In the hotel where Abraham Lincoln kicked off his Civil War presidency, and Dr. Martin Luther King Jr. refined his most famous speech, dozens of organizations gathered this week with a common goal: to forge a historic coalition that would catapult conservatives to the forefront of early voting and election lawfare and expand their movement to Hispanics, Asians, union workers, and African-Americans fleeing the Democratic Party.

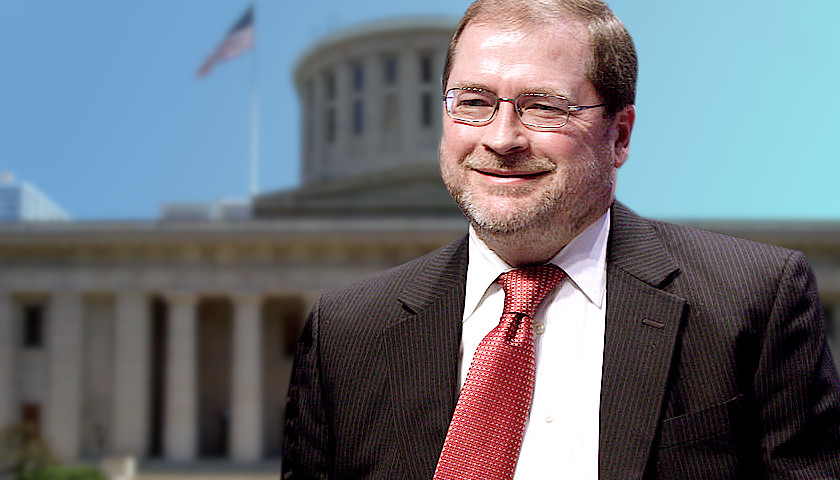

Read the full storyTag: Grover Norquist

Governor Tony Evers Can’t Be Bothered With Issuing Ronald Reagan Day Proclamation

The Ronald Reagan Legacy Project has again asked for all governors to proclaim Feb 6. Ronald Reagan Day in honor of the 40th president’s birthday. Once again, Gov. Tony Evers has refused to do so.

The liberal governor, however, has been glad to issue all manner of proclamations celebrating everything from Tamil Language and Heritage Month to Transgender Day of Remembrance.

Read the full storyNorth Carolina, North Dakota, Among States Phasing Out Income Tax

Americans in search of economic freedom and opportunity are flocking to Florida, Tennessee and Texas, and at least part of the attraction is that these three states, along with six others (Alaska, Nevada, South Dakota, Washington, Wyoming and New Hampshire), don’t levy an income tax.

Other states may soon follow.

“There are 10 states that are in the process of moving their personal income tax to zero,” President of Americans for Tax Reform Grover Norquist said on the John Solomon Reports podcast.

Read the full storyExpert Says Restaurants and Barber Shops Are the Real IRS Targets

Grover Norquist, founder of Americans for Tax Reform, said on Fox News Tuesday that the expanded Internal Revenue Service wouldn’t just go after billionaires and large corporations.

“They are targeting people that they keep telling us they think are – restaurants and barber shops and so on,” Norquist told “America Reports” guest host Gillian Turner. “That’s their target, and we know this because every single Democrat in the Senate voted against, to defeat an amendment which said this law will not allow any increase in audits on people making less than $400,000 a year.”

Read the full storyExclusive: Grover Norquist Previews Biden’s SOTU for The Star News Network

Washington, D.C.– The Americans for Tax Reform president told The Star News Network that President Joseph R. Biden Jr. has an uphill battle when he gives his State of the Union Address to a joint session of Congress here.

“Because his polling numbers are down, because people blame him for inflation and blame him for energy costs, he needs to redirect the entire discussion between now and the election,” said Grover Norquist, the Massachusetts resident, who founded ATR in 1985 at the personal request of President Ronald W. Reagan, so that the conservation movement would have an organization on-call to fight against tax increases and for tax cuts.

Read the full storyNorquist: Perdue’s Promise to End Georgia’s Income Tax Part of Trend in Red States

WASHINGTON, D.C.-The founder and president of Americans for Tax Reform (ATR) praised David A Perdue Jr.‘s pledge to eliminate the state’s income tax in an exclusive interview with The Georgia Star. “His coming out and saying: ‘Let’s phase down to zero,’ is helpful because we’re seeing this in other states,” said Grover Norquist, who started ATR in 1985 at the personal request of President Ronald W. Reagan. “Where either the preferred candidate or the incumbent candidate says: ‘I’m going to take this out,’ or somebody else does,” he said. “In fact, I did not know Perdue was introducing himself with that issue, but that is a huge advantage because he’s not relitigating 2020,” said the Massachusetts native. “He’s looking forward–phasing out the income tax is a forward-looking thing.” “I would project that all red states will, over the next five years, have Republican governors who will say it is our goal to get to zero,” he said. “Doesn’t mean tomorrow, but our goal is to get to zero, which means every year there’s a budget.” When Perdue announced his challenge to Gov. Brian P. Kemp this month for the GOP gubernatorial nomination in the May 24 primary, the former…

Read the full storyHistoric Income Tax Overhaul Reduces Burden by 13 Percent for Most Arizonans

Arizona Governor Doug Ducey is expected to sign a budget bill the Arizona Legislature sent to him on Friday that includes a historic tax reform package. HB 2900 implements the lowest flat tax in the country, 2.5%. The average Arizona family will see a 13% income tax reduction, about $350 per year. According to the nonpartisan Tax Foundation, Arizona previously had one of the highest marginal income tax rates in the country.

The budget bill also eliminates taxes on veterans’ retirement pay and prevents a 77% increase on small business taxes. It reduces property taxes by 10% on small businesses and job creators by 10%, capping the maximum tax rate on businesses at 4.5% and reducing commercial property taxes. According to a report by Ducey, 43% of Arizonans in the private sector work for small businesses. HB 2900 increases the homeowner’s rebate so the state covers half of homeowners’ primary property taxes.

Read the full storyGrover Norquist: Chattanooga’s EPB Will Take 680 Years to Break Even

Grover Norquist cited Chattanooga’s Electric Power Board this week as an example of why the government should not run broadband to compete against private Internet Service Providers.

Read the full storyAmericans for Tax Reform Urges Ohio to Reject ‘Straight-Up’ Gas Tax Increase

Grover Norquist, President and Founder of the nationally recognized Conservative taxpayer advocacy group Americans for Tax Reform (ATR), implored Ohioans Friday to reject the “straight up” gas tax currently being considered by the Ohio Legislature. In an open letter, Norquist warned; A gas tax hike does the greatest harm to households who can least afford it. Coupled with gas tax prices that have been creeping up in Ohio, a gas tax hike would have especially adverse effects on the state’s lower income earners. Additionally, the 2003 gas tax increase failed to meet revenue projections. Also consider that a state gas tax increase would counteract the benefits of federal tax reform and eat into Ohio taxpayers’ federal tax cut savings. This is one of the reasons why Congress has declined to raise the federal gas tax, despite pressure for them to do so. The bill has been a source of significant controversy, forcing a schism between many Ohio Republican legislators and the Ohio Republican Governor, Mike DeWine. While there is an overwhelming consensus that something must be done to address the rapidly decaying roads and bridges in Ohio, how best to fund these repairs is still up for debate. When DeWine first introduced House Bill 62 (HB…

Read the full storyGrover Norquist: Renegade Senators Won’t Hold Up Senate Tax Bill

Rep. Bradley Byrne (R-Ala.) cheered of a $1.5 trillion tax cut, but he was feeling as much trepidation as elation knowing his party’s No. 1 domestic policy goal is now in the hands of the fickle Senate. Byrne was blunt in the statement he released after the 227-205 vote. “I truly hope the Senate does not…

Read the full storyGrover Norquist Praised Chris Christie’s Gas Tax Increase in New Jersey Before He Signed Off on Haslam’s in Tennessee

Washington insider Grover Norquist, founder of Americans for Tax Reform, praised New Jersey Gov. Chris Christie’s gas tax increase in New Jersey in 2016, a year before he claimed Gov. Haslam’s gas tax increase proposal here in Tennessee is “Taxpayer Protection Pledge compliant.” In the letter he sent to Tennessee state legislators on Monday in which he expressed support for the amended version of Gov. Haslam’s gas tax increase that passed the Senate Transportation Committee last week, Norquist also sang the praises of Christie’s earlier gas tax increase in the Garden State. “In New Jersey last year, Americans for Tax Reform supported a tax package enacted by Gov. Christie that raised the gas tax from 14.5 to 23 cents per gallon, but coupled that with a phase out of his state’s death tax, a reduction in the sales tax from 7 to 6.6%, and an increase in the earned income tax credit,” Norquist wrote. “The package, like SB 1221/HB534 was a net tax cut overall. As such, not only did ATR not oppose the deal, ATR urged lawmakers to support it,” he added. “Republican Gov. Chris Christie and the Democratic-controlled Legislature agreed to the hike because the state had run…

Read the full storyGrover Norquist’s Endorsement of Gov. Haslam Gas Tax Increase Backfires

Gas tax increase supporters initially believed they had scored a great political coup on Monday when Washington insider Grover Norquist, founder of Americans for Tax Reform (ATR), declared his support for the amended version of Gov. Haslam’s IMPROVE Act that passed the Senate Transportation Committee last week. That amended version reduced the proposed gas tax increase from 7 cents per gallon to 6 cents per gallon. But the fierce backlash from conservative opponents of the gas tax increase in Tennessee to the last minute attempt by supporters of the governor’s plan to bolster its chances by calling in a “celebrity ” who has never lived in the state and knows little of the intricacies of the bill or the state’s budget, spells more, rather than less, political trouble ahead for the governor and his allies. “The recent amendments made by the Senate, and supported by Gov. Haslam, have improved the bill to the extent that the bill is now a net tax decrease, and thus not a violation of the Taxpayer Protection Pledge…ATR scores the amended version of SB 1221 / HB 534 as a net tax cut and therefore Taxpayer Protection Pledge compliant,” Norquist wrote “in a memorandum to…

Read the full story