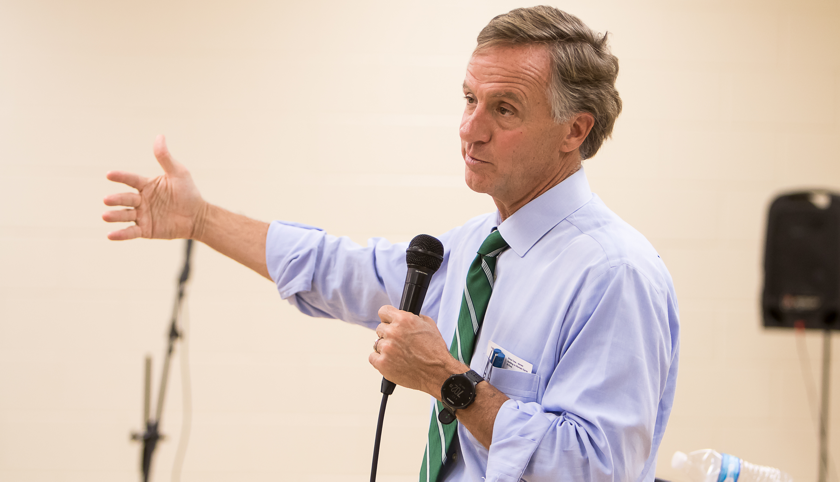

NASHVILLE, Tennessee–Kicking off his campaign for governor Monday, Bill Lee described himself as a Ronald Reagan-admiring fiscal and social conservative whose leadership experiences in business and agriculture compensate for his lack of political experience. Lee, who is chairman of Lee Company, a large family-owned construction, facilities and home services company, is casting himself as a conservative outsider in the race for the Republican nomination. However, Lee’s hesitant position on Gov. Haslam’s gas tax increase, which has passed both the House and Senate, is likely to disappoint conservatives who want candidates with a stronger anti-tax stance. “I’m opposed to raising taxes,” he told the media Monday morning at the Nashville Farmers’ Market, but he did not offer a definitive opinion on the gas tax increase. He said he might have handled it differently, but noted that the IMPROVE Act also included tax cuts and said the bill is “water under the bridge now.” When pressed, he said that because he wasn’t privy to all the legislative discussions surrounding the bill, he didn’t want to comment further. (You can hear the audio below.) Lee was set Monday to launch his “95 Counties, 95 Days RV Tour” with his wife Maria, a…

Read the full storyTag: IMPROVE Act

6 Things Boss Doss Got Wrong In His Sales Pitch For Governor Haslam’s Gas Tax Increasing IMPROVE Act

As the House sponsor of the IMPROVE Act Tax Cut Act of 2017 (HB 534), State Rep. Barry “Boss” Doss (R-Leoma) was well versed on all of the related subject matter and respectful throughout his long and challenging sales pitch for Governor Haslam’s IMPROVE Act to the various committees and on the House floor. There were, however, several things Rep. Doss got wrong. And, as former Majority Leader Gerald McCormick (R-Chattanooga) said several times through the process, “You can have your own opinions, but you can’t have your own facts.” Here are the top six things Boss Doss got wrong: 1. “I’ve been proud that we cut taxes by $300 million so far.” The state portion of the annual budget has grown from $13.7 billion in 2011-12 to a recommended $16.5 billion for 2017-18. Since state law requires that all of the revenues be allocated, that’s a $2.8 billion, or 20 percent, increase in state spending in just six years. 2. The average family of 4 will recognize a monthly increase of $5.54 from the gas tax hike versus a savings in their food tax of $7.72, for a net savings of $2.18 per month. In terms of the…

Read the full storyHouse Republican Conservatives Put Up a Valiant Fight Against Gov. Haslam’s Gas Tax Increase, Setting Stage for 2018 Election

When the Tennessee House of Representatives passed Governor Haslam’s gas tax increase bill by a 60 to 37 margin on Wednesday, a bare majority of Republicans–37 for and 35 against—voted yes in favor of the unpopular tax increase. The 35 conservative Republicans who stood for the foundational principle of limited government were not sufficient to withstand the huge financial and political pressures mounted by the special interests who wanted the bill to pass. Those forces arrayed against the conservative opposition were significant, beginning with Governor Haslam’s taxpayer funded statewide tour that promoted a 962 road project list in all 95 counties, the support of lobbying groups numbering in the thirties, tax reductions for a select group of businesses, and a reported $250 million taxpayer funded deal for the Democrats. These conservatives lost the battle in 2017, but the war for the Tennessee General Assembly election in 2018 has just begun. The arguments made by these 35 stalwarts on the floor of the House on Wednesday will resonate throughout the state over the next year and a half. The process through the House subcommittees and committees was not without controversy including the make up of the Transportation Committee, procedural issues, breaking…

Read the full storyHaslam Bargained with Democrats and Establishment Republicans to Pass Gas Tax Increase Bill

Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017” (HB 534), which includes a 6 cents per gallon gas tax increase and a 10 cents per gallon diesel tax increase phased in over three years, garnered 23 votes from Democrats and 37 establishment Republicans, which was more than sufficient to get it to pass in the Tennessee House of Representatives by a vote of 60 to 37 late Wednesday. It was a long day for State Rep. Barry “Boss” Doss, the leading co-sponsor of the bill, who spent several hours presenting the case for the bill on the floor of the House prior to the final vote. Only two Democrats, State Rep G. A. Hardaway (D-Memphis) and State Rep. John Mark Windle (D-Livingston), joined the conservative caucus of Republicans, who cast 35 votes against the IMPROVE Act “Tax Cut Act of 2017.” Rumors swirled throughout the capitol Wednesday that Governor Haslam had made a deal with the Democrats to secure their votes. Rep. Doss (R-Leoma) was seen conversing on the floor with several Democrats throughout the day, which was not, by itself, particularly unusual. More significantly, Democratic Minority Leader Craig Fitzhugh (D-Ripley) was seen accompanying administrative staffer Warren Wells to the…

Read the full storyNashville Mayor Megan Barry Calls Passage of Gas Tax Hike ‘A Momentous Day in Tennessee,’ Looks Ahead to Mass Transit Plan

Nashville Mayor Megan Barry has been cheering Gov. Haslam’s gas tax hike for road improvements, while keeping an eye ahead toward implementing a $6 billion transit plan. Barry pushed for Gov. Haslam’s IMPROVE Act, which includes the gas tax hike, in the hours leading up to Wednesday’s action on the bill. The bill passed in both the House and Senate. After the bill passed, Barry celebrated with this tweet: Statement on passage of the IMPROVE Act to improve infrastructure & allow local option: This is a momentous day. https://t.co/mtVkjCCePm pic.twitter.com/B30v14FQCe — Megan Barry (@MayorMeganBarry) April 19, 2017 “Our most immediate need is funding,” said Barry, a Democrat, earlier this month in an interview with WSMV Channel 4. The $6 billion transit plan, known as nMotion, was adopted last year by the board of directors of the Regional Transportation Authority. The RTA is made up of Middle Tennessee mayors and Haslam appointees. Their endorsement is nonbinding but gives the plan momentum. The proposal calls for the project to be phased in over 25 years. Funding sources are still on the drawing board but would likely include tax increases. If former mayor Karl Dean’s failed 2014 Amp rapid bus plan is any…

Read the full storyPreliminary Vote on Amendment to Adopt Gas Tax Increase Bill Passes House 61-35, Final Vote Expected Tonight

An amendment by State Rep. Charles Sargent (R-Franklin), a motion to adopt the IMPROVE Act “Tax Cut Act of 2017,” HB 534, passed the Tennessee House of Representatives Wednesday afternoon in a 61-35 vote. This was a preliminary vote prior to the anticipated final vote on IMPROVE Act “Tax Cut Act of 2017,” which is expected to come late Wednesday. Thirty-four Republicans, joined by a solitary Democrat, State Rep. John Mark Windle, voted against the motion to adopt. A full list of the 34 Republicans and one Democrat who voted no was compiled by reporters for The Tennessee Star on the scene (click at the bottom to see the second page): [pdf-embedder url=”https://tennesseestar.com/wp-content/uploads/2017/04/IMPROVE-Act-Amendment-House-Vote-4-19-17.pdf” title=”IMPROVE Act Amendment House Vote 4-19-17″] Notable among those Republicans who voted no were State Rep. Matthew Hill, State Rep. Timothy Hill, State Rep. David Hawk, State Rep. Sheila Butt, State Rep. William Lamberth, State Rep. Judd Matheny, State Rep. Jerry Sexton, and Speaker Beth Harwell. Twenty-three Democrats voted for the motion to adopt, along with 38 Republicans. Notable among those Republicans who voted yes were Majority Leader State Rep. Glen Casada, State Rep. Susan Lynn, State Rep. David Alexander, State Rep. John Ragan, and State Rep. Bill Dunn.…

Read the full storyHaslam Reduced Highway Fund Budget By 13 Percent, Grew State Budget By 20 Percent Before Proposing Gas Tax Increases

Governor Haslam reduced the Highway Fund budget by 13 percent, while he grew the State budget by 20 percent during his first six years in office. Only after he made these reductions in the Highway Fund budget did he propose the gas tax and diesel tax increases included in the IMPROVE Act when he introduced it in January 2017. From Governor Haslam’s first budget year of 2011-12 to the most recent 2016-17, Highway Fund allocations went from $867 million to $757 million, a reduction of 13 percent. HIGHWAY FUND ALLOCATIONS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated DOWN Budget $ $866,886,300 $823,104,600 $683,800,400 $792,219,800 $740,645,600 $756,856,000 -13% Sheet 54 of 656 54 of 545 54 of 542 54 of 550 54 of 558 54 of 558 Page A-22 A-22 A-22 A-22 A-22 A-22 During that same period, the state portion of the budget, excluding the unpredictable and heavily mandated federal funding, grew from $13.7 billion in 2011-12 to $16.5 billion in 2016-17, representing a 20 percent increase. STATE BUDGET IN BILLIONS OF DOLLARS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated INCREASE Billion $ $13.7 $14 $14.6 $14.8 $15.3…

Read the full storyHaslam’s IMPROVE Act Includes Same ‘Economic Development’ That Lost Millions in TNInvestco

“A performance audit from the Tennessee Comptroller’s Office has revealed the State of Tennessee has only recovered $5.3 million of its initial $200 million investment in the TNInvestco program,” according to a statement dated November 10, 2016, under the name of Justin P. Wilson, Comptroller, referring to a performance audit report. The statement from the Comptroller focused primarily on the TNInvestco program from the 60-page October 2016 “Performance Audit Report” produced by the state’s Comptroller’s office on Governor Haslam’s Department of Economic Development and Tennessee Technology Development Corporation. The Report was conducted by the Comptroller’s Department of Audit, Division of State Audit, with the report dated October 25, 2016, signed by Director, Deborah V. Loveless, CPA and addressed to The Honorable Ron Ramsey, Speaker of the Senate; The Honorable Beth Harwell, Speaker of the House of Representatives; The Honorable Mike Bell, Chair, Senate Committee on Government Operations; The Honorable Jeremy Faison, Chair, House Committee on Government Operations; and, Members of the General Assembly; and The Honorable Randy Boyd, Commissioner, Department of Economic and Community Development. At the time of the audit, the program was in in its sixth year, having been approved by the Tennessee legislature in 2009. With…

Read the full storyTDOT Reduces Backlog From $6 Billion to $4.7 Billion, But Total ‘Project Needs’ Grow to $10.5 Billion

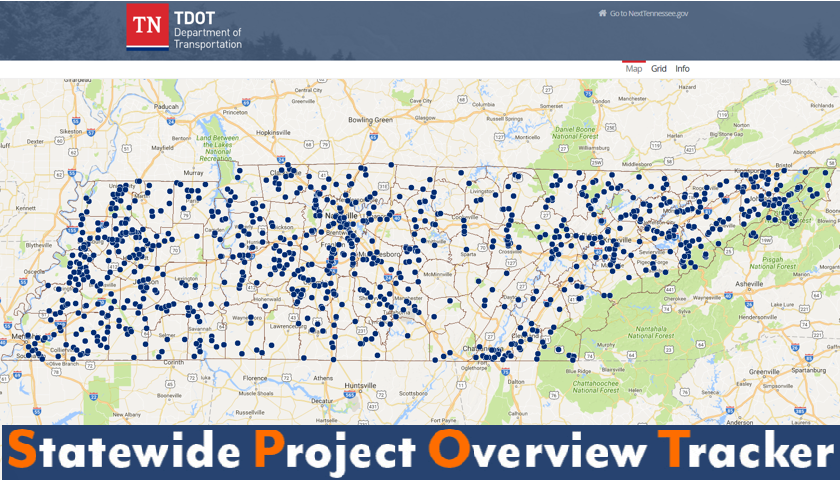

The Tennessee Department of Transportation (TDOT) list of projects issued at the end of 2015 totaled $6.1 billion. The updated project list included with the 2017 IMPROVE Act, on its surface, has a bottom line figure of $10.5 billion with the backlog potion being $4.7 billion. A spreadsheet document dated 11/9/15 was issued on TDOT letterhead titled “Current Backlog,” defined in the secondary heading as “Projects Approved by the TN General Assembly and Currently Under Development.” The last line of the 13-page document states “Total Estimated Cost of Remaining Phases of Work” with a reported total of $6,095,023,692. The 2015 backlog list included a total of 252 projects in 62 counties with Shelby and Blount counties having the highest number of projects at 25 and 10, respectively. Contrasted to the projects in the IMPROVE Act listed in a report generated by TDOT dated 1/12/17, there are now 962 projects in all 95 counties at a cost of $10.5 billion. TDOT’s slick and interactive SPOT – Statewide Project Overview Tracker – displays the IMPROVE Act projects in map and grid form. Utilizing the “grid” feature of the “project needs” page, as it is named, facilitates sorting by “yes” or “no”…

Read the full storyBoss Doss Claim That Tennessee is Lowest Taxed State in Nation Contradicted by Kiplinger Report

State Rep. Barry “Boss” Doss (R-Leoma), chairman of the House Transportation and champion of the IMPROVE Act “Tax Cut Act of 2017” claimed in the Finance, Ways and Means Committee last Tuesday that Tennessee is the lowest taxed state in the nation. The Kiplinger Report, a “leader in personal finance news and business forecasting” put together their list of “10 Best States to Live In For Taxes” in August 2016, and that list does not include Tennessee. In order, Kiplinger’s top 10 are: Wyoming, Alaska, Florida, Nevada, Arizona, Louisiana, Alabama, South Dakota, Mississippi and Delaware. Five states on the list, like Tennessee, do not have an income tax. Other robust criteria Kiplinger used for their ranking was property tax from U.S. Census’ American Community Survey, the Tax Foundation’s figure for average sales tax, fuel tax from The American Petroleum Institute, sin taxes from the state’s tax agency and the Tax Foundation, inheritance and gift taxes from each state’s tax agency, wireless taxes from the Tax Foundation, travel taxes from the state’s tax agency and a lodging tax study by HVS Convention Sports and Entertainment Consulting and the fiscal stability of the states by the Mercatus Center at George Mason University.…

Read the full storyGas Tax Increase Lobbyists Begin Advertising Campaign on Ralph Bristol’s WWTN Show

Regular listeners to Nashville’s Morning News With Ralph Bristol on 99.7 FM WWTN may have noticed a new advertiser on Thursday–the Transportation Coalition of Tennessee. The Coalition is a group of 39 lobbying groups that support Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017,” the majority of which will directly benefit from the additional $10 billion in taxpayer-funded road projects. Several of the lobbying groups, such as the Tennessee County Highway Officials Association, Association of County Mayors and Tennessee County Commissioners Association, are funded by membership dues paid for by taxpayers through county budgets. Reports indicate that the ads are only being played on WWTN during Nashville’s Morning News with Ralph Bristol. Bristol has been a proponent of the IMPROVE Act “Tax Cut Act of 2017” since its introduction and continued his support in the second hour of Thursday’s show with an 8-minute “rant,” as Ralph often refers to them. The full transcript can be found here. In the third hour of the program, the one-minute advertising “spot” by the Coalition went like this: “Governor Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and at…

Read the full storyTransportation Coalition of Tennessee Set to Air ‘It’s Smart’ Ads to Promote Gas Tax Hike

The Transportation Coalition of Tennessee (TCofTN), will launch a series of radio ads touting Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017”, the Times Free Press reports. With the legislation heading to the state House and Senate floor as early as next week, the Transportation Coalition of Tennessee plans to begin airing the 60-second spots starting Thursday, going through April 21. The $127,000 buy’s hits the Chattanooga, Jackson, Memphis, Nashville, Knoxville and Tri-Cities markets. TCofTN describes themselves in a statement announcing the ads as a coalition of “businesses, citizens, community leaders, public officials and organizations that are interested in continuing Tennessee’s transportation infrastructure for the long haul.” Their membership includes senior citizen’s insurance group AARP, auto club AAA, the Nashville Chamber of Commerce, the American Heart Association, Tennessee Road Builders Association and some 33 others. The series, called “It’s Smart,” feature spots voiced by a comforting, grandfatherly persona praising the Governor’s plan, saying: Gov. Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and, at the same time, gives a tax cut to all Tennesseans through a 20 percent tax cut on food. Listen: All the ads are available to enjoy here.…

Read the full storyThe 962 Road Construction Projects Costing $10.5 Billion in The Gas Tax Increase Bill Can Be ‘Modified’ by TDOT

Governor Haslam and other administration officials have stated since announcing the IMPROVE Act , now the “Tax Cut Act of 2017,” on January 18 that the purpose of the gas and diesel tax increases included in the bill is to fund 962 needed road construction projects in all 95 counties for a price tag of $10.5 billion.

These projects, however are the seventh in priority in a list of seven things for which the additional funds raised in the bill can be used.

Read the full storyLetter to the Editor: Haslam’s ‘Tax Cut Act of 2017’ Straight Out of Orwell’s 1984

Dear Tennessee Star, In George Orwell’s dystopian masterpiece 1984, the unfortunate character Winston is battling desperately to grasp objective truth. Meanwhile the power mongers ruling the Ministry of Truth tell him, “War is peace. Freedom is slavery. Ignorance is strength.” Orwell thought he was writing satire; too bad he couldn’t witness our Tennessee General Assembly, where a tax increase is hawked as a tax cut. Gone is the IMPROVE Act; now we have the “Tax Cut Act of 2017.” Same steaming cowpie, just an added dash of Haslamian perfume. We must assume our politicians dreamed this up supposing that average Tennesseans are complete imbeciles who salivate at the mere mention of tax cuts. Well, tax cut for whom, you may ask? Good question. Short answer – it ain’t us. Longer answer – the bulk of the tax cuts are specifically in the Franchise and Excise tax, targeted to save some of Tennessee’s largest corporations about $113 million. Most conservatives might be fine with reasonable corporate tax reductions as the state runs a $2 billion surplus, but not in the same bill that seeks to slam average Tennesseans with a huge increase in fuel taxes. The Governor and his political…

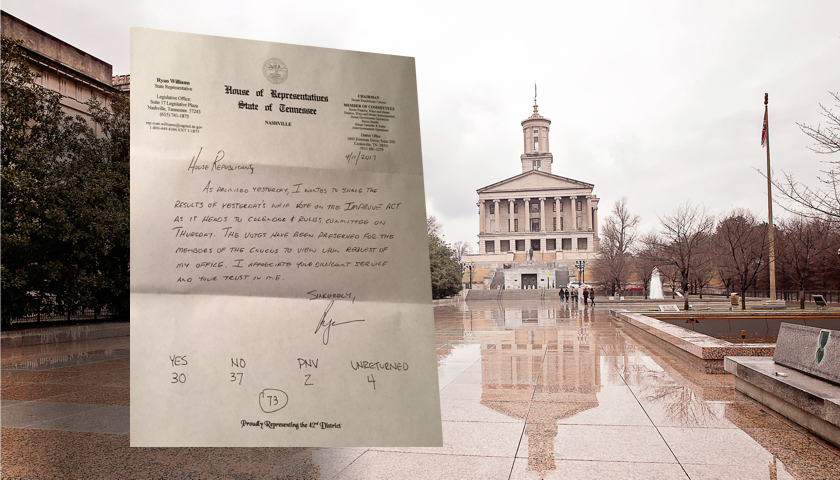

Read the full storyBREAKING: Majority of House Republicans Oppose Gas Tax Increase in ‘Secret’ Whip Vote, 37 to 30

Earlier this week the House Republican Caucus Chair Rep. Ryan Williams (R-Cookeville) conducted a secret poll of the House GOP Caucus members to gauge support for the Haslam IMPROVE Act “Tax Cut Act of 2017.” Williams distributed popsicle sticks to members of the Caucus for them to cast their votes in favor or opposition to the bill as it currently stands. The Tennessee Star has obtained a copy of the Williams vote tally, which shows a clear majority of the Caucus poised to vote against the IMPROVE Act “Tax Cut Act of 2017” that was passed out of the Finance Committee yesterday by voice vote. The “secret” vote among the Republican Caucus members revealed that there are currently 37 “no” votes, 30 “yes” votes, 2 “present and not voting”, and 4 popsicle sticks that were not returned. The GOP Caucus is currently comprised of a total of 73 House Members. Passage of the IMPROVE Act “Tax Cut Act of 2017” on the House Floor will require 50 votes. Therefore, if the numbers revealed in the secret vote tally hold, Governor Haslam will have to secure the votes of almost the entire Democratic Party Caucus to pass his tax plan,…

Read the full storyGas Tax Increase Passes House Finance Committee on a Voice Vote

Rep. Charles Sargent (R-Franklin), chairman of the House Finance, Ways, and Means Committee, presided over a voice vote on Tuesday that advanced the controversial IMPROVE Act “Tax Cut Act of 2017” to the Calendar and Rules Committee, where it awaits scheduling for a vote on the floor of the full House. Rep. Barry Doss (R-Leoma), as sponsor of the bill, once again presented the features of the IMPROVE Act “Tax Cut Act of 2017.” Doss unexpectedly made a point of saying that the renaming of the bill last week to include The Tax Cut Act of 2017 was something that was not important to him, but it was to its sponsor, Rep. Gerald McCormick (R-Chattanooga). Chairman Sargent allowed a leisurely-paced question and answer period from Committee members to Rep. Doss, which came primarily from Democrat members of the Committee. Rep. Mike Carter (R-Ooltewah) pointed out that while he wished it wasn’t included in the IMPROVE Act “Tax Cut Act of 2017”, he wouldn’t vote for a bill that didn’t include the change from the franchise and excise tax to the single sales factor due to the loss of Polaris from his district to the state of Alabama. Rep. David Hawk (R- Greeneville)…

Read the full storySteve Gill Commentary: Crony Capitalism Drives the Haslam Gas Tax Plan

The Haslam Administration is doling out over $113 million in tax CUTS to some of Tennessee’s largest corporations to justify over $350 million in tax INCREASES on working Tennesseans. According to the Times Free Press, just 24 large manufacturing companies will each receive tax breaks of over a million dollars a year under the Haslam plan. Those two dozen companies will reduce their tax burden by over $57 million and receive OVER HALF of the proposed $113 million in Franchise and Excise tax reduction. Tennessee law doesn’t allow the state to release the specific identities of the 24 companies that will benefit most from the Franchise and Excise tax cut. However, according to the Times Free Press certain companies that fit the profile of those who are most likely among the 24 sharing in the $57 million tax break include Nissan, Volkswagen, and General Motors. “This whole tax scheme appears to be built upon a foundation of special treatment for the Governor’s friends while sticking it to ordinary working Tennesseans,” according to State Rep. Judd Matheny. “Before the plan moves one step forward there needs to be full and complete disclosure of who exactly stands to benefit, and how…

Read the full storyDespite Ethics Cloud, ‘Proud’ Barry Doss Presented ‘New and IMPROVED’ Gas Tax Bill for ‘Rebranding’ as ‘Tax Cut Act of 2017’

Rep. Barry Doss (R-Leoma) told the House Finance, Ways and Means Committee on Wednesday he was “proud to bring the bill before you,” as he presented Governor Haslam’s IMPROVE Act, the gas tax increase proposal he co-sponsors, for consideration. Rep. Doss continues to sponsor and present the bill, despite the call for an ethics investigation by the Tennessee Republican Assembly over potential Tennessee Department of Transportation contracts for his company. Doss statement of pride in the gas tax increase proposal came both in his opening statement and again later in response to Rep. David Hawk (R-Greeneville). Hawk said he would continue to work to “present a plan our colleagues can vote for, as opposed to presenting a plan that our colleagues may have to hold their nose and vote for.” Doss took exception to Hawk’s comments, and said again that he was proud to sponsor the gas tax increase bill and that he is “not holding my nose today.” He conceded, however, that it’s “going to take some education of our constituents,” something he said he has “been doing for a solid year.” Although he has served two previous terms in the House of Representatives, Rep. Doss has not been a member…

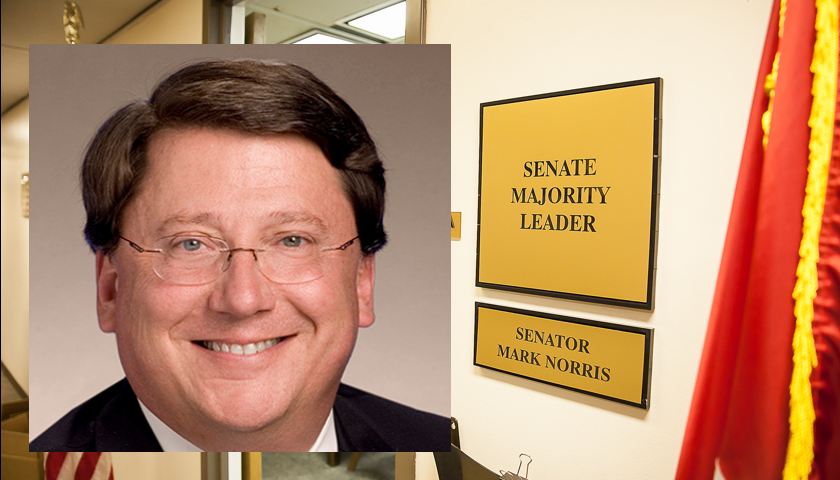

Read the full storyState Senator Mark Norris Accuses House Speaker Beth Harwell Of Working Covertly On Gas Tax Alternative

State Senate Majority Leader Mark Norris has accused House Speaker Beth Harwell of working behind the scenes on a plan to avoid a gas tax increase, the Chattanooga Times Free Press reports. “There’s a fine line between indecision and deception,” Norris (R-Collierville) said Thursday, who did not elaborate on his comment. On Wednesday, Rep. David Hawk (R-Greeneville) told the Budget Subcommittee that he, Harwell and others were working on alternative funding plan for Gov. Haslam’s IMPROVE Act. The amended legislation includes a gas tax hike of six cents and a 10-cent increase on diesel over the next three years, while cutting three taxes in the general fund, including the sales tax on groceries. The Tennessee Star reported Thursday that Harwell (R-Nashville) and others want to use revenues from the sales tax on new and used vehicles toward funding road projects. Harwell said details of the plan are still being finalized. Hawk’s announcement caught Republican Senate Speaker Randy McNally, Budget Subcommittee Chairman Gerald McCormick (R-Chattanooga) Gov. Haslam and others by surprise, according to the Chattanooga Times Free Press. On Wednesday, State Rep. Barry Doss (R-Leoma), chairman of the House Transportation Committee and co-sponsor of the gas tax increase proposal, presented a lengthy argument…

Read the full storySpeaker Harwell Says She Will Have a Road Funding Plan That Does Not Raise The Gas Tax

Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storySpeaker Harwell Says She ‘Cannot Recall a Bill from the Finance Subcommittee’

Tennessee State House Speaker Beth Harwell’s office contacted The Tennessee Star Tuesday morning in response to our story Monday about State Representative Jerry Sexton’s press conference. In that press conference, Rep. Sexton (R-Bean Station) called on Speaker Harwell to send back the Gax Tax bill to the House Transportation Subcommittee. “I saw the recent Tennessee Star article entitled “State Rep. Sexton Tells Speaker Harwell: ‘Hit The Restart Button’ On Gas Tax, Send It Back to Subcommittee ‘To Be Debated Fairly and Openly’” and wanted to clarify something,” Deputy Chief of Staff for Communications and Policy Kara Owen wrote. Ms. Owen continued: The Speaker of the House cannot recall a bill from the House Finance Subcommittee to the House Transportation Subcommittee, per our House rules. This takes a motion on the House floor by a member, and 66 votes (two thirds) for the motion to prevail.

Read the full storyState Rep. Jerry Sexton Calls Out Hypocrisy of Gas Tax Supporters Who Oppose Use of Sales Taxes for Road Construction

Fireworks erupted on the floor of the Tennessee House of Representativesewhen the typically rapid-fire tick-tock of the day’s agenda was interrupted as Rep. Jerry Sexton (R-Bean Station) questioned Rep. Ryan Williams (R-Cookeville) on the “special privilege” of professional sports teams re-directing sale tax revenues back to a Nashville municipal organization whose purpose is to promote sporting events and sports teams. Rep. Sexton drew a strong parallel between the redirection of those funds – which Williams supports – and the redirection a small portion of sales tax revenues for the benefit of road construction, improvements and repairs – which Williams opposes. Williams supports of Gov. Haslam’s plan to raise taxes on gas and diesel to fund road construction instead. Sexton pointedly called out the hypocrisy of supporters of Haslam’s gas tax increase plan, who claim road construction can only be funded by “user fees” of those who use roads, while sports team stadiums can be funded by those who do not use or attend events at those stadiums. Sexton made his remarks during a debate “over an unrelated bill on the House floor on Thursday that would redirect sales taxes collected at a proposed Major League Soccer stadium in Nashville to be…

Read the full storyCommentary: NO, It ISN’T a Tax Cut for Regular Tennesseeans

Proponents of Governor Bill Haslam’s fuel tax increase claim it is actually a tax CUT thanks to reductions in a couple of large corporate taxes, like the Franchise & Excise tax. Cutting taxes on businesses to create more job growth while we have a $2 billion surplus is a great idea…but you don’t have to increase taxes elsewhere to justify it. As Nike ads used to proclaim: “Just DO It!!” The claim that a large tax increase on drivers in Tennessee with a slight reduction of taxes on food is a “net cut” because it is combined with unrelated cuts that benefit a few of the Governor’s cronies is the kind of misrepresentation that“fuels” a legitimate distrust of government. The tax INCREASES on fuel far surpass the CUTS in the sales tax on food. It’s not even close. Muddying the water with corporate tax cuts that benefit a few doesn’t change that truth. As the Haslam IMPROVE Act currently stands, it is a $345 million tax increase. Approximately $188 million will come from the increase in the gasoline tax; another $100 million will be generated by the increased diesel tax; and finally, about $57 million will be collected in the…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyLetter to the Editor: “I am fed up with these blatant, arrogant power grabs”

Dear Tennessee Star, First of all, I just want everyone there to know how much I appreciate you. I have sent the Tennessee Star link to all of my friends and family – both here and in other states. The reason I’m writing today is that I am fed up with these blatant, arrogant power grabs that are so totally disrespectful and contradict the residents of Tennessee. Boss Doss plainly is answering to a boss other than Tennessee residents. I hope voters remove the 10 Republicans who voted for this “amended IMPROVE Act.” This kind of “ramming” seems to be the order of the day. Last night I was at the Metro Council meeting and watched as they went through new resolutions so quickly that I couldn’t even keep up on the agenda! The Vice Mayor actually joked with the Council person reading the resolutions about getting through them so quickly. I was there specifically regarding a zoning change. I have been to every commission meeting, council meeting, and public hearing on this proposal except one when I didn’t receive a notice. The only persons who have spoken in favor of this rezoning are the person wanting to develop…

Read the full storyBoss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee

In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram an amended version of Gov. Haslam’s gas tax increase through the House Transportation Committee he chairs on Tuesday. A bill containing the new and improved IMPROVE Act amendment, which restores many of the elements of Gov. Haslam’s original gas tax increase proposal, passed the House Transportation Committee in an 11 to 7 vote, but that outcome could not have taken place on Tuesday had not Chairman Doss broken Rule 34 of the Tennessee House of Representatives. Rule 34 of the Tennessee House of Representatives allows any member the privilege of “separating the question” when an amendment is added to a bill that is up for consideration. A key element of Rule 34–which is known to every member of the House–is that it is a “privilege” that can be exercised without question whenever a member invokes it in a committee hearing. It is not a “motion,” which is subject to a vote of the committee. Every chairman of every committee in the Tennessee House of Representatives, including Rep. Doss, is well aware that Rule 34 is a privilege,…

Read the full storyUnder Governor Haslam, Tennessee Department of Transportation ‘Overhead’ Costs Have Grown 63 Percent, While ‘Highway Infrastructure’ Spending Has Shrunk By 33 Percent

The Tennessee Department of Transportation (TDOT) total costs for “Administration” plus “Headquarters Operation,” what would be considered “overhead” in the business world, have grown by 63 percent, from $78.9 to $117 million, in the seven years between Gov. Haslam’s first budget in FY 2011-12 and his proposed budget for FY 2017-18. While TDOTs overhead has skyrocketed, spending on one of the main Programs for road improvements, “Highway Infrastructure,” has gone down by more than 30 percent in that same time period. Table 1 provides the details of TDOT’s “Recommended Budget By Program and Funding Source” obtained from multiple years of budget documents and includes the links to the source documents and the page references. The table demonstrates that since fiscal year 2010-11, the last year of Governor Bredesen’s administration, there are multiple Programs, including Administration, Headquarters Operation, State Industrial Access, Planning and Research, Interstate System and Highway Infrastructure and TDOT as a whole, for which the funding was reduced by Gov. Haslam’s in his first year and have never recovered. Table 1 Department of Transportation Recommended Budget by Program Source Source Source Source Source Sheet 46 of 656 Sheet 46 of 550 Sheet 46 of 558 Sheet 47 of 558…

Read the full storyGrover Norquist’s Endorsement of Gov. Haslam Gas Tax Increase Backfires

Gas tax increase supporters initially believed they had scored a great political coup on Monday when Washington insider Grover Norquist, founder of Americans for Tax Reform (ATR), declared his support for the amended version of Gov. Haslam’s IMPROVE Act that passed the Senate Transportation Committee last week. That amended version reduced the proposed gas tax increase from 7 cents per gallon to 6 cents per gallon. But the fierce backlash from conservative opponents of the gas tax increase in Tennessee to the last minute attempt by supporters of the governor’s plan to bolster its chances by calling in a “celebrity ” who has never lived in the state and knows little of the intricacies of the bill or the state’s budget, spells more, rather than less, political trouble ahead for the governor and his allies. “The recent amendments made by the Senate, and supported by Gov. Haslam, have improved the bill to the extent that the bill is now a net tax decrease, and thus not a violation of the Taxpayer Protection Pledge…ATR scores the amended version of SB 1221 / HB 534 as a net tax cut and therefore Taxpayer Protection Pledge compliant,” Norquist wrote “in a memorandum to…

Read the full storyThirty Tennessee General Assembly Members Signed The ‘Taxpayer Protection Pledge,’ But Some Are Breaking It With The IMPROVE Act

“Politicians often run for office saying they won’t raise taxes, but then quickly turn their backs on the taxpayer. The idea of the Pledge is simple enough: Make them put their no-new-taxes rhetoric in writing,” says Americans for Tax Reform. The “Taxpayer Protection Pledge” commits an elected official or candidate for public office “to oppose [and vote against/veto] any efforts to increase taxes.” According to the Americans for Tax Reform searchable data base, the Pledge has been signed by 30 active Tennessee State Representatives and State Senators, who are listed below. State Representatives State Senators District First Last District First Last 24 Kevin Brooks 17 Mae Beavers 19 Harry Brooks 16 Janice Bowling 71 David Byrd 22 Mark Green 63 Glen Casada 26 Dolores Gresham 16 Bill Dunn 27 Ed Jackson 11 Jeremy Faison 23 Jack Johnson 56 Beth Harwell 13 Bill Ketron 7 Matthew Hill 5 Randy McNally 22 Dan Howell 1 Steve Southerland 68 Curtis Johnson 24 John Stevens 89 Roger Kane 14 Jim Tracy 38 Kelly Keisling 57 Susan Lynn 72 Steve McDaniel 36 Dennis Powers 45 Courtney Rogers 61 Charles Sargent 49 Mike Sparks 40 Terri Lynn Weaver The IMPROVE Act includes five tax increases: a…

Read the full storyHouse Transportation Committee Delays Vote on The IMPROVE Act Another Week

State Rep. Courtney Rogers (R-Goodlettsville), Vice-Chair of the House Transportation Committee, acted as Chair when the committee convened on Tuesday in the absence of Chairman Barry Doss (R-Leoma), who was not present at the hearing. Acting Chair Rogers reported to the committee members present that Chairman Doss had asked that HB 534, the “caption bill” for the IMPROVE Act, be “rolled” for one week. The request, which constitutes the second delay in as many weeks of a vote on the bill, seemed an unexpected turn of events to the full-to-capacity meeting room that included media, camera crews, and several Tennessee Department of Transportation representatives. As The Tennessee Star reported last week, the committee voted 9 to 8 when it met one week earlier on March 7 to “roll” the bill forward to this Tuesday’s meeting in order to allow the committee members to review the numerous amendments proposed to the bill. A point of order raised at the March 7 meeting by State Rep. Timothy Hill (R-Blountville)–whether it was in order for Chairman Doss, as sponsor of the bill, to preside over the hearing–was raised indirectly at Tuesday’s meeting. Hill’s earlier point of order was resolved at the March…

Read the full storyState Senate Transportation Committee Passes Amended Gas Tax Hike

The State Senate Transportation Committee passed an amended version of Gov. Haslam’s Gas Tax hike (SB 1221) on Monday. Among the changes were a removal of the inflation indexing provision, a cut in the governor’s proposed gas tax increase from 7 cents per gallon to 6 cents per gallon, and a cut in the proposed diesel fuel tax increase from 12 cents to 10 cents per gallon. Senate revisions to Gov. Haslam’s road-funding bill: – Reduces governor’s proposed gas tax increase from 7 cents per gallon to 6 cents. Phases increases in over 3 years with 4 cents in Fiscal Year 2018, 1 cent in FY 2019 and 1 cent in FY 2020. – Reduces governor’s proposed diesel tax increase from 12 cents per gallon to 10 cents. Phases in over 3 years with 4 cents in FY 2018, 3 cents in FY 2019 and 3 cents in FY 2020 – Alternative fuel tax increase of 8 cents phased in over 3 years. – Removes inflation indexing provision – Removes 3 percent rental car surcharge – Deepens Haslam’s proposed cut to state’s sales tax by reducing the 5 percent tax to 4 percent beginning July 1 as opposed to the 4.5 percent originally…

Read the full storyGas Tax Apologists Unable to Explain Why the 15 Percent of User Fees Diverted From Highway Fund is Not Spent on Road Construction

At least 15 percent of the $1.2 billion in highway user fees collected by the state of Tennessee in FY 2015-2016–$189 million– was diverted away from road construction (see page A-65 of The Budget: State of Tennessee, Distribution of Actual Revenue by Fund, FY 2015-2016). Under Gov. Haslam’s proposed FY 2017-2018 budget, virtually the same amount of highway user fees–$187 million–will continue to be diverted away from road construction. (see page A-67 of The Budget: State of Tennessee, Distribution of Estimated Revenue by Fund, FY 2017-2018). FY 2015-2016 is the most recent year for which actual expenditures are available. Throughout the public debate over the past two months about Gov. Haslam’s proposed IMPROVE Act, which includes a gas tax increase of 7 cents per gallon, apologists for a gas tax increase–including House Transportation Committee Chairman Barry Doss (R-Leoma), House Senate Transportation Chairman Paul Bailey (R-Sparta), and 99.7 FM WWTN radio’s Ralph Bristol, host of Nashville’s Morning News–have yet to answer one key question about the state’s budget priorities: With a $1 billion surplus in the state budget, why do you support a gas tax increase when much of the purported road construction shortfall could be addressed by simply re-allocating the $187…

Read the full storyHouse Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyState Rep Andy Holt Skewers pro-Gax Tax Hike Republicans in Blistering Facebook Rant

Wednesday afternoon, State Representative Andy Holt let loose with a blistering rant against the House Transportation Committee’s arcane maneuvers to pass Gov Bill Haslam’s IMPROVE Act, going so far as to include a photo of a bag of thirty pieces of silver. Via Facebook: Well everyone, The Governor’s gas tax just passed out of the House Transportation Sub-Committee. That’s what you expected from the “fiscally conservative” super-majority controlled republican House of Representatives here in Tennessee, right? So. Gross. If allowed to pass, your taxes are about to go up by HUNDREDS of MILLIONS of dollars in Tennessee — literally!! You all need to know something. You need to know the truth. You deserve the truth. The “media” will likely tell you that the tax was “stripped out of the bill”. That’s not true, and they know it isn’t… This episode of political theater was a well orchestrated display. The bill will soon be returned to its original form so they can add back all the taxes, and possibly more… Worst part of all? The “media” has been told by countless people what’s going on behind the scenes. They’ve literally been shown proof of corruption, lies, and quid pro quo, but…

Read the full storyLetter to the Editor: Today’s Shenanigans at House Transportation Subcommittee Deflate Tennessee Taxpayers

Dear Tennessee Star, Conference room 16 was packed with an overflow standing room only crowd of “Ax the Tax” folks, and they listened respectfully to every word. The Gas Can Man was there bigger than life and getting all kinds of photo ops. Yet, in the end, the Tennessee taxpayer crowd left feeling defeated and deflated like those Tom Brady footballs. I read Rep. Andy Holt’s remarks about the hearing on Facebook. He describes the shenanigans at the Sub House Transportation Committee. Rep. Holt also gives you insight to our own “FAKE MEDIA” which is alive and well in Tennessee….except for one….the conservative Tennessee Star. Go to their web site and check out the latest fact gathering information on this Republican fiasco. To Chairman Terri Lynn Weaver’s credit, she defended and upheld what the taxpayers wanted which was the common sense Hawk Plan. When she voiced that opinion the crowd clapped loudly. But, the votes were not to be. Those who opposed the Haslam Improve Act were: Lt. Col. Courtney Rogers, Chairman Terri Lynn Weaver, Rep. Jerry Sexton, and Rep. John Mark Windle. Those voting in favor of the Haslam Improve Act (the Gas Tax Increase) were: Rep. David…

Read the full storyHaslam’s IMPROVE Act Forced Through House Subcommittee in Rare Political Power Play as Speaker Pro Tem Brought in To Break Tie

Through a series of political maneuvers, Gov. Haslam’s IMPROVE Act has advanced from the House Transportation Subcommittee to the full House Transportation Committee, thanks to the rare tie-breaking vote cast by Speaker Pro Tem State Rep. Curtis Johnson (R-Clarksville). Johnson was brought in at the last minute to the House Transportation Subcommittee Wednesday afternoon to break a 4 to 4 tie. With Johnson’s yes vote, the IMPROVE Act passed on a 5 to 4 vote. Subcommittee members voting yes on the amended IMPROVE Act bill were State Rep. Barry Doss (R-Leoma), who also serves as chairman of the full House Transportation Committee, State Rep. David Alexander (R-Winchester), State Rep. Sam Whitson (R-Franklin), and State Rep. Barbara Cooper (D-Memphis). Subcommittee members voting no on the amended IMPROVE Act bill were State Rep. Terri Lynn Weaver (R-Lancaster), chairman of the Transportation Subcommittee, State Rep. Courtney Rogers (R-Goodlettsville), State Rep. Jerry Sexton (R-Bean Station), and State Rep. John Mark Windle (D-Livingston). The next stop for the IMPROVE ACT is the full House Transportation Committee, chaired by Haslam ally and gas tax advocate Doss. The version of the IMPROVE ACT that passed was amended to remove the gas tax increase originally proposed by the governor.…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full story