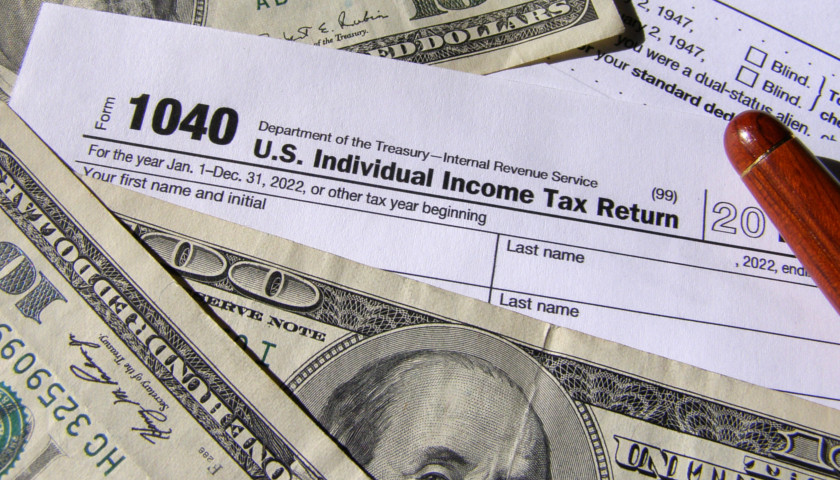

Five current or former IRS employees in the Memphis area have been charged with defrauding federal Covid-19 relief programs after spending relief money on Mercedes, Gucci, and trips to Las Vegas.

U.S. Attorney Kevin G. Ritz, for the Western District of Tennessee, said, “These individuals-acting out of pure greed- abused their positions by taking government funds meant for citizens and businesses who desperately needed it. I thank our law enforcement partners for rooting out this fraud. Our office will not hesitate to pursue and charge individuals who steal from our nation’s taxpayers.”

Read the full story