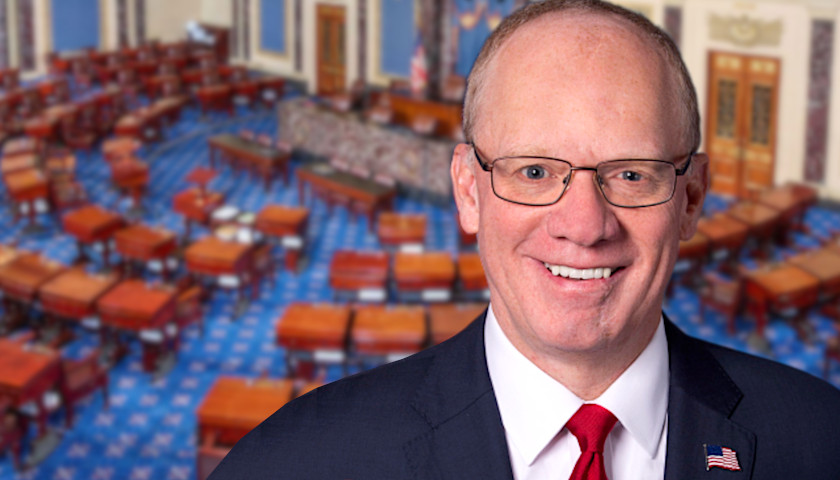

Amid rising concerns about the liberal political agenda driving environmental, social and governance (ESG) investment decisions at the expense of retirement income, U.S. Representative Zach Nunn (R-IA-03) has introduced the “Protecting Retirees’ Savings Act.”

The bill, according to proponents, will help eliminate conflicts of interest for financial managers that cost investors by lowering investment returns.

Read the full story