Wisconsin Representative Scott Fitzgerald (R-05-WI) signed a letter opposing suggested Internal Revenue Service (IRS) oversight of withdrawals and deposits of over $600. The letter was written by Minnesota Representative Tom Emmer (R-06-MN).

Read the full storyTag: IRS

Tennessee Representative Mark Green Sends Letter with over 100 Republicans to Speaker Nancy Pelosi Regarding IRS Data Collection Proposal

In an official press release Tuesday, Tennessee Representative Mark Green (R-TN-07) announced that he and 100 Republican colleagues sent a letter to Speaker Nancy Pelosi, Ways and Means Committee Chairman Richard Neal, Treasury Secretary Janet Yellen, and IRS Commissioner Charles Rettig, expressing their frustration over a recent IRS data collection proposal to increase tax information reporting requirements on financial institutions.

The proposed measure would require financial institutions to report transactions to the Internal Revenue Service on any bank account with a balance of more than $600. The Treasury Department says the proposal for extra data is being sought to target high earners who underreport their tax liabilities.

Read the full storyMany Pandemic Unemployed in Arizona Can Re-File for a Tax Rebate

Arizona taxpayers who received unemployment benefits in 2020 and filed their state tax return before the American Rescue Plan Act (ARP) was enacted on March 11 can receive a new income tax refund.

That’s according to a Thursday announcement from the Arizona Department of Revenue.

Congress passed the ARP to give communities money to address public health and economic recovery issues which resulted from the COVID-19 pandemic.

Read the full storyThe Federalist Intern and Pepperdine Senior Spencer Lindquist Reveals State and Privately Funded Drag Queen Story Hours

Monday morning on the Tennessee Star Report, host Michael Patrick Leahy welcomed Federalist intern and Pepperdine University Senior Spencer Lindquist to the newsmakers line to discuss his recent piece addressing the private and publicly funded Drag Queen Story Hours in public library’s.

Read the full storyIRS Denies Tax Exemption to Christian Group, Associates Bible with GOP

A top Internal Revenue Service official told a Christian group that “Bible teachings are typically affiliated” with the Republican Party as a rationale for denying its application for tax-exempt status.

The Texas-based Christians Engaged filed an appeal on Wednesday to the IRS’ denial, objecting to the tax agency’s assertion that it is partisan.

In a May 18 denial letter, IRS Exempt Organizations Director Stephen A. Martin said Christians Engaged is involved in “prohibited political campaign intervention” and “operate[s] for a substantial non-exempt private purpose and for the private interests of the [Republican Party].”

Read the full storyIRS: California Shrank by 165K Taxpayers, $8.8 Billion in Gross Income

California residents of all ages and incomes are leaving for more tax friendly climates, and they’re taking billions of dollars in annual income with them.

The Internal Revenue Service recently released its latest taxpayer migration figures from tax years 2018 and 2019. They reflect migratory taxpayers who had filed in a different state or county between 2017 and 2018, of which 8 million did in that timespan.

California, the nation’s most-populous state, lost more tax filers and dependents on net than any other state.

Read the full storyCommentary: Be Very Skeptical About Sen. Warren Throwing More Money at the IRS

Closing the “tax gap,” or revenue owed to the federal government that goes uncollected, has long been a favorite deus ex machina for lawmakers who want more revenue without having to raise rates. But Internal Revenue Service (IRS) Commissioner Chuck Rettig really put dollar signs in lawmakers’ eyes when he claimed the tax gap could be as large as $1 trillion. Always eager to appear knowledgeable on policy issues, Sen. Elizabeth Warren is putting forward a plan to collect extra revenue that only gets worse the deeper you dig into it.

First and foremost, it’s important to understand how far off on an island Rettig is with his estimate. The IRS’s last official estimate of the size of the tax gap placed it at a far, far lower $381 billion. Even considering that this estimate may not have factored in underpayment from cryptocurrencies, offshore holdings, and pass-through businesses, the tax gap still remains far closer to $500 billion than to $1 trillion.

Read the full storyMost Americans with Children to Receive Monthly Federal Payments Starting in July

Millions of American families will receive hundreds of dollars in regular federal payments beginning next month, the Internal Revenue Service said Monday.

The IRS announced July 15 as the start date for monthly child tax credit payments that would affect the vast majority of Americans with children.

“Eligible families will receive a payment of up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 and above,” the IRS said in a statement.

Read the full storyTreasury Department and IRS Announce That Tax Deadline Has Been Extended to May 17

The Treasury Department and the Internal Revenue Service announced on Wednesday that the 2020 tax filing and payment deadline is being pushed back from April 15 to May 17.

Read the full storyMemphis IRS Employee Indicted for Allegedly Abusing Position to Help Friends and Family

Federal authorities have indicted an Internal Revenue Service tax examiner for allegedly defrauding her employer by filing false tax returns for various taxpayers in the Memphis area. A press release from the U.S. Attorney’s Office for the Western District of Tennessee identified the woman as Linda Williams, 52, of Memphis.

Read the full storyVirginia General Assembly Pushes Forward with Taxes on Forgiven PPP Loan Revenue

The Virginia General Assembly is moving forward with legislation that would effectively make employers who received Paycheck Protection Plan (PPP) loans liable for state taxes. Bills that would practically exempt all income from the forgiven loans have been replaced with legislation that caps how much of the loan is exempt. Business advocates warn that the taxes could surprise the struggling businesses that the PPP loans were meant to help.

The bills bring Virginia’s tax code into conformity with the IRS; Virginia’s tax law doesn’t automatically change to match federal law, so state legislators pass tax conformity bills.

Read the full storyPuerto Rico: Tax Haven for the Super-Rich

Puerto Rico has become a popular tax haven for super rich Americans who take advantage of local laws, which allow them to avoid paying U.S. federal income taxes.

Over the last decade, thousands of wealthy Americans have built homes, started businesses and spent a significant amount of time in Puerto Rico, all in order to take advantage of the island’s tax code that exempts them from U.S. taxes. While just a few thousand have taken advantage of the law, the U.S. federal government has potentially lost out on hundreds of millions of dollars in tax revenue, according to the Internal Revenue Service (IRS).

“It’s being done, in a sense, in plain sight,” Peter Palsen, an international tax expert at the Washington D.C-area law firm Frost Law, told The Daily Caller News Foundation. “The IRS has the knowledge of who’s doing it.”

Read the full storyTax, Legal Experts Agree Leaker of Trump’s Tax Returns Could Face Prison Time

Tax and legal experts say the leaker or leakers who took President Trump’s personal tax returns and gave them to The New York Times, committed a felony punishable by prison.

Joseph diGenova, a former U.S. Attorney for the District of Columbia who has advised Trump on some legal matters, told Just the News that the leaking was “definitely” a crime that could be liable for both criminal and civil legal actions.

Read the full storyIRS Glitch Leads to Thousands of Foreign Workers Getting Stimulus Checks: Report

A glitch within the Internal Revenue Service (IRS) has reportedly led to as many as thousands of foreign nationals receiving coronavirus stimulus checks intended for U.S. residents.

Read the full storyPhil Roe Calls on IRS to Process Payments to Vulnerable Veterans without Delay

U.S. Rep. Phil Roe M.D. (R-TN-01) encouraged the U.S. Department of Veterans Affairs and the U.S. Department of the Treasury this week to expedite processing of stimulus payments for veterans without further delay.

Read the full storyFormer UAW President Gary Jones Charged with Embezzlement, Racketeering, and Tax Evasion

Former United Auto Workers President Gary Jones was charged with embezzlement, racketeering, and tax evasion Thursday in a massive FBI probe that has brought down several of the union’s top leaders.

Read the full storyComptrollers Call Out Lewis County Officials for IRS Problems

Lewis County officials failed to report and remit federal employment taxes totaling more than $150,000, and the IRS has gotten involved.

Read the full storyIRS Punishes Yet Another Tennessee County with Expensive Fines

IRS officials have imposed a $32,236 penalty on Cocke County.

Read the full storyAudit: IRS Slaps Sevier County with Expensive Fine

Federal officials recently penalized Sevier County with a fine of nearly $45,000 for not complying with IRS regulations.

Read the full storyThe IRS Placed Lien on Hunter Biden for More than $112,000 in Unpaid Taxes From Year He Served on Burisma Board

The IRS placed a tax lien on Hunter Biden seeking $112,805 in unpaid taxes from 2015, according to records the Daily Caller News Foundation obtained.

Read the full storyFBI, IRS Raid United Automobile Worker Chief’s House, Find Wads Of Cash

The FBI and IRS raided the home of the United Automobile Worker Chief President Gary Jones Wednesday and discovered wads of cash.

Read the full storyIRS Analyst Who Allegedly Leaked Michael Cohen’s Bank Records to Avenatti Pleads Guilty

An IRS analyst pleaded guilty Wednesday to leaking former Trump attorney Michael Cohen’s confidential financial records in 2018 to Michael Avenatti, the embattled celebrity lawyer.

Read the full storyTrump Signs Law Making It Harder for IRS to Seize Money From Americans

by Fred Lucas The Internal Revenue Service seized $446,000 from the bank accounts of brothers Jeffrey, Richard, and Mitch Hirsch in 2012, claiming a “structuring” violation against the owners of Bi-County Distributors Inc. for making multiple bank deposits of less than $10,000. The government never charged them with a crime, nor gave them a hearing to enable them to contest the seizure, but after intense national media attention to the case, the government returned the funds. The case was among many that highlighted an abuse by IRS agents known as legal source structuring that allowed the tax collection agency to use a law, the Bank Secrecy Act, intended to combat money laundering, to seize assets. President Donald Trump signed a bipartisan bill Monday to force greater accountability on the IRS in the property seizures, as well as protect taxpayers from identity theft, boost whistleblower protections, and modernize the tax agency. “We just finished signing, the important signing, of the Taxpayer First bill, the IRS Taxpayer First, which is a tremendous thing for our citizens having to deal with the IRS,” Trump told reporters after the signing. “It streamlines and so many other changes are made. That was just done…

Read the full storyHouse Democrats Issue Subpoena for President Trump’s Tax Returns

by Molly Prince House Ways and Means Committee Chairman Richard Neal subpoenaed the U.S. Department of the Treasury and the Internal Revenue Service on Friday to obtain President Donald Trump’s last six tax returns. “After reviewing the options available to me, and upon the advice of counsel, I issued a subpoena today to the secretary of the Treasury and the commissioner of the I.R.S. for six years of personal and business returns,” Neal told The New York Times. “While I do not take this step lightly, I believe this action gives us the best opportunity to succeed and obtain the requested material.” Neal sent the subpoena to Treasury Secretary Steven Mnuchin and I.R.S. commissioner Charles Rettig following Mnuchin’s refusal on Monday to provide House Democrats access to Trump’s personal and business tax returns dating back to the year 2013. Mnuchin contended at the time that the request was politically motivated. He further argued that turning the documents over would violate taxpayer privacy laws and warned that lawmakers would be vulnerable to the same prying. House Democrats have been threatening for years to seize Trump’s tax returns. The president notably caused an outcry after he disregarded decades of precedent by…

Read the full storyTrumps Sue Banks to Keep Them from Complying with Congressional Subpoenas

by Chuck Ross President Donald Trump, his three oldest children, and their companies sued Monday to prevent their two banks from complying with congressional subpoenas for personal and business financial records. The Trump lawyers argued in the lawsuit that the subpoenas, which were issued to Deutsche Bank and Capital One on April 15, “have no legitimate or lawful purpose.” “The subpoenas were issued to harass President Donald J. Trump, to rummage through every aspect of his personal finances, his businesses, and the private information of the President and his family, and to ferret about for any material that might be used to cause him political damage,” reads the lawsuit, which was filed in the Southern District of New York. “No grounds exist to establish any purpose other than a political one.” The House Intelligence and House Financial Services committees issued the subpoenas, which seek a variety of financial records from the president, Donald Trump Jr., Ivanka Trump, Eric Trump, several of their companies, and a joint trust. House Democrats have ramped up their campaign to obtain Trump’s financial records in recent weeks. On April 3, Massachusetts Rep. Richard Neal, the Democratic chairman of the House Ways and Means Committee,…

Read the full storyUS House Panel Chairman Gives IRS April 23 Deadline on Trump Taxes

The Democratic chairman of the U.S. House Ways and Means Committee on Saturday set a new April 23 deadline for the Internal Revenue Service to comply with his request for six years of President Donald Trump’s personal and business tax returns. In a letter to IRS Commissioner Charles Rettig, Ways and Means Chairman Richard Neal said the tax agency’s failure to comply with the new deadline would be interpreted as a denial of his request. The Trump administration has already failed to comply with an earlier April 10 deadline set by Neal. Democrats want to review Trump’s taxes as part of their investigations into possible conflicts of interest posted by his continued ownership of extensive business interests, even as he serves the public as president. Trump broke with a decades-old precedent by refusing to release his returns as a presidential candidate in 2016 and continues to do so as president, saying his tax returns are under IRS audit. Neal, a Massachusetts Democrat, is the only House lawmaker authorized to request taxpayer data from the Treasury, which oversees the IRS. The law says simply that the Treasury “shall furnish” such data when requested. But the White House has said the documents…

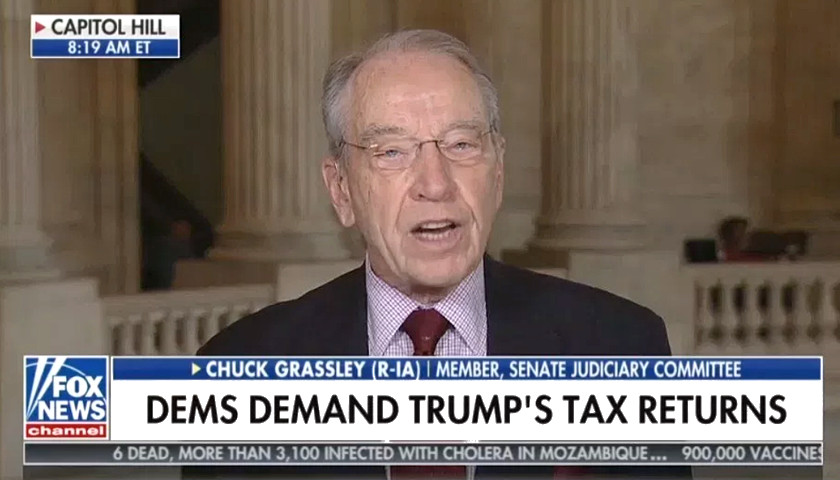

Read the full storyGrassley Explains Why He Doesn’t Want To See Trump’s Tax Returns

by Nick Givas Sen. Chuck Grassley explained why he wasn’t interested in seeing President Donald Trump’s personal tax returns, on “Fox & Friends” Monday. “Listen, you’re asking me as chairman of the Finance Committee, we would have an opportunity to see [Trump’s tax returns] too. I don’t want to see them,” he said. “I am not going to request them and you’re asking me in regard to Trump. I want to tell you that I look at this not from the point of view of Trump, but what is legitimate for Congress to do looking at people’s tax returns,” the Iowa Republican continued. “It’s not to know who the tax returns are. It’s supposed to serve a legislative purpose.” Grassely also said there should be an expectation of privacy with regard to personal tax information and expressed concerns about weaponizing the IRS to neutralize political enemies. “In fact the privacy of your tax returns are guaranteed by Section 6103,” he continued. “We want to make sure that what [former President Lyndon B. Johnson] did, what [former President Richard] Nixon did or what [former President Barack] Obama did — going after conservative organizations, that the IRS is not used for political purposes. But if you…

Read the full storyMick Mulvaney: Democrats Will ‘Never’ See President Trump’s Tax Returns

by Henry Rogers Acting White House Chief of Staff Mick Mulvaney said Democrats in Congress will “never” succeed in obtaining President Donald Trump’s tax returns. Mulvaney mentioned in an interview with “Fox News Sunday” how Democrats are demanding the IRS to hand over Trump’s tax returns. “Democrats are demanding that the IRS turn over the documents. That is not going to happen, and they know it. This is a political stunt,” Mulvaney said. House Democrats said in early March they will be demanding Trump to release his tax returns, ramping up their investigations into the president. “We’re almost ready to go,” Democratic New Jersey Rep. Bill Pascrell told Politico in March when asked about Trump’s tax returns. Democrats have been pushing for the release of Trump’s tax returns since he announced his candidacy for president. This all comes as House Judiciary Committee Chairman Jerry Nadler, a New York Democrat, requested a number of documents from the White House and is sending letters seeking information from people and organizations close to Trump. – – – Henry Rogers is a reporter at Daily Caller News Foundation. Follow Henry Rodgers On Twitter. Content created by The Daily Caller News Foundation…

Read the full storyUS House Panel Asks IRS for Six Years of Trump’s Tax Returns

The head of a House Ways and Means Committee is formally asking the Internal Revenue Service to turn over the last six years of President Donald Trump’s tax returns. Congressman Richard Neal chairs the committee, which oversees tax policy, as Democrats seek to examine Trump’s complex business empire. Trump is the only U.S. president or candidate in more than 40 years to refuse to make his tax returns public. “It is critical to ensure that accountability of our government and elected officials,” Neal said Wednesday. “To maintain trust in our democracy, the American people must be assured that their government is operating properly, as laws intend.” Trump has said he cannot release his returns from 2013 through 2018 because he says he is under audit. “I’ve been under audit for many years because the numbers are big and I guess when you have a name, you’re audited,” he said Wednesday. But Neal is not asking Trump for the returns. He is asking the IRS, and there are no laws preventing the IRS from releasing the returns if they are being audited. Neal said he is certain the Ways and Means committee is within its “legitimate legislative, legal and oversight rights”…

Read the full storySen. Cotton Seeks IRS Inquiry Into Southern Poverty Law Center’s Tax Status

by Fred Lucas Sen. Tom Cotton has asked the Internal Revenue Service to investigate the Southern Poverty Law Center, a liberal activist organization that regularly brands organizations it opposes as “hate groups.” Cotton, R-Ark., said the probe is needed for “protecting taxpayer dollars from a racist and sexist slush fund devoted to defamation.” The Arkansas lawmaker wrote a letter Tuesday to IRS Commissioner Charles Rettig, calling for the tax agency to probe whether the SPLC should retain its 501(c)(3) tax-exempt status. “Recent news reports have confirmed the long-established fact that the SPLC regularly engaged in defamation of its political opponents,” he wrote. “In fact, the SPLC’s defining characteristic is to fundraise off of defamation.” Sen. Tom Cotton has asked the Internal Revenue Service to investigate the Southern Poverty Law Center, a liberal activist organization that regularly brands organizations it opposes as “hate groups.” Cotton, R-Ark., said the probe is needed for “protecting taxpayer dollars from a racist and sexist slush fund devoted to defamation.” The Arkansas lawmaker wrote a letter Tuesday to IRS Commissioner Charles Rettig, calling for the tax agency to probe whether the SPLC should retain its 501(c)(3) tax-exempt status. “Recent news reports have confirmed the long-established…

Read the full storyFormer Iowa School Official on Probation After Embezzling $217K

by Neetu Chandak A former school official was sentenced to three years of probation at a Friday hearing after embezzling $217,000 from a school district near Des Moines, Iowa. Melissa Lantz, 35, stole the money over the course of several years from Woodward-Granger Community School District. She was given a 10-year suspended prison sentence along with paying back the money and doing community service, The Associated Press reported Monday. Former school official who took nearly $217K gets probation https://t.co/RzybpuCTRC pic.twitter.com/XC2qilqL6l — KCCI News (@KCCINews) January 22, 2019 District officials felt Lantz was getting off too easy, according to KCCI. ” … personally, sick to my stomach — I mean, just knowing where [the money] came from at that particular point — disheartening,” Superintendent Brad Anderson said, KCCI reported. Lantz was hired to work with the school district in 2012. She worked her way up to becoming a business manager after handling payroll assignments. A state audit found Lantz issued 101 unauthorized checks to herself, the AP reported in August 2018. Lantz used the money to pay the Internal Revenue Service (IRS), Granger Motors and Homemaker’s Furniture, KCCI reported. She has children attending school in the district, so Lantz will…

Read the full storyColorado Governor Extends Unemployment Benefits to All Federal Workers During Shutdown

Gov. Jared Polis (D-CO) has opened up unemployment benefits for all federal employees working without pay in the state as the government shutdown carries on. “I have authorized an emergency rule that makes unpaid federal workers eligible for unemployment benefits, whether they are reporting for work or not,” Polis said in a Friday statement. “Many federal employees can’t afford to go without a paycheck for a month or longer—Congress needs to re-open the government, but in the meantime, our state will do everything we can to help Coloradans.” Prior to his announcement, only furloughed workers were eligible for unemployment benefits, since the law requires people to be out of work, not just working without pay, to qualify. Polis’ office said that 2,416 furloughed workers had already taken advantage of unemployment benefits, according to Colorado Politics. Under Polis’ emergency rule, essential employees who have been working without pay, such as TSA agents or IRS workers, can now apply for unemployment benefits. “Those federal employees who are required to report for work are feeling the same economic squeeze as those who have been furloughed,” Polis said. “They should not be denied the immediate financial assistance provided by unemployment benefits while being mandated…

Read the full storyCommentary: An Epidemic of Erasures, Redactions, Omissions, and Perjuries

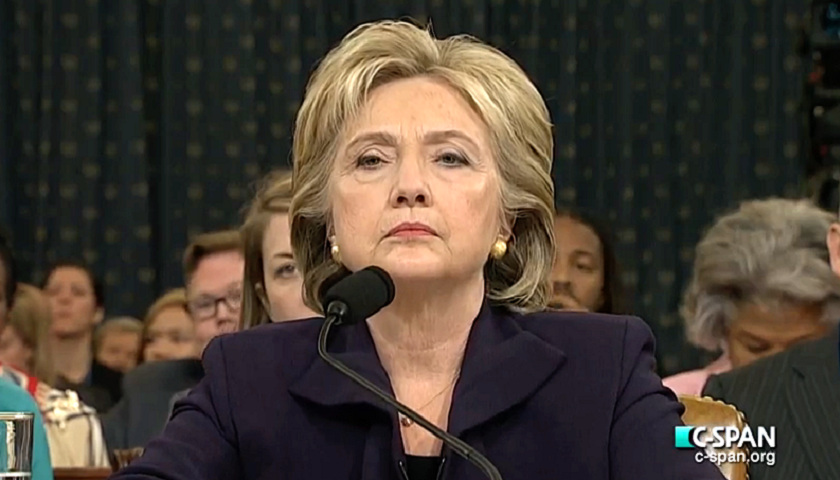

by Victor Davis Hanson Imagine the following: The IRS sends you, John Q. Citizen, a letter alleging you have not complied with U.S. tax law. In the next paragraph, the tax agency then informs you that it needs a series of personal and business documents. Indeed, it will be sending agents out to discuss your dilemma and collect the necessary records. But when the IRS agents arrive, you explain to them that you cannot find about 50 percent of the documents requested, and have no idea whether they even exist. You sigh that both hard copies of pertinent information have unfortunately disappeared and hard drives were mysteriously lost. You nonchalantly add that you smashed your phone, tablet, and computer with a hammer. You volunteer that, of those documents you do have, you had to cut out, blacken or render unreadable about 30 percent of the contents. After all, you have judged that the redacted material either pertains to superfluous and personal matters such as weddings and yoga, or is of such a sensitive nature that its release would endanger your company or business or perhaps even the country at large. You also keep silent that you have a number…

Read the full storyWomen’s March, Other Left-Wing Groups Violated IRS Rules and Their Nonprofit Status Could Be In Jeopardy

by Andrew Kerr, Peter Hasson and Joe Simonson Left-wing nonprofit groups that orchestrated disruptions during Brett Kavanaugh’s Supreme Court confirmation hearings likely violated IRS rules, which can result in their loss of tax-exempt status, according to an investigation by The Daily Caller News Foundation. TheDCNF listened in on a conference call Monday where organizers for three groups behind the protests called on activists to continue their “civil disobedience” as part of their efforts to “shut down” Monday’s upcoming confirmation proceedings. These activist organizations — which include Women’s March, the Center for Popular Democracy and Housing Works — provided cash for the post-and-forfeits to protesters who didn’t show up with their own money before they faced arrest for their conduct, CPD Action national field organizer Darius Gordon and Housing Works national advocacy coordinator Paul Davis both said on Monday’s call. Post-and-forfeit payments are small cash sums paid to resolve low-level misdemeanor crimes and avoid jail time. More than 200 activists connected with #CancelKavanaugh, a movement organized by the three groups, were arrested for disrupting Kavanaugh’s confirmation hearings in early September, and the organizers said they plan to continue its near-constant disruptions of future Senate confirmation proceedings. Women’s March, Center for Popular Democracy Action…

Read the full storyAs a Tax Accountant, I Can Tell You Tax Reform Is Helping Small Businesses

by Kalena Bruce As we enter the summer, Republicans and Democrats continue to debate the merits of the tax cuts. Lost in this partisan bickering is the genuine and long-overdue relief the tax cuts offer small businesses. Sadly, the media reporting on small business tax cuts has been heavily politicized, complicating rather than clarifying the issue. Even The New York Times couldn’t get it straight in an article earlier this year, leading to an embarrassing correction. As a certified professional accountant, I’ve already started dealing with the new tax code for small business clients who file returns on a quarterly basis. Here’s what they need to know. The new tax structure lowers tax rates and expands the income thresholds for anyone who pays individual income tax, including small businesses that are structured as pass-throughs. These include sole proprietorships, partnerships, LLCs, and S-Corps. The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more >> Under the new tax structure, rates fall to 10, 12, 22, 24, 32, 35, and 37 percent from 10, 15, 25, 28, 33, 35, and 40 percent. Income thresholds under these new rates are also expanded. For instance,…

Read the full storyIRS Didn’t Audit Returns of Half of Corporate Giants in 2017

Nearly half of the 616 U.S. corporations worth $20 billion or more didn’t have to worry about IRS auditors catching mistakes — unintentional or otherwise — on their annual tax returns because federal officials didn’t subject them to reviews, according to data obtained by a non-profit government watchdog.

Read the full storyCommentary: Why Are the IRS and Congress Ignoring the Millions of Cases of the Life-Altering Crime of Identity Theft Committed by Illegal Aliens Each Year?

By Printus LeBlanc Despite the media and amnesty proponents on both sides of the aisle declaring illegal immigrants don’t commit crimes, a recent report from CNS News should shut down the amnesty debate. After reviewing several Treasury Inspector General for Tax Administration (TIGTA) reports, CNS found the Internal Revenue Service (IRS) routinely ignores massive numbers of possible identity theft. According to the report, there were 1.2 million cases in 2017 in which illegal aliens filed tax returns using Social Security Numbers (SSN). Why are the IRS and Congress ignoring a problem costing American citizens billions of dollars and countless years to fix? This is not the typical identity theft most people think of, but employment identity theft. Employment identity theft is when someone uses another person’s identity to get a job. The IRS can identify the theft through the ITIN/SSN mismatch process. The process detects instances in which an Individual Taxpayer Identification Number (ITIN) is listed as either the primary or secondary Taxpayer Identification Number on form 1040, and the Form W-2, included with the return has an SSN. What is most infuriating about the recent report is the lack of enforcement of federal law. The IRS found 1.3 million cases of…

Read the full storyEric Holder: DOJ Wrong to Apologize to Tea Party Groups for IRS Scandal

Former Attorney General Eric H. Holder Jr. said the Trump administration was wrong to have apologized to tea party groups snared in the IRS’s targeting scandal, saying it was another example of the new team undercutting career people at the Justice Department who’d initially cleared the IRS of wrongdoing. “That apology was unnecessary, unfounded and inconsistent, it seems to me, with the responsibilities that somebody who would seek to lead the Justice Department should have done,” Mr. Holder said.

Read the full storyLois Lerner Cites Years-Old Threats to Keep Her Dirty IRS Activities Secret

The threats that former IRS senior executive Lois G. Lerner says are serious enough to keep her court depositions forever secret date back to 2014, and she hasn’t shown any new threats, according to new court documents filed late Thursday. Ms. Lerner and her key deputy, Holly Paz, have demanded a judge forever seal their depositions and parts of any documents that mention those depositions, saying they fear for their safety. …

Read the full storyTrump Questions Church Of Scientology Tax Exemption

President Donald Trump apparently does not believes the Church of Scientology is a real religion, which could lead the church to lose its tax-exempt status just as Trump moves to appoint a new head of the Internal Revenue Service. Trump told Lynne Patton — a regional head at the Department of Housing and Urban Development —…

Read the full storyGOP’s Tax Bill Cancels $23 Billion in Credits Claimed by Illegal Immigrants

The new GOP tax overhaul would strip illegal immigrants of the ability to claim several major tax credits, saving the government $23.1 billion over the next decade, according to the bill’s authors. For years Republicans have complained that despite a general ban on taxpayer benefits flowing to illegal immigrants, the IRS has allowed them to collect…

Read the full storyFeds to Pay ‘Generous’ Settlement to Tea Party Groups for Targeting

The government apologized Thursday for illegally targeting tea party groups for intrusive scrutiny and agreed to settlements with hundreds of organizations snared in the targeting, bringing to a close one of the more embarrassing episodes of the Obama administration. Attorney General Jeff Sessions said the IRS owed the groups an apology after years of poor treatment…

Read the full storyKevin Brady: Senate Republicans Need to Back Tax Plan

House Ways and Means Chairman Kevin Brady said Wednesday that Republican senators need to support the tax reform legislation to prevent another legislative disaster. “At the end of the day, look, given what happened in the Senate in health care reform, I think it’s important for every Republican senator to make the commitment now that they’re…

Read the full storyCommentary: Will Speaker Ryan and Majority Leader McConnell Pass President Trump’s Tax Plan?

by CHQ Staff President Trump has released the framework for his tax reform and reduction plan to positive reaction from conservatives. Our friends at the Club for Growth issued a statement saying, “Fundamental tax reform comes around only once in a generation, and this is our chance. The outline is both aggressive and very pro-growth with its rate reductions. Club for Growth congratulates the members of the Big Six for their hard work and will continue to support the pro-growth efforts of the Trump administration and Congress as they seek to make tax reform a reality. To this end, the Club will also work with Congress to pass a budget in order to get reconciliation tax instructions.” The House Freedom Caucus, the steadfast conservative warriors who have held establishment Speaker of the House Paul Ryan’s feet to the fire on many issues were also positive about the President’s Plan: President Trump has delivered a forward-looking tax reform framework that will let hard working Americans keep more of their money, simplify our system, end carve outs for special interests, and will help make our businesses competitive abroad. The Freedom Caucus looks forward to sending a final bill based on this…

Read the full storyTrump to Unveil Tax Cuts Wednesday

US President Donald Trump will roll out a plan to reform America’s tax code Wednesday, a high stakes bid to salvage his agenda and bolster his faltering presidency. Amid a string of legislative setbacks, Trump teased a “big announcement tomorrow,” when the White House and Republicans will unveil tax reform plans. “I’ve asked lawmakers in both…

Read the full storyDonald Trump’s DOJ Won’t Pursue Charges Against Lois Lerner, Former IRS Senior Executive

Donald Trump’s DOJ won’t pursue charges against Lois Lerner, former IRS senior executive The Trump Justice Department has once again cleared former IRS senior executive Lois G. Lerner of criminal liability stemming from the tea party targeting. In a letter to top Republicans, Assistant Attorney General Stephen E. Boyd said they re-reviewed the case and concluded there isn’t enough evidence to charge Ms. Lerner, who was at the center…

Read the full storyPresident Trump Launches Tax Overhaul Initiative, Calls on Congress to Support ‘The American Model’

President Donald Trump traveled to Springfield, Missouri Wednesday to begin, in earnest, his bid to overhaul the leviathan that is the US Tax Code. “We’re here today to launch our plans to bring back Main Street by reducing the crushing tax burden on our companies and on our workers, ” President Trump began. “Our self-destructive tax code costs Americans millions and millions of jobs, trillions of dollars, and billions of hours spent on compliance and paperwork.” Dubbed ‘The American Model,’ President Trump said his Administration will enact policies to encourage companies to hire and grow in America, to raise wages for American workers, and to help rebuild our American cities and communities. “That is how we will all succeed and grow together, as one team, with one shared sense of purpose, and one glorious American destiny,” he said. Tax reform was a major part of candidate Donald Trump’s bid for the presidency, as a part of an America-first, pro-growth platform to unleash the country’s idle economic engine. “In the last 10 years, our economy has grown at only around two percent a year,” Trump said, “If you look at other countries and you look at what their GDP is,…

Read the full storyTrump Faces Difficult Task of Corralling Divided GOP on Tax Reform

The White House claims it is making progress on tax reform and could roll out part of its plan next week, but the president’s increasingly contentious relationship with lawmakers on the Hill has put a pall over the effort’s progress. President Donald Trump has been using Twitter to blast Senate Majority Leader Mitch McConnell and reportedly…

Read the full storyHouse Conservatives Set Ambitious Tax Reform Target: The IRS

A group of 151 conservative Republican congressmen are calling for the Internal Revenue Service to be abolished, calling it an “inefficient behemoth weighing down our economy.” “At its worst, the IRS has shown a capacity for outright corruption and political targeting,” the Republican Study Committee wrote in its budget released Thursday. “Under the Obama Administration, the…

Read the full storyBefore Lois Lerner Targeted the Tea Party, She Helped the Clinton Foundation

Six years before she became the central figure in the IRS’s illegal targeting of Tea Party tax-exemption applicants, Lois Lerner cleared the way for the Clinton Foundation’s transformation from building a presidential library to being a $2 billion global political influence peddling machine, according to documents obtained by The Daily Caller News Foundation’s Investigative Group. She…

Read the full story