gov. Haslam said…

Read the full storyFormer Lt. Gov. Ron Ramsey: ‘I Have Never Felt the Need to Have Anything in Writing’ From Legal Counsel on Consultant Role to Pro-Gas Tax Group

Former Lt. Governor Ron Ramsey tells The Tennessee Star that his legal counsel, James Weaver, a partner with the prestigious Nashville law firm Waller Lansden Dorch & Davis, who has advised him that his appearance at a WWTN Gas Tax Town Hall to advocate in favor of Gov. Haslam’s gas tax increase, a position held by his client, the Transportation Coalition of Tennessee, is “perfectly acceptable under all Tennessee laws” has done so verbally, but not in writing. “James and I have had lots of discussions about what I can and cannot do in this first year,” Ramsey tells The Star in an emailed statement. “James is an expert in this area. As my council, I have never felt the need to have anything in writing from him. I simply wanted his advice and council,” Ramsey adds in the statement. At former Lt. Gov. Ramsey’s invitation, The Star has reached out to Mr. Weaver and anticipates providing more details on the Tennessee statutes as they relate to guidelines for consulting and lobbying as they apply to former members of the Tennessee General Assembly during their first 12 months out of office. At issue is whether Ramsey, as a paid consultant…

Read the full story