A high ranking source who serves on the Republican Governors Association’s (RGA) select national finance committee told The Tennessee Star that current and former RGA staff appear to be actively trying to damage the gubernatorial campaigns of Rep. Diane Black (R-TN-06) and possibly Bill Lee, while promoting close Haslam ally Randy Boyd in the Republican primary. Specifically, the source said, Haslam and the RGA Executive Director Paul Bennecke (who Haslam personally hired to the RGA during his previous stint as chairman) were coordinating with at least one White House staff member in an attempt to disparage and downplay Black’s close working relationship with President Trump and with Vice President Mike Pence. Haslam was a vociferous “Never-Trumper” who just three weeks before Trump won the 2016 election demanded Trump resign as the nominee and in so doing became the only Republican governor who said he would not be voting for Trump. The governor was particularly incensed when during his recent rally for Marsha Blackburn in Nashville, Trump took time to give Black special attention. During that rally, Trump did not mention any candidates other than Blackburn and Black, singling her out and saying “I want to recognize Diane Black, who is…

Read the full storyTag: Gov. Haslam

Gas Tax Increases Another 1 Cent Per Gallon Today Thanks to Gov. Haslam, Democrats, and ‘Moderate’ Republicans

The state gas tax increased another 1 cent per gallon today, thanks to the IMPROVE Act passed by Democrats and “moderate” Republicans in the Tennessee General Assembly and signed into law by Gov. Bill Haslam in May 2017. The controversial law raised state gas taxes by 6 cents per gallon and diesel taxes by 10 cents per gallon. The gas tax increases were phased in over three years. The first 4 cents per gallon increase went into effect on July 1, 2017. An additional 1 cent per gallon gas tax increase goes into effect today, and the final 1 cent per gallon gas tax increase goes into effect July 1, 2018. The law was deemed necessary to fund road construction by Haslam and his allies despite the fact the state of Tennessee had a $2 billion surplus at the time it was passed and signed into law. One under reported element of the law at the time was a provision that allowed the twelve largest counties in the state to hold local referendums to increase local taxes to fund transportation projects. It was this provision upon which former Nashville Mayor Megan Barry relied when she introduced her $9 billion transit…

Read the full storyDave Ramsey Breaks Ground On New Corporate Headquarters In Franklin

Dave Ramsey broke ground Thursday on new Williamson County corporate headquarters for Ramsey Solutions, his growing financial advice company. Thursday’s private ceremony was set to feature remarks from Ramsey and Gov. Bill Haslam, according to a news release. Representatives from the city of Franklin, the Williamson County Chamber of Commerce, Gresham Smith and Partners, and Solomon Builders were scheduled to attend, along with Ramsey family members and more than 600 Ramsey Solutions employees. The new headquarters will be on 47 acres in the Berry Farms development in Franklin. The more than 223,000-square-foot building will include a coffee shop, bookstore and studio for “The Dave Ramsey Show,” in addition to office space for more than 1,000 people. The company estimates the new headquarters will open in August 2019. Ramsey Solutions closed on the property in 2015. The company is currently located in multiple locations in Cool Springs, occupying a total of more than 150,000 square feet. Ramsey Solutions, formerly known as the Lampo Group, is celebrating its 25th anniversary this year. Ramsey is known for common sense financial advice delivered through books, radio shows, live events, classes, coaching and digital products. Over the years, the Tennessee native, who was born…

Read the full storyMastermind Of Pilot Flying J Rebate Scam And Three Others Sign Plea Agreements

Four former Pilot Flying J employees officially agreed Monday to plead guilty in the company’s diesel fuel rebate scam, reports WSMV Channel 4. John “Stick” Freeman, the mastermind of the scheme, along with John Spiewak, Vicki Borden and Katy Bibee, signed plea agreements filed in U.S. District Court for the Eastern District of Tennessee. With Monday’s filings, there are now 14 sales staff members and executives who have agreed to confess and talk, according to the Knoxville News Sentinel. Pilot Flying J, which is headquartered in Knoxville and operates hundreds of gas stations and convenience stores in the U.S. and Canada, is owned by the family of Tennessee Gov. Bill Haslam. The billionaire CEO is his brother Jimmy Haslam, who also owns the Cleveland Browns. Their father founded the company in 1958. Jimmy Haslam has not been charged in the scandal, although the FBI indicated in testimony and court records that he was a suspect, according to the News Sentinel. He has denied knowing about the scam. Gov. Haslam has not been involved in running the company for many years but has an ownership share in the business. He has said his holdings were placed in a blind trust when he…

Read the full storyMae Beavers Tells Haslam State Will Pay For Roads After Gas Tax Repeal With $2 Billion Surplus and Ending Diversion of Road Funds to Other Uses

Gov. Bill Haslam threw a soft ball over the middle of the plate to State Senator Mae Beavers (R- Mt. Juliet) about her campaign pledge to repeal the gas tax, and the recently announced GOP Gubernatorial candidate knocked it out of the park. Appearing in Nashville at one of the three ceremonial signings for the IMPROVE ACT passed by the Tennessee General Assembly this session that he signed in May, Haslam asked what he thought of Beavers’ campaign pledge to repeal the 6 cents per gallon gas tax increase and 10 cents per gallon diesel tax increase included in the new law. “If you want to repeal that, then how are you going to pay for road improvements? And are you going to take the tax cuts that we’ve made off the table, too?” Haslam asked. “That’s an easy question to answer,” Beavers told The Tennessee Star Monday afternoon. “If the Governor and legislative leadership had allowed for a full and fair discussion of road funding alternatives rather than cutting back room deals and strong arming the gas tax increase down taxpayers throats then Governor Haslam might be aware of the other alternatives available,” Beavers noted. “We can repeal…

Read the full storyDemocrats Unlikely to Get The $250 Million Education Bill For Their Yes Vote On The IMPROVE Act

House Minority Leader Craig Fitzhugh (D-Ripley) said Wednesday in both the Finance, Ways & Means Subcommittee and full Committee that he didn’t have the votes for the $250 million K-12 Block Grant Act, which was reportedly part of the deal Governor Haslam made to get needed support from the Democrats to pass his IMPROVE Act. On the morning of the House floor vote which eventually approved the IMPROVE Act, there were rumors that the Governor would appropriate $250 million for an education plan and that the Democrats, despite their expected opposition to the gas tax increase, were going to vote for it. The deal appeared successful when 23 of 25 Democrats voted in favor of the IMPROVE Act. The rumors of the quid pro quo deal were confirmed when the video of Leader Fitzhugh explaining the plan during an April 4 Education Administration & Planning Subcommittee meeting came to light. The plan, called the K-12 Block Grant Act, would take $250 million from various sources, as Fitzhugh explained, and put it in an endowment type fund from which the interest would be drawn and allocated to school systems throughout the state for non-recurring expenses. During the Finance, Ways & Means…

Read the full storyThe $250 Million Education Bill the Democrats Reportedly Want in Return for IMPROVE Act Support is Still Alive

Twenty-three of the 25 Democrats in the House voted for Gov. Haslam’s gas tax increasing IMPROVE Act last Wednesday, amid rumors of a $250 million deal made between Governor Haslam and House Minority Leader Craig Fitzhugh (D-Ripley) in a quid pro quo tradeoff: Democrats vote for the governor’s bill, the governor backs House Bill 841, sponsored by Fitzhugh, which appropriates $250 million from excess state tax revenue over-collected in fiscal years 2015-16 and 2016-17 to spend on education in the K-12 Block Grant Act. Democrats would have been expected to oppose the gas tax increase, given the many arguments that the IMPROVE Act’s tax cuts went largely to a handful of businesses, not middle class and working class voters who comprise the traditional Democratic constituency. The higher cost of living for middle class and working class voters resulting from the increased prices for food and other staples of life resulting from higher diesel taxes paid by trucking companies will likely not be offset by the small reductions in the sales tax on food. HB 841 was on the agenda for the House Finance Ways & Means Subcommittee meeting scheduled for Wednesday, April 26, but Leader Fitzhugh said the plan is…

Read the full storyBoss Doss Admits To TDOT Contract After Being Elected

For the first time, State Rep. Barry “Boss” Doss (R-Leoma), who is the House sponsor of Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017” and is serving as Chairman of the House Transportation Committee, admitted to having a contract with the Tennessee Department of Transportation (TDOT) since he was elected in 2012. The admission came during an interview with WSMV Monday, as he was attempting to refute conflict of interest charges related to his sponsorship of the IMPROVE Act “Tax Cut Act of 2017.” The potential conflict of interest, as reported by The Tennessee Star, was raised on March 27 via a letter from the Tennessee Republican Assembly (TRA) to Speaker Beth Harwell (R-Nashville) that called for an ethics investigation. Rep. Doss, serving as Chairman of the Transportation Committee and House sponsor of Governor Haslam’s IMPROVE Act with his “capability to sway the committee” or “manipulation of the rules” with the outcome of the legislative process having the potential for “direct financial impact on his business” did not meet the “Guiding Principle” of avoiding even the appearance of conflicts, TRA said. Thus far, Speaker Harwell has not responded to the request for an investigation and Doss had not commented. That was until Monday, when Rep.…

Read the full storyJeff Hartline Commentary: In Tennessee, Growing Government is the New Faux ‘Conservative’

By Jeff Hartline We hear from time to time the graying generation express “Fifty is the new Thirty” or we hear fashionistas tell us that “Red is the new Black”. In trying to piece together the policy “MOAB” that went off yesterday in the Tennessee General Assembly, we have concluded “Growing Government is the new faux ‘Conservative’ “. How so, you say? Well, for years conservatives have been hearing that all we need to get Tennessee back on track is to elect more Republicans. So, Tennessee voters did just that. In fact, the voters overachieved by electing a Republican Governor, seventy-four State Representatives (out of a possible 99) and twenty-eight State Senators (out of a possible 33). We heard “It matters who governs” and “We want to right-size government”. So, how’s that working out for conservative policy? Well, if you consider conservatism to be standing up for smaller and more limited government, more Constitutionally-focused government, less taxes, limited state spending, more efficiency, more transparency, less cronyism and focused attention on traditional family values, you have been sorely disappointed. Politically-savvy individuals realize that when you have divided government, you must be willing to compromise on issues in order to get anything…

Read the full storyNashville Mayor Megan Barry Calls Passage of Gas Tax Hike ‘A Momentous Day in Tennessee,’ Looks Ahead to Mass Transit Plan

Nashville Mayor Megan Barry has been cheering Gov. Haslam’s gas tax hike for road improvements, while keeping an eye ahead toward implementing a $6 billion transit plan. Barry pushed for Gov. Haslam’s IMPROVE Act, which includes the gas tax hike, in the hours leading up to Wednesday’s action on the bill. The bill passed in both the House and Senate. After the bill passed, Barry celebrated with this tweet: Statement on passage of the IMPROVE Act to improve infrastructure & allow local option: This is a momentous day. https://t.co/mtVkjCCePm pic.twitter.com/B30v14FQCe — Megan Barry for Congress (TN-7) (@MeganCBarry) April 19, 2017 “Our most immediate need is funding,” said Barry, a Democrat, earlier this month in an interview with WSMV Channel 4. The $6 billion transit plan, known as nMotion, was adopted last year by the board of directors of the Regional Transportation Authority. The RTA is made up of Middle Tennessee mayors and Haslam appointees. Their endorsement is nonbinding but gives the plan momentum. The proposal calls for the project to be phased in over 25 years. Funding sources are still on the drawing board but would likely include tax increases. If former mayor Karl Dean’s failed 2014 Amp rapid bus…

Read the full storyMetro Nashville School Board Member Mocks Gov. Haslam’s Letter To Students About Testing

Metro Nashville school board member Will Pinkston said this week that Gov. Haslam’s letter to students to motivate them for standardized testing “might be the dumbest thing I’ve ever seen.” Pinkston took to Twitter Monday to make his comments about the April 10 letter. This might be the dumbest thing I've ever seen. Headline: @BillHaslam Pressures Kids to Do Well on Standardized Tests. #number2pencil pic.twitter.com/2TmF8FQYcj — Will Pinkston (@WillPinkston) April 18, 2017 In attempting to strike a friendly and encouraging tone, Haslam wrote “you may feel excited or maybe a little nervous” about standardized testing and somewhat oddly compared it to a yearly visit to the doctor’s office for a check-up. Far from feeling excited about standardized testing, students and teachers alike in recent years have said testing takes up too much time and that tests are poorly written and too often address topics not covered in the curriculum, causing students to despair. Schools across the state are engaged in TNReady testing this month, trying to leave behind the problems of last year when procedural glitches forced the state Department of Education to cancel its contract with the testing vendor and find a new one for this year. Haslam’s…

Read the full storyHaslam Reduced Highway Fund Budget By 13 Percent, Grew State Budget By 20 Percent Before Proposing Gas Tax Increases

Governor Haslam reduced the Highway Fund budget by 13 percent, while he grew the State budget by 20 percent during his first six years in office. Only after he made these reductions in the Highway Fund budget did he propose the gas tax and diesel tax increases included in the IMPROVE Act when he introduced it in January 2017. From Governor Haslam’s first budget year of 2011-12 to the most recent 2016-17, Highway Fund allocations went from $867 million to $757 million, a reduction of 13 percent. HIGHWAY FUND ALLOCATIONS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated DOWN Budget $ $866,886,300 $823,104,600 $683,800,400 $792,219,800 $740,645,600 $756,856,000 -13% Sheet 54 of 656 54 of 545 54 of 542 54 of 550 54 of 558 54 of 558 Page A-22 A-22 A-22 A-22 A-22 A-22 During that same period, the state portion of the budget, excluding the unpredictable and heavily mandated federal funding, grew from $13.7 billion in 2011-12 to $16.5 billion in 2016-17, representing a 20 percent increase. STATE BUDGET IN BILLIONS OF DOLLARS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated INCREASE Billion $ $13.7 $14 $14.6 $14.8 $15.3…

Read the full storyHaslam’s IMPROVE Act Includes Same ‘Economic Development’ That Lost Millions in TNInvestco

“A performance audit from the Tennessee Comptroller’s Office has revealed the State of Tennessee has only recovered $5.3 million of its initial $200 million investment in the TNInvestco program,” according to a statement dated November 10, 2016, under the name of Justin P. Wilson, Comptroller, referring to a performance audit report. The statement from the Comptroller focused primarily on the TNInvestco program from the 60-page October 2016 “Performance Audit Report” produced by the state’s Comptroller’s office on Governor Haslam’s Department of Economic Development and Tennessee Technology Development Corporation. The Report was conducted by the Comptroller’s Department of Audit, Division of State Audit, with the report dated October 25, 2016, signed by Director, Deborah V. Loveless, CPA and addressed to The Honorable Ron Ramsey, Speaker of the Senate; The Honorable Beth Harwell, Speaker of the House of Representatives; The Honorable Mike Bell, Chair, Senate Committee on Government Operations; The Honorable Jeremy Faison, Chair, House Committee on Government Operations; and, Members of the General Assembly; and The Honorable Randy Boyd, Commissioner, Department of Economic and Community Development. At the time of the audit, the program was in in its sixth year, having been approved by the Tennessee legislature in 2009. With…

Read the full storyGovernor ‘Hot Boxing’ Legislators to Get Yes Votes on Gas Tax Increase

Governor Haslam is concerned enough about the final outcome of next week’s proposed gas tax increase vote on his IMPROVE Act “Tax Cut Act of 2017” to set up a series of private 20 minute meetings with state legislators who are on the fence. In an email sent to staff assistants of fifteen members of the Tennessee House of Representatives on Wednesday obtained by The Tennessee Star, one of the governor’s administrative assistants “requested” these targeted legislators appear in “his conference room on the first floor of the Capitol,”beginning on Thursday. The purpose of these meetings appears to be for the governor to give these state legislators the “hot box” treatment. “Hot boxing” is a method of interrogation in which the person being interrogated “is locked in a ‘hot box’ – a small, hot room,” according to List Verse. In the political world, “hot boxing” usually refers to intense one-on-one pressure applied by a powerful political figure to a less powerful political figure. The treatment is delivered in an environment totally controlled by the more powerful political figure. Its purpose is to coerce the less powerful political figure to comply with the political will of the more powerful political figure.…

Read the full storyWWTN’s Ralph Bristol Blasts Conservative State Representative Who Opposes Haslam’s Gas Tax Increase Bill

Ralph Bristol, host of Nashville’s Morning News on 99.7 FM WWTN, blasted a leading conservative Republican State Representative who opposes Gov. Haslam’s gas tax increase proposal, the IMPROVE ACT “Tax Cut Act of 2017,” on his program Thursday morning. Earlier this month, State Rep. Jerry Sexton (R-Bean Station) called on Speaker Beth Harwell (R-Nashville) “to hit the restart button in regards to the IMPROVE Act and to send the bill back to Transportation Subcommittee to be debated fairly and openly,” as The Tennessee Star reported. Bristol is no fan of Sexton or his opposition to the gas tax increase, and made that point very clear on his program Thursday. Recent developments “will hopefully bury Jerry Sexton in the graveyard of political one-hit blunders,” Bristol said near the end of a lengthy soliloquy in which he praised the current version of Gov. Haslam’s gas tax increase bill. The IMPROVE Act “Tax Cut Act of 2017,” he said, “is still, in my opinion, by far the most conservative plan on the table to increase funding for transportation in Tennessee.” Bristol also seemed eager to participate in the debate on the floor of the Tennessee House or Represenatives next week when the…

Read the full storyThe 962 Road Construction Projects Costing $10.5 Billion in The Gas Tax Increase Bill Can Be ‘Modified’ by TDOT

Governor Haslam and other administration officials have stated since announcing the IMPROVE Act , now the “Tax Cut Act of 2017,” on January 18 that the purpose of the gas and diesel tax increases included in the bill is to fund 962 needed road construction projects in all 95 counties for a price tag of $10.5 billion.

These projects, however are the seventh in priority in a list of seven things for which the additional funds raised in the bill can be used.

Read the full storyState Senator Mark Norris Accuses House Speaker Beth Harwell Of Working Covertly On Gas Tax Alternative

State Senate Majority Leader Mark Norris has accused House Speaker Beth Harwell of working behind the scenes on a plan to avoid a gas tax increase, the Chattanooga Times Free Press reports. “There’s a fine line between indecision and deception,” Norris (R-Collierville) said Thursday, who did not elaborate on his comment. On Wednesday, Rep. David Hawk (R-Greeneville) told the Budget Subcommittee that he, Harwell and others were working on alternative funding plan for Gov. Haslam’s IMPROVE Act. The amended legislation includes a gas tax hike of six cents and a 10-cent increase on diesel over the next three years, while cutting three taxes in the general fund, including the sales tax on groceries. The Tennessee Star reported Thursday that Harwell (R-Nashville) and others want to use revenues from the sales tax on new and used vehicles toward funding road projects. Harwell said details of the plan are still being finalized. Hawk’s announcement caught Republican Senate Speaker Randy McNally, Budget Subcommittee Chairman Gerald McCormick (R-Chattanooga) Gov. Haslam and others by surprise, according to the Chattanooga Times Free Press. On Wednesday, State Rep. Barry Doss (R-Leoma), chairman of the House Transportation Committee and co-sponsor of the gas tax increase proposal, presented a lengthy argument…

Read the full storySpeaker Harwell Says She Will Have a Road Funding Plan That Does Not Raise The Gas Tax

Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storyTennessee Republican Assembly Calls for Ethics Investigation of Boss Doss Over TDOT Contracts

The Tennessee Republican Assembly has asked Speaker Beth Harwell (R-Nashville) to begin an ethics investigation of the business conduct of State Rep. Barry Doss (R-Leoma), a vocal supporter of Gov. Haslam’s gas tax increase proposal, over potential Tennessee Department of Transportation (TDOT) contracts for his firm. “The Tennessee Republican Assembly (TRA) is calling upon you, Speaker Beth Harwell, to investigate a potential ethics violation by Rep. Barry Doss, who also serves as Chair of the Transportation Committee,” the organization said in a letter dated March 27 signed by its entire leadership team and hand delivered to members of the Tennessee House of Representatives on Tuesday. “Chairman Doss should have recused himself from the proceedings that could potentially have a direct financial impact on his business,” the TRA said of his oversight of the Transportation Committee as it considered the gas tax increase proposal last week. “In this role, Rep. Doss has the capability to sway the committee by means of influence or by manipulation of the rules governing the committee derived from Mason’s Manual,” the letter continued. “In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyGrover Norquist Praised Chris Christie’s Gas Tax Increase in New Jersey Before He Signed Off on Haslam’s in Tennessee

Washington insider Grover Norquist, founder of Americans for Tax Reform, praised New Jersey Gov. Chris Christie’s gas tax increase in New Jersey in 2016, a year before he claimed Gov. Haslam’s gas tax increase proposal here in Tennessee is “Taxpayer Protection Pledge compliant.” In the letter he sent to Tennessee state legislators on Monday in which he expressed support for the amended version of Gov. Haslam’s gas tax increase that passed the Senate Transportation Committee last week, Norquist also sang the praises of Christie’s earlier gas tax increase in the Garden State. “In New Jersey last year, Americans for Tax Reform supported a tax package enacted by Gov. Christie that raised the gas tax from 14.5 to 23 cents per gallon, but coupled that with a phase out of his state’s death tax, a reduction in the sales tax from 7 to 6.6%, and an increase in the earned income tax credit,” Norquist wrote. “The package, like SB 1221/HB534 was a net tax cut overall. As such, not only did ATR not oppose the deal, ATR urged lawmakers to support it,” he added. “Republican Gov. Chris Christie and the Democratic-controlled Legislature agreed to the hike because the state had run…

Read the full storyIf Mark Green Does Not Run, Mae Beavers Will Be Only Potential or Announced GOP Candidate For Governor Who Opposes The Gas Tax Increase

“Sen. Mae Beavers, R-Mt. Juliet, said she is in the early stages of a possible run at the state’s top position after the leading conservative candidate might be headed to the nation’s capitol,” the Lebanon Democrat reported on Monday. If State Senator Mark Green (R-Clarksville) becomes the next Secretary of the Army, as many insiders expect will be the case, State Senator Mae Beavers (R-Mt. Juliet) will be the only potential or announced GOP candidate for Governor who opposes the gas tax increase. “Beavers said the idea to run for governor emerged recently after several phone calls and comments from supporters, many of which she spoke with at the recent Wilson County Republican Party Convention,” the Lebanon Democrat noted. “I said on Friday I would throw out the idea and see what happens,” Beavers told the Lebanon Democrat. “Sen. Green was the most conservative candidate. A lot of people felt the need to support a candidate who shares similar views,” she added. When the State Senate Transportation Committee passed an amended version of Gov. Haslam’s Improve Act last week that raised the gas tax by 6 cents per gallon rather than 7 cents per gallon, Beavers was the sole no…

Read the full storyGrover Norquist’s Endorsement of Gov. Haslam Gas Tax Increase Backfires

Gas tax increase supporters initially believed they had scored a great political coup on Monday when Washington insider Grover Norquist, founder of Americans for Tax Reform (ATR), declared his support for the amended version of Gov. Haslam’s IMPROVE Act that passed the Senate Transportation Committee last week. That amended version reduced the proposed gas tax increase from 7 cents per gallon to 6 cents per gallon. But the fierce backlash from conservative opponents of the gas tax increase in Tennessee to the last minute attempt by supporters of the governor’s plan to bolster its chances by calling in a “celebrity ” who has never lived in the state and knows little of the intricacies of the bill or the state’s budget, spells more, rather than less, political trouble ahead for the governor and his allies. “The recent amendments made by the Senate, and supported by Gov. Haslam, have improved the bill to the extent that the bill is now a net tax decrease, and thus not a violation of the Taxpayer Protection Pledge…ATR scores the amended version of SB 1221 / HB 534 as a net tax cut and therefore Taxpayer Protection Pledge compliant,” Norquist wrote “in a memorandum to…

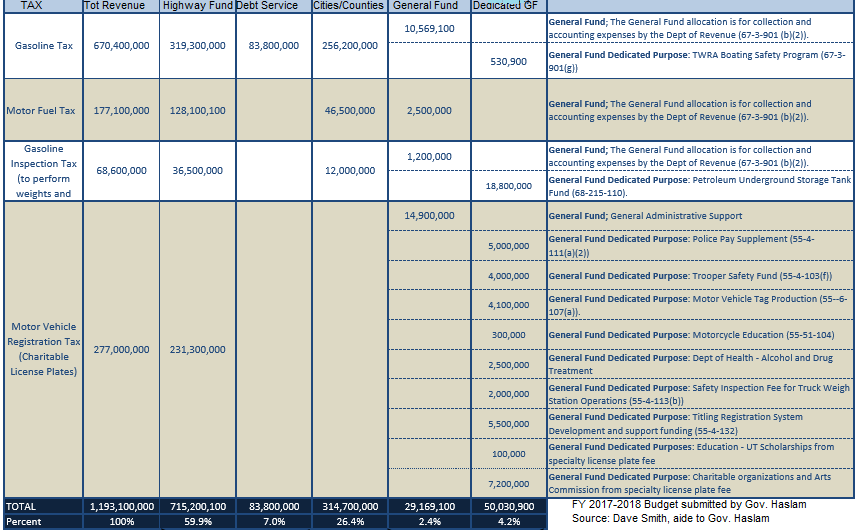

Read the full storyGov. Haslam Admits Up to $70 Million of Gas Taxes Can Be Spent on Mass Transit by Cities and Counties

A spokesperson for Gov. Haslam has admitted that up to $70 million of highway user fees collected by the State of Tennessee, primarily from gas taxes, can be spent on mass transit in the FY 2017-2018 budget. In that budget, which he transmitted to the Tennessee General Assembly on January 30 of this year, Gov. Haslam estimates that $314.7 million of the $1.2 billion in highway user fees the State of Tennessee will collect in the upcoming fiscal year will be given to cities and counties. Those “Funds may be expended by municipalities receiving the funds for the purpose of funding mass transit systems,” Gov. Haslam’s top aide, Dave Smith, says in an email statement provided to The Tennessee Star by 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News. “No more than 22.22% of the funds may be used for the purpose of funding mass transit,” Smith continues, citing Tennessee Code Annotated § 54-4-203-204. “No more than 22.22% of county funds may be expended for the purpose of funding mass transit,” Smith adds, citing Tennessee Code Annotated § 54-4-103. The total amount cities and counties may expend “for the purpose of funding mass transit” in FY 2017-FY 2018 under the budget…

Read the full storyMetro Transit Authority CEO Steve Bland Asks Nashville Mayor Megan Barry for $85 Million Increase in Capital Budget

“The Metro Transit Authority asked Nashville Mayor Megan Barry for a 427 percent capital budget increase on Monday,” Fox 17 WZTV reports. MTA’s request for this quadrupling of its capital budget comes as the Tennessee General Assembly is debating Gov. Haslam’s IMPROVE Act proposal, which would increase gas taxes by 7 cents per gallon and diesel taxes by 12 cents per gallon. As The Tennessee Star reported earlier this week, in FY 2015-2016, highway user fees, primarily gas and diesel taxes, generated $1.2 billion in revenue for the State of Tennessee. $309 million of these highway user fees were given by the State of Tennessee to cities and counties for “transportation” projects: The Haslam administration has not, as of yet, presented evidence that all of the $309 million in highway user fee taxes sent to city and county governments for “transportation” projects is spent on road construction. “The money in the cities and counties column is their share of the collected taxes,” State Rep. Lynn asserted in her email to a constituent. It is at present unknown how much of these $309 million in highway user fee taxes sent to city and county government is spent on projects such as parks,…

Read the full storyHigh Noon: Steve Gill and Ralph Bristol Debate the Gas Tax on WWTN Tomorrow

Steve Gill and Ralph Bristol will debate the merits of Gov. Haslam’s proposed gas tax increase on 99.7 FM WWTN’s Dan Mandis Show tomorrow (Wednesday) at noon. Gill, the former Nashville talk radio host who led the successful opposition to Gov. Sundquist’s proposed state income tax in 2000-2002, is opposed to Haslam’s proposal to increase the gas tax by 7 cents per gallon as well as any other kind of tax increase. Bristol, the host of Nashville’s Morning News on 99.7 FM WWTN, said in testimony before the State Senate Transportation Committee on Februrary 27, “It is my humble, but considered opinion that Governor Haslam has almost presented a thoughtful, responsible plan that preserves the integrity of an admirable and enviable tax system . . . and that his plan adequately addresses a real need that has always been considered so sacred that it deserved special protection, even from economic downturns that affect the rest of the people’s purse.” “I do not support the Governor’s plan, as is, because I don’t believe it is the revenue neutral plan it advertises itself to be,” Bristol stated in his testimony But the bottom line for Bristol, he concluded in his testimony, is that “Governor Haslam’s…

Read the full storyFifty Leading Tennessee Conservatives Send Open Letter to State Legislature Opposing Gas Tax Increase

Fifty leading Tennessee conservatives have sent an open letter to the Tennessee General Assembly opposing Gov. Haslam’s proposed IMPROVE Act, which includes a 7 cents per gallon gas tax increase and a 12 cents per gallon diesel tax increase. The letter was released Tuesday morning, on the same day the House Transportation Committee is scheduled to vote on the IMPROVE Act. Conservative political strategist Steve Gill noted: “The names on this letter should raise concerns among Republican legislators. These are the exact types of conservative political activists who run in Republican primaries, recruit others to run in Republican primaries, and help those who run in Republican primaries.” Gill said that a gas tax increase, if passed, will likely be THE issue in 2018 Republican primary races. “Voters will essentially have a referendum to repeal the tax by replacing those who voted for it with those who will vote to repeal the tax increase,” Gill noted. “The mail pieces and radio adds against the tax increasers almost write themselves.” Another Republican political consultant pointed out the ideological impact of the current internal policy battles in the Republican Party at the state and national level. “The Ryan Obamacare-lite plan may expand the…

Read the full storyGas Tax Apologists Unable to Explain Why the 15 Percent of User Fees Diverted From Highway Fund is Not Spent on Road Construction

At least 15 percent of the $1.2 billion in highway user fees collected by the state of Tennessee in FY 2015-2016–$189 million– was diverted away from road construction (see page A-65 of The Budget: State of Tennessee, Distribution of Actual Revenue by Fund, FY 2015-2016). Under Gov. Haslam’s proposed FY 2017-2018 budget, virtually the same amount of highway user fees–$187 million–will continue to be diverted away from road construction. (see page A-67 of The Budget: State of Tennessee, Distribution of Estimated Revenue by Fund, FY 2017-2018). FY 2015-2016 is the most recent year for which actual expenditures are available. Throughout the public debate over the past two months about Gov. Haslam’s proposed IMPROVE Act, which includes a gas tax increase of 7 cents per gallon, apologists for a gas tax increase–including House Transportation Committee Chairman Barry Doss (R-Leoma), House Senate Transportation Chairman Paul Bailey (R-Sparta), and 99.7 FM WWTN radio’s Ralph Bristol, host of Nashville’s Morning News–have yet to answer one key question about the state’s budget priorities: With a $1 billion surplus in the state budget, why do you support a gas tax increase when much of the purported road construction shortfall could be addressed by simply re-allocating the $187…

Read the full storyState Rep. Susan Lynn: ‘I Am Not For The Gas Tax So There Is Nothing To Debate’

“No, I am not for the gas tax so there is nothing to debate,” State Rep. Susan Lynn (R- Mount Juliet) tells The Tennessee Star in response to challenger Jeremy Hayes’ March 8 press release calling on her to debate him over the issue. Hayes opposes Gov. Haslam’s proposed gas tax increase. In a February 28, 2017, exclusive interview with The Star, Hayes announced his run for the 57th House District in the 2018 Republican primary, citing Lynn’s support for Gov. Haslam’s gas tax increase proposal. “Thank you for giving me the opportunity to clear up this untruthful rhetoric,” Lynn responded to Hayes’ challenge in an email sent to The Star, adding: I have never voted for a tax increase and I have voted to lower our taxes many times. It is my responsibility as the representative for the 57th district to present facts, hear ideas and to create opportunities for constituents to discuss policy. While some lawmakers are shying away from holding Town Hall meetings – I have held seven since January and I will hold more on this topic and others. This individual worked for my democrat opponent – his integrity on this and other matters is entirely suspect. I’d…

Read the full storyHouse Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyHaslam’s IMPROVE Act Forced Through House Subcommittee in Rare Political Power Play as Speaker Pro Tem Brought in To Break Tie

Through a series of political maneuvers, Gov. Haslam’s IMPROVE Act has advanced from the House Transportation Subcommittee to the full House Transportation Committee, thanks to the rare tie-breaking vote cast by Speaker Pro Tem State Rep. Curtis Johnson (R-Clarksville). Johnson was brought in at the last minute to the House Transportation Subcommittee Wednesday afternoon to break a 4 to 4 tie. With Johnson’s yes vote, the IMPROVE Act passed on a 5 to 4 vote. Subcommittee members voting yes on the amended IMPROVE Act bill were State Rep. Barry Doss (R-Leoma), who also serves as chairman of the full House Transportation Committee, State Rep. David Alexander (R-Winchester), State Rep. Sam Whitson (R-Franklin), and State Rep. Barbara Cooper (D-Memphis). Subcommittee members voting no on the amended IMPROVE Act bill were State Rep. Terri Lynn Weaver (R-Lancaster), chairman of the Transportation Subcommittee, State Rep. Courtney Rogers (R-Goodlettsville), State Rep. Jerry Sexton (R-Bean Station), and State Rep. John Mark Windle (D-Livingston). The next stop for the IMPROVE ACT is the full House Transportation Committee, chaired by Haslam ally and gas tax advocate Doss. The version of the IMPROVE ACT that passed was amended to remove the gas tax increase originally proposed by the governor.…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyRalph Bristol Testifies Before State Senate Transportation Committee on Gas Tax Increase Proposal

At the invitation of Chairman State Sen. Paul Bailey, 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News, testified before the State Senate Transportation Committee on Monday afternoon about Gov. Haslam’s proposal to pay for additional road construction funding by increasing the state’s gas and diesel tax. Bristol provided The Tennessee Star with this summary of his prepared statement, which he authorized us to release after 1:30 p.m. today, when he was scheduled to deliver his testimony. Here is the complete final draft of his prepared statement, as provided to The Star late Monday morning: Testimony to Senate Transportation Committee (final draft) By Ralph Bristol, host, Nashville’s Morning News, 99.7 WTN (approx. 7:00) I’ll try to honor Chairman Bailey’s request to share a summation of my radio audience’s response, over the past few months, to the proposals before them, including, but not limited to the governor’s, to increase transportation funding, and to offer my own insight, however limited value that might have. First, understand that I understand my audience is not representative of all of Tennessee. Nor, might I add, are the fans of of the Tennessean or the Memphis Commercial Appeal, but I digress. People who listen to…

Read the full storyGov. Haslam Has Cut State’s Portion of Highway Fund Budget by $56 Million Annually, Compared to Predecessor

During the six years he has served as the head of Tennessee’s state government, Gov. Haslam has cut the state’s portion of the Highway Fund budget by an annual average of $56 million when compared to his predecessor, Gov. Phil Bredesen. In the last six years of Gov. Phil Bredesen’s eight-year term, between FY 2005-06 and FY 2010-11, the annual average state allocation to the Highway Fund was $833 million. While the actual dollars fluctuated from year to year, overall the Highway Fund budget grew about 12 percent in those six years. Under Gov. Haslam, the state’s portion of the Highway Fund budget shrank to an annual average of $777 million during the six years between FY 2011-12 and FY 2016-17. That is an average annual reduction of $56 million, an overall reduction of 7 percent. The total Highway Fund grew 2 percent per year under Gov. Bredesen, and has been reduced 1.1 percent per year by Gov. Haslam. In that same six-year period, Gov. Haslam’s total state budget grew 18 percent. “The detailed breakdown of reduction in road spending under Governor Haslam is shocking but, unfortunately, not surprising,” State Sen. Mae Beavers (R-Mt. Juliet) tells The Tennessee Star. “I…

Read the full storyHaslam Gas Tax Hike Opponents Gather at ‘Tank the Tax’ Rally Set for Wednesday

As the Haslam IMPROVE Act plan to increase fuel taxes returns to the Transportation Subcommittee on Wednesday March 1, Americans for Prosperity and other activists plan to “turn up the heat” by gathering at Legislative Plaza to express opposition to the proposed tax increases. The Transportation Subcommittee, Chaired by Rep. Terri Lynn Weaver (R-Lancaster), is scheduled to meet at noon. Andy Ogles, Tennessee Director of Americans for Prosperity, said that activists will be coming from across the state to express opposition to the proposed tax increases. “Once taxpayers realize that the huge tax increases proposed by the Governor are coming when we have a TWO BILLION DOLLAR SURPLUS their reaction to the plan becomes almost a unanimous ‘NO’ and they can’t understand why their elected officials are even entertaining the idea,” Ogles noted. “The only way the Haslam Plan passes is if their supporters successfully hide the truth about what the plan actually means to the wallets of working men and women in Tennessee. To stop it, we simply need to get the truth out and encourage taxpayers to get engaged in this fight.” Ogles also expressed concern about the glaring absence of conservative leadership in the Legislature on this issue.…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyPure Foods Goes Bankrupt After Benefiting From $1.2 Million in Tennessee State Economic Development Funds

Less than two weeks before Governor Haslam introduced his IMPROVE Act centered on a gas tax increase for road funding, Pure Foods, Inc., a recipient of $1.2 million in state economic development funds, filed for bankruptcy. The $1. 2 million from the state’s FastTrack Economic Development (ED) Fund did not go directly to Pure Foods. Instead, it was allocated for use by KEDB for construction of a speculative building that Pure Foods leased for 10 years. According to the Kingsport Tennessee Times News, in March 2015, the Canadian based gluten-free snack food company, Pure Foods, Inc., was set to establish its U.S. headquarters at the Gateway Commerce Park in Kingsport, Sullivan County. The deal included an investment of $22 million, an 80,000-plus square foot facility, and the creation of 273 new jobs generating an annual a payroll of $8 million. The Kingsport Economic Development Board (KEDB) and the Kingsport Chamber of Commerce also supported the project by providing financial assistance and various incentives, including the purchase of 33 acres of land in the Gateway Commerce Park for $6.5 million borrowed from First Tennessee Bank. According to the Transparent Tennessee website’s FastTrack Project Database, ED grants provide additional support for…

Read the full storyGov. Haslam Gets Tough Questions From Informed Crowd at Franklin County Gas Tax Town Hall

Governor Haslam appeared nervous and off his game Monday night, as he was peppered with questions he could not answer at a “gas tax town hall” tour stop at the Franklin County Annex Building in Winchester. After giving 30 minutes of opening comments to the standing-room-only crowd of about 150 people, the governor opened the meeting up to questions and was challenged for the next 45 minutes with more than two dozen questions critical of his proposal to raise fuel taxes. The first questioner contrasted the 7 cents per gallon gas tax and 12 cents per gallon diesel tax increase with the half-percent reduction in the grocery sales tax contained in the governor’s plan. The questioner pointed out that the two things that have strapped everyone are groceries and fuel. The fuel tax increases will offset any grocery tax savings, the questioner stated. The governor then went through his math to assert that his proposal represents a 4 cent increase per $100 purchased in diesel fuel, but the man who posed the question found that arithmetic unsatisfying. He sat down, shaking his head. County Commissioner Dave Van Buskirk asked if the money will only go to roads. Gov. Haslam said…

Read the full storyBREAKING: Gov. Haslam Claims ‘There Have Not Been Any Other Alternatives Proposed’ To His Gas Tax Increase

“Gov. Bill Haslam did not acknowledge the multiple alternatives to his proposed gas tax increase that legislators have introduced in the statehouse during an interview with Knoxville media Friday,” WBIR TV reports. “There have not been any other alternatives proposed. No one else has laid out a plan and said ‘This is how we’re going to pay for it,’” WBIR reports Haslam stated when asked about alternative plans to fund road construction, such as The Hawk Plan, which would provide that funding by reallocating 0.25 percent of the current sales tax. “He’s very aware of other plans,” State Rep. David Hawk (R-Greeneville), author of The Hawk Plan, told WBIR: Hawk said he has discussed his plan with Haslam of taking one-quarter of one percent of sales tax revenue to create a recurring dedicated fund to address transportation needs long-term. Rep. Jason Zachary of Knoxville said his constituents are pushing him to find an alternative to a tax increase by pointing out the state is sitting on a $1 billion dollar budget surplus and another $1 billion surplus is projected for this year. He has proposed allocating a quarter of any state surplus money over $5 million each month to TDOT.…

Read the full storyGov. Haslam to Hold ‘Town Hall’ on Gas Tax Increase Monday in Winchester

Gov. Haslam will “hold a town hall meeting on proposed gas tax increase” on Monday, February 20, at 6:00 pm in Winchester, the Franklin County seat, the Winchester Herald Chronicle reports: Gov. Bill Haslam will be in Franklin County Monday to discuss his plan for a 7 cent tax increase per gallon on gasoline and 12 cents on diesel to go toward roadway improvements. The meeting will be held at 6 p.m. at the Franklin County Annex Building [located at 855 Dinah Shore Blvd. in Winchester, 90 miles southeast of Nashville]. The purpose of the event, which is open to the public, is to provide a forum on a plan focusing exclusively on increasing much-needed funding to repair and maintain safe highways and bridges throughout Tennessee. Haslam has also proposed that sales tax be reduced on food products. Curiously, the governor’s website makes no mention of the event, which the Herald Chronicle calls “a town hall” in its headline, but which sounds more like another stop in the governor’s promotional tour for his proposed 7 cents a gallon gas tax. Typically, a town hall on a particular public policy topic is an open discussion of all possible solutions on that…

Read the full storyGov. Haslam Stumbles in Smith County: ‘The Only Reason Government Exists At All Is to Buy Things for the People That They Can’t Buy for Themselves’

“The only reason government exists at all is to buy things for the people that they can’t buy for themselves,” Gov. Haslam told the Smith County Rotary Club on Friday as he continued to promote his proposal to increase the gas tax by 7 cents per gallon. You can hear the governor say this at the 16:50 mark of this video, made available courtesy of The Smith County Insider. Social media across Tennessee lit up Friday and Saturday criticizing Haslam’s articulation of the classic Democrat view of the role of government. It was a statement of the sort Franklin Delano Roosevelt, Lyndon Johnson, and Hubert Humphrey would have been delighted to claim as their own. Former State Rep. Joe Carr captured the reaction of many opponents to this surprising Haslam statement on his Facebook page. “Wrong! The reason government exists is to ‘secure our unalienable Rights granted to us by God’”, the former State Rep. posted. “I am sure Governor Haslam actually believes this statement along with 90% of the Tennessee General Assembly,” Carr added. Gov. Haslam may not be aware of just how tone-deaf this statement sounds. It is a lightning rod to those who see his proposed gas…

Read the full storyEXCLUSIVE Grassroots Pundit Interview With Sponsor of Hawk Plan to Fund Roads by Reallocating Sales Tax

In an exclusive interview with The Tennessee Star’s Grassroots Pundit, Laura and Kevin Baigert, on Capitol Hill Wednesday, State Rep. David Hawk (R-Greeneville) explained the details of his increasingly popular Hawk Plan to fund additional road construction by reallocating 0.25 percent of the state’s 7 percent sales tax. “We’ve had substantial over collections over the last two and a half years and looking at a third year in a row where we’re over collecting franchise and excise tax, over collecting sales tax collections. Saying that, there’s more money coming in than we had budgeted. Substantially more,” Hawk noted. Several estimates place the current annual surplus at about $950 million. Hawk explained that the 0.25 percent he wants to allocate comes from the 1 percent of the current 7 percent sales tax that is not specifically dedicated to particular state programs. “I found that the last time the legislature increased the sales tax in Tennessee it went from 6 percent to 7 percent in 2002,” Hawk told the Baigerts. ‘Those dollars [collected with that extra 1 percent added to the sales tax that year] were largely unaffiliated,” Hawk explained. “The 6 percent below had strings attached to them,” he continued. “There…

Read the full storyGov. Haslam Defends His Gas Tax Proposal on Nashville’s Morning News With Ralph Bristol

Gov. Haslam appeared on 99.7 FM WWTN’s Nashville Morning News with Ralph Bristol on Thursday to defend his controversial proposal to increase the gas tax by 7 cents per gallon (from 21 cents to 28 cents) to fund more road construction. His proposal also increases the diesel tax by 12 cents per gallon (from 18 cents to 30 cents). Haslam specifically took aim at the increasingly popular alternative to his proposal, the Hawk Plan, which would fund road construction by reallocating 0.25 percent of the 7 percent state sales tax from the general fund to road construction. “Your main opposition to the alternative to your plan, the Hawk Plan . . . is that that would shift the burden for paying for our roads and bridges from out-of-state users of the roads to Tennesseans unrelated to their road usage. Do you have any way to quantify that balance now and how much shift this would produce?” Bristol asked. “We’re in the process of doing that. I think it’s safe to say that the increase I’m proposing for fuel that half of that would come from either out of state automobile drivers or trucking companies,” Haslam told Bristol. “That’s actually not…

Read the full storyGov. Haslam Proposes Free Community College For ‘All Adults’ in State of the State Address

Gov. Haslam proposed free community college for “all adults” in his State of the State address last Monday “I am proposing that Tennessee become the first state in the nation to offer all adults access to community college free of tuition and fees,” Haslam said: Just like the Tennessee Promise, Tennessee Reconnect will provide last-dollar scholarships for adult learners to attend one of our community colleges for free – and at no cost to the state’s General Fund. With the Reconnect Act, Tennessee would be the first in the nation to offer all citizens – both high school students and adults – access to a degree or certificate free of tuition and fees. No caps. No first come, first served. All. Just as we did with Tennessee Promise we’re making a clear statement to families with Reconnect: wherever you might fall on life’s path, education beyond high school is critical to the Tennessee we can be. We don’t want cost to be an obstacle anyone has to overcome as they pursue their own generational change for themselves and their families It was unclear if by “all adults” he intended to include illegal aliens currently residing in the state. In the…

Read the full storyGrassroots Pundit: Sumner County’s Role in the Governor’s Gas Tax Increase Story

The story of the Governor’s proposed gas tax increase introduced on Wednesday was being written for nearly two years in Sumner County. The most recent chapter was added with the attendance of County Executive Holt and Jimmy Johnston of Forward Sumner, the county’s hired provider of economic and community development services, at the Governor’s press conference Wednesday. In preparation for the budget year that runs July 1 to June 30, the Sumner County Budget Committee holds several workshop-like sessions in April and May to review all of the required and requested budget line items. This was the case in 2015, the first budget to be set after the 24% property tax increase. As an outcome of a Highway Commission meeting, an additional $100,000 was proposed for the Highway Department. The proposal came out of the Highway Commission to address the poorly received stoppage of brush pick up, especially in light of the considerable property tax increase. Initially, the $100,000 was added to the proposed 2015-16 budget. But, then at the Budget Committee meeting of June 8, 2015, after County Executive Holt made the argument that funding to the Highway Department would have to be maintained in the future, it was…

Read the full story