The National Federation of Independent Business’ (NFIB) political action committee endorsed Tennessee U.S. Senator Marsha Blackburn (R-TN) for reelection on Wednesday.

Read the full storyTag: NFIB

NFIB: Minnesota’s 9.8 Percent Corporate Income Tax Is Highest in Nation

In 2024, Minnesota has the highest corporate tax rate in the United States at 9.8%.

The National Federation of Independent Business called on state lawmakers to create a tax system that reduces the burden on small business owners.

Read the full storyGroups Oppose ‘High Hazard’ Hiring Requirements at Ohio Oil Refineries

Opposition surrounds a proposal in the Ohio House that would increase hiring requirements at oil refineries in the state, including a mandate that employees demonstrate fluency in English.

The National Federation of Independent Business (NFIB) and Americans for Prosperity-Ohio (AFP-Ohio) turn their arguments against House Bill 205 – dubbed the “High Hazard Training Certification Act” – to the Senate after it passed the lower chamber earlier this week. It has not been assigned to a committee in the Senate.

Read the full storyBipartisan Pennsylvania Bill Would Allow ‘Personal Option’ Through Association Health Plans

A bipartisan group of Pennsylvania state lawmakers are championing legislation enabling small-business association healthcare plans to offer workers affordable coverage.

Such plans facilitate lower costs by allowing business and industry organizations to pool their members and negotiate insurance prices. The measure’s author, Representative Valerie Gaydos (R-Moon Township), was among numerous sponsors who told The Pennsylvania Daily Star they experienced firsthand how governmental burdens have made it harder for companies to provide their members with inexpensive medical coverage. Gaydos said this is particularly true since the Affordable Care Act (ACA), signed by President Barack Obama in 2010, heavily restricted association plans.

Read the full storyOhio Legislative Committee Approves Universal License Recognition Bill

Advocates for occupational licensing reform successfully urged an Ohio House panel on Tuesday to unanimously pass a Senate bill to recognize professional certifications awarded by other states.

Eighteen states, varied in their politics and geography, already recognize out-of-state licenses for most professions, including neighboring Pennsylvania. These universal-recognition laws all require the licensee to have current permission to work in his or her state and have no pending professional disciplinary matters or disqualifying criminal records. Licensees remain subject to any fees or testing required by their adopted states.

Read the full storyMaricopa County Approves New Program to Give Small Businesses a Larger Share of Its Business

Maricopa County announced Monday that the Board of Supervisors approved a new Small Business Advocacy Program (SBAP), which aims to provide these local enterprises with a larger share of county business.

“The program is about making sure that small and local businesses are being given a chance to sell goods and services to the county. The county buys everything from baby diapers to xenon light bulbs, we buy dentists and landscapers, plumbers and engineers – you name it – we probably buy it. It is a Board priority to support small and local businesses, when it makes sense, for purchases that are under $100,000 and not covered under an existing contract,” said the Maricopa County Office of Procurement (MCOP) in an email to the Arizona Sun Times.

Read the full storyOhio New Business Startups See Uptick

Ohio new business startups broke a downward trend in August, but not enough to return to levels from a year ago.

The state registered 15,815 new business filings in August, slightly higher than July, which represented a six-month low and four consecutive month of declines, Secretary of State Frank LaRose announced.

Read the full storyBlake Masters Receives Endorsement from Leading Small Business Advocacy Organization

Trump-endorsed Arizona Senate nominee Blake Masters received another big-ticket endorsement Thursday, this time from the National Federation of Independent Business (NFIB), the national leading small business advocacy group.

“Blake Masters has experience working in the business community and will be a strong supporter of Arizona’s small businesses in the U.S. Senate,” said Chad Heinrich, NFIB Arizona State Director. “His top priority in Congress will be to get the economy back on track and to create a pro-small business environment. He has also expressed an interest in improving workforce training, which will help small businesses immensely as they continue to manage a worker shortage. We are proud to endorse Blake Masters today and look forward to working with him.”

Read the full storyNFIB Tennessee PAC Endorses Governor Lee for Re-Election

The NFIB Tennessee PAC, composed solely of NFIB members across the state, has endorsed Governor Bill Lee for re-election.

Read the full storyNational Federation of Independent Business Endorses State Representative Candidate Jake McCalmon

Tennessee House District 63 candidate Jake McCalmon on Wednesday picked up the endorsement of a small business-focused group.

The National Federation of Independent Business (NFIB), known as the “voice of small business,” opted to endorse the businessman over his other GOP rivals.

Read the full storyDespite a Slim Lead in Virginia Gubernatorial Race, New PPP Poll Should Have Democrats ‘Fearing for Their Lives’ Expert Says

A new University of Mary Washington (UMW) poll of 1,000 Virginia adults found Terry McAuliffe leading with 43 percent, Glenn Youngkin with 38 percent, and Liberation Party candidate Princess Blanding at two percent. Among the 528 likely voters in the poll, Youngkin gained ten points, reaching 48 percent, while McAuliffe and Blanding stayed at 43 percent and two percent, respectively. But elections forecaster Chaz Nuttycombe said that the big story is the Public Policy Polling (PPP) poll released Tuesday that had McAuliffe leading Youngkin 45 to 42 percent; it surveyed 875 Virginia voters on September 17 and 18 with a 3.3 percent margin of error. It did not include Blanding.

“The one big exclamation point that should be having Dems say, ‘Oh s–t, oh f–k, oh s–t, oh f–k,’ is the PPP poll that came out. That had McAuliffe up by three. PPP is a very Democrat-leaning pollster,” he said. “Their polls usually overestimate Democrats by a few points.”

Read the full storyVirginia Gov. Northam Proposes $862 Million of American Rescue Plan Act Funds to Partially Refill Unemployment Trust Fund

As part of his “Investment Week” announcing American Rescue Plan Act (ARPA) allocation proposals, Governor Ralph Northam announced $862 million for Virginia’s unemployment insurance trust fund, depleted during COVID-19.

“Shoring up the Commonwealth’s unemployment insurance trust fund is a smart investment that will prevent Virginia businesses from paying higher taxes and allow our economy to continue surging,” Northam said in a Tuesday announcement.

Read the full storyVirginia NFIB Director Calls for Back-To-Work Bonuses

A May survey from the NFIB found that nationally, seasonally-adjusted 48 percent of small businesses reported unfilled job openings for the fourth consecutive month.

“Virginia small businesses are having a historically hard time hiring workers and getting back to pre-COVID levels,” NFIB Virginia State Director Nicole Riley said in a press release.

Read the full storyNorment, Saslaw Discuss If Virginia Will Remain Business-Friendly in the Future

In a post-session virtual luncheon hosted by Wason Center Academic Director Quentin Kidd, Senate Minority Leader Thomas Norment (R-James City) expressed alarm at erosion of Virginia’s business-friendly status while Senate Majority Leader Dick Saslaw (D-Fairfax) said moderate pro-business senators were helping protect Virginia’s business environment — for now.

Read the full storyVirginia NFIB: Business Is Improving, but Employers Are Having Trouble Filling Positions

As the country emerges from COVID-19 restrictions, small businesses are doing better, according to a March report from the National Federation of Independent Business (NFIB). However, uncertainty about the next few months for business owners is still high, and businesses are having trouble finding qualified workers to fill positions.

“Virginia’s small businesses are working hard on their recovery but are struggling to find the right workers to fill open positions,” NFIB Virginia State Director Nicole Riley said in a Wednesday press release

Read the full storyVirginia Business Community Praises COVID-19 Stimulus, but Seeks State Action for Full Benefits

Virginia business advocates praised the COVID-19 stimulus package passed by Congress but said additional state action is necessary for businesses to receive the full benefits of the legislation.

The $900 billion COVID-19 stimulus provides about $325 billion in aid to small businesses nationally, including $284 billion for forgivable Paycheck Protection Program (PPP) loans, $20 billion for Economic Injury Disaster Loan grants, $15 billion for live venues, independent movie theaters and cultural institutions and another $12 billion for businesses in low-income and minority communities.

Congress’ bill also addressed a couple of concerns businesses raised regarding the first wave of PPP loans. The bill simplifies the forgiveness applications and makes the loans tax deductible at the federal level. The deductibility applies to loans that already have been received and any loans received in the second wave, which would prevent a hidden tax increase on businesses.

Read the full story80 Percent of Small Business Owners Are Waiting to Receive a Loan from the SBA, Survey Finds

The National Federation of Independent Business (NFIB) Research Center released a survey Tuesday that said 80 percent of small business owners are still waiting to receive a loan from the Paycheck Protection Program (PPP).

“Small businesses were prepared and ready to apply for these programs, the only financial support options for most, and it is very frustrating that the majority of these true small businesses haven’t received their loan yet,” Holly Wade, NFIB Director of Research & Policy Analysis, said. “Small businesses make up nearly half of the economy and it’s crucial that their doors stay open.”

Read the full storyGroups Come Together for ‘No Tax on My Occupation’ Lobby Day at State Legislature

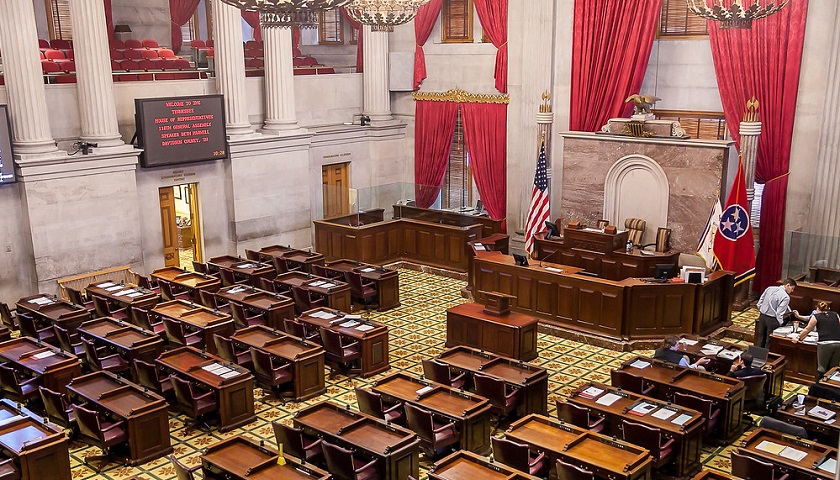

NASHVILLE, Tennessee – Eight groups partnered together Tuesday for a “No Tax on my Occupation” lobby day at the Tennessee state legislature.

Read the full storyGlen Casada Tells Small Business NFIB to Get Involved in Tennessee Politics

NASHVILLE, Tennessee — The best way Tennessee’s small business owners can help state legislators and, ultimately, themselves, is to get more engaged in state politics, said state House Speaker Glen Casada, R-Franklin. Casada made those remarks Tuesday at the Cordell Hull State Office Building while addressing members of the NFIB: Small Business Association. “For too many years conservatives and pro-business people have said ‘Government is a mess, I give up. I will run my business. I will take care of my family. That is what I’m going to do,’” Casada said. “The problem is if you become disengaged with government it tends to creep into areas where it doesn’t belong. We need everyone in this room to be engaged and that means coming to the capitol like this and that means getting to know your legislator and holding them accountable.” The NFIB represents about 6,000 independent business owners around the state, said Jim Brown, Tennessee director of the National Federation of Independent Business. Tennessee, Casada told the group, has made drastic improvements in its economy the past eight years, and people nationwide will likely soon consider it one of the nation’s best. The NFIB, according to literature organizers handed out…

Read the full storyBlackburn, Bredesen Reveal Stark Differences on Judges, Obamacare at NFIB Forum

NASHVILLE, Tennessee–Tennessee U.S. Senate Republican candidate Marsha Blackburn (R-TN-07) said, if elected, she’ll vote to appoint federal judges based on whether they abide by what’s in the U.S. Constitution. Her opponent, Democrat Phil Bredesen, said voting to appoint a judge really boils down to his or her qualifications and temperament. When it comes to the debate over health insurance and Obamacare, Blackburn said she wants laws changed to allow Tennesseans to buy health insurance across state lines. That would create more competition and lower costs. Bredesen, when pressed for his opinion on the matter, said he favors Medicaid expansion in Tennessee. These were among some of the insights members of the Tennessee business community could glean from both candidates at a forum Wednesday at Lipscomb University in Nashville. The Tennessee chapter of the National Federation of Independent Business sponsored the event, along with the Tennessee Business Roundtable, and the Tennessee Chamber of Commerce & Industry. Per the rules, both candidates spoke separately, and neither of them could discuss their opponent. In her opening remarks, Blackburn told the audience the U.S. Chamber of Commerce endorses her candidacy. “They feel I will bring the best ideas. I will help remove the obstacles…

Read the full storyNFIB: E-Verify and Tennessee Businesses

The National Federation of Independent Business (NFIB) has updated information for Tennessee businesses to help owners and managers keep up with what Tennessee state law requires when it comes to the E-Verify system. As of Jan. 1, 2017 – due to an update to the Tennessee Lawful Employment Act (TLEA) passed in 2011 – all Tennessee employers with 50 or more employees must use the E-Verify system to verify that their workers are eligible for U.S. employment. Previously, employers had a choice of compliance options; now employers of this size must use E-Verify. If a staff member was hired on or after Jan. 1, 2017, E-Verify must be used for them. This applies to employees working in or outside the state of Tennessee, and if the employer fails to use E-Verify, they could receive a $500 civil penalty per day of noncompliance (or more for repeat offenses). Employers with between six and 49 employees are required to either use E-Verify for workers hired on or after Jan. 1, 2017, or request and retain I-9 documentation from each employee. I-9 documentation includes: Tennessee driver’s license or photo id license issued by the Tennessee Department of Safety Valid driver’s license or photo id…

Read the full storyTennessee Adds 45,000 Jobs Over Past Year

Tennessee’s unemployment rates remain low and the state added 45,000 jobs the past year, the National Federation of Independent Business said. According to the March 2018 numbers from the Tennessee Department of Labor and Workforce Development, 82 of the state’s 95 counties saw lower unemployment rates that month than they did in February, NFIB said. The lowest rate, 2.5 percent, was in Williamson County; the highest, 5.8 percent, was in Houston and Bledsoe counties, although that rate was a decrease for both counties from the prior month. Between April 2017 and April 2018, Tennessee added approximately 45,000 new jobs, with the biggest swells occurring in the leisure/hospitality, professional/business services, and education/health services sectors. “It doesn’t seem that long ago that several Tennessee counties had unemployment rates in the high teens, so the continuing trend of low unemployment rates across the state is wonderful news,” NFIB/TN State Director Jim Brown said. The good news continued in April as well. In mid-May, Gov. Bill Haslam and Department of Labor and Workforce Development Commissioner Burns Phillips announced that the statewide unemployment rate in April was 3.4 percent, representing the third consecutive month this number had held steady. April 2018 marked one year since…

Read the full storyNFIB Grades 110th Tennessee General Assembly from the Small Business Perspective

The National Federation of Independent Businesses (NFIB) rated the 110th Tennessee General Assembly on Wednesday, just few days after Tennessee’s legislative body adjourned for the year. “The Tennessee Legislature is now adjourned, but NFIB/TN worked hard to protect the state’s small business owners right until the end. In late April, just before adjournment, hundreds of NFIB/TN members made calls and emails about House Bill 2310. This bill contained a harmful provision that would have authorized the state to hire third parties to conduct sales and use tax audits. However, thanks to your activism, NFIB/TN convinced lawmakers that the state should always conduct these proceedings rather than farm them out to vendors who would have access to confidential taxpayer information,” the NFIB said in a statement, adding: Here’s a roundup of the other key state victories achieved for your small business over the past two years during the 110th General Assembly, none of which could be achieved without your support—thank you for raising your voices! Labor Reform (SB 262) This bill preempts any local governments from establishing predictive or restrictive scheduling laws on businesses. NFIB/TN supported it, and it passed the House 67-24-1 and the Senate 29-3. Regulatory Reform (SB 1194,…

Read the full storyNew Survey: Majority of Tennessee Small Business Owners Oppose Haslam’s Gas Tax Increase

Fifty-five percent of “Tennessee members of the National Federation of Independent Business [NFIB], the nation’s leading small-business association,” oppose Gov. Haslam’s gas tax increase proposal to fund road construction, the NFIB said in a statement released on Monday. “NFIB’s policy positions are based on the direct input of our members,” Jim Brown, state director of NFIB, said in the statement: When asked if they support or oppose a proposed seven-cent increase in the gas tax and 12-cent increase in the diesel tax, 55 percent of NFIB members responding to the survey oppose, 40 percent support, and 5 percent are undecided. Respondents were more definitive about the proposal to “index” future gas tax increases to changes in the Consumer Price Index, Brown said. Seventy-five percent of respondents oppose, while 19 percent support and 5 percent are undecided. “Small business owners . . . are clearly opposed to indexing because they believe it would bypass future legislatures and increase revenues automatically without making the case for specific infrastructure needs,” Brown said. Brown said a few parts of the proposal registered modest or mixed support. Sixty-two percent support the proposed $100 annual fee on electric vehicles and increasing charges on vehicles using alternative…

Read the full story