Ohio’s Future Foundation Chairman and former Congressman Jim Renacci hosted a forum on the gas tax Monday evening with Greg Lawson of The Buckeye Institute and Paul Lewis of the Eno Center for Transportation. Gov. Mike DeWine (R-OH) has been pushing for an 18-cent gas tax increase, which Monday night’s panelists think might be too high. Although a controversial subject, the panelists were in agreement on one thing: the state government needs to be smarter with how it spends its money. “I think the real opportunity is to focus on trying to make our transportation institutions more efficient and a lot of that has to do with investing smartly, not necessarily focusing on big, expansive projects, but more doing the things that voters are actually looking for, which is roads that are well maintained, buses that run on time—kind of the run-of-the-mill stuff that isn’t as exciting as a new highway or some kind of new big project, but it’s the thing that people care about everyday. It’s really kind of focusing on asset management and taking better care of what we have,” Lewis said. Lawson agreed with the sentiment, and encouraged politicians not to get “hung up” on the…

Read the full storyTag: Gas tax

Ohio Governor DeWine Blasts Republican Controlled House for Lowering Gas Tax Proposal

Governor Mike DeWine aggressively condemned his fellow Republicans Monday for not supporting his gas tax increase in a candid interview with the Cleveland Plain Dealer Editorial Board. During the interview, he accused them of outright endangering the safety of Ohioans statewide by not supporting his plan. DeWine, in one of his first major bills proposed to Ohio legislature, chose to introduce House Bill 62 (HB 62), to the 2020-2021 transportation budget. Starting off his tenure as a Republican Governor with a tax increase was inevitably going to give many Republicans pause. However, this initial hesitation was greatly compounded by the fact that there are no tax offsets to the hike. In addition, the tax increase will not be gradually phased in over several years, as similar tax increases often are, but will into effect immediately. Lastly, the tax will be indefinitely pegged to the Consumer Price Index which could potentially see the tax increase every year. This is a tough pill to swallow for many Ohio Republican legislators. Conversely, DeWine is accurate when he notes the dire state of roads and bridges in Ohio. As previously reported: A 2018 study gave the state’s infrastructure an “A-” while the national state average came in at a “D+.”…

Read the full storyDeWine Sends ODOT Director to Senate to Lobby for 18-Cent Gas Tax

COLUMBUS, Ohio – The Ohio Senate Transportation, Commerce, and Workforce Committee began hearing testimonies Monday on Gov. Mike DeWine’s demand for an 18-cent gas-tax increase. The chairman of that committee, Sen. Rob McColley (R-01) (pictured, left), however, made it clear that he and his fellow Senate Republicans oppose the 18-cent figure, and even suggested an income-tax cut to offset a gas-tax increase. But Ohio Department of Transportation (ODOT) Director Jack Marchbanks (pictured, right) said Monday during his testimony that anything less than 18-cents wouldn’t cut it, and claimed that the smaller gas-tax increase of 10.7-cents passed in the House’s version of the transportation budget last week “falls far short of Ohio’s real need.” “As you may recall, due to flat revenues, highway construction inflation, and mounting debt payments, ODOT is in jeopardy of being unable to fulfill its mission to maintain the state’s most valuable physical asset: our state highway system. The credit cards are maxed out and the long-term health of Ohio’s transportation system is now at stake,” Marchbanks said. He argued that an 18-cent increase is necessary because the “state has avoided making the difficult decision to find a long-term solution to our transportation revenue shortfall for more…

Read the full storyFederalism Committee Chair John Becker Gauges Gas Tax as Ohio Statehouse Battle Ignites

COLUMBUS, Ohio — The battle over a gas tax increase has officially kicked off in the Ohio Statehouse. Since taking office, Ohio Republican Gov. Mike DeWine has insisted that a gas tax was critically necessary to preserving and repairing the state’s decaying roads and bridges. Though many in the state on both sides of the political aisle agreed that some form of revenue increase would be necessary, the real question was exactly how much would the increase would be. In his State of the State Address on Tuesday, as previously reported, DeWine explicitly stated that his proposed gas tax increase of 18 cents was lowest it could go: “Members of the General Assembly, by requesting $1.2 billion dollars to fill the budget hole and meet existing needs, let me assure you that I am taking a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy. He intended for it to go into effect immediately with no tax break offsets, and would peg it to the Consumer Price Index (CPI), thereby ensuring it would increase over time as the economy grew. However, prior to that speech, Ohio Republican State Speaker of the House Larry Householder…

Read the full storyDeWine Breaks from Republicans on Gas Tax

COLUMBUS, Ohio–In Tuesday’s State of the State Address, Ohio Republican Governor Mike DeWine made it very clear he would not back down on the 18 cent gas tax, leaving many state Republicans in a complicated position. In his Address, DeWine made it clear that, not only was the gas tax absolutely necessary but that an 18 cent per gallon increase (generating an additional $1.2 billion per year) was also the bare minimum necessary to address the needs of the state. “Our local jurisdictions and the state have a combined shortfall this year and for years into the future of at least $1.2 billion dollars per year. It will take this much additional revenue just for us to maintain our roads in their current condition and do only a modest amount of new work,” DeWine said. “Members of the General Assembly, by requesting $1.2 billion dollars to fill the budget hole and meet existing needs, let me assure you that I am taking a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” Despite his assertion that this is as low as the hike can be, a senior legislator from his…

Read the full storyMichigan’s Democratic Governor Pushes for an Enormous Gas Tax Increase

by Chris White Democratic Michigan Gov. Gretchen Whitmer is proposing what some opponents are calling a draconian gas tax increase to fix the state’s crumbling road infrastructure. Whitmer’s budget proposal will include a 45-cent gas tax increase, which would be phased in over three separate intervals, the governor’s spokeswoman Tiffany Brown told reporters Monday. The rate would begin increasing in October, hit its second phase in April 2020, and ease into its final phase by the end of that year. The increase is expected to generate roughly $2 billion a year in additional revenue for roads, according to media reports. Whitmer, a Democrat who ran on fixing Michigan’s roads, will present her idea to lawmakers Tuesday during a joint meeting of the House and Senate appropriations committees. Whitmer’s plan would make Michigan one of the highest fuel tax rates in the country, behind the likes of California and Pennsylvania. Michigan motorists currently pay 26.3-cent per gallon. Total at-pump costs in the state are already the sixth highest in the nation, in part because Michigan applies its 6 percent sales tax to fuel purchases. Michigan Republicans have mixed feelings about such an increase. Michigan Republican Party Chair Laura Cox panned…

Read the full storyDeWine’s First State of the State Address Focuses on Long Term Plans for Ohio

COLUMBUS, Ohio– Tuesday, Ohio Republican Governor Mike DeWine addressed a joint session of the Ohio legislature in his first State of the State Address. While he covered several topics ranging from workforce development to infrastructure repair, the speech’s main focus was three key points; the gas tax, greater protections for children, and environmental action. Prior to his remarks, DeWine was asked what, specifically, he would address. He did not mention the raising gas tax. However, almost half of the speech he gave focused directly or indirectly on the necessity of doing just that. He stated: These are the essential facts: Our counties, cities, villages, and townships have seen their resources for road and bridge repairs dwindle and dwindle over the years. A dollar of gas tax in 2005—the last time the gas tax was raised—now only buys 58 cents worth of road and bridge repairs. And our local partners—townships, villages, cities, and counties—have received no relief for 14 years. Each year, their infrastructure degrades more and more. Each year, they fall further and further behind. And each year, their roads and bridges get less and less safe…by requesting $1.2 billion dollars to fill the budget hole and meet existing needs, let me assure you…

Read the full storyColumbus Democratic Mayor Backs Governor DeWine’s Gas Tax

COLUMBUS, Ohio– In a statement made via a Facebook Video, Columbus, Ohio’s Democratic Mayor Andrew J. Ginther announced that he is backing DeWine’s 18 cent gas tax hike. The mayor said he is backing the bill because: It will help us increase our funding for infrastructure in Columbus neighborhoods by 19 million a year. We think that’s worthwhile because we know infrastructure is really about people; opening up jobs and opportunities for others in the community to share in our prosperity. House Bill 62 (HB 62), which would create the transportation budget for the 2020-2021 biennium, includes the 18 cent gas tax increase and is currently being reviewed by the House Finance Committee. Governor DeWine made the case Tuesday in his State of the State Address for the necessity of the bill, stating: Mr. President, Mr. Speaker, Members of the General Assembly—our families should not be driving on roads that are crumbling and bridges that are failing. I appeal to you—as legislators, as fathers and mothers, as sons and daughters—help us fix this! The state has avoided its responsibility for too long—and now is the time to act. As previously reported, 30 percent of all roads are in “poor or mediocre condition.” DeWine dedicated almost half of his hour-long address to…

Read the full storyWhat to Expect from Ohio Governor DeWine’s State of the State Address

COLUMBUS, Ohio — Ohio Republican Governor Mike DeWine is scheduled to give his first State of the State Address Tuesday, but don’t expect any major revelations from it. In an interview last week, the first term governor stated, “I don’t think you’ll find any great surprises,” adding: We’re going to talk about the things that we’ve been talking about — early childhood development. We’re going to talk about the lead paint problem. We’re going to talk about public health issues. We’re going to talk about early childhood education, the drug problem. While these points have shaped his tenure as Governor thus far, there are two areas he did not note but are likely be addressed. The 18 cent gas tax outlined in his proposed Department of Transportation budget has been controversial at best. Should it pass, there will not be an incremental introduction of the tax. Instead, the entire 18 cent hike will go into effect immediately. Although there is a bipartisan consensus that something has to be done about the severe underfunding of road and bridge repair, the amount and effects have been called into question. The Ohio Speaker of the House, Republican Larry Householder recently stated: So the situation that we’re in…

Read the full storyOhio Department Of Transportation Introduces Comprehensive Gas Tax that Could Increase Every Year

Friday, Ohio Department of Transportation Director Jack Marchbanks formally introduced the proposed 2020-21 Biennial Budget. House Bill 62 (HB 62), the budget’s formal designation, includes an 18-cent gas tax increase. While lower than some reports have suggested, the proposed tax will give Ohio one of the highest gas tax rates in the country. In addition, it contains a provision that could raise gas taxes even higher in the coming years. The 18 cent tax would go into effect immediately upon passage. When measured against other states, this is an exceptionally aggressive approach. When Nebraska voted to raise its takes, it did so in increments of 1.6 cents per year. A more incremental approach could ensure Ohioans don’t face “sticker shock” at the pump. The bill would also tie the gas tax rate to the Consumer Price Index (CPI). At the start of every fiscal year, the tax will be reexamined and if the CPI has increased, the tax will increase with it. While it would ensure that road repair is adequately funded, there is a significant drawback. As written, the law does not stipulate that the gas tax would decrease, should the CPI decrease. if the Ohio economy faces a sudden hardship or enters a recession, Ohioans would…

Read the full storyOhio Governor DeWine to Announce Gas Tax Hike

At an annual forum sponsored by the Associated Press, Ohio Republican Gov. Mike DeWine announced Wednesday he intends to formally recommend raising the current gas tax. The recommendation will come as he introduces his first two-year transportation budget Friday. Despite appointing an Advisory Committee on Transportation Infrastructure Issues specifically to explore alternative solutions to simply raising the gas tax, the governor made it clear he felt there was no real alternative. He did make a point to say the hike is “just to keep us where we are today and with the ability to do some safety projects that absolutely need to be done.” It can be inferred from this statement that his intention is to raise the gas tax enough to not let the state’s road and bridge repair funding deficit get worse than it currently is. This suggests that the tax hike would be more modest relative to addressing the full scope of road and bridge repair needed in Ohio. Currently, there is a $1 billion gap in funding. The current state tax on gas in Ohio is 28 cents per gallon. However, when combined with federal and local taxes, the total amount climbs to just about 46.5 cents per gallon.…

Read the full storyGovernor Walz’s $49 Billion Budget Proposal Will Make Minnesota a ‘Cold California’

Gov. Tim Walz (D-MN) unveiled his highly anticipated budget proposal for the 2020-2021 biennium at a press conference Tuesday afternoon. When all is said and done, the two-year budget registers at $49.5 billion with no cuts to any existing spending. “I’ve often said that a budget is far more than a fiscal document; it’s a moral document. This budget reflects the morals and values of the people of Minnesota. This is the budget that Minnesotans voted for in historic numbers in November,” Walz said during his lengthy address. Walz said his proposal prioritizes three core areas: education, health care, and “community prosperity.” For the first, Walz proposed a three percent followed by a two percent increase in education spending, which is roughly $523 million more. “While some schools have turf fields and a stadium, another school is trying to pass a referendum to fix a leaky roof,” he said. “As a former teacher, I’ve seen firsthand the power of investment in a child.” He went on to lay out a number of health care proposals, including a “OneCare Minnesota” public buy-in option, and the continuation of the two percent provider tax, which Republicans would like to let expire at…

Read the full storyGovernor DeWine Accelerates Gas Tax Planning with No Limits Set

It’s safe to say that when Ohio Governor Mike DeWine appointed his “Governor’s Advisory Committee on Transportation” to develop solutions for paying for road and bridge repairs, citizens were hoping they’d come up was some creative answers. Instead, the committee reached a consensus last week that the primary means by which road repairs would need to be funded would be through raising gas taxes. During a meeting with the Canton Repository Editorial Board, Governor DeWine made it clear that he would be taking their advice. He noted that not only was raising the gas taxes essential to fixing the problem but that he couldn’t put a number on how high the hike would be. When asked how much the raise could be per gallon, he stated: Well I’m not going to talk about it yet. I’m not going to put a number on it…Just to maintain status quo, we’ve got to come up with $1.5 billion a year. So how we do that? I’ve been in discussions with the members of the leadership of the legislature of how to do that. Just doing the numbers, significant amount of that has to come from the gas tax. Many advocates note that there will never…

Read the full storyDeWine Appointed Committee Recommends Gas Tax Hike for Ohio

After two meetings and two hours of public testimony, the Governor’s Advisory Committee on Transportation has, so far, agreed on only one thing to save Ohio’s roads and bridges: raise taxes. As previously reported, the committee was officially launched on January 31st. Hand-picked by Governor Mike DeWine, the bipartisan committee of industry leaders, advisers, and infrastructure experts was assigned the review the current infrastructure needs and explore creative and unique solutions. While they have yet to make their final report, these initial findings are sure to disappoint many of DeWine’s voters, should they be adopted. The current gas tax was set at 28-cents-a-gallon on July 1st, 2005. These revenues are intended to directly fund the maintenance, repair, and expansion of roads and bridges throughout the state. Over time, two primary factors have greatly diminished their ability to do so. The first is that, as cars have become more efficient and achieve higher miles-per-gallon, revenues have decreased. In addition, the higher demand and proliferation of electric vehicles has had an effect that will significantly increase over time. Until this problem is addressed, the more ubiquitous electric cars become, the harder it is to maintain the roads all drivers use. The second factor is…

Read the full storyCity of Memphis Employees Allegedly Steal Gas

Employees who work for the City of Memphis are using taxpayer money to fill up their personal vehicles with gasoline, according to that city’s CBS affiliate WREG. No word yet on whether Tennessee’s fuel tax increase drove those city employees to do this. City officials, the station went on to say, have launched an internal investigation. “According to that investigation, the city doesn’t do a good enough job of tracking who’s getting gas and where it’s going. That’s largely because some fuel stations don’t have an effective way of doing it,” WREG reported. “Two city employees have been fired for filling up their personal cars with city gas, purchased with taxpayer dollars. Security at city-owned pumps varies. Some are padlocked, requiring a special key. Others are automated, unlocked using electronic key fobs.” The audit, the station went on to say, says those pumps track gas usage easily. The others, however, typically require manual logs that don’t always exist. “The issue increases the potential for fraud. The city’s General Services Division says it’ll fix the problem by putting devices to unlock pumps directly into city vehicles,” WREG reported. “They’re designed to track who’s driving, how much gas they’re getting and when…

Read the full storyFrench President Macron Waves The White Flag On Carbon Taxes

by Michael Bastasch French President Emmanuel Macron decided to scrap the planned carbon tax on fuels after weeks of protests rocked Paris and other major cities across the country. An Élysée Palace official told The Associated Press Wednesday that “the president decided to get rid of the tax.” Macron’s decision comes one day after the government announced plans to delay implementing the carbon taxes for six months. The fuel taxes were meant to go into effect in January as part of France’s plan to fight global warming. Prime Minister Edouard Philippe told French lawmakers the carbon tax “is now abandoned.” Phillippe said the government is “ready for dialogue” on what the next steps will be. [ RELATED: France May Be Ahead Of The Curve When It Comes To Global Warming Policy Backlash ] Thousands of protesters called “yellow vests” took to the streets to protest the carbon taxes, which would have added 33 cents to a gallon of diesel and 17 cents for a gallon of gasoline. Taxes already make up about 60 percent of the price of fuel in France. The average cost to fill a tank in France runs about $7 per gallon. The protests, the worst to hit Paris in 50 years, were also…

Read the full storyCalifornia’s Gas Prices Inch Toward $4 Per Gallon At A Bad Time For Democrats

by Chris White Gas prices in Southern California are hovering around $4 per gallon as Golden State Democrats attempt to defend an unpopular gas tax outgoing Democratic Gov. Jerry Brown signed in 2017. The average pump price for regular gas in the Los Angeles area is hovering around $3.736 a gallon Thursday, up nearly 19 percent from a year earlier, according to the American Automobile Association. It’s an unwelcome development for Democrats who are fighting for their political lives. The average price in California stood at $3.683 a gallon, up 18 percent from $3.11 in 2017, the AAA said. A portion of the increase stems from the unpopular 12-cent increase in California’s fuel excise tax that went into effect in November. The state tax now sits at 41.7 cents per gallon and is one of the highest in the country. Nearly 58 percent of voters oppose the tax increase, including 39 percent who say they strongly reject the legislation, according to a survey the University of California, Berkeley’s Institute of Governmental Studies conducted shortly after the measure was passed in April 2017. Only 35 percent of voters surveyed at the time favored the law, which also hikes vehicle registration fees to fix roads. Opposition against…

Read the full storyDemocrat Gubernatorial Candidate Karl Dean Calls for Higher Gas Taxes

Democratic Party candidates in California are starting to distance themselves from a 12 cent a gallon gas tax increase imposed on drivers in their state and which is subject to a repeal effort this Fall. At least 4 Democrat candidates are turning against their own party on the issue of increased gas taxes. But in Tennessee, Democrat gubernatorial candidate Karl Dean is not only embracing last year’s IMPROVE Act fuel tax increase that raised gas and diesel taxes over $300 million a year, he wants to allow local governments to raise the fuel taxes even higher. Dean, a former two-term mayor of Nashville, says the state needs to expand on the IMPROVE Act, the 2017 law that increased gas taxes 6 cents a gallon and diesel taxes 10 cents per gallon. The tax increase was passed while Tennessee enjoyed about a $2 billion dollar SURPLUS. The phased in gas tax increase went up another one cent per gallon on July first. The final cent in the six cent increase goes into effect July 1, 2018. “Unlike my opponent,” Dean said in endorsing local option fuel tax increases, “I believe passing the IMPROVE Act was the right move for Tennessee. But…

Read the full storyIndicted Lawrence County Sheriff Jimmy Brown Loses Election

Lawrence County Sheriff Jimmy Brown, who is under indictment for alleged abuse of power, lost his re-election bid last Thursday. And, a race with statewide interest is drawing questions over irregularities. Military and law enforcement veteran John Myers, a Republican, beat the Democratic sheriff by 53 percent to 31 percent, The (Columbia) Daily-Herald reported Saturday. Independent Rick Osborne took approximately 16 percent of the vote. ‘Boss Doss’ loss raises questions The Lawrence County election process was called into question, especially over the narrow defeat of State Rep. Barry “Boss” Doss (R-Leoma) lost to newcomer Clay Doggett, The Tennessee Star reported. A 16 hour delay occurred in the reporting of the results in the Republican primary. “The fact that several different and inconsistent vote numbers have been reported from Lawrence County over the past 24 hours raises serious questions about whether the disparities are due to incompetence or actual technical issues or something more sinister. The fact that the Secretary of State’s office seemed to have no idea that there were problems indicates that an investigation or a full audit is in order,” Tennessee Star Political Editor Steve Gill said. Late Friday, the Election Administrator’s office confirmed to The Tennessee Star that Lawrence…

Read the full storyTennessee House District 75: Bruce Griffey Challenge to Rep Tim Wirgau Has Become a House Race to Watch

While much of the focus during the Republican primary season has been on the 18 House seats vacated by Republican legislators who are retiring or seeking other offices a handful of challenges to incumbents are attracting increasing attention. One of those races is in West Tennessee’s 75th District (covering Henry, Stewart and Benton counties) where incumbent Tim Wirgau is facing serious competition from Bruce Griffey. Wirgau has been in the Legislature since 2011 and chairs the House Local Government Committee. Bruce Griffey is an attorney and Chairman of the Henry County Republican Party who lives in Paris, TN. Griffey has taken Wirgau to task for Wirgau’s vote in support of providing taxpayer funded in-state tuition for illegal aliens (2016 HB 675). Illegal immigration has topped the list of Republican voter concerns in Tennessee and opposition to providing in-state tuition to illegals has been extraordinarily high according to polls of likely Republican primary voters. A Tennessee Star poll conducted in December 2017 that focused on GOP Primary voters underlined how support for using taxpayer funds to subsidize tuition for illegal aliens may be harmful to Republican candidates facing primary opposition. Those polled were asked: In 2018, the Tennessee state legislature is expected…

Read the full storyDemocrats Target Republican Mae Beavers with Facebook Attack Claiming She ‘Opposes Tax Cuts’

A Democrat Party PAC is hitting conservative Republican candidate for Wilson County Mayor Mae Beavers with a Facebook ad that claims she “opposes tax cuts.” The Tennesseans for Common Sense PAC, with leadership that includes longtime liberal Democrat activist Carol Andrews, is also running radio ads, purchased at least one billboard and has done one county wide mailing so far. The PAC, in the supposedly non-partisan County Mayor’s race, clearly intends to help re-elect Democrat Randall Hutto. Andrews herself is a candidate for the Democratic Party State Executive Committee in the August 2 Democrat Primary. The Democrat PAC is targeting Beavers for her vote in opposition to the Improve Act, which Hutto favored. The Improve Act raised fuel taxes and registration fees about $350 million a year at a time when Tennessee enjoyed a $2 billion surplus. A narrow majority of Republicans in the House supported the tax increase, 37-35, but proponents relied on Democrat votes to get enough to pass it. Beavers was one of only about 6 Republicans in the Senate to vote against the tax increase. Advocates of the plan have argued that the Improve Act cut taxes on the sales tax on food; but even when…

Read the full storyCalifornia Voters Prepare To Square Off Against Gov. Jerry Brown Over Gas Tax Repeal

by Chris White Gov. Jerry Brown is leaving office after the midterms, but the California Democrat plans on engaging in one last brutal campaign to defend an extremely unpopular gas tax he approved in 2017. Brown is pledging to raise $25 million in a campaign to fight the repeal effort. He is also soliciting help from business and labor leaders, who view the gas tax as an instrument to build up California’s roads. Supporters of the repeal are eager to knock it around with the 80-year-old governor. “This has nothing to do with taxes,” Brown said of Prop 6, which seeks to repeal a gas tax the governor passed in April 2017. “This is engineered by the Republican congressional delegation to prop up their vulnerable Republicans,” he said in a June 6 interview with The New York Times. The Road Repair and Accountability Act imposes a 12-cents-a-gallon increase on Californians and raises the tax on diesel fuel by 20 cents a gallon. It also implements an additional charge to annual vehicle license fees ranging from $25 to $175 depending on the car’s value. The measure gained has become a hot-button issue in the Golden State. California currently ranks seventh highest in the country when it…

Read the full storyOFF THE RECORD: GOP 6th Congressional District John Rose – Will Little Brother Track Big Sister’s Farm Bureau Agenda?

Multi-millionaire John Rose is running in the GOP primary for Diane Black’s seat to represent the 6th Congressional District. He will face off with proven ultra-conservative state Rep. Judd Matheny, self-described conservative retired judge Bob Corlew, and the whoever-heard-of-them candidates Christopher Monday and “U-turn” LaVern Vivio. Roses’s big sister is Rhedona Rose, head of the Tennessee Farm Bureau (TFB). TFB’s parent is the American Farm Bureau Federation, a non-profit organization with affiliate farm bureaus in all 50 states, including Tennessee. The TFB is reputed to be the largest farm bureau in the country. Little brother John Rose, former Commissioner of Agriculture during governor Don Sundquist’s administration, is running on a “I’m a non-career politician” type platform. Oh yeah, right, you were never elected to any political position, you were just a political appointee, chaired the Tennessee State Fair Association and held a seat on the boards of the Tennessee Board of Regents, the University of Tennessee Board of Trustees and the Tennessee Wildlife Resources Commission. And then there’s big sister’s head honcho position with the Tennessee Farm Bureau. No politicking there – sure. Big sister Rhedona Rose is the first woman head of the statewide TFB. She used to be the executive…

Read the full storyGas Can Man Headed to Murfreesboro Friday Morning to Protest Gas Tax Increase and Dish Out Free Gas

One hundred early morning drivers in Murfreesboro will get up to $25 towards a fill up in free gas thanks to Gas Can Man this Friday. The $25 represents about a month’s worth of the fuel taxes the average Tennessee driver is paying thanks to the gas tax increase passed by the legislature last year. Gas Can Man will promote the need to oppose higher federal gas taxes and repeal the gas tax increase that Tennessee imposed last year. Gas Can Man is part of the Energize America Coalition that has done over 50 similar events across the country in the last few years. The first 100 drivers at 7:30 am Friday morning in Murfreesboro will get up to $25 towards a fill up! To find out exactly where the gasoline giveaway will take place, tune into SuperTalk 99.7 WTN at 7:05 am Friday morning or go to Gas Can Man on Facebook to find the location. Tennessee Star readers will also find the location posted promptly at 7:05 am on Friday on the Facebook page for The Tennessee Star. Governor Bill Haslam and the Tennessee legislature permanently raised fuel taxes by over $300 million a year, despite Tennessee having…

Read the full storyEXCLUSIVE Interview: Joe Carr Standing Firm on Conservative Record in 14th District State Senate Special Election

MURFREESBORO, Tennessee — Joe Carr held forth on a range of issues Thursday at Slick Pig BBQ on East Main, a favorite hangout where he feels right at home. In an interview with The Tennessee Star, the conservative State Senate candidate energetically answered questions on immigration, health care and education. Carr announced Monday that he will run for the State Senate seat being vacated by Sen. Jim Tracy (R-Shelbyville), who late last week was appointed as state director of rural development for the U.S. Department of Agriculture. Tracy’s resignation means there will be a special election within the next few months. Murfreesboro businessman Shane Reeves also announced this week that he will run for the seat as a Republican. Carr served in the Tennessee State House of Representatives from 2008 to 2014, lost the 2014 Republican U.S. Senate primary to Lamar Alexander, and also lost the 2016 Republican 6th Congressional District primary to Rep. Diane Black (R-TN-06). He lives on his family farm in Lascassas and is semi-retired after having founded and sold two engineering firms. In recent years, he has become known for his T-Bones and Politics fundraisers featuring big-name guest speakers. Viewed as a solid conservative by his admirers, Carr is against the…

Read the full storyIncensed Californians Working to Recall State Assemblyman Who Supported Gas Tax Hike

Earlier this year, the Democrat super-majority in the California legislature passed a substantial gas tax hike. Though wildly unpopular with the relative few who took notice, Governor Jerry Brown signed it quickly, and put into motion an uptick in fuel costs to consumers estimated to raise a staggering $5 billion in new recurring revenues to help underwrite the Golden State’s bloated budget. Republicans, fueled by the outrage of every day Californians at the imminent tax increase, responded by launching a recall effort against newly-elected Assemblyman Josh Newman, whom they say was key to the passage of the tax hike. The Washington Free Beacon reports the effort, led by San Diego radio talker Carl DeMaio, is garnering vast support amongst California voters. The first step to recall a sitting elected official is to gather petitions signed by voters. The Beacon reports, “Republicans opposed to the most recent gas tax hike Newman backed submitted 84,988 signatures for the recall effort on Tuesday, nearly 20,000 more than the 63,592 the law requires.” DeMaio told The Beacon, “The overwhelming number of signatures we collected in just six weeks demonstrates a real rebellion is brewing in California against the out-of-control tax raisers in the state legislature.” He continued, “This recall…

Read the full storyMae Beavers Tells Haslam State Will Pay For Roads After Gas Tax Repeal With $2 Billion Surplus and Ending Diversion of Road Funds to Other Uses

Gov. Bill Haslam threw a soft ball over the middle of the plate to State Senator Mae Beavers (R- Mt. Juliet) about her campaign pledge to repeal the gas tax, and the recently announced GOP Gubernatorial candidate knocked it out of the park. Appearing in Nashville at one of the three ceremonial signings for the IMPROVE ACT passed by the Tennessee General Assembly this session that he signed in May, Haslam asked what he thought of Beavers’ campaign pledge to repeal the 6 cents per gallon gas tax increase and 10 cents per gallon diesel tax increase included in the new law. “If you want to repeal that, then how are you going to pay for road improvements? And are you going to take the tax cuts that we’ve made off the table, too?” Haslam asked. “That’s an easy question to answer,” Beavers told The Tennessee Star Monday afternoon. “If the Governor and legislative leadership had allowed for a full and fair discussion of road funding alternatives rather than cutting back room deals and strong arming the gas tax increase down taxpayers throats then Governor Haslam might be aware of the other alternatives available,” Beavers noted. “We can repeal…

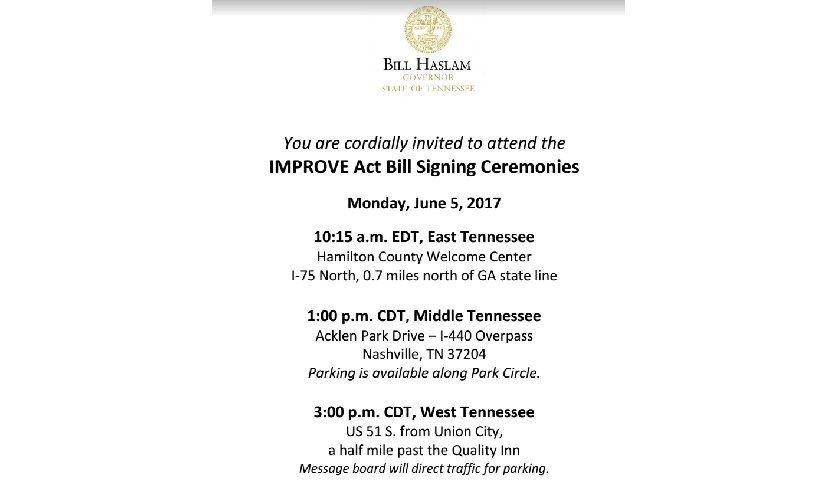

Read the full storyGov. Haslam Holds Ceremonial Signings Today for Gas-Tax Increasing IMPROVE Act In Each of Tennessee’s Three Grand Divisions

Governor Haslam will hold ceremonial signings of the controversial and gas-tax increasing IMPROVE Act Monday in each of Tennessee’s three grand divisions, as reported last week by The Tennessee Star. According to the invitation on Governor Bill Haslam’s letterhead, the IMPROVE Act signing ceremonies will be held as follows: 10:15 a.m. EDT, East Tennessee Hamilton County Welcome Center I-75 North, 0.7 miles north of GA state line 1:00 p.m. CDT, Middle Tennessee Acklen Park Drive – I-44 Overpass Nashville, TN 37204 3:00 p.m. CDT, West Tennessee US 51 S. from Union City A half mile past the Quality Inn The signings are spaced so closely together in time, Gov. Haslam is almost certainly flying from site to site at taxpayers’s expense to celebrate this tax increase. The IMPROVE Act, initially named for “Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy,” was renamed to the Tax Cut Act of 2017, by its House sponsor of HB 534 Rep. Barry “Boss” Doss (R-Leoma), will raise the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon phased in over three years. Effective July 1, the gas tax will increase from 20 cents to 24…

Read the full storyGas Tax Increase Fails in Louisiana

The Hayride is reporting that the effort to increase the gas tax in the state of Louisiana has failed in the State’s House of Representatives: We heard this morning from several people in the know that at last night’s meeting of the Louisiana House Republican Delegation, Rep. Steve Carter admitted to the members that HB 632, the gas tax increase bill he’s been trying to drag across the finish line for this entire legislative session, simply does not have the 70 votes required for passage on the House floor. And shortly thereafter, the Louisiana Association of General Contractors, which had been attempting to rally support for Carter’s gas tax bill, threw in the towel on the gas tax. That association’s CEO Ken Naquin said as much in an e-mail to AGC’s membership… From: Ken Naquin Sent: Wednesday, May 31, 2017 10:27 AM To: LAGC Subject: Fuel Tax Bill Dead for Session To: LAGC Highway Division Members Ladies and Gentlemen: Yes, the tag line is correct. Rep. Steve Carter will address the House floor today and hang HB 632 up, on the calendar. As of late last night, after an exhaustive full floor lobby, we can only garner 60 yes votes,…

Read the full storyOFF THE RECORD in Henry County

On May 25th, the Henry County GOP and Republican Women held a “Meet & Greet” reception for their state Senator John Stevens. Rep. Tim Wirgau who also represents Henry County, showed up to participate even though he had not been invited as a speaker. According to an attendee, both Stevens and Wirgau talked “pretty much in lock-step agreement on all issues discussed at this meeting.” Backing off of Boss Doss’ rebranded “Tax Cut Act of 2017” both Stevens and Wirgau talked extensively about the gas tax which they both supported, except now they were calling it Governor Haslam’s name for the tax increase – the “Improve Act of 2017”. Justifying their support for increasing taxes, both Wirgau and Stevens used what sounded like talking points provided to legislators that have to defend unpopular votes. Stevens started off by saying that, “”the voters should thank us for passing this bill!” He then went into great detail explaining how transiting big rigs will pay Tennessee fuel tax regardless of which state they refuel in because the International Federal Tax Agreement law which apportions fuel tax according to miles traveled in a specific state using specific states’ rates, will result in the big rigs paying 40% of…

Read the full story70 Grassroots Activists Honor Gas Tax Opponents at Knoxville Event

KNOXVILLE, Tennessee — Seventy grassroots activists came out to hear a debriefing Tuesday evening on the recently concluded legislative session by Knoxville Republican gas tax opponents Representatives Roger Kane and Jason Zachary at an Americans For Prosperity (AFP) West Knoxville Town Hall. Kane and Zachary were recognized by AFP’s Deputy State Director, James Amundsen, as the only two Knoxville representatives who voted against the gas tax increase. Representatives Zachary and Kane gave opening comments to the standing room only crowd at O’Charley’s on Parkside Drive in the Turkey Creek section of Knoxville followed by a question and answer session for an event that ran more than an hour. Zachary started his comments by passing out and reviewing two handouts printed on his official letterhead, “Under Conservative Leadership, Tennessee is a Better Place To Live, Work, And Raise A Family” and “Bills Passed On Behalf Of District 14, 2017 Session.” As he went through the six bills, HB 0055, 0056, 0057, 0362, 0368 and 0469, Zachary explained how they came about through requests by individuals, making the point that “especially at the state level, one person can make a tremendous difference.” Kane made a similar point when he said, “We actually…

Read the full storyFormer Lt. Gov. Ron Ramsey Says ‘There Was Some Punishment Levied Against Some House Members’ for Voting No on Gas Tax

During a press conference in Blountville, former Lt. Governor Ron Ramsey said that, “[w]hen I was in the legislature, let me assure you, actions had consequences,” as the reason why none of the new transportation funding is headed to Washington County. Ramsey summed it up this way: “There was no doubt, in the end, that there was some punishment levied against some House members on funding. Not against the Senate members, but against the House members.” For example, Ramsey said the Senate included funding for the Sullivan County Agriculture Center and East Tennessee State University, after which the House stripped away some of the funding. Rep. Timothy Hill, whose district covers Johnson County and parts of Carter and Sullivan Counties, voted against the gas tax. “Well, Timothy Hill’s district is the Ag Center. That’s one. I even made a phone call to say, ‘That this is kind of my pet project.’ It’s not up to the House members on that, but still they felt like it was time to ‘exact a pound of flesh’ was exactly the words that I heard” No TDOT projects were included for Johnson County which Hill also represents. Similarly, there were no TDOT projects listed for…

Read the full storyAFP Sponsors ‘Day at the Capitol’ for Key Vote in Louisiana Gas Tax Hike Battle

If it seems like every other State in the Union has either raised their fuel tax – or is working on it – it’s because they are. A full 21 states’ legislatures have proposed raising the gas tax, and more of those proposals have been successful than not. California and Tennessee consumers will see a sharp increase in prices at the pump thanks to increased taxes; while South Carolina’s governor just spared his constituency by vetoing a gas tax hike. Louisiana is up next, with a vote Tuesday in the powerful Ways and Means Committee which will determine the fate of a years-long battle to raise the gas tax there. Americans for Prosperity (AFP), whose Tennessee state group opposed the gas tax in Tennessee, is sponsoring a “Day at the Capitol” through its Louisiana state group. Activists are called to gather Tuesday, May 16 in Baton Rouge from 9 a.m. to 12 p.m. at the Ways and Means Committee room. The hearing begins at 9:30 a.m. The Hayride reports: There are 19 members of the House Ways And Means Committee – 12 Republicans and seven Democrats. HB 632 by Rep. Steve Carter, which is the gas tax bill, has eight…

Read the full storyCalifornians Are Revolting Against Democrats Who Voted For Gas Tax Hike

Californians are pushing back against the Democratic lawmakers who passed the largest gas tax in the state’s history last month. Citizens have signed signatures for a recall effort against Democratic state Sen. Josh Newman for his vote in favor of for the Road Repair and Accountability Act, and another lawmaker is moving forward on an initiative…

Read the full storySC Gov. McMaster Vetoes Gas Tax, In Stark Contrast to TN Gov. Haslam, Who Championed It

South Carolina Governor Henry McMaster posted a video “Gas Tax Veto” to his Facebook page, saying “Today I vetoed the General Assembly’s gas tax bill, and I would like to tell you why.” He continued, “Unfortunately, raising taxes was the only solution seriously considered by the legislature.” Quite a contrast to recent events in Tennessee, where Governor Haslam was the one who would only accept a gas tax increase to fund roads through his IMPROVE Act. The Governor persisted in his “my way or the highway” solution to road funding, despite other alternatives being offered by some members of the House of Representatives, and nearly half of his own party at 35 of 37 Republican Representatives, voting against it. Tennessee suffers from much the same problem as South Carolina, as stated by Governor McMaster, “Right now over one-fourth of your gas tax dollars are not used for road repairs. They’re siphoned off for government agency overhead and programs that have nothing to do with roads.” As previously reported by The Tennessee Star, some of the current road “user fees” are diverted from the Highway Fund, and the Tennessee Department of Transportation (TDOT) “overhead” has grown 63 percent under Governor…

Read the full storyEffort to Correct Some of The Gas Tax ‘User Fee’ Diversion From The Highway Fund Amended Away

A bill introduced to remove a portion of the diversion of fuel tax “user fees” from the Highway Fund to the General Fund was amended so drastically that the bill was rewritten so that it rewrote the bill, and instead increased the amount distributed to the Wildlife Resources Fund. As reported by The Tennessee Star, and confirmed by Rep. Susan Lynn (R-Mt. Juliet), Tennessee Code Annotated requires that portions of the “user fee” fuel taxes be allocated to the General Fund to cover the costs incurred by the state Department of Revenue for the collection of those taxes. HB 910 / SB 230 by Rep. Tim Wirgau (R-Buchanan) and Sen. Mark Green (R-Clarksville), respectively, would have “eliminated the administrative allocation of the gasoline tax, motor fuel tax, and gasoline inspection tax to the General Fund.” It would have no impact on the total collections from the various fuel taxes, but would simply allocate them to the Highway Fund rather than the General Fund. The fiscal memo for the original bill reported increases to the Highway Fund of $12 million and to local governments of $2.6 million. The bill was then completely re-written by the amendment so that the diversions to the General Fund…

Read the full storyGubernatorial Candidates Randy Boyd and Karl Dean Will Fight for Votes of Political Moderates

Four months into his 2015 appointment as the new Commissioner of Economic and Community Development, and two years before he announced his run for governor, Randy Boyd told his hometown weekly that, “I’m probably the most hated, disrespected, untolerated political entity in existence… I’m a moderate.” Former Nashville Mayor Karl Dean, the first declared gubernatorial Democrat candidate also describes himself as a moderate and recognizes that he will need “moderate Republican votes” in order to win. Both candidates say education and economics are the top priorities, both say they are business-friendly and both shower admiration on Haslam’s leadership. For voters, however, even those who identify as “moderate” or “independent,” it will be difficult to distinguish between Boyd and Dean, except perhaps for choosing whether to vote in the Republican or Democrat primary. Political analysts suggest that states with open primaries like Tennessee, work to the advantage of moderate candidates. Both candidates have been married to the same partner for a long time and while Boyd made his fortune by copying a similar commercially available product, Dean married into his wealth. His wife Delta Anne Davis, is an heir to the millions her uncle Joe C. Davis made through the coal…

Read the full storyChaos at the Capitol: Democrats’ Quid Pro Quo Education Money for Gas Tax Votes Passes, But Budget in Limbo

Thursday on the House floor, between recesses where Republicans were presumably working out their differences over parts of the budget, and working their way through a pile of amendments to HB511, Democrat Rep. Craig Fitzhugh, the House Minority Leader, went to bat for a third time to secure a pot of recurring education money to be used at the discretion of local school districts. Fitzhugh opened his remarks by acknowledging a “rumor” that the Democrats had cut a deal with Governor – gas tax votes for the education slush fund, but he denied that there was any quid pro quo agreement. The starting bid for Fitzhugh’s proposed K-12 Block Grant Act was $500 million which he admitted was “ambitious.” It was then reduced to $250 million which he admitted was also “too much.” The new amount introduced in Amendment #7 to the budget, was further reduced to $150 million, money that Fitzhugh said would go to all the state’s public schools, poor and rich alike. Appealing to his House colleagues to pass his amendment, Fitzhugh said that approving the block grant funds that would be held in a trust fund would help get around the Copeland Cap problem. Fitzhugh closed…

Read the full storyThe $250 Million Education Bill the Democrats Reportedly Want in Return for IMPROVE Act Support is Still Alive

Twenty-three of the 25 Democrats in the House voted for Gov. Haslam’s gas tax increasing IMPROVE Act last Wednesday, amid rumors of a $250 million deal made between Governor Haslam and House Minority Leader Craig Fitzhugh (D-Ripley) in a quid pro quo tradeoff: Democrats vote for the governor’s bill, the governor backs House Bill 841, sponsored by Fitzhugh, which appropriates $250 million from excess state tax revenue over-collected in fiscal years 2015-16 and 2016-17 to spend on education in the K-12 Block Grant Act. Democrats would have been expected to oppose the gas tax increase, given the many arguments that the IMPROVE Act’s tax cuts went largely to a handful of businesses, not middle class and working class voters who comprise the traditional Democratic constituency. The higher cost of living for middle class and working class voters resulting from the increased prices for food and other staples of life resulting from higher diesel taxes paid by trucking companies will likely not be offset by the small reductions in the sales tax on food. HB 841 was on the agenda for the House Finance Ways & Means Subcommittee meeting scheduled for Wednesday, April 26, but Leader Fitzhugh said the plan is…

Read the full storyBoss Doss Admits To TDOT Contract After Being Elected

For the first time, State Rep. Barry “Boss” Doss (R-Leoma), who is the House sponsor of Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017” and is serving as Chairman of the House Transportation Committee, admitted to having a contract with the Tennessee Department of Transportation (TDOT) since he was elected in 2012. The admission came during an interview with WSMV Monday, as he was attempting to refute conflict of interest charges related to his sponsorship of the IMPROVE Act “Tax Cut Act of 2017.” The potential conflict of interest, as reported by The Tennessee Star, was raised on March 27 via a letter from the Tennessee Republican Assembly (TRA) to Speaker Beth Harwell (R-Nashville) that called for an ethics investigation. Rep. Doss, serving as Chairman of the Transportation Committee and House sponsor of Governor Haslam’s IMPROVE Act with his “capability to sway the committee” or “manipulation of the rules” with the outcome of the legislative process having the potential for “direct financial impact on his business” did not meet the “Guiding Principle” of avoiding even the appearance of conflicts, TRA said. Thus far, Speaker Harwell has not responded to the request for an investigation and Doss had not commented. That was until Monday, when Rep.…

Read the full storyHouse Majority Leader Glen Casada Defends His Vote to Increase The Gas Tax

House Majority Leader Glen Casada (R-Franklin), issued a press release Monday defending his vote to increase the gas tax through Governor Haslam’s IMPROVE Act, after initially announcing on February 8 his support for the alternative Hawk Plan. The press release was forwarded via email, addressed to “Friends,” stating “I wanted to forward a statement I released to the press regarding my vote on the IMPROVE Act.” If the comments on Rep. Casada’s Facebook page responding to posts on the gas tax, the overwhelming majority of which are against the gas tax, is representative of other feedback he’s been getting, it likely prompted Casada’s need to explain his vote. The cover email continued, Though I still believe there was a better way to fund road construction for Tennessee that did not raise taxes, I did vote for the amendment that was the IMPROVE Act. My support for the alternative plan that would have shifted funds to the Department of Transportation without raising the gasoline tax died twice in committee and again on the House floor. Thus, my only option was to do nothing on road funding, or vote for the IMPROVE Act – the next best vehicle available to attain our goal of…

Read the full story6 Things Boss Doss Got Wrong In His Sales Pitch For Governor Haslam’s Gas Tax Increasing IMPROVE Act

As the House sponsor of the IMPROVE Act Tax Cut Act of 2017 (HB 534), State Rep. Barry “Boss” Doss (R-Leoma) was well versed on all of the related subject matter and respectful throughout his long and challenging sales pitch for Governor Haslam’s IMPROVE Act to the various committees and on the House floor. There were, however, several things Rep. Doss got wrong. And, as former Majority Leader Gerald McCormick (R-Chattanooga) said several times through the process, “You can have your own opinions, but you can’t have your own facts.” Here are the top six things Boss Doss got wrong: 1. “I’ve been proud that we cut taxes by $300 million so far.” The state portion of the annual budget has grown from $13.7 billion in 2011-12 to a recommended $16.5 billion for 2017-18. Since state law requires that all of the revenues be allocated, that’s a $2.8 billion, or 20 percent, increase in state spending in just six years. 2. The average family of 4 will recognize a monthly increase of $5.54 from the gas tax hike versus a savings in their food tax of $7.72, for a net savings of $2.18 per month. In terms of the…

Read the full storyPreliminary Vote on Amendment to Adopt Gas Tax Increase Bill Passes House 61-35, Final Vote Expected Tonight

An amendment by State Rep. Charles Sargent (R-Franklin), a motion to adopt the IMPROVE Act “Tax Cut Act of 2017,” HB 534, passed the Tennessee House of Representatives Wednesday afternoon in a 61-35 vote. This was a preliminary vote prior to the anticipated final vote on IMPROVE Act “Tax Cut Act of 2017,” which is expected to come late Wednesday. Thirty-four Republicans, joined by a solitary Democrat, State Rep. John Mark Windle, voted against the motion to adopt. A full list of the 34 Republicans and one Democrat who voted no was compiled by reporters for The Tennessee Star on the scene (click at the bottom to see the second page): [pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2017/04/IMPROVE-Act-Amendment-House-Vote-4-19-17.pdf” title=”IMPROVE Act Amendment House Vote 4-19-17″] Notable among those Republicans who voted no were State Rep. Matthew Hill, State Rep. Timothy Hill, State Rep. David Hawk, State Rep. Sheila Butt, State Rep. William Lamberth, State Rep. Judd Matheny, State Rep. Jerry Sexton, and Speaker Beth Harwell. Twenty-three Democrats voted for the motion to adopt, along with 38 Republicans. Notable among those Republicans who voted yes were Majority Leader State Rep. Glen Casada, State Rep. Susan Lynn, State Rep. David Alexander, State Rep. John Ragan, and State Rep. Bill Dunn.…

Read the full storyHaslam Reduced Highway Fund Budget By 13 Percent, Grew State Budget By 20 Percent Before Proposing Gas Tax Increases

Governor Haslam reduced the Highway Fund budget by 13 percent, while he grew the State budget by 20 percent during his first six years in office. Only after he made these reductions in the Highway Fund budget did he propose the gas tax and diesel tax increases included in the IMPROVE Act when he introduced it in January 2017. From Governor Haslam’s first budget year of 2011-12 to the most recent 2016-17, Highway Fund allocations went from $867 million to $757 million, a reduction of 13 percent. HIGHWAY FUND ALLOCATIONS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated DOWN Budget $ $866,886,300 $823,104,600 $683,800,400 $792,219,800 $740,645,600 $756,856,000 -13% Sheet 54 of 656 54 of 545 54 of 542 54 of 550 54 of 558 54 of 558 Page A-22 A-22 A-22 A-22 A-22 A-22 During that same period, the state portion of the budget, excluding the unpredictable and heavily mandated federal funding, grew from $13.7 billion in 2011-12 to $16.5 billion in 2016-17, representing a 20 percent increase. STATE BUDGET IN BILLIONS OF DOLLARS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated INCREASE Billion $ $13.7 $14 $14.6 $14.8 $15.3…

Read the full storyHaslam’s IMPROVE Act Includes Same ‘Economic Development’ That Lost Millions in TNInvestco

“A performance audit from the Tennessee Comptroller’s Office has revealed the State of Tennessee has only recovered $5.3 million of its initial $200 million investment in the TNInvestco program,” according to a statement dated November 10, 2016, under the name of Justin P. Wilson, Comptroller, referring to a performance audit report. The statement from the Comptroller focused primarily on the TNInvestco program from the 60-page October 2016 “Performance Audit Report” produced by the state’s Comptroller’s office on Governor Haslam’s Department of Economic Development and Tennessee Technology Development Corporation. The Report was conducted by the Comptroller’s Department of Audit, Division of State Audit, with the report dated October 25, 2016, signed by Director, Deborah V. Loveless, CPA and addressed to The Honorable Ron Ramsey, Speaker of the Senate; The Honorable Beth Harwell, Speaker of the House of Representatives; The Honorable Mike Bell, Chair, Senate Committee on Government Operations; The Honorable Jeremy Faison, Chair, House Committee on Government Operations; and, Members of the General Assembly; and The Honorable Randy Boyd, Commissioner, Department of Economic and Community Development. At the time of the audit, the program was in in its sixth year, having been approved by the Tennessee legislature in 2009. With…

Read the full storyBoss Doss Claim That Tennessee is Lowest Taxed State in Nation Contradicted by Kiplinger Report

State Rep. Barry “Boss” Doss (R-Leoma), chairman of the House Transportation and champion of the IMPROVE Act “Tax Cut Act of 2017” claimed in the Finance, Ways and Means Committee last Tuesday that Tennessee is the lowest taxed state in the nation. The Kiplinger Report, a “leader in personal finance news and business forecasting” put together their list of “10 Best States to Live In For Taxes” in August 2016, and that list does not include Tennessee. In order, Kiplinger’s top 10 are: Wyoming, Alaska, Florida, Nevada, Arizona, Louisiana, Alabama, South Dakota, Mississippi and Delaware. Five states on the list, like Tennessee, do not have an income tax. Other robust criteria Kiplinger used for their ranking was property tax from U.S. Census’ American Community Survey, the Tax Foundation’s figure for average sales tax, fuel tax from The American Petroleum Institute, sin taxes from the state’s tax agency and the Tax Foundation, inheritance and gift taxes from each state’s tax agency, wireless taxes from the Tax Foundation, travel taxes from the state’s tax agency and a lodging tax study by HVS Convention Sports and Entertainment Consulting and the fiscal stability of the states by the Mercatus Center at George Mason University.…

Read the full storyGas Tax Increase Lobbyists Begin Advertising Campaign on Ralph Bristol’s WWTN Show

Regular listeners to Nashville’s Morning News With Ralph Bristol on 99.7 FM WWTN may have noticed a new advertiser on Thursday–the Transportation Coalition of Tennessee. The Coalition is a group of 39 lobbying groups that support Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017,” the majority of which will directly benefit from the additional $10 billion in taxpayer-funded road projects. Several of the lobbying groups, such as the Tennessee County Highway Officials Association, Association of County Mayors and Tennessee County Commissioners Association, are funded by membership dues paid for by taxpayers through county budgets. Reports indicate that the ads are only being played on WWTN during Nashville’s Morning News with Ralph Bristol. Bristol has been a proponent of the IMPROVE Act “Tax Cut Act of 2017” since its introduction and continued his support in the second hour of Thursday’s show with an 8-minute “rant,” as Ralph often refers to them. The full transcript can be found here. In the third hour of the program, the one-minute advertising “spot” by the Coalition went like this: “Governor Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and at…

Read the full storyTransportation Coalition of Tennessee Set to Air ‘It’s Smart’ Ads to Promote Gas Tax Hike

The Transportation Coalition of Tennessee (TCofTN), will launch a series of radio ads touting Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017”, the Times Free Press reports. With the legislation heading to the state House and Senate floor as early as next week, the Transportation Coalition of Tennessee plans to begin airing the 60-second spots starting Thursday, going through April 21. The $127,000 buy’s hits the Chattanooga, Jackson, Memphis, Nashville, Knoxville and Tri-Cities markets. TCofTN describes themselves in a statement announcing the ads as a coalition of “businesses, citizens, community leaders, public officials and organizations that are interested in continuing Tennessee’s transportation infrastructure for the long haul.” Their membership includes senior citizen’s insurance group AARP, auto club AAA, the Nashville Chamber of Commerce, the American Heart Association, Tennessee Road Builders Association and some 33 others. The series, called “It’s Smart,” feature spots voiced by a comforting, grandfatherly persona praising the Governor’s plan, saying: Gov. Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and, at the same time, gives a tax cut to all Tennesseans through a 20 percent tax cut on food. Listen: All the ads are available to enjoy here.…

Read the full storyFACT’S David Fowler Praises ‘Little Guys’ In Fight Against Gas Tax

David Fowler of the Family Action Council of Tennessee has waded into the gas tax debate, writing in a blog post last week that while the issue is outside the focus of his group, it is “just too interesting to let slide.” “To appreciate what’s going on, you need to understand that the state House has always had a top-down management style,” wrote Fowler, who served in the state Senate for 12 years before joining FACT as president in 2006. “It works sort of like this,” Fowler wrote. “The Speakers typically give the rank-and-file Representatives (hereafter, the ‘Little Guys’) the freedom to represent their folks back home, so long as their views on something important don’t conflict with that of the Speaker or the Governor, to whom the Speakers for some reason seem to always take some kind of fealty oath. But when there is a conflict, the Speaker uses the loyalty of his or her committee and subcommittee chairs, engendered by their being given a position of ‘importance,’ to bring down the hammer and get the ‘preferred’ agenda rammed through.” Fowler applauds the “Little Guys” who won’t “shut up and go along” with the gas tax, part of Gov.…

Read the full storyThe 962 Road Construction Projects Costing $10.5 Billion in The Gas Tax Increase Bill Can Be ‘Modified’ by TDOT

Governor Haslam and other administration officials have stated since announcing the IMPROVE Act , now the “Tax Cut Act of 2017,” on January 18 that the purpose of the gas and diesel tax increases included in the bill is to fund 962 needed road construction projects in all 95 counties for a price tag of $10.5 billion.

These projects, however are the seventh in priority in a list of seven things for which the additional funds raised in the bill can be used.

Read the full story