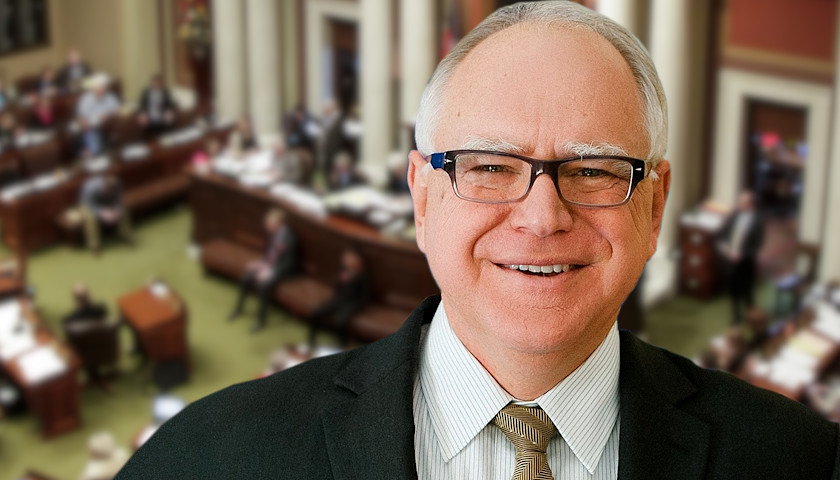

The combined state and federal corporate tax rate in Minnesota would reach 35.1 percent under President Joe Biden’s infrastructure plan, representing a tie for the third highest levy among the 50 states, according to a new study from the Tax Foundation.

U.S. corporations currently pay a 21 percent corporate income tax rate to the federal government, the Tax Foundation reported, but they also pay additional corporate taxes in 44 states and Washington, D.C. State corporate income tax rates range from zero to 11.5 percent, so the current combined average paid by corporations is 25.8 percent, the study said.

Corporations based in six states – Ohio, Nevada, South Dakota, Texas, Washington and Wyoming – are charged no state income tax, though they have to pay their share to the federal government, the Tax Foundation said.

Read the full story