Ohio House Democrats and Republicans unveiled a set of bills Monday at a joint press conference, continuing an unusual bipartisan push in the Ohio Legislature after successfully passing a state budget bill. “By working together, we can strengthen Ohio families, give our children a brighter future and create a strong foundation for economic growth,” said House Minority Leader Emilia Strong Sykes (D-Akron) during Monday’s press conference. Two of the bills unveiled Monday focus on strengthening the state’s foster care system. House Bill 8, sponsored by a Democrat and a Republican, seeks to improve foster caregiver training so foster parents can be trained more effectively. House Bill 14 would establish the Kinship Navigator Program, a new program that would help caregivers locate support services that are available to them. “The state’s done a lot to help those struggling with addiction. What we’re trying to do is make sure we’re also helping others who have been impacted by the addiction crisis,” House Speaker Larry Householder (R-Glenford) said. Ohio’s foster care system is “being stretched to the limit” as a result of the opioid epidemic. In Ohio alone, the number of kids in foster care has surpassed 15,000 and increased by 25…

Read the full storyTag: Mike DeWine

Lyft Opposes Proposal to Impose Sales Tax on Rides

by Todd DeFeo Levying a sales tax on transportation network companies in Ohio could have a potentially dangerous effect on the state’s residents, Lyft told members of the Ohio House Finance Committee. State lawmakers are looking to mandate ride-sharing companies such as Uber and Lyft collect a sales tax on the base fare or fees based on distance or time. Officials say the proposal could bring in more than $50 million over the two-year budget. But, in written testimony filed with members of the House Finance Committee, Lyft said the tax would be more harmful than helpful. “A sales tax – plus the recently increased gas tax set to go into effect this summer – could have (a) severe and disproportionate impact on those who can least afford it, not to mention the impact on Lyft drivers themselves,” the company said in its testimony. “Of additional concern, the sales tax being considered by the Ohio House of Representatives will force passengers to pay one of the highest sales taxes on ride-sharing in the nation.” Last month, Gov. Mike DeWine signed a bill increasing Ohio’s gas fuel tax by 10.5 cents per gallon starting July 1. DeWine originally asked for…

Read the full storyOhio’s Revised Budget Proposal Makes Tax Code ‘Fairer’ But Punishes Small Businesses Retroactively, Conservatives Say

A revised state budget proposal unveiled Thursday by House Republican leadership would introduce substantial income tax cuts for Ohioans but would do so by eliminating tax breaks for small businesses. The budget plan, House Bill 166, builds off of the budget proposal put forward by Gov. Mike DeWine, who said Friday that the bill sticks to the “essential principles” of his proposal. Under the proposal, Ohio’s lowest tax brackets would be completely eliminated, such that earners who make $22,250 or less annually wouldn’t pay any state income taxes. The state’s middle two brackets would also see significant reductions in income taxes. But these income tax reductions would be partially paid for by cutting down on the state’s small business tax deduction. Currently, small businesses don’t pay taxes on the first $250,000 of income, but that would be lowered to $100,000 under the new budget proposal. “We shouldn’t try to pick winners and losers. What we should try to do is set a balanced field out there and let people compete in business,” House Speaker Larry Householder (R-Glenford) said when unveiling the proposal. The Buckeye Institute, an Ohio-based conservative think tank, believes that Republicans are making a mistake in not…

Read the full storyCleveland Heights City Council Calls Heartbeat Bill ‘Intrusion’ on ‘Liberty’ in Letter to DeWine

Cleveland Heights Mayor Carol Roe and members of the city council have issued a letter to Gov. Mike DeWine to warn that “all options” are on the table in response to the controversial heartbeat bill. The letter begins by expressing “concern and disappointment” with DeWine for signing the heartbeat bill, which bans abortions in the state after a fetal heartbeat is detectable in unborn children. “This law, known as the ‘heartbeat bill,’ amounts to a virtual ban on abortion. As you know, this bill would go into effect prior to when most women realize they are pregnant,” the letter states. The letter was signed by Roe, Vice Mayor Melissa Yasinow, and Council Members Craig Cobb, Michael Ungar, and Kahlil Seren. They argue that the restrictions imposed by the heartbeat bill wouldn’t allow “anywhere near a sufficient amount of time” to overcome the state’s current barriers to abortion, such as its “24 hour, two-visit requirement.” “That is why this law is an effective ban on any safe and legal abortion in Ohio. This law’s intrusion into a person’s right to liberty, bodily autonomy, and privacy is unacceptable,” they write. The letter takes issue with the heartbeat bill for not providing…

Read the full storyOhio Conservatives Suggest Ways to Fix the State’s GOP

Two conservatives with clout in Ohio say they can fix the Ohio Republican Party, which they say has members that are too elite, lean left politically, and are too vindictive toward others. Those ideas include making Ohio a right-to-work state and changing its primary election system, they told The Ohio Star. “The Republicans here are afraid of their own shadow. We are still a union state, and that is probably one of our issues. They are afraid to go right-to-work,” said Ray Warrick (pictured, right), who chaired the Warren County Republican Party for two years. “They are afraid of upsetting the unions and that is because all but about four or five state representatives and all but about one state senator, Republicans, take money from the unions. They are all in the bag. In many states a Republican would never get a dime from the unions.” The odds of Ohio going right-to-work? “Slim and none,” Warrick said. “Mike DeWine as governor has said it is just not on the table. But it is the only thing that should be on the table.” According to BNA.com, Ohio is one of five states that has a “labor-Republican alliance.” Meanwhile, various news…

Read the full storyDeWine Claims He’s Asked His Team to Work on ‘Red Flag’ Law

Gov. Mike DeWine told the media Monday morning that he has asked his team to draft a red-flag bill to send to the Republican-controlled General Assembly. Former Gov. John Kasich repeatedly lobbied for red-flag legislation in the state, and refused to sign a controversial “Stand Your Ground” bill at the end of last session because it didn’t include such a provision. After another fatal shooting over the weekend, DeWine seems to be following in Kasich’s footsteps. “I am deeply concerned about what we are seeing in this country in regards to attacks on houses of worship,” DeWine said. “This is something that has to be deplored, I deplore – it’s sickening. People who go to worship certainly have the right to believe they are going to be safe.” According to The Columbus Dispatch, the comments were unprompted by reporters’ questions, but opened the floor up to discussion of a potential red-flag bill. “I have asked my team to work on that—trying to get a red flag law that can pass. That’s my goal,” DeWine said. The last time he spoke about the topic was in January before being officially sworn into office. “Well, I’ve talked about this during the…

Read the full storyOhio Republican Elite Lean Left and Act Vindictively, Tea Party Members Say

Ohio Tea Party members say an elite political class of Republicans-In-Name-Only controls the state’s GOP. Any conservatives not among the establishment class Republicans are kept at a distance. Once in office, these powerful RINOs use their power and influence to penalize people who speak up against them — and this includes even the relatives of the people who don’t conform, Tea Party members said. John McAvoy, a Tea Party official in northwest Ohio, told The Ohio Star this week that this was especially true when former Republican Gov. John Kasich held office. Kasich, of course, does not hold U.S. President Donald Trump, a fellow Republican, in high esteem. “If you were going to benefit from Kasich then you had to be a Never Trumper. I have had phone conversations with people when we were running state central committee candidates who told me ‘If you ever say I said this I will deny it, but I must support Kasich. The reason I must support him is because I have a brother-in-law who works for the Turnpike Commission and if I don’t support Kasich then my brother-in-law loses his job,” McAvoy said. “There were things like that. That is how the…

Read the full storyDeWine Supports Bailout of Ohio’s Nuclear Power Plants

Gov. Mike DeWine expressed support for saving Ohio’s two nuclear power plants that are expected to close if they don’t receive legislative relief. As The Ohio Star previously reported, lawmakers introduced a bill in early April that would effectively save Ohio’s only two nuclear plants. FirstEnergy Solutions, a subsidiary of FirstEnergy, announced in February that it would be closing its two Ohio-based plants, as well as a third in Shippingport, Pennsylvania, which employs a substantial number of Ohioans. A bankruptcy judge, however, rejected the company’s plan to shut down its plants, and so lawmakers are stepping in. Under House Bill 6, the state would subsidize the plant with taxpayer dollars through a new “Ohio Clean Air Program.” As reported: These funds would be passed to the energy company under the newly created ‘Ohio Clean Air Program.’ Funding would come from a $2.50 surcharge for every residential electric consumer in the state, and an additional $20 for all commercial customers, and a further $250 from industrial customers. In total, $300 million would be raised with $180 million going directly to FirstEnergy Solutions. According to The Columbus Dispatch, DeWine supports the plan, though he didn’t directly comment on House Bill 6.…

Read the full storyTea Party and GOP Members Believe Gov. Mike DeWine and Lt. Gov. Jon Husted Cut a Secret Deal in 2018 Election

There’s no hard evidence to back it up, but sources believe Ohio Gov. Mike DeWine and Lt. Gov. Jon Husted, both Republicans, allegedly made a secret pact during the 2018 election season to assist one another’s political fortunes. Initially, Husted ran for governor, but he later dropped out of that race to seek the lieutenant governor’s job, as DeWine’s running mate, sources told The Ohio Star. Ohio voters elected DeWine governor in 2018. “This stuff about a deal the two men made is not news,” said John McAvoy, a Tea Party official in northwest Ohio who said, at one time, he supported Husted. “People around Ohio know this. It’s common knowledge here.” This matters because some people in Ohio believe members of the state’s GOP leadership can and will exclude conservative candidates not among the state’s political elite. McAvoy, however, said he could not prove his accusations. In another part of Ohio, Ray Warrick, who chaired the Warren County Republican Party for two years, also said he and other conservatives throughout the state believe or speculate DeWine and Husted made a secret deal. “These two men actually spent the first two months of the campaign beating each other up,”…

Read the full storyDeWine Claims Vaping Isn’t Safer Than Smoking Cigarettes

Gov. Mike DeWine joined Ohio Department of Health Director Amy Acton Wednesday for a press conference to warn parents against the dangers of vaping. DeWine’s first budget proposal for the 2020-2021 biennium calls for increasing the age to purchase tobacco and vaping products to 21. On Wednesday, DeWine said that e-cigarette marketers “are convincing some people that their product is a safer alternative than smoking, and that’s simply not the case.” “With sleek, fun packaging and flavors like ‘candy crush’ and ‘watermelon wave,’ these products are clearly being marketed to kids. We should work to ensure kids don’t start using e-cigarettes in the first place,” DeWine continued. “It is our duty to warn parents of the risks of e-cigarettes and help families realize the long-term consequences of vaping may be no safer than smoking.” According to DeWine’s office, 350 kids in the United States under the age of 18 become daily smokers, while the rate of e-cigarette use among high-school kids increased from 11.7 percent to 20.8 percent, a 78 percent spike. That means that more than 3 million high-school students have used e-cigarettes in the past month. “We are seeing an explosive increase in vaping among our youth, and…

Read the full storyThe Bob Frantz Authority on WHK Radio in Cleveland Talks to State Rep Candace Keller About the Heartbeat Bill

Franz: Certainly there are a lot of important faith-based organizations that helped to accomplish what was accomplished last week in Columbus. As our state legislature and our governor combined to finally win for life. The Heartbeat Bill is now law. I know a lot of faith-based people in this listening audience who are not just faithful themselves but belong to groups and there are faith-based organizations that have worked very very hard to lobby members of the Ohio state general assembly. The House and the Senate. To protect life. To fight for life. To pass a Heartbeat Bill that would make it illegal for a woman to have an abortion after a second life is confirmed. After a second heartbeat is detected. Indicating there are now two bodies that need to be protected. To separate individual lives that need to be protected. And of course, we know the battle. This has been years in the making. It passed last year before it was vetoed for a second time by Governor John Kasich. Not so much this time. The Heartbeat Bill is now the Heartbeat law. It was passed and signed into law last week by Governor Mike DeWine. And joining…

Read the full storyOhio Lawmakers Look to Come Together on Tax Reform Amid Divisive Abortion Battle

Ohio House Democrats unveiled a number of proposals Thursday that they claim will “modernize” Ohio’s tax system to “benefit working people, families and small businesses.” They’re calling the set of proposals the “People First Tax Reform,” which will include a “Working Families First” tax incentive. This incentive would reform Ohio’s Earned Income Tax Credit by removing caps and making the credit refundable, according to a press release from the minority caucus. House Democrats claim this incentive could save families up to $212 million each year, and note that similar ideas were included in the biennial transportation budget. “We saw some pieces of the Working Families tax incentive in the transportation budget, so we know there is a bipartisan appetite for these commonsense reforms,” House Minority Leader Emilia Strong Sykes (D-Akron) said. “We need to work together to get our state on the right track so we can start growing again.” Another proposal calls for fixing the “state’s LLC loophole,” which Democrats describe as a “tax giveaway to Ohio businesses that, when designed, was supposed to create jobs.” Ohio’s job creation has consistently lagged behind the national average in recent years. “Years of tax giveaways and loopholes have held our state…

Read the full storyHeartbeat Bill Set to Become Law in Ohio After Emotional Day at the Statehouse

One of the most divisive and talked-about bills in Ohio’s history is officially on its way to Gov. Mike DeWine’s desk and is expected to be signed into law at any moment. After months of debate and numerous committee hearings, the heartbeat bill passed the Ohio House Wednesday afternoon in a 56-40 vote along party lines. It then went back to the Senate where changes made to the bill in the House were approved in an 18-13 vote. According to Cleveland-based reporter Laura Hancock, four Republicans voted against the bill in the Senate, since it doesn’t include exceptions for rape or incest. Here is the roll call in the #senate Which quickly voted to go with changes made in the Ohio house to #heartbeat #abortion bill. pic.twitter.com/PscVpnLE9P — Laura Hancock (@laurahancock) April 10, 2019 The House Health Committee was still hearing witness testimony on the bill as early as Tuesday, when several pro-choice religious organizations testified against it, as The Ohio Star reported. Protesters and activists from both sides of the debate gathered in the House chambers during Wednesday’s vote. While representatives were casting their votes, pro-abortion activists held a banner over the upper railings of the chambers, which read:…

Read the full storyBuckeye Institute Annual Report Identifies $2.5 Billion in Savings for Ohio Taxpayers

The Buckeye Institute released its annual Piglet Booklet Wednesday, which identifies wasteful government spending across state agencies that could save Ohio taxpayers $2.5 billion. “In this year’s Piglet Booklet, The Buckeye Institute identified at least $2.5 billion that policymakers can save Ohioans. And with the increase in the gas tax, it is critical to cut spending and taxes to relieve the growing burden on Ohio families,” said Greg Lawson, research fellow at The Buckeye Institute and author of the report. “Making these cuts will save Ohio taxpayers money, make government more efficient and effective, and keep the state on solid financial ground to better weather the next economic storm,” Lawson continued. The Piglet Booklet identifies four key areas where government spending and oversight can be reduced, including corporate welfare programs, government philanthropy and advocacy, burdensome occupational licensing regimes, and earmarks in spending bills. “Governments should not engage in crony capitalism by supporting one private company over another—it is ethically inappropriate and economically harmful,” the report says of the corporate welfare category. It identifies eight different “corporate welfare programs that should be eliminated,” such as the $3.1 million that is used to conduct “marketing on behalf of the state’s wine grape…

Read the full storyOhio’s Lt. Gov. Husted Named as Director of Another Top State Office

Ohio Lt. Gov. Jon Husted was named director of the Governor’s Office of Workforce Transformation, a role he will take on in addition to his capacity as director of InnovateOhio. Gov. Mike DeWine announced the appointment during a Thursday Cabinet meeting, saying he was “pleased” to have Husted “serve as the point person for Ohio’s workforce development efforts.” “It is so important that we continue to invest in our state’s most valuable asset—our workforce, and Lt. Gov. Husted will ensure that our efforts in this area are focused and deliver results,” DeWine said, according to a press release. In his new role, Husted will oversee 75 different workforce development programs across 12 state agencies, and will report directly to the governor. The position was previously occupied by Ryan Burgess, but he stepped down after being appointed director of cabinet affairs for DeWine. “Ohio’s economy has a lot of things working in its favor right now, but if we are going to reach our full potential and make our state more attractive to new businesses, we have to close our skills gap,” said Husted, who worked as vice president of the Dayton-area Chamber of Commerce before entering public office. “If we…

Read the full storyOhio Lawmakers Look to Institute $10,000 Fines for Violations of Heartbeat Bill, Use Money Collected for Adoption Efforts

Ohio House Republicans added substantial new provisions to their version of the “heartbeat bill” that have the potential to make one of the state’s most controversial pieces of legislation even more divisive. While the Senate already passed its version of the bill last month, it is still making its way through the committee process in the House. During its third hearing for the bill Tuesday, the Ohio House Health Committee adopted several changes to the text of the bill. One of those changes would allow the Ohio State Medical Board to fine up to $10,000 for “each separate violation or failure of a person to comply” with the provisions of the bill. Money collected through these fines would then be deposited into a new “Foster Care and Adoption Initiatives Fund,” which would be established upon the bill’s passage. Another change would require the Ohio Director of Health to adopt rules “specifying the appropriate methods of performing an examination for the purpose of determining the presence of a fetal heartbeat of an unborn human individual.” Along those lines, the new changes prevent the exclusion of transvaginal ultrasounds “as a method of detection.” Transvaginal ultrasounds, as opposed to abdominal ultrasounds, can detect…

Read the full storyCommunities Brace for Diesel Tax Increases After Ohio Gov. DeWine Signs Gas Tax Into Law

In one of his first major acts in office, Gov. Mike DeWine (R-OH) signed into law the state’s first gas tax increase since 2005. The issue has been the focal point of his first few months in office, and negotiations with House and Senate Republicans have not been easy. But on Tuesday, all parties finally agreed to a compromise: 10.5 cents on regular fuel, and 19 cents on diesel. That will bring the total gas tax to 38.5 cents, and the total diesel tax to 47 cents, both of which are currently taxed at an equal rate of 28 cents. The increase, set to go into effect July 1, doesn’t seem to have the support of most Ohioans, especially those who rely on diesel fuel. “Diesel fuel powers our economy, because it’s what the trucks that deliver Ohio-made products to market run on. A 19 cent increase on diesel will move Ohio well past the state average of 30.2 cents of tax per gallon and leave us with the sixth highest tax rate on diesel fuel in the country. This does not make Ohio more competitive and will be damaging to Ohio’s economy and to our businesses,” the Ohio Chamber…

Read the full storyOhio Conference Committee Fails to Reach Deal on Gas Tax, Cancels Monday Meeting

The Ohio Legislature failed to agree on a transportation budget before its midnight deadline Sunday. While several items were agreed to, a comprise hasn’t yet been reached on the gas tax. As The Ohio Star reported, the Ohio House and Gov. Mike DeWine settled on an 11-cent gas-tax increase, seven cents down from what DeWine initially proposed. “I’m pleased that we have reached an agreement with the Speaker of the House on the transportation budget that will enable the Ohio Department of Transportation to improve and maintain safer roads, bridges, highways, and intersections across Ohio. I am hopeful that the Senate agrees to this plan as well,” DeWine said in a statement after the agreement was announced. But the Ohio Senate is opposed to the 11-cent figure, and previously passed a bill that would institute a six-cent hike. A joint conference committee composed of six members has been meeting since Wednesday, but failed to reach an agreement. Senate President Larry Obhof (R-Medina) has been relatively quiet on the matter, but spoke with reporters Friday about the negotiations. “We will continue conversations and will all be back on Monday or Tuesday of next week. So I think it’s just a matter…

Read the full storyOhio Republicans Rally Behind Constitutional Carry Bill

Ohio House Republicans introduced a bill Wednesday to bring constitutional carry to the state, which allows gun owners to carry concealed weapons without obtaining a permit. The bill, House Bill 174, was introduced by Reps. Ron Hood (R-Ashville) and Tom Brinkman (R-Mt. Lookout) and quickly gained the support of 27 other Republicans. Current Ohio law allows Ohioans to carry concealed weapons only after they obtain a permit from a county sheriff’s office, pass a criminal background check, and complete eight hours of training. House Bill 174 would change all of that. It states that anyone 21 or older “and not prohibited by federal law from firearm possession to carry a concealed deadly weapon” would be able to do so “without needing a license.” In its current form, the bill would take things one step further by allowing Ohioans to conceal and carry legal rifles and shotguns. Ohio Gun Owners Director Chris Dorr spoke with Hood and Brinkman shortly after their bill was introduced. https://www.youtube.com/watch?time_continue=8&v=Zu5ewRRJSWw “What’s so exciting is we now have an opportunity to actually pass a bill now with West Virginia and Kentucky going constitutional carry. We’ve got over a dozen states going constitutional carry,” Hood said. “Legislators and…

Read the full storyA DeWine Campaign Promise Turned Into $176K Salary for Lt. Gov. Husted

“InnovateOhio” was a central campaign promise of the Mike DeWine/Jon Husted gubernatorial ticket that ended up securing Husted a $176,426 salary. DeWine and Husted, now governor and lieutenant governor, announced the initiative in September 2018 and said it would “bring the best and brightest technology minds” to Ohio to help “improve state and local government.” “The private sector uses innovative ideas and technology to improve their customer service and save money, and there is no reason we can’t bring that approach to the way our government operates,” Husted said at the time. According to a press release from the campaign, InnovateOhio is “about how we make state government a more effective and efficient leader in using technology to improve customer service and save tax dollars.” “In doing so, we make Ohio a state that attracts talent, business, and new investment,” the press release added. Specific proposals under the InnovateOhio initiative included the funding of “at least 10,000 in-demand industry certificates,” which was included in DeWine’s first budget proposal, and the establishment of “opportunity zones for economically-distressed communities.” Republicans, who said they wanted to create a good relationship with the incoming administration, then addressed InnovateOhio in a December 2018 bill. Senate…

Read the full storyFormer Ohio State Senator Randy Gardner Now Highest Paid Member of DeWine Administration at $190,000 Salary

Former State Sen. Randy Gardner, who was picked by Gov. Mike DeWine to lead the Department of Education, is currently the highest paid member of the new administration. Gardner will receive a base salary of $190,008, which is more than $100,000 higher than the average $87,600 salary he made as a state senator, and nearly $15,000 more than the $176,115 salary his predecessor made. State pensions are factored on the highest three years of pay, meaning if Gardner can hold down his current position for three years, his pension will be based solely on his time running the Department of Education. Gardner has been in Ohio politics since 1985 as either a state representative or senator, but was apparently a high-school teacher before entering the political scene. The numbers were obtained by Cleveland.com, and show that Gardner will make more than both DeWine and Lt. Gov. Jon Husted, who are paid $154,248 and $176,676 respectively. Husted’s salary is higher because he was tapped to lead InnovateOhio, a new state agency housed in the Governor’s Office. As such, he can receive the salary for that position in lieu of the lieutenant governor’s salary. The only other cabinet-level officials who will make…

Read the full storyExperts Say DeWine’s Predicted Revenue Forecast Is Off by $705 Million

An expert analyst suggested that the revenue forecast in Gov. Mike DeWine’s budget proposal is $705 million too high during a testimony before the House Finance Committee Tuesday. According to Legislative Service Commission Director Mark Flanders, DeWine’s General Revenue Fund (GRF) tax revenue forecasts would come up $704.9 million short across the next three fiscal years. “Legislative Budget Office economists forecast somewhat lower baseline GRF tax revenues for the current fiscal year and the next biennium than are forecast for the executive budget,” Flanders said in his testimony. Specifically, Flanders said his economists came up with predictions that are $196.7 million lower than DeWine’s in Fiscal Year 2019, $347.3 million lower in Fiscal Year 2020, and $160.9 million lower in Fiscal Year 2021. “The outlook for state government revenues is greatly influenced by the course of Ohio’s economy and the economy of the nation. U.S. economic expansion was strong through much of last year, but recent economic indicators have been mixed,” Flanders said. But Kim Murnieks, director of the Office of Budget and Management, claimed Tuesday that the forecasts in DeWine’s budget are are “conservatively forecast.” “As we introduce this budget, the state is in strong fiscal condition, about to…

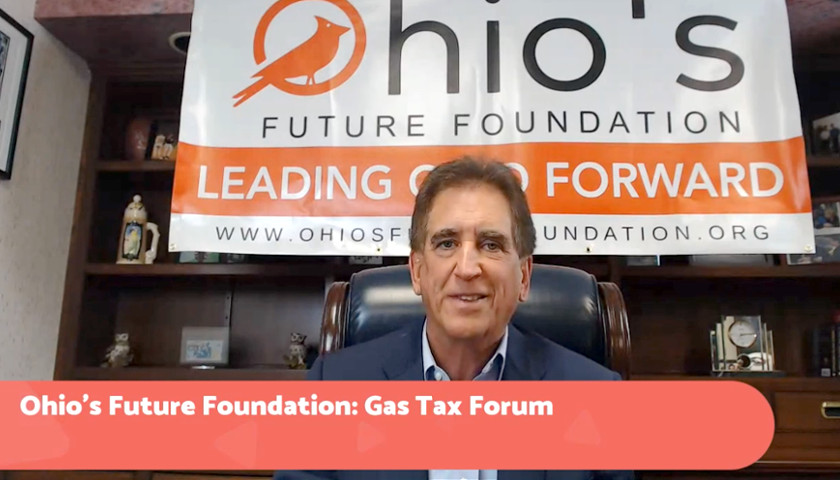

Read the full storyFormer Congressman Renacci Calls for Smarter Government Spending During Forum on Gas Tax

Ohio’s Future Foundation Chairman and former Congressman Jim Renacci hosted a forum on the gas tax Monday evening with Greg Lawson of The Buckeye Institute and Paul Lewis of the Eno Center for Transportation. Gov. Mike DeWine (R-OH) has been pushing for an 18-cent gas tax increase, which Monday night’s panelists think might be too high. Although a controversial subject, the panelists were in agreement on one thing: the state government needs to be smarter with how it spends its money. “I think the real opportunity is to focus on trying to make our transportation institutions more efficient and a lot of that has to do with investing smartly, not necessarily focusing on big, expansive projects, but more doing the things that voters are actually looking for, which is roads that are well maintained, buses that run on time—kind of the run-of-the-mill stuff that isn’t as exciting as a new highway or some kind of new big project, but it’s the thing that people care about everyday. It’s really kind of focusing on asset management and taking better care of what we have,” Lewis said. Lawson agreed with the sentiment, and encouraged politicians not to get “hung up” on the…

Read the full storyLake Erie Improvements Bill Turned Into a 90-Page Spending Package with $2 Million in Renovations to the Ohio Governor’s Residence

The Ohio Governor’s Residence in Bexley is set to receive $2 million in renovations on the taxpayer’s dime after the funding was tossed into a catch-all bill passed at the last minute of 2018. Senate Bill 51 was initially introduced in the Ohio Senate in February 2017 as a piece of legislation focused on facilitating “Lake Erie shoreline improvements.” It didn’t pass the Senate until July 2018, and wasn’t taken up by the House until December. As it was introduced, the bill was only 14 pages long and was intended to amend two sections of Ohio Revised Code and “authorize the creation of a special improvement district to facilitate Lake Erie shoreline improvement.” By the time it was passed, the bill was 90 pages long, amended eight sections of Ohio Revised Code, offered amendments to 16 different sections of two House bills, and had a final description of: “Authorize the creation of a special improvement district to facilitate Lake Erie shoreline improvement, to revise other laws governing taxation and public property and otherwise provide authorization and conditions for the operation of state programs, and to make appropriations.” Of those appropriations was a $107 million “administrative building fund” under the Department…

Read the full storyOhio House Democrats Question ‘Fiscal Stability’ of Republican Governor’s $69 Billion Budget Proposal

Ohio House Democrats are raising concerns over the “fiscal stability” of Republican Gov. Mike DeWine’s $69 billion budget proposal released Friday. House Minority Leader Emilia Strong Sykes (D-Akron) said that while her caucus was “encouraged by the governor’s commitment to supporting Democratic policies of investing in families, maintaining access to quality, affordable health care, and cleaning up Lake Erie,” she had concerns about the proposal’s “fiscal stability.” “We have serious concerns regarding the fiscal stability of the current proposal. We can’t build a budget on broken economic assumptions or wishful thinking. We need to be honest and realistic about where new spending comes from,” she continued. Rep. Jack Cera (D-Bellaire), the House Democratic budget panel leader, said he was “heartened that the governor is stepping up on a number of issues Democrats have been pushing,” but had similar concerns about its “fiscal assumptions.” “That promise is sacred, and it can’t be built on shaky economic ground or faulty fiscal assumptions. The governor is proposing investments, but it’s unclear where the additional spending will come from,” he said. Cera went on to claim that “investing in education and children is important,” but the state needs “to be realistic about [its] fiscal…

Read the full storyOhio Governor Mike DeWine Cites Bible in Budget Proposal That Increases Spending by Seven Percent

Gov. Mike DeWine (R-OH) released his first two-year budget proposal Friday morning in what he is describing as a $69 billion investment in “Ohio’s future.” “As I shared in my State of the State address, the Bible tells us that there is a time and a place for everything. Now is the time for us to invest in Ohio,” DeWine said in a letter addressed to his “fellow Ohioans.” “We must invest in our children to help our youngest Ohioans get the best start in life. We must invest in efforts to fight mental health and substance use disorders so our fellow Ohioans can lead fulfilling, healthy lives. We must invest in Ohio’s workers and in innovation and technology that spurs job creation so our families can prosper. And, we must invest in preserving and protecting Lake Erie and all of Ohio’s waterways, so that all Ohioans have access to clean water and our outdoor spaces are preserved for generations to come,” he continued, touching on the main priorities of his budget. While the proposal places a significant emphasis on mental health and child support services, DeWine identified five core areas for his budget, including: Children and Families Local Communities…

Read the full storyThird Time’s a Charm: Ohio House Begins Heartbeat Bill Debate Again Tuesday

COLUMBUS, Ohio – The Ohio House version of the infamous heartbeat bill will get its first hearing Tuesday morning in the House Health Committee. The bill was introduced by State Reps. Ron Hood (R-78) and Candice Keller (R-53), and has 48 cosponsors. Two previous iterations of the bill cleared the Ohio House and Senate, but both were vetoed by former Gov. John Kasich. Gov. Mike DeWine, however, said in January that he would “absolutely” sign the heartbeat bill into law if it makes it to his desk. Hood, who will testify before the House Health Committee Tuesday morning, was also a lead sponsor of 2018’s heartbeat bill. After it passed the House, he called it “the vehicle that is needed to revisit Roe v. Wade.” “The House passage of the bill is a critical step in that long-awaited process. I am confident that this bill will protect tens of thousands of innocent lives with detectable heartbeats it if becomes law,” he added. The current version of the bill, HB 68, would take things one step further by establishing a Joint Legislative Committee on Adoption Promotion and Support. According to the bill, this committee would be authorized to “review or study…

Read the full storyDeWine Sends ODOT Director to Senate to Lobby for 18-Cent Gas Tax

COLUMBUS, Ohio – The Ohio Senate Transportation, Commerce, and Workforce Committee began hearing testimonies Monday on Gov. Mike DeWine’s demand for an 18-cent gas-tax increase. The chairman of that committee, Sen. Rob McColley (R-01) (pictured, left), however, made it clear that he and his fellow Senate Republicans oppose the 18-cent figure, and even suggested an income-tax cut to offset a gas-tax increase. But Ohio Department of Transportation (ODOT) Director Jack Marchbanks (pictured, right) said Monday during his testimony that anything less than 18-cents wouldn’t cut it, and claimed that the smaller gas-tax increase of 10.7-cents passed in the House’s version of the transportation budget last week “falls far short of Ohio’s real need.” “As you may recall, due to flat revenues, highway construction inflation, and mounting debt payments, ODOT is in jeopardy of being unable to fulfill its mission to maintain the state’s most valuable physical asset: our state highway system. The credit cards are maxed out and the long-term health of Ohio’s transportation system is now at stake,” Marchbanks said. He argued that an 18-cent increase is necessary because the “state has avoided making the difficult decision to find a long-term solution to our transportation revenue shortfall for more…

Read the full storyOhio Workers Injured on the Job Will No Longer Be Prescribed Oxycontin

The Ohio Bureau of Workers’ Compensation voted Friday to no longer prescribe the powerful opioid Oxycontin to workers injured on the job. According to a Friday press release from the BWC, Chief Medical Officer Terry Welsh recommended that the drug be phased out of the organization’s formulary (a list of drugs the BWC will cover when prescribed), and the Board of Directors voted in favor of following his directive. Oxycontin will be replaced with Xtampza ER, which Welsh called “an equally effective but harder-to-abuse drug.” “Xtampza is a sustained-release form of oxycodone, like Oxycontin, but it utilizes a unique abuse-deterrent technology that makes it difficult to manipulate—crush, snort or inject—for aberrant use,” Welsh elaborated. “Thanks to technology, this just seems like the next responsible step to protect our injured workers from potential addiction and overdose death to dangerous drugs.” Oxycontin will be phased out of BWC’s system staring July 1, a move that also follows the recommendation of BWC’s Pharmacy and Therapeutics Committee. The establishment of that committee was one of several precautionary steps the BWC took to “mitigate the opioid epidemic’s impact on Ohio’s workforce,” the press release states. Gov. Mike DeWine (R-OH) applauded the BWC’s decision, calling it…

Read the full storyMinnesota Republicans Introduce Bill to Ban Abortions After Fetal Heartbeat Is Detected

Minnesota’s Senate Republicans have introduced a bill that would ban abortions in the state after a fetal heartbeat is detected in a pregnant woman’s unborn child. Senate File (SF) 869 was introduced Thursday and is co-sponsored by five Republican state senators, including Sens. Andrew Mathews (R-Milaca), Mark Koran (R-North Branch), Justin Eichorn (R-Grand Rapids), Mary Kiffmeyer (R-Big Lake), and Michelle Benson (R-Ham Lake). “Except in the case of a medical emergency, a physician must first test a pregnant woman to determine if a fetal heartbeat is detectable in the pregnant woman’s unborn child before performing an abortion,” the bill states. “A physician shall not perform an abortion on a pregnant woman when it has been determined that the unborn child has a detectable fetal heartbeat, except in the case of a medical emergency.” If passed, violation of the bill would result in a gross misdemeanor punishable by “imprisonment for not more than one year or payment of a fine of not more than $3,000 or both.” Such bills are commonly referred to as “heartbeat bills” and have been introduced in several other state legislatures across the country. Ohio legislators, for instance, attempted to pass their own version of a heartbeat…

Read the full storyRichard Cordray, Dem Candidate for Ohio Governor, Hopes to Continue Monitoring Consumers Just Like He Did at CFPB

Democratic-hopeful Richard Cordray recently announced in his bid for Ohio’s governor seat that he intends to enact failed policies from his time at the Obama administration’s Consumer Financial Protection Bureau (CFPB). In April, it was revealed that under Cordray’s direction the CFPB allegedly faced at least 1,000 different hacks, including 240 data breaches, while the bureau was in the process of gathering 991 million American credit card accounts, The Daily Caller reported. During a 2014 hearing, Cordray explained that his agency was “collecting aggregated information,” and was unable to guarantee that “consumer information is 100 percent secure.” Acting Director Mick Mulvaney confirmed Cordray’s comments while testifying before Congress in April, saying that “everything” the CFPB collects is “subject to being lost.” The CFPB has been at the center of controversy ever since its 2011 founding, and was criticized in November by President Trump’s Treasury Department as having an “unaccountable structure.” “The CFPB was created to pursue an important mission, but its unaccountable structure and unduly broad regulatory powers have led to regulatory abuses and excesses,” the Treasury stated in a report, according to USA Today. “The CFPB’s approach to enforcement and rulemaking has hindered consumer choice and access to credit,…

Read the full story