Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storyTag: gas tax proposal

Americans For Prosperity To Hold ‘A Gas Tax Day Of Action’ In Speaker Harwell’s District

Americans For Prosperity-Tennessee (AFP) announced ‘A Day of Action’ in the fight against the gas tax hike in the home district of Speaker Beth Harwell (R-Nashville), in order to encourage her to oppose the unpopular measure. Volunteers will be door-knocking all day Saturday, April 8 from 9 a.m. to 5 p.m. in the Belle Meade, Forest Hills and Oak Hill areas of Nashville. Full details are available on AFP’s Facebook page. The gas tax increase is the more common term applied to Governor Haslam’s IMPROVE Act – recently renamed the “Tax Cut Act of 2017” – which, in its current form, includes a 6 cent per gallon gas tax increase and a 10 ten cent per gallon diesel tax increase. The tax hikes are slated to be phased in over a three-year period to fund the Tennessee Department of Transportation’s (TDOT) list of 962 projects that currently carry a $10.5 billion price tag. Speaker Harwell has played a key role this session in the advancement of the gas tax through the Tennessee House of Representaives. At the outset of the current 110th Tennessee General Assembly, she assigned the members and picked the chairmen of the House Committees and Subcommittees including the critical…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyBoss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee

In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram an amended version of Gov. Haslam’s gas tax increase through the House Transportation Committee he chairs on Tuesday. A bill containing the new and improved IMPROVE Act amendment, which restores many of the elements of Gov. Haslam’s original gas tax increase proposal, passed the House Transportation Committee in an 11 to 7 vote, but that outcome could not have taken place on Tuesday had not Chairman Doss broken Rule 34 of the Tennessee House of Representatives. Rule 34 of the Tennessee House of Representatives allows any member the privilege of “separating the question” when an amendment is added to a bill that is up for consideration. A key element of Rule 34–which is known to every member of the House–is that it is a “privilege” that can be exercised without question whenever a member invokes it in a committee hearing. It is not a “motion,” which is subject to a vote of the committee. Every chairman of every committee in the Tennessee House of Representatives, including Rep. Doss, is well aware that Rule 34 is a privilege,…

Read the full storyUnder Governor Haslam, Tennessee Department of Transportation ‘Overhead’ Costs Have Grown 63 Percent, While ‘Highway Infrastructure’ Spending Has Shrunk By 33 Percent

The Tennessee Department of Transportation (TDOT) total costs for “Administration” plus “Headquarters Operation,” what would be considered “overhead” in the business world, have grown by 63 percent, from $78.9 to $117 million, in the seven years between Gov. Haslam’s first budget in FY 2011-12 and his proposed budget for FY 2017-18. While TDOTs overhead has skyrocketed, spending on one of the main Programs for road improvements, “Highway Infrastructure,” has gone down by more than 30 percent in that same time period. Table 1 provides the details of TDOT’s “Recommended Budget By Program and Funding Source” obtained from multiple years of budget documents and includes the links to the source documents and the page references. The table demonstrates that since fiscal year 2010-11, the last year of Governor Bredesen’s administration, there are multiple Programs, including Administration, Headquarters Operation, State Industrial Access, Planning and Research, Interstate System and Highway Infrastructure and TDOT as a whole, for which the funding was reduced by Gov. Haslam’s in his first year and have never recovered. Table 1 Department of Transportation Recommended Budget by Program Source Source Source Source Source Sheet 46 of 656 Sheet 46 of 550 Sheet 46 of 558 Sheet 47 of 558…

Read the full storyHouse Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyState Rep. Susan Lynn Confirms User Fees are ‘Diverted From the Highway Fund’ in Email Sent to Entire Tennessee General Assembly

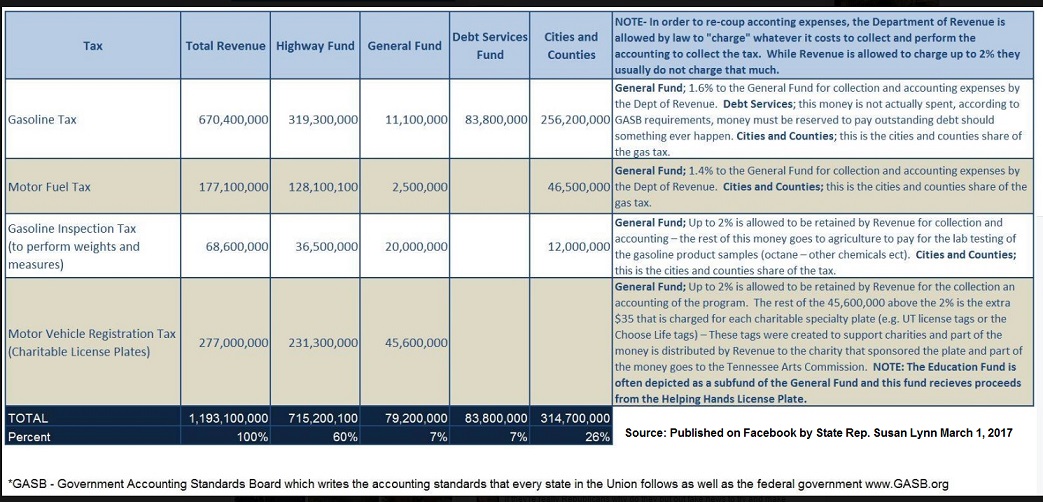

“I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes,” State Rep. Susan Lynn (R-Mt. Juliet) told a constituent in an email, confirming The Tennessee Star’s report that Highway Fund user fees are being allocated to the General Fund, Education and Debt Service. The constituent had forwarded a link to The Star’s report on Wednesday that “The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service.” In the email reply to her constituent, Rep. Lynn copied every member of the Tennessee General Assembly in both the House and Senate, ensuring that they have knowledge of the “diversion” of user fees from the Highway Fund. You can read the first part of Lynn’s reply to her constituent here: I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes. Each amount makes perfect sense. Please see my slide below with…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyNo Response From Sen. Paul Bailey to Dept. of Revenue Confirmation Pilot Flying J Will Benefit From Gas Tax ‘Float’

State Senator Paul Bailey, Chairman of the State Senate Transportation Committee, has not responded to an inquiry from The Tennessee Star to explain the Tennessee Department of Revenue’s correction of his assertion that Pilot Flying J, the truck stop company owned and operated by Gov. Haslam’s family, will not benefit from holding on to the extra cash generated by the proposed gas tax increase for 20 to 51 days. The Tennessee Department of Revenue has corrected Sen. Paul Bailey’s statement regarding the timing of when fuel taxes must be remitted to the state. According to the Department of Revenue’s Communications Director, Kelly Cortesi, “The gasoline tax is imposed when the fuel is first imported into Tennessee. The diesel tax is imposed when the fuel is sold to the wholesaler. In either case, the taxpayer is the importer/supplier, and the return is due on the 20th day of the following month.” Sen. Bailey is the general manager and vice-president of Charles Bailey Trucking Company. The Department of Revenue was forwarded Sen. Bailey’s statement and was asked to confirm whether it was accurate in light of the fact that the Department’s website says that fuel taxes are not due to the state until…

Read the full storyDept. of Revenue Confirms Pilot Flying J Will Hold on to Extra Cash from Gas Tax Increase for 20 to 51 Days

Last week The Tennessee Star asked State Sen. Paul Bailey, chair of the Senate Transportation Committee and general manager and vice-president of Charles Bailey Trucking Company, about the possible impact Gov. Haslam’s proposed gas tax increase will have on Pilot Flying J’s business operations and whether it would be in the public interest to have a full and open discussion in a committee hearing about this issue. Pilot Flying J, the fourteenth largest privately held company in the country, owns and operates more than 500 gas and diesel truck stops around the country, approximately 40 of which are in the state of Tennessee. The Haslam family owns Pilot Flying J, and Gov. Haslam, while not involved in the operation of the business, has a significant equity interest in the company, though he has never fully disclosed the exact amount of that interest. While supportive of discussing the general issue of whether the “float” that unremitted fuel taxes benefit a fuel supplier, Sen. Bailey raised the additional question of exactly when the taxes collected are paid to the Tennessee Department of Revenue: “The payer of these taxes remit payment to the state upon delivery to their terminals; therefore, the only ‘float’ comes to…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyPure Foods Goes Bankrupt After Benefiting From $1.2 Million in Tennessee State Economic Development Funds

Less than two weeks before Governor Haslam introduced his IMPROVE Act centered on a gas tax increase for road funding, Pure Foods, Inc., a recipient of $1.2 million in state economic development funds, filed for bankruptcy. The $1. 2 million from the state’s FastTrack Economic Development (ED) Fund did not go directly to Pure Foods. Instead, it was allocated for use by KEDB for construction of a speculative building that Pure Foods leased for 10 years. According to the Kingsport Tennessee Times News, in March 2015, the Canadian based gluten-free snack food company, Pure Foods, Inc., was set to establish its U.S. headquarters at the Gateway Commerce Park in Kingsport, Sullivan County. The deal included an investment of $22 million, an 80,000-plus square foot facility, and the creation of 273 new jobs generating an annual a payroll of $8 million. The Kingsport Economic Development Board (KEDB) and the Kingsport Chamber of Commerce also supported the project by providing financial assistance and various incentives, including the purchase of 33 acres of land in the Gateway Commerce Park for $6.5 million borrowed from First Tennessee Bank. According to the Transparent Tennessee website’s FastTrack Project Database, ED grants provide additional support for…

Read the full storySimilar To Haslam, Democrats Want to Increase Gas Tax 5 Cents Per Gallon But Also Want Sales Tax Revenue for Mass Transit

Two leading Democrats in the Tennessee General Assembly support the main element of Gov. Haslam’s plan to fund road construction by increasing the state tax on gasoline. For State Rep. John Ray Clemmons (D-Nashville) and State Sen. Sara Kyle (D-Memphis), however, it’s a matter of degree. While Gov. Haslam wants to increase the tax on gas by 7 cents per gallon, these Democrats want to increase it by 5 cents per gallon. As for the diesel tax, Democrats would increase it 9 cents per gallon, 3 fewer than the 12 cents per gallon increase Gov. Haslam has proposed. The Democrat gas tax proposal has a great deal in common with Gov. Haslam’s proposal, and very little in common with the Republican alternative to Haslam’s plan. That alternative, known as the Hawk Plan, would fund road construction by reallocation 0.25 percent of the sales tax, while not raising gas taxes. Like Gov. Haslam’s proposal, the Democrats want gas taxes to increase automatically every year. While Haslam simply proposes indexing the annual increase to the rate of inflation, Clemmons and Kyle want a more complex indexing formula, based on: (1) The state’s population growth rate, multiplied by seventy-five percent (75%); and…

Read the full storyNew Survey: Majority of Tennessee Small Business Owners Oppose Haslam’s Gas Tax Increase

Fifty-five percent of “Tennessee members of the National Federation of Independent Business [NFIB], the nation’s leading small-business association,” oppose Gov. Haslam’s gas tax increase proposal to fund road construction, the NFIB said in a statement released on Monday. “NFIB’s policy positions are based on the direct input of our members,” Jim Brown, state director of NFIB, said in the statement: When asked if they support or oppose a proposed seven-cent increase in the gas tax and 12-cent increase in the diesel tax, 55 percent of NFIB members responding to the survey oppose, 40 percent support, and 5 percent are undecided. Respondents were more definitive about the proposal to “index” future gas tax increases to changes in the Consumer Price Index, Brown said. Seventy-five percent of respondents oppose, while 19 percent support and 5 percent are undecided. “Small business owners . . . are clearly opposed to indexing because they believe it would bypass future legislatures and increase revenues automatically without making the case for specific infrastructure needs,” Brown said. Brown said a few parts of the proposal registered modest or mixed support. Sixty-two percent support the proposed $100 annual fee on electric vehicles and increasing charges on vehicles using alternative…

Read the full storyState Rep. Andy Holt Supports the Hawk Plan, Opposes Haslam Gas Tax Increase

State Rep. Andy Holt “told a group of local citizens Saturday that Gov. Bill Haslam’s proposed gasoline tax increase is unnecessary and ill-timed and that there are better ways to fund road improvements,” the Post-Intelligencer reports. “Holt argued against the Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy or IMPROVE Act, introduced last month by Haslam,” according to the Post-Intelligencer. “I’m going to get a higher fuel tax and higher increase in goods and services, and a very small decrease in my groceries,” Holt, a Dresden resident, told the crowd, adding: If you extrapolate all the projects that have been approved by the legislature, and you factor in a highly increased amount of construction costs, and you put that out over a thirty-year period, and you then extrapolate what all those cost increases will be over time, then you can get to eleven billion dollars,” he said. We’re rated consistently as having the second-, third- or fourth-best road system in the United States of America . . . I think that’s a far cry from a crippling catastrophe that is looming within the next couple of weeks.” We’re in a surplus environment this year. That doesn’t mean we…

Read the full storyGov. Haslam Stumbles in Smith County: ‘The Only Reason Government Exists At All Is to Buy Things for the People That They Can’t Buy for Themselves’

“The only reason government exists at all is to buy things for the people that they can’t buy for themselves,” Gov. Haslam told the Smith County Rotary Club on Friday as he continued to promote his proposal to increase the gas tax by 7 cents per gallon. You can hear the governor say this at the 16:50 mark of this video, made available courtesy of The Smith County Insider. Social media across Tennessee lit up Friday and Saturday criticizing Haslam’s articulation of the classic Democrat view of the role of government. It was a statement of the sort Franklin Delano Roosevelt, Lyndon Johnson, and Hubert Humphrey would have been delighted to claim as their own. Former State Rep. Joe Carr captured the reaction of many opponents to this surprising Haslam statement on his Facebook page. “Wrong! The reason government exists is to ‘secure our unalienable Rights granted to us by God’”, the former State Rep. posted. “I am sure Governor Haslam actually believes this statement along with 90% of the Tennessee General Assembly,” Carr added. Gov. Haslam may not be aware of just how tone-deaf this statement sounds. It is a lightning rod to those who see his proposed gas…

Read the full storyState Senator Bell Agrees ‘With Most of What I Hear on Flame-throwing Conservative Talk Show in Nashville’

State Sen. Mike Bell (R-Riceville) told the Cleveland/Bradley Economic Development Council he listened to the WWTN Gas Tax Town Hall moderated by Ralph Bristol on the Dan Mandis Show on Thursday, the Cleveland Daily Banner reported. “As I drove here, I was listening to a flame-throwing conservative talk show in Nashville, and I listen to it when I am up there and agree with most of what I hear,” Bell said. “What was interesting was out of the whole panel they had, and they had an audience of 100 people as well, there wasn’t a single person–even those who oppose the plan–who did not say we had a need,” Bell said. “So at least we’ve got opponents agreeing that we’ve got a need,” he added. The Tennessee Star, which attended the event, reported that the studio audience size was about 20. The panel at the Town Hall included three State Representatives, two State Senators, a representative of Gov. Haslam, Andy Ogles, executive director of Americans for Prosperity-Tennessee, and former Lt. Governor Ron Ramsey, representing the Transportation Coalition of Tennessee. While all members of the panel, including gas tax increase proposal opponent Andy Ogles of Americans for Prosperity-Tennessee, stated that there was a…

Read the full storyDetails of Gov. Haslam’s Gas Tax Proposal From His State of the State Address

Gov. Haslam dedicated about one-third of his State of the State address, delivered to the General Assembly on January 30, to his gas tax proposal. Haslam refers to his proposal using the acronym in the bill that includes the details: the IMPROVE Act (Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy). You can read the complete text of the address here: Here’s the full excerpt of the address related to gas tax proposal, with emphasis added by The Tennessee Star: With the IMPROVE Act we’re proposing to increase the gas tax 7 cents and the diesel tax 12 cents per gallon, and all new revenue goes only to address our transportation needs. The legislation will mean 962 projects in all 95 counties, both urban and rural. It will also mean 78 million dollars annually in increased revenue for counties and 39 million dollars annually in increased revenue for our cities. Scores of mayors across Tennessee – cities and counties, rural and urban – have told me that, if we don’t do something to address the fuel tax, they will have no alternative but to raise the property tax in their municipalities. I know some of you think we…

Read the full storyAmericans For Prosperity Opposes Gas Tax, Proposes Alternative

Andy Ogles, executive director of Americans for Prosperity-Tennessee (AFP), unveiled the group’s alternative plan to finance Tennessee’s highway infrastructure improvements on Thursday, vigorously rejecting Gov. Haslam’s proposed 7 cents per gallon gas tax increase. Speaking at the WWTN Gas Tax Town Hall, Ogles accepted the premise that Tennessee’s budget over the coming years should allocate $2 billion for highway improvement and new construction. But Ogles said relying upon the increase in the gas and diesel tax as the only “user fee” mechanism to fund those improvements was not a stable long-term solution, since improvements in gas mileage and the possible rise of alternative means of powering vehicles would likely continue to limit the revenues from those sources to the state. Ogles said that if you except the idea of user fees then one such user fee could be vehicle fees at the time of a vehicle purchase or registration. “I think there’s some math that is important to remember,” Ogles told the panel and studio audience. “And the biggest number or numbers that you should remember is that currently, Tennessee has $1.8 billion in surplus. Now, there’s a lot of moving parts to this and talking about math on the…

Read the full storyEight Alternative Ways to Pay for Highways in Tennessee

Increasing the tax on gasoline from 21 cents per gallon to 28 cents per gallon, as Gov. Bill Haslam has proposed, is not the only way to pay for new highways in Tennessee. The 2015 Comptroller’s Report, for instance, lists these eight additional ways: (1) Variable Rate and Indexed Fuel Tax Rates (2) Vehicle Registration Fees (3) Tolls (4) Debt Financing (5) Fees or Taxes on Alternative Fuel Vehicles (6) Local Funding Options (7) Vehicle Miles Traveled (VMT) Tax (8) Public-Private Partnerships Here’s how that report breaks those eight additional ways down: (1) Variable Rate and Indexed Fuel Tax Rates Since 1989, when Tennessee last increased its gas tax rate, general inflation as measured by the Consumer Price Index (CPI) has increased 85 percent. The Federal Highway Administration’s measure of highway-related construction costs increased 56 percent, with greater fluctuations above and below the CPI. o Several states (18) have implemented variable rate taxes on fuels to allow fuel taxes to better adjust to changes in purchasing power over time. Measures used to adjust the rates include the CPI and/or the wholesale or retail price of fuel. Most states have placed limits on the variable rate to control for the potential…

Read the full story