The Tennessee Star on Monday obtained videos from a newly released ad campaign by Senator Marsha Blackburn (R-TN), who is currently favored to win reelection against State Senator Gloria Johnson (D-Knoxville), which feature prominent Tennessee conservatives celebrate Blackburn’s role in the successful 2003 effort to defeat an income tax proposal.

Read the full storyTag: income tax

Ohio Congressman Introduces Bill to Repeal 16th Amendment, Arguing Government Shouldn’t Tax Income

Congressman Warren Davidson, R-Ohio, introduced legislation to repeal the 16th Amendment, stating that the government should not tax people’s income.

“Originally the country didn’t have an income tax,” Davidson said on the Wednesday edition of the “Just the News, No Noise” TV show. “They passed the 16th amendment to make it legal to tax people’s income. It was originally just going to be for the really, really rich people. And of course, now it’s hitting everybody.”

Read the full storyMackinac Center Sues Michigan over Income Tax Dispute

A new lawsuit says Michiganders should get a permanent income tax break instead of one for just one year.

Lawmakers, including two plaintiffs, passed legislation in 2015 enacting an income tax reduction trigger that lowers the current rate when the state’s revenue outpaces inflation by a set amount. Last year’s state revenue triggered a rollback of the rate from 4.25% to 4.05%.

Read the full storyWisconsin’s Budget-Writing Committee Passes Budget with ‘Historic’ $4.3 Billion Tax Cut

After a season of spending, the Wisconsin Legislature is finally getting around to talking tax cuts. Perhaps Republicans have saved the best for last.

The Republican-controlled Joint Finance Committee put the finishing touches on a complete rewrite of Democrat Governor Tony Evers’ 2023-25 state budget proposal, passing a tax reform package that promises to deliver $3.5 billion in income tax cuts and nearly $800 million in property tax relief.

Read the full storySenator Marsha Blackburn Calls Hunter Biden’s Guilty Plea on Federal Charges ‘No Coincidence’

Tennessee U.S. Senator Marsha Blackburn (R-TN) released a statement Tuesday after President Joe Biden’s son, Hunter Biden, was federally charged with two violations of failure to pay income tax and one violation of unlawful firearm possession.

Blackburn said, “It’s no coincidence that less than a week after President Trump is arraigned, Hunter Biden is pleading guilty to a sweetheart deal with no jail time. The DOJ is going for the low-hanging fruit by charging Hunter Biden with a gun felony and two tax misdemeanors, after years of slow walking their investigation.”

Read the full storyTreasurer: Michigan Income Tax to Drop for One Year

Michiganders should see $50 of savings after the state income tax decreases to 4.05% for one year.

“Michigan’s strong economic position has led to a reduction in the state income tax from 4.25% to 4.05% for 2023,” Treasurer Rachael Eubanks said in a statement. “When Michiganders file their 2023 state income taxes in 2024, they will see the rate adjustment in the form of less tax owed or a larger refund.”

Read the full storyArizona Lawmaker Introduce Bill to Abolish the State Income Tax

Although Arizona’s state income tax recently dropped to one of the lowest in the nation, a rookie lawmaker disagrees with the concept of having an income tax at all. Rep. Austin Smith, a West Valley Republican, filed House Bill 2395. He said taxpayers have struggled to make ends meet due to the current economic environment.

Read the full storyArizona Among 11 States Cutting Individual Income Taxes in 2023

Eleven states will reduce their individual income tax rates on Jan. 1.

Arizona, Idaho, Indiana, Iowa, Kentucky, Mississippi, Missouri, Nebraska, New Hampshire, New York, and North Carolina will cut the individual income tax rate on New Year’s Day, according to the Tax Foundation. Over the past two years, more than 20 states have cut individual income tax rates.

Read the full storyStudy: Ohio Outside of Capital Area Is Losing Population

A new study released this week by a Columbus-based nonprofit observed that, with the exception of Ohio’s capital city and its surrounding suburbs, the Buckeye State is losing population.

The paper by the Greater Ohio Policy Center (GOPC), titled “Ohio + Columbus: A Tale of Two States,” posits that “much of Ohio functions like a legacy state rather than a rapidly growing place.” In other words, many places in the state experienced manufacturing booms a century ago but have seen industrial activity quickly decline in recent decades.

Read the full storyGubernatorial Hopeful Jensen Calls for ‘Phasing Out’ Minnesota’s Income Tax to Help Fight Inflation, Boost Economy

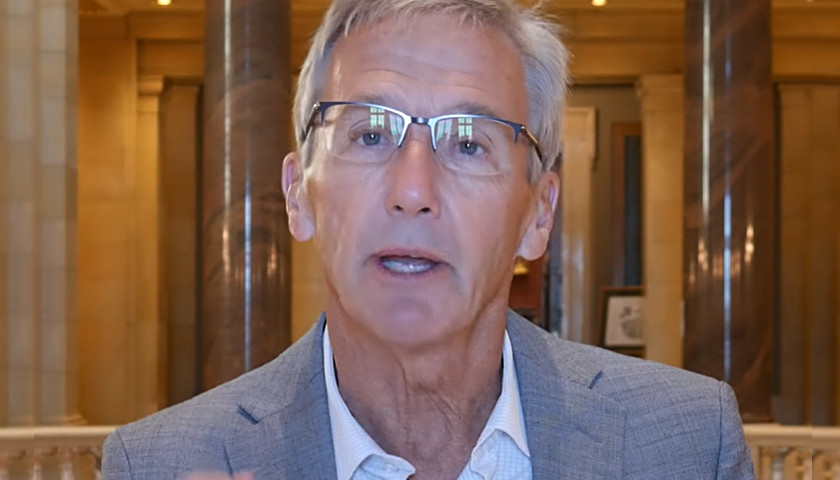

Republican gubernatorial candidate Dr. Scott Jensen announced at a Thursday press conference his comprehensive plan to fight inflation.

Jensen’s “FIT” plan — “Fight Inflation Together” — comprises a variety of reforms and policies pertaining to taxes and spending. These include but are not limited to investigating wasteful government spending, vetoing tax increases and initiatives that increase the cost of living, eliminating social security taxes, and enacting deregulatory measures that allow businesses to obtain permits and licenses with less hassle.

Read the full storyArizona Free Enterprise Club Labels Red4ED ‘One of the Most Expensive Failures in Arizona Political History’

The Arizona Free Enterprise Club (AFEC) analyzed the success of the Red4ED movement in Arizona since it launched a little over four years ago, and concluded that after spending over $30 million, the movement not only failed to accomplish anything, but failed to stop historic tax cuts. Red4Ed’s two initiatives and referendum were struck down by courts as “legally flawed,” resulting in AFEC labeling its efforts “the largest, most expensive failure in Arizona political history.”

Arizona Educators United launched Red4Ed in 2018 ostensibly to increase teachers’ salaries and funding for K-12 education. People and teachers showed up all over, at the state capitol and at events and protests, wearing red shirts and carrying red signs. But AFEC said “the movement was quickly hijacked by the teachers’ unions and other out-of-state special interest groups.” It soon turned into “a singular quest to double the state income tax through a ballot initiative.”

Read the full storyLegislature Pushes $2.5 Billion Tax Break to Gov. Whitmer

The GOP-dominated Michigan Legislature approved $2.5 billion in far-ranging tax relief amid record 40-year-high inflation.

Meanwhile, Gov. Gretchen Whitmer and Democrats pitched sending immediately $500 checks to working families. Senate Majority Leader Mike Shirkey, R-Clarklake, characterized the plan as trying to “pay off” Michiganders for her COVID policies.

Read the full storyCity Income Tax Law in Front of Ohio Supreme Court

Emergency legislation enacted at the beginning of the COVID-19 pandemic that changed the way municipal income taxes were handed out to cities is now in front of the Ohio Supreme Court.

The Buckeye Institute, a Columbus-based policy group, originally filed suit in July 2020, challenging the state law that requires an employee to pay income taxes in the city where an employee works instead of where they live.

Read the full storyGov. Evers, Others Pan Proposal to Eliminate Wisconsin Income Tax

There is a growing list of people and groups who are not fans of the idea to scrap Wisconsin’s personal income tax.

Former Gov. Scott Walker, University of Wisconsin economist Noah Williams, and a host of conservative reform groups on Thursday proposed eliminating Wisconsin 6.27% personal income tax and replacing the lost revenue with a slight increase in the state’s sales tax.

Walker, and Williams’ analysis, say most Wisconsin taxpayers will save about $1,700 a year with that swap.

Read the full storyFormer Gov. Walker Proposes Eliminating Wisconsin Income Tax

There is a plan that would end Wisconsin’s 6.27% personal income tax.

Former Gov. Scott Walker, University of Wisconsin economist Noah Williams, and a coalition of reform groups in the state on Thursday proposed eliminating the individual income tax as a way to jumpstart the state’s economy.

Read the full storyMeasure to Cancel Arizona Income Tax Cut Certified for 2022 Ballot

Voters in Arizona will have the chance to strike down the largest personal income tax cut in state history.

Arizona Secretary of State Katie Hobbs notified Gov. Doug Ducey’s office Friday that her office certified a ballot initiative to appear on the November 2022 general election ballot. Designated as Proposition 307, the initiative needs a simple majority to vote “no” to strike down Senate Bill 1828. The law gradually flattens Arizona’s progressive income tax to 2.5%.

Read the full storyGeorgia September Net Tax Revenues Up 30.3 Percent

Georgia’s September net tax collections totaled nearly $2.82 billion for an increase of $655 million, or 30.3 percent, compared to September of last year when net tax collections totaled $2.16 billion. This, according to a press release that Governor Brian Kemp emailed late last week.

Read the full storyOhio Judge Allows Municipal-Income-Tax Challenge to Go Forward

A judge has ruled a lawsuit challenging the city of Cleveland’s ability to collect income tax from a doctor who had not worked in the city during the pandemic can go forward.

Dr. Manal Morsy’s lawsuit, one of several filed against Ohio cities by The Buckeye Institute, tests a state law that was altered during the COVID-19 pandemic to continue to allow cities to collect taxes from workers who did not work in those cities.

Cuyahoga County Court of Common Pleas Judge Dick Ambrose denied Cleveland’s motion to dismiss Wednesday.

Read the full storyThe Tennessee Star Washington Correspondent Neil McCabe on Wrong Way Milley Story and the Changing Mood of Democratic Congressmen

Wednesday morning on the Tennessee Star Report, host Michael Patrick Leahy welcomed The Tennessee Star’s Washington Correspondent Neil McCabe to the newsmakers line to weigh in on Wrong Way Milley and the mood in Congress.

Read the full storyOhio Municipal Income Tax Issue Continues in Courts

An Ohio organization that has fought cities collecting income taxes from people who had not worked in specific cities during the COVID-19 pandemic has filed an appeal in a Cincinnati case that was dismissed in June.

The Buckeye Institute, a Columbus-based think tank, recently filed its appeal with the First District Court of Appeals on behalf of Josh Schaad, who lives in Blue Ash but is employed in Cincinnati. The case was dismissed four months after it was filed.

Read the full storyArizona Legislative Report Reveals ‘Extraordinary’ Fiscal Growth in State

A new report from the Arizona Legislature’s Joint Legislative Budget Committee shows Arizona is in great economic condition, breaking records. Revenues from taxes are high or better than projected, with significant gains expected in the future, and personal income is growing at the fastest pace since 1985. It comes after Arizona passed historic tax cuts, reducing the personal income tax to the lowest flat tax in the country at 2.5%. However, some of the rosy picture is due to COVID-19 relief.

Governor Doug Ducey issued a statement about the report, “It paints a picture of a state economy that has emerged from the COVID-19 pandemic not only in great shape, but poised to achieve even greater accomplishments in the years ahead. The ‘extraordinary growth’ Arizona saw in Fiscal Year 2021 is positive news for every Arizonan. We are leading the way in the nation’s economic recovery.”

Read the full storyLawsuit Filed Against Referendums That Attempt to Reverse Arizona’s Historic Tax Cuts

The Arizona Free Enterprise Club filed a lawsuit recently against Invest in Arizona over the organization’s attempt to get three referendums on the Arizona ballot that would reverse Arizona’s recently passed tax cuts. The lawsuit contends that since the tax cuts “provide for, and directly relate to, the generation of revenues that are remitted to the general fund and appropriated to various agencies, departments and instrumentalities of the state government,” they cannot be the subject of a referendum and are unconstitutional.

AFEC President Scot Mussi, who is one of the plaintiffs, said, “All three bills directly provide for the support and maintenance of the state, were key aspects of the state’s budget, and therefore are not referable by Invest in Arizona.”

Read the full storyHistoric Income Tax Overhaul Reduces Burden by 13 Percent for Most Arizonans

Arizona Governor Doug Ducey is expected to sign a budget bill the Arizona Legislature sent to him on Friday that includes a historic tax reform package. HB 2900 implements the lowest flat tax in the country, 2.5%. The average Arizona family will see a 13% income tax reduction, about $350 per year. According to the nonpartisan Tax Foundation, Arizona previously had one of the highest marginal income tax rates in the country.

The budget bill also eliminates taxes on veterans’ retirement pay and prevents a 77% increase on small business taxes. It reduces property taxes by 10% on small businesses and job creators by 10%, capping the maximum tax rate on businesses at 4.5% and reducing commercial property taxes. According to a report by Ducey, 43% of Arizonans in the private sector work for small businesses. HB 2900 increases the homeowner’s rebate so the state covers half of homeowners’ primary property taxes.

Read the full storyArizona Republicans Negotiate Budget, State Debt Paydown

Two Arizona lawmakers are attempting to make changes to the state’s budget bills, which held up the signing of the law last week.

“The changes include smaller tax cuts until actual revenue comes in above projections and a much larger paydown of state debt,” as reported by Fox 10.

Read the full storyOhio City Income Tax Law Continues to be Challenged

An Ohio think tank’s fight over the state’s municipal income tax laws, which continue to be an issue during the COVID-19 pandemic, has moved to the state court of appeals.

The Buckeye Institute, a research and education think tank based in Columbus, has filed four lawsuits challenging the state law that requires taxes to be paid to the city where work is actually done. During the pandemic, however, more and more people were working from home but still paying taxes to cities where their office was located, rather than where they actually worked.

The Buckeye Institute appealed Thursday to the Ohio Tenth District Court of Appeals its case of three of its employees who worked from home after the state’s stay-at-home order but continued paying taxes to city of Columbus. A Franklin County judge dismissed the case Tuesday.

Read the full storyIn Debate, GOP Gubernatorial Candidates Discuss Amazon and Small Business

Six of the seven GOP gubernatorial candidates met for a debate hosted by the Virginia Federation of Republican Women on Tuesday evening. Candidates answered questions about Dominion voting machines, Second Amendment rights, transportation, and funding law enforcement. Organizers said Pete Snyder had a prior engagement.

Larry O’Connor asked the candidates, “Amazon is king right now in northern Virginia if you didn’t know any better. How will we expect small businesses to survive when government regulations that make it difficult for them are thrown out the window for literally the richest man in the world? How do you plan to protect key real estate in northern Virginia from being swallowed up by one company as well?”

Read the full storyLawsuits Filed Against Ohio Cities over Municipal Income Tax Collections During Pandemic

Two Ohioans filed lawsuits this week challenging Ohio tax law that allows cities to tax income of workers who, the lawsuits say, do not live in nor work in the municipalities.

The Buckeye Institute, an independent research and educational group, filed the lawsuits on behalf of Eric Denison and Josh Schaad against the cities of Columbus and Cincinnati. The lawsuits ask the court to declare unconstitutional Ohio law that allows cities to tax workers who do not live in and have not been working in those cities.

Read the full storyOhio Legislation Seeks to Change Local Income Tax Structure

Legislation in the Ohio General Assembly seeks to change the state’s 60-year-old income tax structure that allows municipalities to tax workers even if they don’t physically work in the city taxing them.

The bill, HB 754 and its companion SB 352, would modify income tax withholding rules for COVID-19-related work-from-home employees, taxing those Ohio workers where they live, rather than where they work.

Read the full storyBuckeye Institute Sues Over Law Allowing Columbus to Collect Income Taxes From Commuters Despite Emergency Order Preventing Them from Working in the City

The Buckeye Institute said that it and three employees filed a lawsuit over the taxing of workers’ income in Columbus since they do not live in the city and were not allowed to work there during Ohio’s Stay-at-Home order.

The lawsuit, which is available here, was filed in the Court of Common Pleas in Franklin County.

Read the full storyPending Senate Bill Would Amend Ohio Constitution to Require Supermajority Vote to Raise Income Taxes

A bill that is pending in the State Senate Ways and Means Committee would make it more difficult for the Ohio General Assembly to raise taxpayers’ income taxes.

Read the full storyMichigan Rep Wants to Phase Out State’s Income Tax

Michigan’s state income tax was raised in 2007 in what was supposed to be a temporary fix, but it ended up being permanent. More than a decade later, one Republican state lawmaker plans to change that.

Read the full storyDesperate David Briley Punches Down, Criticizes Nashville Tea Party’s Opposition to Property Tax Increase

On Friday’s Tennessee Star Report with Michael Patrick Leahy and special guest Ben Cunnigham – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 am to 8:00 am – Leahy and Cunningham talked about Cunningham’s recent Tweets stating that he would hold John Cooper accountable to his implied commitments to the reallocation of Davidson County funds and not raising property taxes.

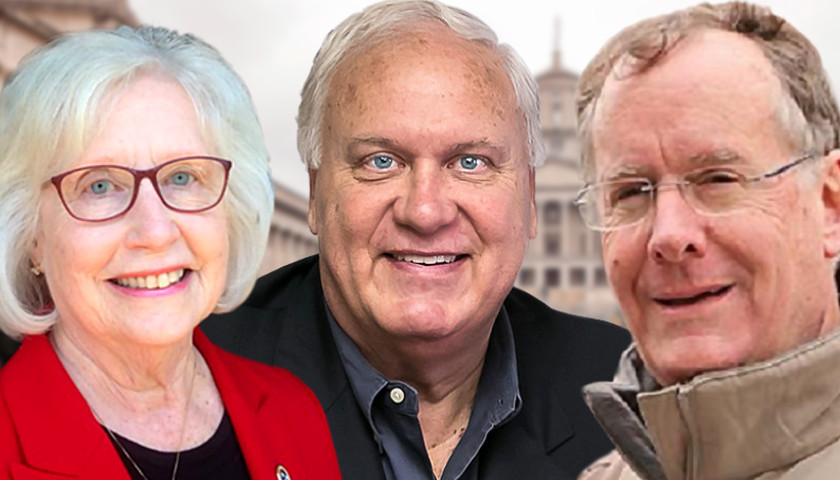

Read the full storySteve Gill, Ben Cunningham, and Mae Beavers Blast ‘Fibber Phil’ Bredesen and The Tennessean for Rewriting History on 2000 Horn Honkers Uprising That Stopped State Income Tax

On Friday morning’s Tennessee Star Report with Steve Gill and Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 am to 8:00 am – Steve Gill talked with veteran grassroots activist Ben Cunningham and former State Sen. Mae Beavers regarding The Tennessean’s revisionist history and continuous cover up for ‘Fibber Phil’ Bredesen’s lies – in particular their dishonest misrepresentation in a story published Thursday on how the state income tax proposed by then-Gov. Don Sundquist was stopped. Tennesseans who were living in Nashville at the time know the proposed income tax was stopped by a populist uprising led by state legislators Marsha Blackburn, Mae Beavers, and Diane Black, and talk radio hosts Steve Gill and Phil Valentine. Bredesen is the Democrat nominee for the U.S. Senate seat currently held by retiring Sen. Bob Corker (R-TN). He faces Rep. Marsha Blackburn (R-TN-07), the Republican nominee, in the November 6 general election. Gill, Cunningham, and Beavers also reflected upon the historic fight to keep a state income tax out of Tennessee. Gill: Am I overstating it, Ben, to say that Phil [Valentine] and Marsha and Diane and Mae and your efforts and the efforts and…

Read the full storyStates With Higher Taxes Lose Population While States With Lower Taxes, Like Tennessee, Gain Population

News flash: People move out of states with high tax burdens, more regulations and fewer jobs to states with fewer taxes and regulations and more jobs. The former tend to be in Democratic-controlled states, while the latter tend to be in Republican-controlled states. That report comes last week from Mark J. Perry at AEIdeas, a public policy blog from American Enterprise Institute, a think tank. Perry is a professor of economics and finance at the University of Michigan’s Flint campus. He is known as the creator and editor of the economics blog Carpe Diem. Perry refers to a Carpe Diem post he made last month in which he studied household moving data from North American Moving Services’ US Migration Report for 2017. Measures included economic performance, business climate (right to work, for example), business climate and individual taxes. The top five outbound states (where people leave) are: Illinois, Connecticut, New Jersey, California and Michigan. Illinois, Connecticut and New Jersey tied for the worst at 38 percent inbound but 62 percent outbound. The top five inbound states (which gain population) are: Arizona, Idaho, South Carolina, North Carolina and Tennessee. For example, in 2017, Tennessee had an inbound rate of 58 percent…

Read the full storyFailed Former Governor Don Sundquist – Who Tried To Force State Income Tax on Tennesseans–‘Is Helping Randy Boyd’ In His Gubernatorial Race

Don Sundquist, the establishment Republican who failed in his efforts to force a state income tax on Tennesseans when he served as the state’s governor between 1995 and 2003, has a new political purpose–he wants to help his “friend and neighbor” Randy Boyd become the next governor of the state. The Tennessee Star obtained a copy of the Sundquist family Christmas Letter for 2017 in which the former governor and his wife issued a call for help and support in the gubernatorial campaign of Knoxville-area businessman, Randy Boyd. At the end of the second paragraph of the five-paragraph missive, the Sundquists boast about the many high-level political events they have been a part of through the year. After a quick recap of what was undoubtedly a beautiful week spent in a villa in Tuscany, Italy, the couple talk about their time in Washington, D.C. for the 50th anniversary of the Fund for American Studies that the letter says former Governor Sundquist “has been a part of since its inception.” A notable high point of the event was a featured speech by the newest member of the Supreme Court, Justice Neil Gorsuch. Next, the letter sets up for a pivot and an ‘ask,’ with:…

Read the full story