Georgia Governor Brian Kemp signed an executive order Tuesday declaring a state of emergency in the Peach State due to high inflation, which included temporarily suspending the state’s excise tax on motor and locomotive fuel.

Read the full storyTag: inflation

Minnesota’s Average Gas Prices Jump by 30 Cents, Nearing $4

Average gas prices in Minnesota have jumped by more than 30 cents in a week, according to AAA data.

The current average price is $3.98 per gallon, up 36 cents from a week ago, the AAA data says. Average prices in the seven-county metro are over $4.

Read the full storyMore Americans Taking Second Jobs, Part-Time Work as Inflation Continues to Rage

An increasing number of Americans are taking up part-time work and even getting second jobs as worsening economic conditions such as high inflation have chipped away at their finances, according to experts who spoke to the Daily Caller News Foundation.

The median real weekly earnings for Americans are down 2.1% since the first quarter of the Biden administration, with data from August showing a spike in the unemployment rate and a job market that is beginning to cool, according to the Federal Reserve Bank of St. Louis. Due to wages failing to keep up with inflation and debt levels increasing, workers are increasingly taking part-time jobs and even second jobs in order to make ends meet, according to economists who spoke with the DCNF.

Read the full storySmall Businesses Feel the Pain of Inflation-Driven Interest Rates

Small business owners are feeling the pain of inflation-driven interest rate hikes, another difficulty for those owners to overcome as they continue to recover from the COVID-19 pandemic-era shutdowns.

A rash of federal spending and an increase in the money supply in recent years have fueled inflationary pressures. Prices soared during the beginning of the Biden administration, making it hard for Americans to make ends meet.

Read the full storyPowell Signals More Rate Hikes Could Be On The Horizon

Federal Reserve Chair Jerome Powell raised the possibility of more interest rate hikes in prepared remarks Friday as inflation remains above the Fed’s target rate.

Powell hinted that the Fed will raise interest rates in the future if factors like high inflation, a hot labor market and sustained economic growth persist, according to a speech given by Powell at the Jackson Hole Economic Symposium. Interest rates have been raised 11 times since March 2022 in an effort to fight inflation, bringing the federal funds rate within a range of 5.25% and 5.50%, the highest rate since January 2001.

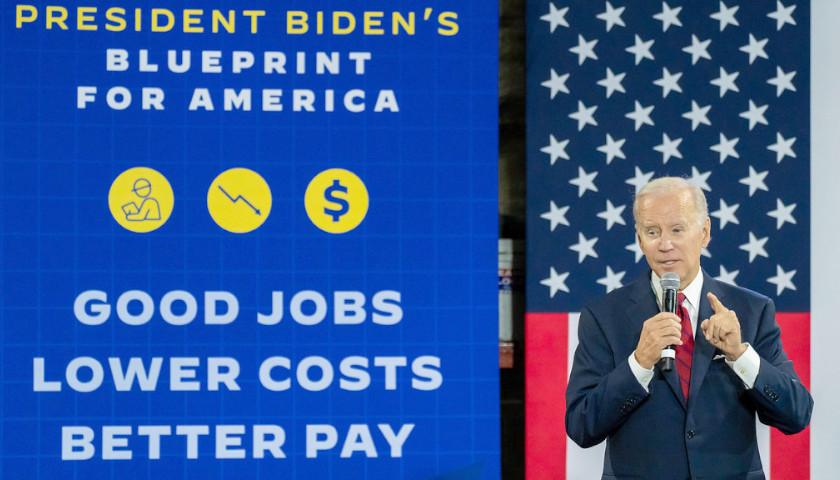

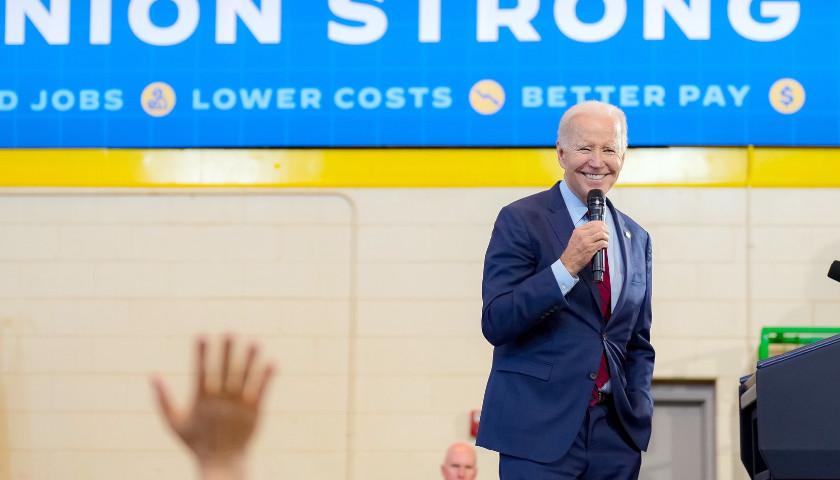

Read the full storyBiden Peddles Policy Success in Badger State; the Numbers Tell a Different Story

On the one-year anniversary of the ill-named Inflation Reduction Act, President Joe Biden paid a call on Milwaukee to sell his tax-and-spend policies that the White House likes to call “Bidenomics.”

But a lot of Badger State residents who have seen their earnings swallowed up by the inflation fueled in no small part by “Bidenomics” aren’t seeing the benefits the president is touting.

Read the full storyInterest Rate Hikes Fail to Pump the Brakes as Inflation Rises

Inflation rose in July after steadily declining from a high of 9.1% in June 2022, according to the latest Bureau of Labor Statistics (BLS) release on Thursday.

The Consumer Price Index (CPI), a broad measure of the prices of everyday goods like energy and food, increased 3.2% on an annual basis in July, compared to 3.0% in June, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, remained high, rising 4.7% year-over-year in July, compared to 4.8% in June.

Read the full storyWisconsin Lawmakers Introduce ‘Tiny Tot Tax Cut’

Taking a page from a Florida plan to bring tax relief to families, two Badger State Republican legislators are pushing a bill that would create a sales tax exemption on baby-related products.

State Representative David Steffen (R-Howard) and State Senator Jesse James (R-Altoona) recently introduced the “Tiny Tot Tax Cut” to help fight inflation where it can hurt families the most.

Read the full storyInflation Rose Slightly in June, Data Shows

Newly released federal inflation data shows that inflation ticked up in June.

The U.S. Bureau of Economic Analysis Friday released its Personal Consumption Expenditure, a favorite inflation marker for the Federal Reserve, which showed a 0.2% increase.

Read the full storyInflation Tanks Small-Dollar Donations to 2024 Campaigns

As prices across the country remain high, small-dollar donations have decreased for 2024 political campaigns, Politico reported Friday.

Although inflation fell in June, prices are still above pre-pandemic levels, and candidates who previously reaped the benefits of grassroots donations are not receiving them at the same degree, according to Politico. The campaign arms of House Republicans and Democrats, as well as presidential candidates, saw a drop in small-donor donations compared to previous cycles.

Read the full storyMinnesota Business Firms Report Inflation, Wages Expectations in State Survey

Minnesota businesses reported their experience and expectations regarding inflation and other economic indicators in a new survey.

The Minnesota Department of Employment and Economic Development and the Federal Reserve Bank of Minneapolis surveyed randomly selected 229 Minnesota firms in May and June, according to the report. The department announced the results this week.

Read the full storyIndependence Day Cookout Spending to Hit Record High Amid Inflation

Individual spending on Fourth of July food items has risen to $93.34 on average across the U.S., the highest the National Retail Federation (NRF) has recorded since it began collecting this information in 2003.

The cost of one person’s July Fourth foods rose about 10 percent over the past year from $84.12, according to NRF. Inflation remained twice as high as the Federal Reserve’s target in May, according to a Labor Statistics (BLS) report, and the price of energy and food increased 4.0 percent on an annual basis last month.

Read the full storyCommentary: ‘Bidenomics’ Are Leaving Americans Behind

“When you think about wages going up, when you think about inflation at its lowest by more than 50 percent than it was a year ago, that’s because of the work that this President has done. And he’s going to continue to focus on what we can do to lower cost for the American people. And so, that is incredibly important.”

That was White House Press Secretary Karine Jean-Pierre on June 26, outlining President Joe Biden’s views on the current state of the U.S. economy, which have seen a diminution of the purchasing power of American households as high inflation set in following the more than $6 trillion that was printed, borrowed and spent into existence for Covid coupled with the economic lockdowns and production halts—literally too much money chasing too few goods.

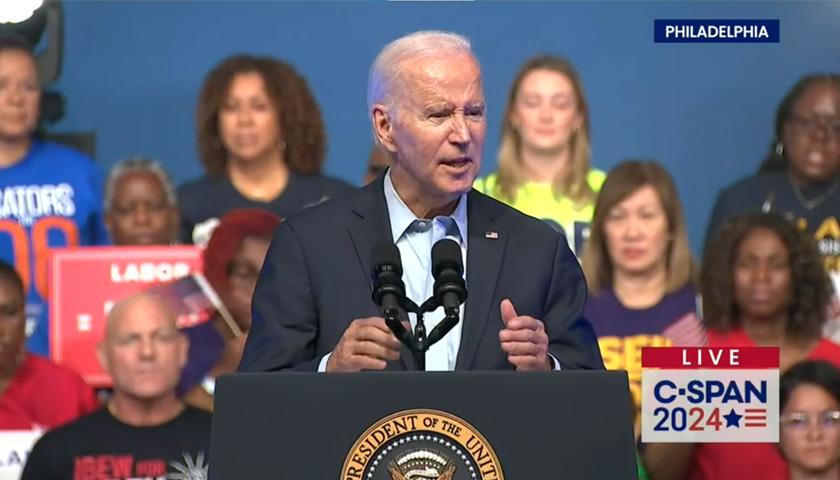

Read the full storyBiden Sets Leftist Tone for 2024 Re-Election Effort at Philadelphia Event

President Joe Biden held his first presidential re-election campaign event on Saturday at the Philadelphia Convention Center, making strong appeals to his left-wing base.

Biden appeared alongside organized-labor activists and mentioned in the first few seconds of his oration that when he thinks of working Americans, he especially values the ones who associate with causes he finds politically congenial.

Read the full storyPennsylvania Representatives Blast Biden on Quality-of-Life Issues Ahead of His Philadelphia Visit

One day before Joe Biden heads to a Saturday Philadelphia rally, U.S. Representatives Guy Reschenthaler (R-PA-14) and Dan Meuser (R-PA-9) excoriated him in a press call over quality of life issues.

Joined by Pennsylvania GOP Chairman Lawrence Tabas, the two lawmakers blasted the president for seeking reelection in 2024, insisting Biden has made life worse for Americans on virtually every facet affected by public policy. They mentioned that inflation rages, real wages slump, energy production languishes, gas prices rise, fentanyl use spreads, reading and math scores tumble and crime swells.

Read the full storyInflation Rises Slightly in May

The latest federal data released Tuesday showed that inflation rose slightly last month.

The U.S. Bureau of Labor Statistics released its Consumer Price Index for May, a federal marker of inflation that rose 0.1% last month, part of a 4% increase in the previous 12 months. Most economists say 2% to 3% inflation is healthy for the economy.

Read the full storyApril Home Sales Down, Prices Up in Wisconsin

The latest snapshot of Wisconsin’s housing market isn’t all that great, although realtors say there are signs things are improving.

The Wisconsin Realtors released their April 2023 report on Thursday, and it shows that both sales and home inventories are down, while prices are up.

Read the full storyCrom’s Crommentary: Republicans Need to Hold the Line and Tamp Down This Dramatic Increase in Spending

Friday morning on The Tennessee Star Report, guest host John Harris welcomed original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyAmericans’ Inflation Pain Hits a New High

Regardless of a slowdown in the rise of inflation, Americans report that higher prices are causing financial hardship, a new poll indicates.

Gallup released the poll data Thursday, which found that 61% of those surveyed say price hikes have caused financial hardship, up from 49% in January of last year. That 61% figure is a high point for Americans since Gallup began tracking the data in 2021, when inflation was growing faster.

Read the full storyAmericans’ Views of Housing Market Worse than After 2008 Market Crash

Americans’ views of the housing market have plunged as interest rates continue to rise because of government-fueled inflation.

Gallup released new polling data showing that only 21% of Americans say now is a good time to buy a house, down 9 percentage points from the previous year. This year and last year during the Biden administration are the only times that fewer than half of Americans said it was a good time to buy a house since Gallup began asking in 1978.

Read the full storyState Senator Lauds Passage of Upcoming Tax Rebates Coming to Arizonans

Arizona State Senator Jake Hoffman released a statement Friday celebrating the upcoming tax rebates Arizonans will receive based on the State Budget passed by the Legislature and signed by Governor Katie Hobbs (D).

“Gas, groceries, housing, and energy prices have surged over the past three years since Democrats took control of the federal government,” Hoffman said. “This is the first time in at least 30 years our state lawmakers have been able to step up to the plate to provide a tax rebate of this magnitude for our citizens. I’m proud of the leadership of the Arizona Freedom Caucus, and for the support of our Republican colleagues, to dedicate $260 million to helping struggling Arizona families.”

Read the full storyPennsylvania Democrats Want Prisoners Included In Minimum Wage Hike

A Pennsylvania state correctional-facility inmate can expect to earn between $0.23 and $0.50 per hour at his prison job — not counting free room and board. Sixteen Pennsylvania House Democrats now want the state government that feeds and shelters these prisoners to pay them $21 an hour for their work.

Led by Representative Chris Rabb (D-Philadelphia), these lawmakers are spearheading legislation to dramatically increase the state minimum wage and apply the new rate to prisoners.

Read the full storyHousing Costs Keep Phoenix Inflation Near Nation’s Highest

April inflation rates show the Phoenix metropolitan area remains among the highest in the nation, with the increased cost of housing fueling the expensive cost of living.

The U.S. Bureau of Labor Statistics released national inflation data for April on Wednesday, showing the Consumer Price Index rose 0.4% last month. The numbers are seasonally adjusted. The increase is an acceleration from March, which saw only 0.1% in higher CPI among metros.

Read the full storyData Shows Booming Florida Economy Despite Inflationary Headwinds

Data shows that despite lingering inflation, Florida’s economy is excelling.

The latest data from the Florida Office of Economic and Demographic Research shows tax revenues are up and federal data reveals the Sunshine State had the nation’s 10th lowest unemployment rate.

Read the full storyGeorgia Again Reports Decreased Tax Collections

Georgia officials reported net tax collections for April decreased by 16.5% over a year ago.

The Peach State’s April net tax collections approached $4.2 billion, a decrease of $829.5 million compared to April 2022, when net tax collections surpassed $5 billion. Despite the drop, year-to-date net tax collections of nearly $27.8 billion are up 0.9%, or $256.9 million, compared to last fiscal year.

Read the full storyGeorgia Gov. Kemp Bashes Washington Spending but Touts Federally Funded Grants

Georgia Gov. Brian Kemp regularly blames Washington policies for causing inflation and hurting Georgians, but he doesn’t hesitate to announce grants — such as those for rural broadband projects — that rely on federal tax dollars.

“While failed policies coming out of Washington, D.C. are pushing us closer to a recession and forcing hardworking Georgians to endure sky-high inflation, we on the state level are doing what we can to return money back where it belongs – in taxpayers’ hands,” Kemp said in a statement earlier this month in announcing officials had issued the first round of “surplus tax refund checks” to Georgia taxpayers.

Read the full storyFed Raises Interest Rates by a Quarter Point to Fight Inflation

The Federal Reserve Bank on Wednesday raised interest rates a quarter of a point again in an effort to cool inflation. “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5 to 5-1/4 percent,” the Fed said in an announcement about the rate hike. The rate was 4-3/4 to 5 percent.

Read the full storyEducation Superintendent Tom Horne Blasts Opposition to Teacher Pay Increase Bill

Arizona Superintendent of Public Instruction Tom Horne (R) released a statement Tuesday blasting opposition from Democrats and the state’s teacher union to House Bill (HB) 2800, sponsored by Representative Matt Gress (R-Phoenix).

“Shockingly, the Arizona teacher’s union and a number of Democrats in the legislature, oppose the bill. All we can think of is that they are opposed to it because it is a Republican bill. These kinds of questions should be bipartisan, and people should not oppose a good bill, just because [a] Republican introduced it,” Horne said.

Read the full storyPollster: Biden’s Re-Election Campaign Announcement ‘Like Christmas’ to Trump, Republicans

President Joe Biden announced his re-election campaign Tuesday, insisting he’s running again to “stand up for fundamental freedoms.”

Republicans in the nation’s presidential battleground states say the out-of-touch 80-year-old Democrat has cost Americans their freedoms — and their finances.

Read the full storyRepublican State Senator Proposes $15 Pennsylvania Minimum Wage Bill

Pennsylvania’s state Senate Republican Policy chair on Friday said he’s sponsoring legislation gradually raising the commonwealth’s minimum hourly wage to $15 and thence indexing it to inflation.

Senator Dan Laughlin (R-Erie), one of his chamber’s most moderate Republicans representing one of its most electorally competitive districts, said in a statement that he carefully mulled the issue before announcing his measure. The Keystone State’s pay floor rose to $7.25 per hour in 2008, matching the federal minimum wage, and the senator insisted now is the time for an increase, observing that 30 states now set their floors higher.

Read the full storyInflation Rises Again in March, but at Slower Pace

Inflation rose again in March, but at a slower pace than previous months, the U.S. Bureau of Labor Statistics latest consumer pricing data shows.

The Consumer Price Index rose 0.1% in March, contributing to a 5% rise over the last 12 months, about double what economists say is a healthy inflation rate. Price changes varied by the respective good and service.

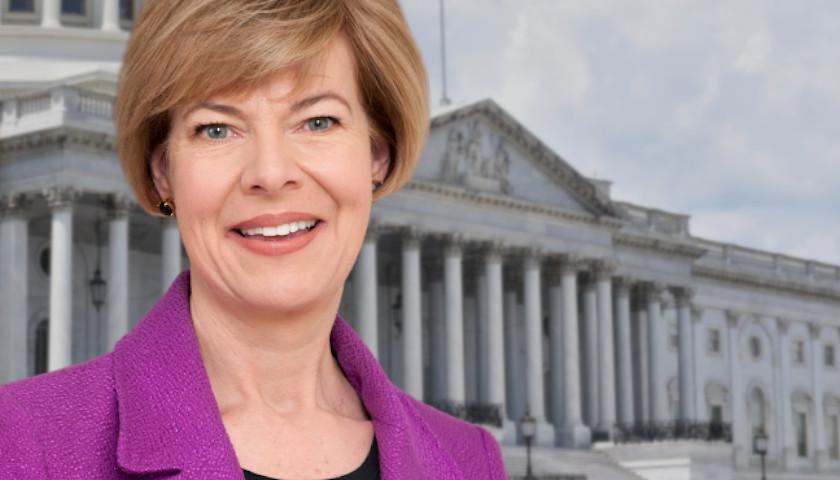

Read the full storyFar-Left Wisconsin U.S. Senator Tammy Baldwin Announces Bid for a Third Term

Liberal Wisconsin U.S. Senator Tammy Baldwin made it official Wednesday, announcing her quest for a third term.

The Madison Democrat insists “Wisconsinites need someone who can fight and win,” but Baldwin has shown during her time in D.C. that she’s a very dependable vote for the far left agenda — an agenda that’s out of touch with many voters in the politically purple Badger State.

Read the full storyCrom’s Crommentary: Job Layoffs, Gnawing Inflation, Weak Economy and Vote for Pay

Monday morning on The Tennessee Star Report, host Leahy welcomed the original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyUnemployment Claims Rise in Minnesota

Minnesota had the sixth lowest decrease in unemployment claims since last week, WalletHub reported Thursday.

Across the country, new unemployment claims decreased 7.3% week-over-week March 27 amid high inflation and threat of a recession, the report said.

Read the full storyCommentary: Once Again, Wages Are Rising Slower than Inflation

This week’s jobs report reveals the labor market is finally starting to crack under the weight of two years of Bidenflation and the resulting rapid increase in interest rates.

The economy created the fewest jobs last month than in any month in Biden’s presidency. The average weekly hours for employees also fell again.

Read the full storyPennsylvania Leadership Conference Poll: Election Integrity Conservatives’ Foremost Concern

At the Pennsylvania Leadership Conference this weekend, a straw poll of right-leaning activists from across the Keystone State found election integrity tops their public concerns.

Cybersecurity Association of Pennsylvania President Scott R. Davis, who administered the survey, told attendees at the Penn Harris Hotel west of Harrisburg that 38 percent of those who voted called election integrity the foremost issue facing the state General Assembly. Trailing that topic were the state budget (28 percent) and gun laws (six percent). Eleven percent chose another issue.

Read the full storyFed Raises Interest Rates a Quarter-Point, Highest Levels Since 2007

The Federal Reserve hiked its target federal-funds interest rate by a quarter of a percentage point Wednesday, the ninth in a series of hikes that started in March 2022.

The hike brings Fed’s target rate to a range between 4.75 percent and 5 percent with the Fed maintaining its pace of slowed increase. Most economists expected a quarter-point interest-rate hike in an effort to bring inflation down, but the current banking calamities contributed to the possibility of a pause, according to Bloomberg.

Read the full storyInflation Continues to Outpace Wages, Data Shows

Inflation has outpaced wages for nearly two years, recently released federal data shows.

A closer look at federal wage and pricing data shows workers are making less overall as the price for all kinds of goods and services rise faster than average hourly wages.

The U.S. Bureau of Labor Statistics tracks “real” average hourly earnings, which are wages of Americans with rising inflation taken into account.

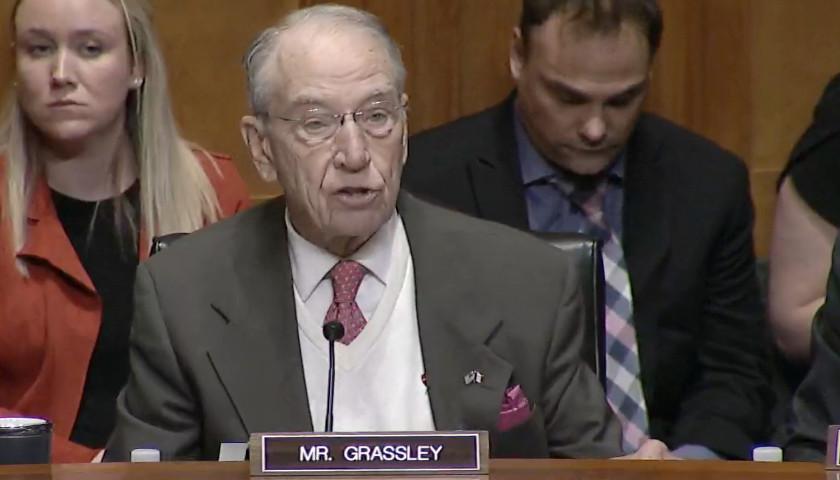

Read the full storyIowa U.S. Senator Chuck Grassley Grills Biden’s Treasury Secretary on Social Security, Inflation During Biden Budget Hearing

U.S. Sen. Chuck Grassley (R-IA) on Thursday grilled Treasury Secretary Janet Yellen on whether she still believes inflation is a positive for Americans and the economy.

During the Senate Finance Committee hearing on President Joe Biden’s $6.9 trillion budget proposal, Grassley also asked Yellen whether her boss has it in him to rise about politics and lead on shoring up a troubled Social Security system headed down the road to insolvency.

Read the full storyCrom’s Crommentary: ‘We’re Only Beginning to See the Tip of the Iceberg with SVB Scandal’

Wednesday morning on The Tennessee Star Report, host Michael Patrick Leahy welcomed the original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyFounder and CEO of CapWealth Management Tim Pagliara Explains How Silicon Valley Bank Failed

Wednesday morning on The Tennessee Star Report, host Michael Patrick Leahy welcomed the founder of CapWealth Management, Tim Pagliara in studio to explain how Silicon Valley Bank failed.

Read the full storyPoll: Inflation Has Americans Worried About Covering Expenses After Job Loss

A majority of Americans polled said they couldn’t afford to pay emergency expenses or cover their living expenses for just one month if they lost their primary source of income, according to Bankrate’s latest Annual Emergency Savings Report. The main reason cited is record-high inflation.

The majority surveyed, 68%, said they’re “worried they wouldn’t be able to cover their living expenses for just one month if they lost their primary source of income.”

Read the full storyFed’s Favorite Inflation Index Blew Past Expectations in January

The Federal Reserve’s preferred measure of inflation, the personal consumption expenditures (PCE) price index, surged past economists’ expectations in January, breaking a recent downward trend, according to the Bureau of Economic Analysis (BEA) Friday.

The PCE price index jumped by 0.6% on a monthly basis, and climbed to 5.4% on a year-over-year basis, up from 5.3% in December, the BEA reported. Economists had predicted the year-over-year number would continue to fall to 5% in January, but prices instead shot up at the highest levels since June, The New York Times reported.

Read the full storyInflation Continues to Worry Georgians, Groups Say

Inflation will likely stick around for the foreseeable future, and the elevated inflation continues to worry Georgia businesses, groups said.

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers increased by 6.4% over the past 12 months, higher than anticipated. Additionally, the Producer Price Index increased by 6% over the same period.

Read the full storyCommentary: ‘Economist’ Krugman’s Accounting of the National Debt is Jailworthy

The national debt has risen at a blistering pace over recent decades and is now higher than any era of the nation’s history—even when adjusted for inflation, population growth, and economic growth (GDP).

Denying this reality, Nobel Prize-winning economist Paul Krugman recently wrote two columns for the New York Times in which he claimed that the debt is an “overhyped issue” and “isn’t all that unusual” from a historical perspective. His attempts to support these assertions employ the kind of fraudulent accounting that could land a corporate executive in jail.

Read the full storyCommentary: Biden Has Mastered the Art of Dodging Blame for Inflation

It is frustrating that so many otherwise competent, knowledgeable economists and commentators are failing to land a punch on President Joe Biden regarding inflation.

It’s not that people don’t know the economy is floundering. They do. Almost 66% of Americans believe the country is on the wrong track, according to the latest RealClearPolitics polling average, a sentiment driven by inflation and the difficulties it has caused for people trying to keep up with household expenses.

Read the full storyCrom’s Crommentary: The Biden Administration ‘Is Doing Absolutely Nothing Good’ to Stop Inflation, or Solve Any of our National Problems

Wednesday morning on The Tennessee Star Report, host Leahy welcomed the original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyInflation Rebounds in January

The U.S. Bureau of Labor Statistics released fresh inflation figure Tuesday which show inflation picked back up in January.

The BLS Consumer Price Index rose 0.5% last month, part of a 6.4% increase over the last year. Overall, January’s rate is not as high as the peak inflation spikes seen in recent years, but it is still well above the increases considered advantageous by most economists.

Read the full storyBiden Touts Economy in Wisconsin as Badger State Suffers Consequences of Big Government Policies

President Joe Biden paid a call on Wisconsin Wednesday, touting job creation and boasting that the Big Government agenda he laid out in this week’s State of the State address will get the nation’s economy humming.

But the president’s cheerleading tour conflicts with the realities on the ground for Badger State businesses dealing with higher prices, supply chain issues and labor shortages.

Read the full storyTennessee Senator Marsha Blackburn Joins Colleagues in Re-Introducing Bill that Addresses Federal Debt Crisis

Tennessee Senator Marsha Blackburn (R-TN) joined a group of Republican colleagues this week in re-introducing the Full Faith and Credit Act. The bill is led by Florida Senator Rick Scott (R-FL).

Read the full story